Diesel Power Engine Market Size (2024 – 2030)

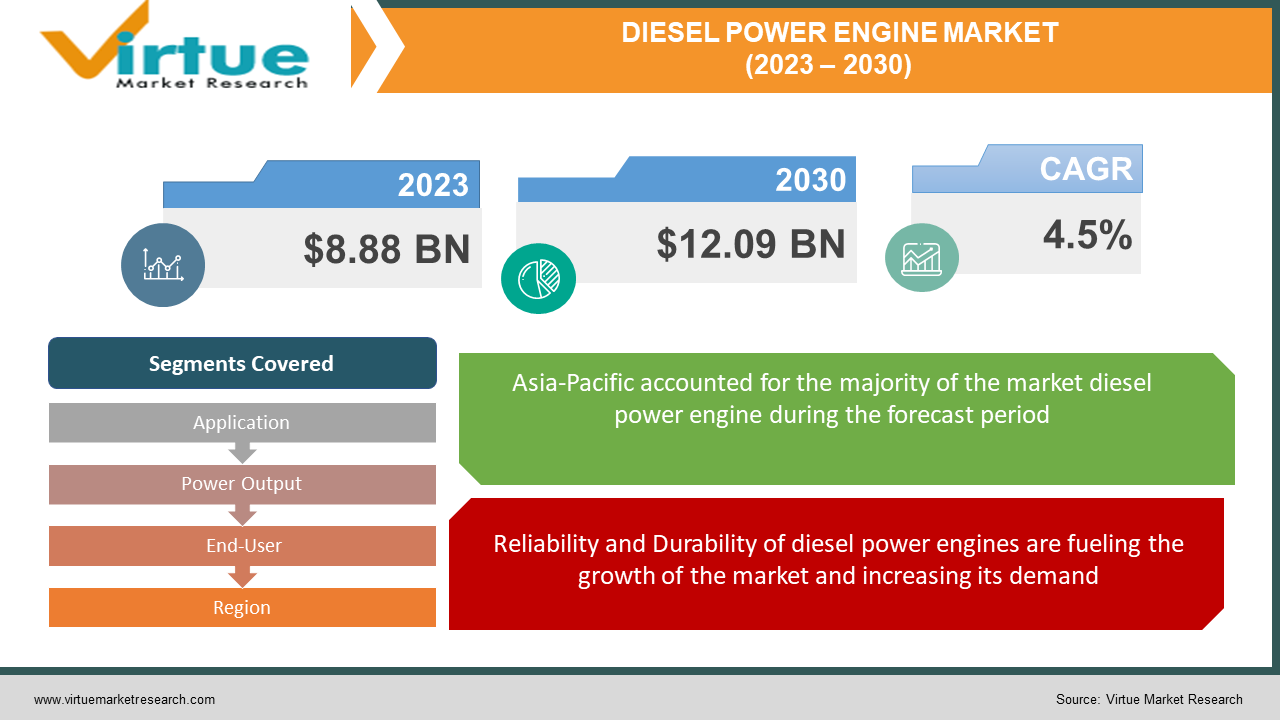

The Diesel Power Engine Market was valued at USD 8.88 Billion and is projected to reach a market size of USD 12.09 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.5%.

Market Overview:

The diesel power engine sector constitutes a significant portion of the global power generation industry, encompassing various applications such as standby and prime power generation, industrial machinery, construction equipment, and marine propulsion systems. Its reliance on the reliability and fuel efficiency of diesel engines has rendered them indispensable across sectors requiring steadfast and continuous power solutions. However, recent years have witnessed a shift driven by environmental concerns, leading to advancements in emission control technologies and exploration of alternative power sources. Consequently, the diesel power engine market has gravitated toward more sustainable and cleaner technologies while maintaining its stronghold in sectors where its inherent strengths remain crucial.

Key Market Insights:

The diesel power engine market sees promising prospects with the surge in electrification initiatives across Africa, notably projects like the Western Africa Regional Off-Grid Electrification Project. In sectors like mining, diesel engines persist as favored power sources due to their stability, catering to heavy-duty operations. Similarly, in healthcare, diesel power engines stand as the most dependable backup, ensuring continuous power supply for critical medical equipment like oxygen ventilators and ECG machines.

Addressing power outage-related delays in construction projects, diesel power engines find adoption for ensuring uninterrupted power supply on construction sites. In manufacturing, these engines serve as the preferred power source to avert production disruptions and maintain product quality. Additionally, the iron and steel industry relies on diesel power engines for backup in scenarios involving sudden power needs or shutdowns.

India presents expanding opportunities for diesel power engines due to the government's focus on infrastructure development, particularly in areas like roads, railways, and metro networks. Government regulations such as the decade-based ban on older diesel vehicles in Delhi are expected to support market growth. Despite these regulations, diesel-based vehicles maintain their economic edge in the Indian market, driving growth indirectly through increased vehicle turnover.

Diesel Power Engine Market Drivers:

Reliability and Durability of diesel power engines are fueling the growth of the market and increasing its demand.

The robustness and enduring operational lifespans of diesel power engines fuel market growth and demand. Industries reliant on uninterrupted operations, such as hospitals, data centers, heavy-duty construction, and mining, prefer diesel engines due to their reliability in critical applications.

Energy Efficiency and better fuel economy provided by diesel power engines are a great attraction for industries heightening their growth.

Diesel engines' superior energy efficiency and better fuel economy attract industries seeking cost-effective solutions. This efficiency is particularly crucial in sectors like long-haul transportation, where diesel-powered vehicles strike a balance between power and fuel efficiency, along with extended operational ranges in marine and off-road applications.

Diesel Power Engine Market Restraints and Challenges:

Environmental Regulations and Emissions Control

Meeting stringent environmental regulations and emissions standards poses a significant challenge. Diesel engines are known to produce emissions with adverse environmental and health effects, necessitating costly emission control technologies, which increase overall engine costs.

Competition from Alternative Power Sources

The diesel power engine market faces stiff competition from alternative, eco-friendly power sources like natural gas engines, hybrid systems, and renewable energy solutions. This necessitates innovation and adaptation to remain competitive in an evolving market driven not only by cost and reliability but also environmental impact considerations.

Diesel Power Engine Market Opportunities:

The diesel power engine market holds opportunities in expanding into emerging markets with rising energy demands, catering to the need for reliable backup power solutions in regions with unstable electrical grids, and diversification by integrating cleaner technologies and hybrid systems. Specialized applications in off-road machinery and marine transport continue to value the robustness and efficiency of diesel engines, presenting avenues for market growth and adaptation in an evolving energy landscape.

DIESEL POWER ENGINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Application, Power Output, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cummins Inc., Caterpillar Inc., Rolls-Royce Power Systems AG, Wärtsilä Corporation, Yanmar Co., Ltd., Kohler Co., Deutz AG, Mitsubishi Heavy Industries, Ltd., Volvo Penta, Perkins Engines Company Limited |

Diesel Power Engine Market Segmentation: By Application

-

Standby Power

-

Prime Power

-

Continuous Power

-

Peak Shaving

-

Combined Heat and Power

-

Marine Propulsion

-

Construction Equipment

-

Industrial Machinery

-

Mining Equipment

-

Off-Road Vehicles

Among the applications within the diesel power engine market, Standby Power typically holds the largest market share, accounting for approximately 45.6%. This dominance is due to the critical role standby generators play in ensuring uninterrupted electricity during outages, vital for sectors like critical infrastructure, healthcare, data centers, and businesses. With increased occurrences of extreme weather and grid instability, the demand for reliable backup power sources has surged, propelling Standby Power as the leading segment. Meanwhile, the Combined Heat and Power category emerges as the fastest-growing application segment. This growth stems from the focus on energy efficiency and sustainability. CHP systems optimize fuel by simultaneously producing electricity and useful thermal energy, a factor driving their expanding use in various industries and institutions aiming to cut energy costs and emissions.

Diesel Power Engine Market Segmentation: By Power Output

-

Low Power Engines

-

Medium Power Engines

-

High Power Engines

The Medium Power Engines segment stands as the largest within the diesel power engine market, constituting around 64% of the share. Their versatility finds application across diverse industries like construction, industrial machinery, and commercial backup power due to their balance between efficiency and output. High Power Engines, on the other hand, represent the fastest-growing segment at an estimated CAGR of 11.3%. Their increasing demand arises from sectors requiring robust, high-capacity engines, such as large-scale industrial applications, marine propulsion for bigger vessels, and power plant expansions. Advancements in emission control and fuel efficiency have enhanced the appeal of high-power diesel engines, contributing to their accelerated market growth.

Diesel Power Engine Market Segmentation: By End-User

-

Residential

-

Commercial

-

Industrial

-

Oil & Gas

-

Mining

-

Healthcare

-

Data Centers

-

Telecom

-

Transportation

-

Marine

-

Construction

The industrial sector commands the diesel power engine market with approximately 46.4% of revenue share. Diesel engines play a crucial role in various industrial applications, ensuring robustness, reliability, and efficiency across manufacturing, construction, and heavy machinery operations. The need for continuous and backup power in industrial settings further propels the demand for diesel generators, solidifying the industrial sector's dominance. Meanwhile, Data Centers emerge as the fastest-growing segment at a projected CAGR of 13.4%. The surge in data storage demand and the critical necessity for uninterrupted power supply drive this growth, with diesel generators serving as a dependable standby power source, crucial for data integrity and operations continuity.

Diesel Power Engine Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific leads the diesel power engine market, holding an estimated share of 37%. The region's rapid industrialization, particularly in countries like China and India, coupled with its thriving maritime sector, contributes significantly to the demand for diesel power engines. The diverse energy needs and continuous growth in sectors like construction and infrastructure further solidify Asia-Pacific's dominance. Additionally, the Asia-Pacific region is forecasted to be the fastest-growing market with an anticipated CAGR of 17.8%, driven by expanding industrial and construction sectors, coupled with the demand for reliable power sources in remote areas and off-grid locations.

COVID-19 Impact Analysis on the Global Diesel Power Engine Market:

The COVID-19 pandemic presented a mixed impact on the global diesel power engine market. Initially, disruptions in supply chains and manufacturing processes led to production delays. The decline in oil prices further affected the market's economic feasibility for diesel-powered solutions. However, the pandemic underscored the importance of reliable backup power, boosting the demand for standby generators in critical infrastructure and healthcare facilities. As economies recover, opportunities arise for retrofitting older diesel engines to meet stricter emission standards, contributing to a more sustainable post-pandemic recovery.

Latest Trends/Developments:

One notable trend is the increasing adoption of advanced digital technologies in diesel engines. Manufacturers are integrating IoT sensors and remote monitoring capabilities to enhance performance and optimize maintenance schedules, reducing downtime and operational costs while improving reliability.

A significant development in the market is the focus on cleaner and sustainable diesel engine technologies. Investments in research aim to reduce emissions and enhance fuel efficiency. Advanced exhaust after-treatment systems like selective catalytic reduction and the exploration of alternative fuels like biodiesel and synthetic diesel are underway to minimize the environmental impact of diesel engines while maintaining efficiency and versatility.

Key Players:

-

Cummins Inc.

-

Caterpillar Inc.

-

Rolls-Royce Power Systems AG

-

Wärtsilä Corporation

-

Yanmar Co., Ltd.

-

Kohler Co.

-

Deutz AG

-

Mitsubishi Heavy Industries, Ltd.

-

Volvo Penta

-

Perkins Engines Company Limited

In March 2023, Wärtsilä unveiled an improved version of its Wärtsilä 31 diesel engine, offering higher power output. This upgraded diesel engine showcases an elevated power-to-size ratio without altering its physical dimensions, leading to decreased ownership expenses and lower maintenance costs.

Chapter 1. Diesel Power Engine Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Diesel Power Engine Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Diesel Power Engine Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Diesel Power Engine Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Diesel Power Engine Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Diesel Power Engine Market – By Power Output

6.1 Introduction/Key Findings

6.2 Low Power Engines

6.3 Medium Power Engines

6.4 High Power Engines

6.5 Y-O-Y Growth trend Analysis By Power Output

6.6 Absolute $ Opportunity Analysis By Power Output, 2024-2030

Chapter 7. Diesel Power Engine Market – By Application

7.1 Introduction/Key Findings

7.2 Standby Power

7.3 Prime Power

7.4 Continuous Power

7.5 Peak Shaving

7.6 Combined Heat and Power

7.7 Marine Propulsion

7.8 Construction Equipment

7.9 Industrial Machinery

7.10 Mining Equipment

7.11 Off-Road Vehicles

7.12 Y-O-Y Growth trend Analysis By Application

7.13 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Diesel Power Engine Market – By End-User Industry

8.1 Introduction/Key Findings

8.2 Residential

8.3 Commercial

8.4 Industrial

8.5 Oil & Gas

8.6 Mining

8.7 Healthcare

8.8 Data Centers

8.9 Telecom

8.10 Transportation

8.11 Marine

8.12 Construction

8.13 Y-O-Y Growth trend Analysis By End-User Industry

8.14 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 9. Diesel Power Engine Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By End-User Industry

9.1.4 By Power Output

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By End-User Industry

9.2.4 By Power Output

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By End-User Industry

9.3.4 By Power Output

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By End-User Industry

9.4.4 By Power Output

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By End-User Industry

9.5.4 By Power Output

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Diesel Power Engine Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cummins Inc.

10.2 Caterpillar Inc.

10.3 Rolls-Royce Power Systems AG

10.4 Wärtsilä Corporation

10.5 Yanmar Co., Ltd.

10.6 Kohler Co.

10.7 Deutz AG

10.8 Mitsubishi Heavy Industries, Ltd.

10.9 Volvo Penta

10.10 Perkins Engines Company Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Diesel Power Engine Market was valued at USD 8.88 Billion and is projected to reach a market size of USD 12.09 Billion by the end of 2030 growing at a CAGR of 4.5%.

The reliability and durability of diesel power engines along with Energy efficiency and better fuel economy are drivers of the Diesel Power Engine market.

Based on power output, the Diesel Power Engine Market is segmented into Low Power Engines, Medium Power Engines, and High Power Engines.

Asia Pacific is the most dominant region for the Diesel Power Engine Market.

Cummins Inc., Caterpillar Inc., Rolls-Royce Power Systems AG, Wärtsilä Corporation, and Yanmar Co., Ltd. are a few of the key players operating in the Diesel Power Engine Market.