Digital Clinical Trial Recruitment Market Size (2025-2030)

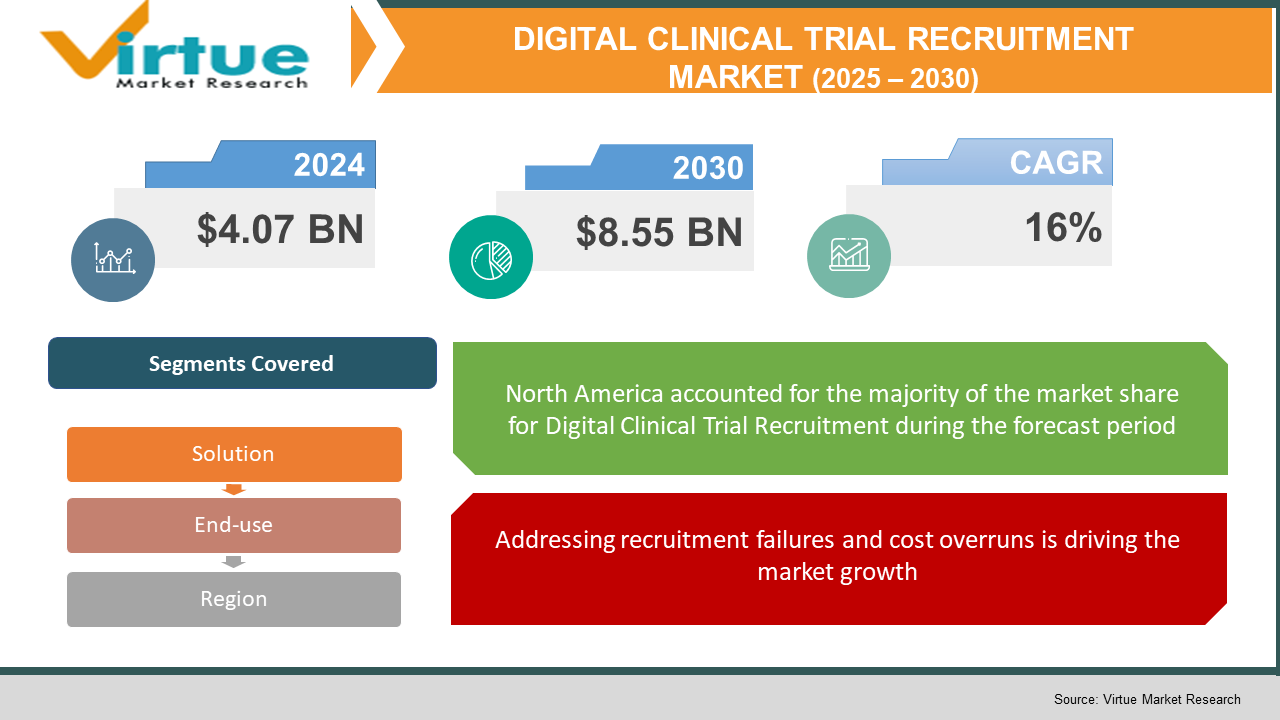

The Global Digital Clinical Trial Recruitment Market was valued at USD 4.07 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 16% from 2025 to 2030. By 2030, the market is projected to reach USD 8.55 billion.

This market includes platforms and solutions that use digital technologies—such as social media, mobile apps, electronic health records (EHR), AI-driven matching, and telehealth—to identify, engage, and enroll participants into clinical studies. Driven by industry efforts to address costly and time-consuming recruitment delays, these solutions offer improved patient targeting, outreach, and retention through predictive analytics, AI-based matching, and virtual trial integration. Pharmaceutical companies, contract research organizations (CROs), and healthcare providers increasingly rely on these platforms to streamline recruitment, enhance participant diversity, and reduce trial timelines. As decentralized and virtual trial models become mainstream, digital recruitment has become essential to ensure timely enrollment and successful trial outcomes.

Key market insights:

80% of clinical trials failed to meet enrollment targets on time, and recruitment accounts for nearly 30% of trial costs.

North America represented approximately 50% of global spend on patient recruitment services in 2023, with Canada as the fastest regional grower.

Phase III trials accounted for the largest share (~52–57%) of patient recruitment services in 2022–2023.

Phase I segments showed fastest growth in recruitment service adoption.

Virtual and decentralized trials grew significantly, with 55–70% of sponsors using digital methods in 2023; this segment, including fully virtual trials, exhibited strong CAGR (~7%).

AI-driven patient matching tools such as TrialMatchAI achieve around 92% accuracy for oncology trial identification.

New AI-powered platforms (e.g., TrialWire’s AI Voice Screen) rolled out in early 2025.

Global Digital Clinical Trial Recruitment Market Drivers

Addressing recruitment failures and cost overruns is driving the market growth

Recruitment remains a major bottleneck in clinical trials and accounts for nearly 30% of total trial costs. Approximately 80% of trials fail to meet planned enrollment timelines, and protocol modifications in complex phase iii trials can add direct expenses of over USD 535,000 per amendment, extending R&D timelines by months. Digital recruitment platforms provide solutions through sophisticated data analytics applied to EHR, social media, and real world evidence, enabling rapid identification of eligible participants. AI tools match patients to trials with high precision, such as TrialMatchAI achieving 92% success rates. By reducing delays and avoiding expensive amendments, digital recruitment platforms deliver clear value. Given the per-patient costs—tens of thousands of dollars in phase i and exponential costs in later stages—these savings are critical. AI-driven engines also reduce manual screening effort by over 40%, translating into operational improvements. As pharma companies and CROs face pressure to deliver cost-effective drug pipelines, digital recruitment solves a high-impact pain point. Speed, accuracy, and cost containment collectively motivate pharmaceutical sponsors and CROs to actively invest in digital recruiting solutions.

Enhancing patient diversity and remote participation is driving the market growth

Clinical trials historically struggle with enrolling diverse and representative populations. Digital recruitment opens access to underrepresented patients through targeted outreach via social media, mobile apps, and community networks. Retail health chains and platforms like Science 37 and Opyl leverage AI-enabled social channels for multilingual, community-based recruitment. Virtual and decentralized trial models allow patients to participate from home with remote monitoring, reducing travel burdens and enabling inclusion of rural and underserved demographics. Patient-centric approaches, including telehealth-enabled enrollment and eConsent, support participant comfort and retention rates, improving eligibility and adherence. Regulators such as the FDA and EMA increasingly emphasize diversity in trial populations, incentivizing sponsors to pursue broader geographic and demographic representation. Digital recruitment platforms are designed to comply with data privacy standards like HIPAA and GDPR, building trust among varying patient groups. As the industry moves toward personalized medicine and therapies for rare diseases, digital tools that optimize inclusion and engagement without costly site expansion are increasingly essential.

Regulatory incentives and pandemic driven transformation is driving the market growth

The COVID‑19 pandemic accelerated decentralized methods and emphasized rapid digital recruitment capability. About 55% of trial sponsors adopted DCT tools post-2020, and virtual visits rose by over 50% . Governments promoted remote trial models during the pandemic, removing regulatory impediments to eConsent, remote monitoring, and telehealth-based trial conduct. The FDA’s 2023 guidance explicitly endorses decentralized elements in drug approval processes . Meanwhile, regions like India are implementing recruitment advertising and regulatory streamlining to increase digital trial competitiveness . As sponsors strive to maintain trial momentum and resilience, reliance on digital recruitment platforms has solidified as essential. Digital approaches ensure reproducibility and remote compliance, addressing pandemic-exposed vulnerabilities in traditional trial models. Regulatory support and crisis-induced adoption have permanently moved patient recruitment strategies toward digitally enabled systems.

Global Digital Clinical Trial Recruitment Market Challenges and Restraints

Privacy concerns and data governance is restricting the market growth

Digital recruitment platforms rely on accessing sensitive personal health information, digital identifiers, and behavioral data. While HIPAA-compliant and GDPR-aligned solutions exist, platforms still face regulatory scrutiny and patient concern around data consent, usage, and storage. Healthcare providers and EHR vendors may limit access due to liability concerns. Deploying AI-driven tools requires clarity on model decisions and traceability, especially for eligibility matching or exclusion criteria. Without transparent explainability, trust from regulators and ethics bodies may be difficult to secure. Cross-border trials present further complexity due to disparate data privacy laws. Privacy breaches or unauthorized data use could derail trial enrollment and lead to reputational and financial damage. Strong privacy frameworks, patient opt-in procedures, and algorithm auditing are essential, but add operational cost and complexity. As data-driven tools expand globally, governing information assets remains a key restraint to adoption.

Engagement and digital literacy barriers is restricting the market growth

Although digital recruitment offers access to new patient pools, barriers exist in patient awareness, trust, and digital literacy. Older adults and underserved communities may be resistant to online or virtual trial invitations. The lack of digital access or distrust in web‑based platforms can limit reach. Recruitment via social media may face skepticism or low trust from certain demographics. Providers and trial sites also face internal resistance to changing engagement workflows, as many still rely on physician referrals and local outreach. Training site personnel to deploy digital campaigns, manage eConsent, and monitor remote participants introduces resource strain. Low patient engagement and dropout risks may counteract efficiency gains. Ensuring equitable access to digital tools and building trust through multichannel engagement is critical but requires investment in outreach, education, and on-site support.

Market opportunities

Digital clinical trial recruitment platforms have significant untapped potential driven by technological innovation, evolving trial models, and regulatory pressures. First, end-to-end AI matching engines represent a compelling growth frontier. Platforms like TrialMatchAI and TrialGPT achieve ~92% accuracy in oncology patient identification. These tools can be trained on federated and de-identified patient data to maintain privacy while enabling high-fidelity trial matching, lowering dropout rates and supporting adaptive eligibility criteria. Second, integration of decentralized trial workflows across recruitment, eConsent, remote monitoring, wearable integration, and digital twins can create shared digital platforms. Science 37, Opyl, and TrialWire demonstrate how combining AI, telehealth, and mobile engagement delivers seamless participant onboarding and site orchestration. Third, growth in rare disease and personalized medicine trials demands agile, targeted recruitment within global patient networks; digital platforms can mobilize niche communities efficiently. Additional opportunity exists in emerging markets: India seeks to grow its trial share through streamlined regulations and recruitment advertising. Tailored campaigns, multilingual interfaces, and decentralized engagement models can unlock diverse patient populations. Fourth, pay‑for‑performance and outcome-based recruitment contracts—linking fee structures to enrollment speed, retention, and diversity outcomes—offer vendors new commercial models. Finally, clinical operations consolidation favors platforms integrating recruitment, CTMS, site feasibility, and monitoring under one digital umbrella . As industry coalesces around hybrid, patient-centered trial models, digital recruitment solutions are poised to become central to trial architecture, delivering measurable operational and strategic advantages.

DIGITAL CLINICAL TRIAL RECRUITMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

16% |

|

Segments Covered |

By solution, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Opyl, Science 37, TrialWire, Antidote, NetraMark, IQVIA, Thermo Fisher Scientific (PPD), Clariness, and BBK Worldwide |

Digital Clinical Trial Recruitment Market segmentation

Digital Clinical Trial Recruitment Market By Solution:

• AI‑driven patient matching

• Social media and digital marketing outreach

• EHR integration and EHR‑based identification

• Virtual trial enrollment and eConsent systems

• CTMS‑integrated recruitment modules

AI-driven patient matching is the most dominant solution segment in the digital clinical trial recruitment market. Leveraging EHR data, claims, and structured/unstructured records, AI algorithms provide fast, automated identification and ranking of eligible candidates. Tools like TrialMatchAI and TrialGPT demonstrate over 87–92% accuracy in oncology trial matching. These systems significantly reduce manual screening, save time, and lower operational cost. As recruitment remains central to trial success, sponsors and CROs prioritize high-precision AI matching over manual outreach or simple digital marketing. AI matching platforms serve as the entry point for all downstream recruitment workflows and offer measurable ROI via faster enrollment and improved diversity, making them the leading solution category.

Digital Clinical Trial Recruitment Market By End-use:

• Pharma and biotech companies

• Contract Research Organizations (CROs)

• Healthcare providers and networks

• Virtual and decentralized trial platforms

Pharma and biotech companies are the dominant end‑users of digital clinical trial recruitment solutions. These sponsors face the highest cost pressure during trial design and execution, particularly in phase II and III studies. They increasingly rely on digital tools to meet enrollment targets, manage patient diversity mandates, and reduce time to market. In-house recruitment teams are adopting AI matching, eConsent, and outreach platforms to reduce trial timelines and costs. Additionally, pharma companies partner with CROs and technology vendors to co-develop integrated platforms (e.g., Opyl’s Opin.ai solutions). The scale of investment and responsibility from sponsors ensures pharma remains the largest driver of digital recruitment adoption.

Digital Clinical Trial Recruitment Market Regional segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is the dominant region in the digital clinical trial recruitment market. It accounted for approximately half of patient recruitment spend in 2024, driven by the US market (USD 390 million for recruitment services) . The region benefits from mature healthcare infrastructure, extensive EHR networks, robust regulatory support, and high clinical trial volume. Sponsors are advanced in deploying AI matching, eConsent, decentralized trial frameworks, and integrated digital recruitment platforms. Canada is also experiencing strong growth. Meanwhile, Europe is adopting digital recruitment rapidly, with regulatory support from bodies like EFPIA and EMA encouraging decentralized methods. The Asia-Pacific region is emerging as a major growth zone; India and China are gaining clinical trial share driven by regulatory reform and lower operating costs . However, their base levels remain lower than North America. Latin America and Middle East/Africa are early adopters and evolving through partnerships with global CROs. Overall, North America leads due to scale, technology readiness, and financial centrality.

COVID-19 Impact Analysis on the Digital Clinical Trial Recruitment Market

The COVID‑19 pandemic catalyzed adoption of digital recruitment solutions and accelerated decentralized trial methods. Traditional trials grounded in in-person site visits were halted, highlighting recruitment vulnerabilities and enrollment failures. Global adoption of decentralized trial designs surged to an estimated 55–70% of study protocols . Remote recruitment methods—telehealth screening, eConsent, mobile outreach—became essential. Sponsors and CROs engaged digital marketing, centralized e-recruitment portals, and AI-enabled matching to maintain enrollment. For example, Science 37 and Opyl increased remote site capabilities to adapt to COVID‑19 restrictions . Meanwhile, regulators enacted new guidance for remote recruitment and electronic monitoring . These shifts transformed temporary pandemic measures into long-term structural changes in trial recruitment. Post-pandemic, digital recruitment technologies are now mainstreamed as standard operating practice, reinforcing efficiency, resilience, and patient-centric trial design.

Latest trends/Developments

Several prominent trends are shaping the digital clinical trial recruitment landscape. Artificial intelligence and machine learning integration continues to evolve, with systems like TrialMatchAI and TrialGPT automating matching from structured EHRs and unstructured physician notes. Multimodal platforms combining AI matching with social outreach, eConsent, and virtual site workflows are emerging—Opyl’s Opin.ai marrying social media targeting with site referrals is one example. Voice-based recruitment assistants (TrialWire’s AI Voice Screen) launched in early 2025 highlight innovation in remote patient engagement. Decentralized and virtual trial models remain prominent, with fully remote trial designs gaining recognition and higher retention rates. Patient centricity continues to drive trends: multilingual campaigns, wearable monitoring, home nurse visits, and digital biomarkers enrich recruitment modalities. Privacy-preserving technologies like federated learning are being developed to reconcile data access needs with governance. Regulatory environment in India and other emerging markets supports recruitment advertising and technology deployment. Taken together, these developments reflect an ecosystem moving beyond tools to integrated platforms that operationalize recruitment as part of trial infrastructure.

Key Players:

- Opyl

- Science 37

- TrialWire

- Antidote

- NetraMark

- IQVIA

- Thermo Fisher Scientific (PPD)

- Clariness

- BBK Worldwide

- IQVIA

Chapter 1. Digital Clinical Trial Recruitment Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. DIGITAL CLINICAL TRIAL RECRUITMENT MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. DIGITAL CLINICAL TRIAL RECRUITMENT MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. DIGITAL CLINICAL TRIAL RECRUITMENT MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. DIGITAL CLINICAL TRIAL RECRUITMENT MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. DIGITAL CLINICAL TRIAL RECRUITMENT MARKET – By Solution

6.1 Introduction/Key Findings

6.2 AI driven patient matching

6.3 Social media and digital marketing outreach

6.4 EHR integration and EHR based identification

6.5 Virtual trial enrollment and eConsent systems

6.6 CTMS integrated recruitment modules

6.7 Y-O-Y Growth trend Analysis By Solution

6.8 Absolute $ Opportunity Analysis By Solution, 2025-2030

Chapter 7. DIGITAL CLINICAL TRIAL RECRUITMENT MARKET – By End use

7.1 Introduction/Key Findings

7.2 Pharma and biotech companies

7.3 Contract Research Organizations (CROs)

7.4 Healthcare providers and networks

7.5 Virtual and decentralized trial platforms

7.6 Y-O-Y Growth trend Analysis By End use

7.7 Absolute $ Opportunity Analysis By End use, 2025-2030

Chapter 8. DIGITAL CLINICAL TRIAL RECRUITMENT MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End use

8.1.3. By Solution

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Solution

8.2.3. By End use

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Solution

8.3.3. By End use

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Solution

8.4.3. By End use

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Solution

8.5.3. By End use

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. DIGITAL CLINICAL TRIAL RECRUITMENT MARKET – Company Profiles – (Overview, Solution Type , Portfolio, Financials, Strategies & Developments)

9.1 Opyl

9.2 Science 37

9.3 TrialWire

9.4 Antidote

9.5 NetraMark

9.6 IQVIA

9.7 Thermo Fisher Scientific (PPD)

9.8 Clariness

9.9 BBK Worldwide

9.10 IQVIA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Digital Clinical Trial Recruitment Market was valued at USD 4.07 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 16% from 2025 to 2030. By 2030, the market is projected to reach USD 8.55 billion.

Key drivers include costly recruitment delays, patient diversity needs, and regulatory support for decentralized trials.

Segments include AI matching, social outreach, EHR integration, eConsent, and vendor profiles like pharma, CROs, providers.

North America dominates due to mature infrastructure, high trial volume, and strong AI adoption.

Leading players include Opyl, Science 37, TrialWire, Antidote, NetraMark, IQVIA, Thermo Fisher Scientific (PPD), Clariness, and BBK Worldwide.