Digital Adoption Platform Market Size (2024 – 2030)

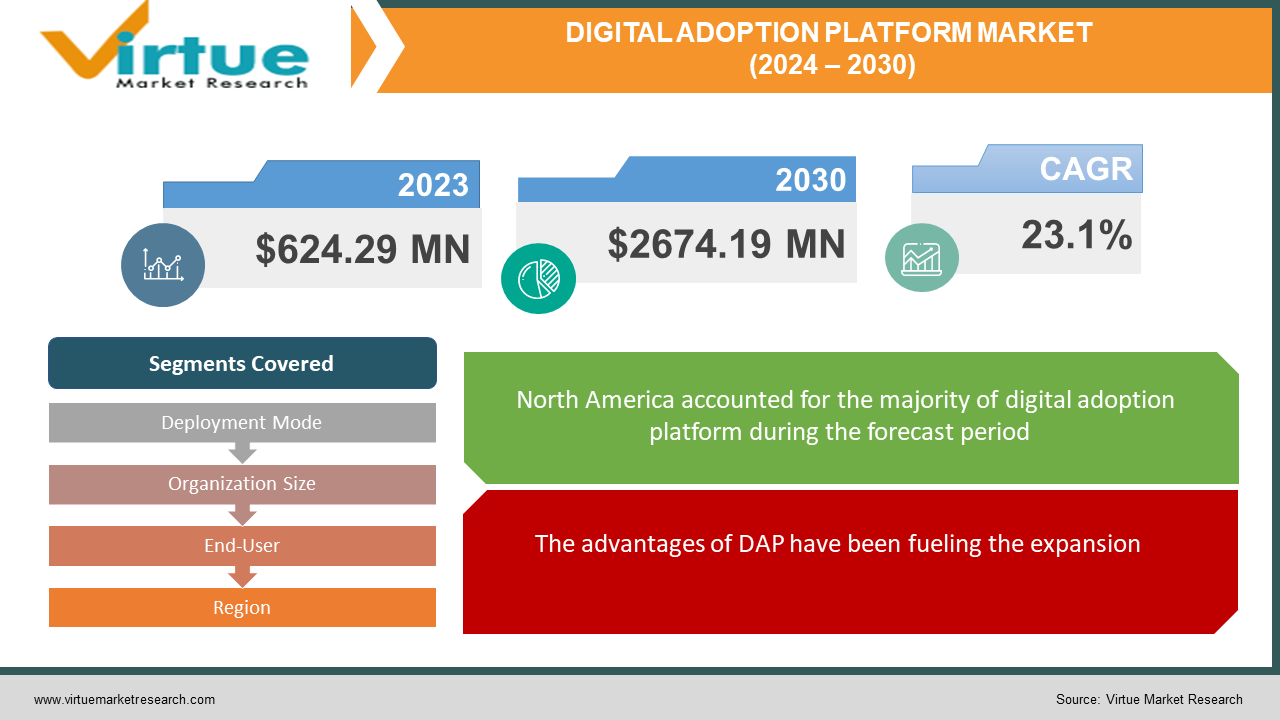

The global digital adoption platform market was valued at USD 624.29 million and is projected to reach a market size of USD 2674.19 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 23.1%.

A digital adoption solution that completely interfaces with corporate systems is called a digital adoption platform (DAP). The program guides users through various sections of the program and provides step-by-step directions to assist with the completion of particular tasks. A DAP's job is to make it easier for clients or employees of a business to adopt digital technology. DAPs provide comprehensive resources to address any queries and guide users through the application, making it quick and simple for anyone to become proficient with new technology. The program helps guarantee that customers won't miss important elements or become lost while figuring out particular jobs on the site. This technology emerged during the early 2010 period. Initially, its adoption was limited, as many of them were unaware of its use. Additionally, this platform did not have advanced features. Presently, this market has experienced good growth owing to technological advancements and integration systems. In the future, a notable development is anticipated due to market expansion and industry applications.

Key Market Insights:

The adoption of digital technology is at the top of boardroom agendas, with an estimated $424 billion spent globally on workplace software.

Seventy percent of businesses are either developing or have already implemented a digital transformation plan.

In three to five years, 39% of CEOs anticipate that their digital transformation efforts will pay off.

86% of businesses in the professional services sector are probably going to use digital platforms and applications between 2023 and 2027, according to Statista.

Seventy percent of digital transformation projects fall short of their goals. To tackle this, organizations have been focusing on employee management, training, leadership skills, and continuous measurement to ensure better profits.

Digital Adoption Platform Market Drivers:

The advantages of DAP have been fueling the expansion.

Integrating digital technology into an organization's operations, strategies, and products is known as digital transformation. The objective is to develop new goods and services and enhance current ones. Most companies have been adopting digital technologies to keep up with the latest trends. DAP helps with a better understanding of software applications and programs by providing steps and tutorials. With changing technologies, employees can continuously adapt to them and stay up-to-date by utilizing these platforms. This is beneficial, especially for new hires, to stay competitive by knowing about the latest technologies and updates. It even provides personalization as per the needs of an individual, allowing them to get a better understanding of their roles and tasks. Besides, the need for support teams can be reduced as this platform has self-service features. This can reduce costs for a company. This also helps with gaining valuable insights about ways to improve their work, interactions, and preferences by using advanced analytics.

The increasing complexity of software ecosystems has contributed to their success.

To satisfy their business goals, organizations that embrace digital transformation frequently use a sophisticated and varied suite of software tools and apps. This creates complexity because of the use of diverse technologies, the employment of specialized software for distinct purposes, and the personalization of solutions to adhere to the needs of employees. The increasing intricacy of software ecosystems presents a difficulty for end users in comprehending and efficiently employing the features of any program. To help customers overcome these difficulties, DAP facilitates in-app assistance and customized support to enhance the productivity of the workers and subsequently augment their performance.

Digital Adoption Platform Market Restraints and Challenges:

Data security, integration difficulties, resistance to change, and associated costs are the main issues that the market is currently facing.

Sensitive information can be fed to these platforms. This data can be misused, creating fraud and leakage, resulting in damage to the company. Addressing this concern is, therefore, crucial for any business. Secondly, integrating DAP with new and old software or systems can be a difficult task. Incompatibility can be faced, creating obstacles to workflow operations. Thirdly, employees might not be familiar with the benefits of this technology and can assume circumstances and information about the same. This can cause a decline in the adoption rate. Besides, a few users might not benefit from all the available features, limiting the impact. Moreover, the expenses associated with the installation can be a barrier. Additionally, maintenance charges add up. This can create financial restraints for smaller firms.

Digital Adoption Platform Market Opportunities:

Integrating digital adoption platforms with LMSs (learning management systems) can provide numerous possibilities for the industry. This can lead to comprehensive learning, user-friendly features, and detailed structures, encouraging more people to try the same. Organizations can even track user progress and content performance. Technologies like artificial intelligence (AI) and machine learning (ML) have been advantageous for the market. By incorporating these fields into these platforms, user adoption rates can be increased by tracking the analytics that pertains to targeting specific age audiences, analyzing geographic trends, and finding out about user preferences. Implementing gamification features can create a positive impact. By creating levels and providing badges, rewards, and other promotions to users, a greater audience base can be achieved. This even motivates people to actively engage with these platforms. Furthermore, expansion into end-user industries can be advantageous. All industries have different requirements for software. By creating and specializing in this software and having the right knowledge about it, launches of these platforms can be done in specific industries.

DIGITAL ADOPTION PLATFORM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

23.1% |

|

Segments Covered |

By Deployment Mode, Organization Size, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

WalkMe, AppLearn, Userlane, Whatfix, Pendo, Appcues Gainsight PX, Inline Manual, Userpilot, Toonimo |

Digital Adoption Platform Market Segmentation: By Deployment Mode

-

Cloud-Based

-

On-Premise

The cloud-based sector is both the largest and fastest-growing category, depending on deployment mode. This mode can save costs for the company because on-premise installation is not required. This means that businesses can use this technology by downloading the software through the Internet. Secondly, this type offers data privacy. Due to its advanced protection features, unauthorized access can be restricted. Thirdly, data recovery is simpler since it is stored in multiple places. During any disaster, this feature can be extremely beneficial. Furthermore, their availability is easier since many prominent companies offer this solution. This creates a sense of trust in the consumers helping the market.

Digital Adoption Platform Market Segmentation: By Organization Size

-

Large-Scale Organizations

-

Small and Medium-Scale Organizations

Large-scale organizations are the largest industry, with a total share exceeding 57% in 2023. These businesses have the resources and capital required to continue growing. This facilitates their ability to collaborate with several reputable businesses, which eventually boosts revenue generation. Their effective networking and partnerships with other businesses provide simpler access to their offerings. These companies are usually backed by good investors, so they can invest more in developing solutions tailored to the needs of the particular sector. Furthermore, since they have a lot of employees, they usually work in a flexible mode, giving these individuals the liberty to work from home. Employing this technology, therefore, becomes vital for managing the workforce and yielding better results. Small and medium-sized businesses are the organizations with the fastest rate of growth. Numerous advancements have been made in improving the economy. As a result, a large number of new businesses and rising enterprises have been able to get the funds necessary for the employment of this software. In addition, freelancing has grown in popularity. Since the majority of them work from home, the demand for this platform has seen an upsurge due to its application in training and analyzing performance. Furthermore, many businesses may run remotely without having a physical location. In these situations, this software becomes essential, which raises its demand.

Digital Adoption Platform Market Segmentation: By End-User

-

Healthcare

-

BFSI

-

Manufacturing

-

Retail and Consumer Goods

-

IT and Telecommunications

-

Government and Public Sector

-

Others

Based on end-users, the BFSI sector is the largest in this market, with a share of around 22.9% in 2023. A wide range of intricate software programs are extensively used in the BFSI industry to perform several tasks, including risk management, compliance, financial analytics, and customer relationship management. DAPs are essential to making the user experience in these complex software environments simpler. The healthcare sector is the fastest-growing end-user. There have been many new technologies that have emerged in this sector. Existing ones have undergone a lot of advancements. Researchers are continuously working on commercializing innovations in the medical device and clinical research sectors. As such, utilizing this technology is gaining prominence to stay updated and for efficient onboarding as well as training.

Digital Adoption Platform Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on region, North America is most dominant region, with a rough share of 32% in 2023. Countries like the United States and Canada are at the top. This area has a robust economy, supporting many investments. This creates an opportunity for people in the DAP industry to cater to new technologies with advanced functionalities. The market here is also diverse due to the number of companies that have a significant presence in these areas. They have many subsidiaries and branches in different parts of the world, creating more revenue. WalkMe, Pendo, Appcues, and Userlane are a few such examples. They have been established for a long time, making them early adopters of this technology. Furthermore, due to the investments, companies here are involved in a lot of research and developmental activities, due to which they are involved in breakthroughs. However, Asia-Pacific is the fastest-growing region, with an approximate share of 22%. Countries like China, India, and South Korea are the notable ones. Urbanization has been a primary reason for this. This has changed the standard of living. Governmental bodies and other business tycoons are actively involved in funding many projects. Collaboration between companies has also increased, creating a deeper understanding of the technology and leading to excellent outcomes. Apart from this, there has been a rapid shift towards remote work, creating the need to utilize technologies that support this environment.

COVID-19 Impact Analysis on the Global Digital Adoption Platform Market:

The outbreak of the virus had a positive impact on the market. Lockdowns, social isolation, and movement restrictions were the new norm. This created a need for remote work. Digitalization has become a new trend. This platform gained a lot of prominence during this period. Companies were seeking solutions that enabled them to adapt to this change rapidly. Training programs and other virtual onboarding activities were facilitated because of this technology. They even helped with ensuring software adoption by providing tutorials and guidelines. The smooth working of employees was possible by embracing this platform. This was used in many end-user industries for different applications. According to a report by ClickLearn, 97% of businesses believed that the pandemic sped up the digital transformation. Post-pandemic, the market has continued to grow owing to the elevation in demand.

Latest Trends/ Developments:

Businesses in this sector are driven to grow their market share through a variety of tactics, such as investments, joint ventures, and acquisitions. To maintain competitive pricing, businesses are investing a significant amount of money in upgrading their current technology. This has led to even more growth.

Using mobile-friendly approaches has been one recent trend. A lot of people have been using their smartphones and tablets for work-related purposes. Companies in this industry have been prioritizing creating user-friendly features and functionalities that are compatible with these devices to generate more profits.

Key Players:

-

WalkMe

-

AppLearn

-

Userlane

-

Whatfix

-

Pendo

-

Appcues

-

Gainsight PX

-

Inline Manual

-

Userpilot

-

Toonimo

-

In December 2023, Generis and Userlane declared their strategic alliance. The Munich-based software startup Userlane is well-known for its Digital Adoption Platform (DAP), which is intended for businesses, while Generis is the creator of the CARA platform for data, content, and business process management in regulated sectors. Through this partnership, their systems will be more seamlessly integrated, allowing CARA Platform users to quickly increase return on investment and accelerate user adoption.

-

In October 2023, WalkMe introduced Propel as a strategic initiative to support partners in expanding the Digital Adoption Platform (DAP) industry. The goal of the program is to give both new and current partners the groundwork necessary to generate enterprise-scale income. A cloud-based DAP called WalkMe assists businesses in tracking, directing, and taking action to quicken their digital transitions. Organizations can comprehend user interactions throughout their whole technology stack thanks to the platform's data collecting.

-

In March 2022, Omniplex Learning announced the debut of Omniplex Guide, a digital adoption platform (DAP) that aids companies in adjusting to new technologies. The cloud-based solution accelerates training and digital transformation by offering interactive, in-situ advice. The Omniplex Guide assists staff members by offering in-app instructions, support, and assistance as required. It may aid with digital transformation initiatives, increase employee task performance, and enhance training outcomes.

Chapter 1. Digital Adoption Platform Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Digital Adoption Platform Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Digital Adoption Platform Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Digital Adoption Platform Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Digital Adoption Platform Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Digital Adoption Platform Market – By Organization Size

6.1 Introduction/Key Findings

6.2 Large-Scale Organizations

6.3 Small and Medium-Scale Organizations

6.4 Y-O-Y Growth trend Analysis By Organization Size

6.5 Absolute $ Opportunity Analysis By Organization Size, 2024-2030

Chapter 7. Digital Adoption Platform Market – By Deployment mode

7.1 Introduction/Key Findings

7.2 Cloud-based

7.3 On-premise

7.4 Y-O-Y Growth trend Analysis By Deployment mode

7.5 Absolute $ Opportunity Analysis By Deployment mode, 2024-2030

Chapter 8. Digital Adoption Platform Market – By End-User

8.1 Introduction/Key Findings

8.2 Healthcare

8.3 BFSI

8.4 Manufacturing

8.5 Retail and Consumer Goods

8.6 IT and Telecommunications

8.7 Government and Public Sector

8.8 Others

8.9 Y-O-Y Growth trend Analysis By End-User

8.10 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Digital Adoption Platform Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Organization Size

9.1.3 By Deployment mode

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Organization Size

9.2.3 By Deployment mode

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Organization Size

9.3.3 By Deployment mode

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Organization Size

9.4.3 By Deployment mode

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Organization Size

9.5.3 By Deployment mode

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Digital Adoption Platform Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

10.1 WalkMe

10.2 AppLearn

10.3 Userlane

10.4 Whatfix

10.5 Pendo

10.6 Appcues

10.7 Gainsight PX

10.8 Inline Manual

10.9 Userpilot

10.10 Toonimo

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Digital Adoption Platform Market was valued at USD 624.29 million and is projected to reach a market size of USD 2674.19 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 23.1%.

The advantages of DAP and the increasing complexity of software ecosystems are the main factors propelling the Global Digital Adoption Platform Market.

Based on End-Users, the Global Digital Adoption Platform Market is segmented into Healthcare, BFSI, Manufacturing, Retail and Consumer Goods, IT and Telecommunications, Government and Public Sector, and Others.

North America is the most dominant region for the Global Digital Adoption Platform Market.

WalkMe, AppLearn, and Userlane are the key players operating in the Global Digital Adoption Platform Market.