Die Casting Market size (2025-2030)

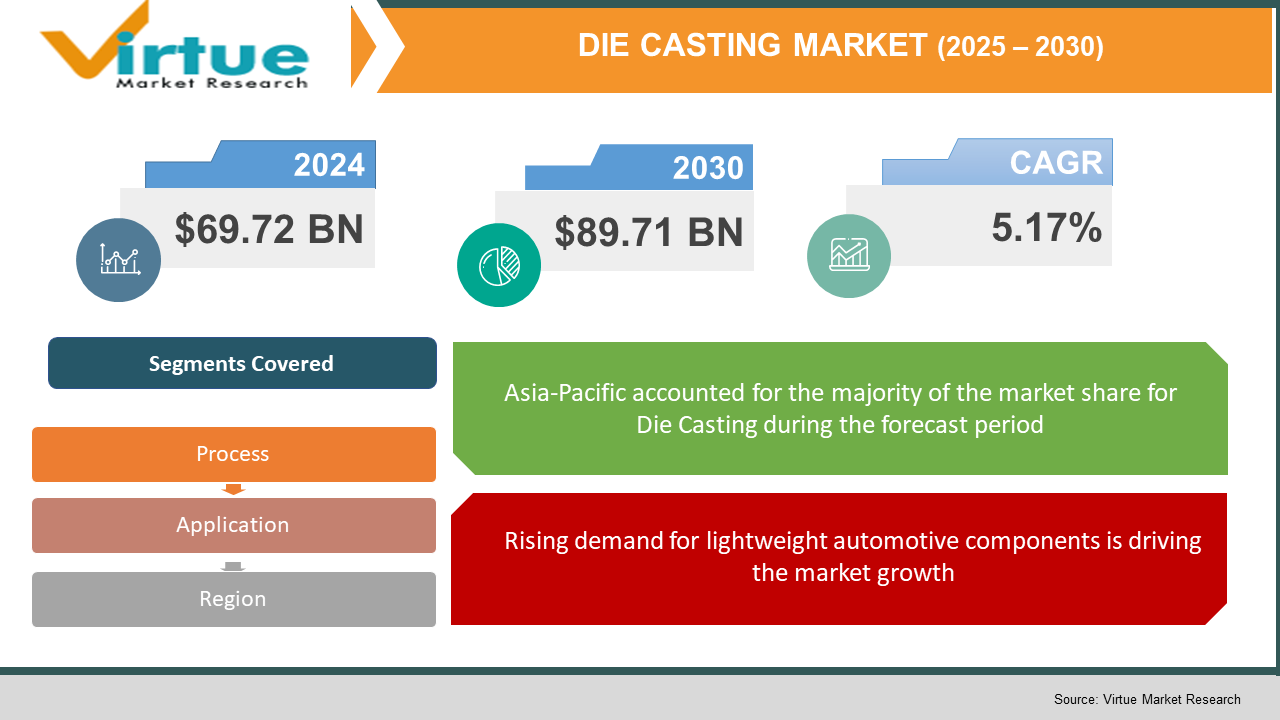

The Global Die Casting Market was valued at USD 69.72 billion in 2024 and is projected to grow at a CAGR of 5.17% from 2025 to 2030. By the end of 2030, the market is expected to reach USD 89.71 billion.

This method produces high-precision components with smooth or textured surfaces, minimal finishing requirements, and excellent mechanical properties. It is commonly used in the production of automotive components, electronics housings, aerospace parts, and industrial machinery. Growth in this market is fueled by demand for lightweight, durable parts in automotive manufacturing and advancements in electronics and consumer goods. Additionally, increased focus on fuel efficiency and emission control standards is leading to the adoption of lighter metals and die-cast parts. The rise in electric vehicle production and infrastructure development in emerging economies also contribute to expanding demand for high-volume, low-cost die casting solutions.

Key market insights:

Asia-Pacific accounted for over 54% of the global die casting market share in 2024 due to its strong automotive production, electronic component manufacturing, and favorable manufacturing cost structure

Aluminum die casting remains the most widely used metal, making up approximately 68% of all die castings due to its lightweight and corrosion-resistant properties

High-pressure die casting represents more than 70% of the process segment due to its speed, efficiency, and ability to create intricate components with tight tolerances

Automotive applications dominate the market, contributing to more than 60% of the global demand for die-cast parts, especially in engine blocks, transmission cases, and structural parts

Vacuum die casting is emerging as the fastest-growing sub-process, with demand increasing due to its superior mechanical performance and lower porosity outcomes

The electric vehicle industry’s rising demand for aluminum alloy battery enclosures and motor casings is opening new avenues for die casting applications

Technological integration, such as the use of simulation software, automation, and real-time monitoring, is improving yield and reducing operational costs in die casting operations globally

Global Die Casting Market Drivers

Rising demand for lightweight automotive components is driving the market growth

Automakers are shifting toward aluminum and magnesium die casting solutions to reduce vehicle weight, improve fuel economy, and comply with strict environmental regulations. Electric vehicles in particular have accelerated this trend, as lighter components help compensate for the weight of batteries, thus extending range and improving performance. Die-cast aluminum components are replacing traditional steel parts in engines, transmissions, chassis, and even in newer structural battery enclosures. With regulations tightening across Europe, North America, and Asia, manufacturers are increasingly turning to high-pressure and vacuum die casting technologies to meet these evolving requirements. Furthermore, improvements in alloy strength, surface finish, and structural integrity have allowed manufacturers to die cast components previously machined or forged, further expanding application scope. The automotive industry’s transition toward hybrid and fully electric platforms also encourages the use of larger, more complex die-cast parts, making the technology central to future manufacturing strategies. With millions of vehicles produced annually and electrification trends gaining momentum, this demand is expected to continuously drive die casting market growth over the coming decade.

Expansion of consumer electronics and industrial applications is driving the market growth

While automotive remains the core end-use industry, the die casting market is expanding rapidly into consumer electronics, industrial equipment, telecommunications, and medical devices. The consumer electronics sector, including smartphones, laptops, smart home devices, and wearables, requires compact, lightweight, and thermally efficient metal components. Die casting offers the precision and surface finish required for such applications, with aluminum and magnesium alloys being ideal materials due to their heat dissipation and corrosion resistance. Similarly, in industrial machinery, die-cast components such as pumps, valves, and motor housings benefit from the high dimensional accuracy and durability provided by die casting processes. Aerospace and defense sectors are also utilizing high-strength, lightweight magnesium and aluminum castings in applications ranging from drone frames to avionics housings. The increased adoption of smart home technology, 5G infrastructure, and renewable energy equipment further creates opportunities for die cast parts, especially in electrical enclosures, thermal management systems, and structural supports. As digital transformation and miniaturization continue across industries, the demand for complex, thin-walled die-cast components is expected to grow, supporting a robust and diversified market expansion.

Advancements in die casting technology and process automation is driving the market growth

Technological innovation is enhancing the capabilities, efficiency, and scalability of die casting processes. High-pressure die casting remains dominant due to its speed and ability to produce intricate geometries, but other methods like vacuum die casting and squeeze die casting are gaining popularity for their ability to deliver superior mechanical properties and lower porosity. Automation plays a key role in improving productivity, ensuring consistency, and reducing labor dependency. Robotic material handling, automated mold clamping, and real-time temperature and pressure controls help streamline production and reduce cycle times. Simulation software now allows foundries to optimize die design and casting parameters before production, minimizing trial-and-error and material waste. Integration of Internet of Things (IoT) devices enables predictive maintenance, quality control, and monitoring of process conditions in real time. In addition, manufacturers are investing in advanced materials, such as new aluminum and magnesium alloys, to meet more stringent performance and weight requirements. Environmental sustainability is another area of focus, with closed-loop systems for recycling and energy-efficient furnaces gaining traction. The use of water-based lubricants, automation-driven scrap reduction, and smart factory initiatives are further modernizing the die casting industry. Collectively, these advancements make die casting more competitive, reliable, and aligned with the goals of smart manufacturing and sustainable production.

Global Die Casting Market Challenges and Restraints

Volatility in raw material prices is restricting the market growth

These non-ferrous metals are heavily influenced by global market dynamics, including demand-supply imbalances, geopolitical events, trade tariffs, and currency exchange rates. For example, aluminum prices have experienced notable swings in recent years due to global energy costs, mining disruptions, and policy changes in major producing nations. Sudden increases in raw material prices can erode profit margins for die casters, especially in price-sensitive sectors such as consumer goods and low-cost automotive components. The inability to predict or control these price movements adds uncertainty to manufacturing cost structures and can deter long-term contracts. Additionally, smaller manufacturers with limited buying power face higher risks from these fluctuations compared to large integrated players. To mitigate these issues, companies often resort to long-term supply agreements, material hedging strategies, or switching between alloy compositions. However, these solutions are not always viable or sufficient, particularly during prolonged market volatility. This ongoing raw material cost uncertainty remains a key restraint on profitability and planning in the global die casting market.

Lack of standardization and quality consistency is restricting the market growth

The die casting industry is highly fragmented, especially in developing markets, where a large number of small and medium-sized enterprises operate without standardized quality control systems. This lack of uniformity can lead to significant disparities in casting quality, mechanical properties, dimensional accuracy, and surface finish. Inconsistencies in die material selection, melting practices, mold design, and process control can result in high rejection rates, customer dissatisfaction, and reduced product lifespan. As a result, many OEMs prefer working only with certified, large-scale suppliers who can guarantee consistent quality and traceability. This creates a barrier to entry for smaller foundries seeking to participate in high-margin segments. Moreover, the absence of global quality benchmarks or widely adopted industry standards prevents harmonization and restricts international business expansion for smaller players. While some regions enforce ISO and IATF certifications, adoption is uneven. Increasing focus on quality assurance, regulatory compliance, and certification will be necessary to address these issues and ensure sustainable market growth across all tiers of the die casting industry.

Market opportunities

The die casting market offers several promising opportunities that could significantly influence its trajectory over the coming years. One of the most substantial opportunities lies in the global shift toward electric vehicles. As automakers accelerate their transition to electric mobility, the demand for lightweight die-cast aluminum and magnesium components is expected to surge. Die casting is instrumental in manufacturing battery enclosures, electric motor housings, inverter cases, and other structural and thermal components used in EV platforms. Furthermore, the growth of connected, autonomous vehicles introduces new requirements for lightweight yet strong enclosures for sensors and electronic control units, presenting new applications for advanced die casting. Wind turbines, solar panel frames, and battery energy storage systems often rely on die-cast aluminum parts due to their durability and corrosion resistance. Additionally, the continued digitalization of industry has driven demand for die-cast parts in computing, data centers, and 5G infrastructure. On the process innovation side, the adoption of digital twins, advanced simulation, and data analytics tools creates avenues for better product development, real-time monitoring, and cost reduction. Environmentally, the ability to use recycled metals aligns die casting with sustainability initiatives, offering a competitive edge as industries pursue circular economy goals. Expansion into underpenetrated markets in Africa, Latin America, and Southeast Asia further opens up geographic growth. These regions are witnessing increasing industrialization, urbanization, and vehicle production, making them ideal targets for new die casting facilities and partnerships. In summary, a convergence of megatrends including electrification, digitalization, and sustainability is creating a wide landscape of opportunities for forward-thinking die casting companies.

DIE CASTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.17% |

|

Segments Covered |

By Process, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

|

Die Casting Market segmentation

Die Casting Market segmentation By Process:

- High Pressure Die Casting

- Low Pressure Die Casting

- Vacuum Die Casting

- Squeeze Die Casting

- Gravity Die Casting

High pressure die casting is the most widely used process. Its popularity stems from its ability to produce large volumes of high-precision, thin-walled components in short cycle times. The process is especially suitable for aluminum and magnesium alloys and is commonly used in automotive manufacturing for engine blocks, gear housings, and transmission cases. The process offers advantages such as good surface finish, high dimensional accuracy, and minimal post-processing. It is ideal for complex geometries that require tight tolerances and consistency. As manufacturing trends continue to favor mass production and lightweighting, high pressure die casting is expected to maintain its dominance through 2030.

Die Casting Market segmentation By Application:

- Automotive

- Electrical & Electronics

- Industrial Machinery

- Aerospace & Defense

- Consumer Goods

Automotive is the leading application segment in the die casting market. This dominance is driven by the industry’s need for lightweight, high-strength components to meet fuel efficiency and emissions regulations. The rise of electric vehicles has further increased the reliance on die casting to produce structural battery housings and motor casings. Given the scale of global vehicle production and the continued shift to electric mobility, the automotive segment is expected to retain its leadership in die casting applications over the forecast period.

Die Casting Market Regional segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Asia-Pacific is the dominant region in the global die casting market, contributing more than half of total market revenue. The region’s strength lies in its expansive automotive and electronics manufacturing sectors, cost-effective labor, and increasing infrastructure investment. China leads the region, followed by India, Japan, and South Korea, all of which have robust domestic markets and export capacities. Government initiatives supporting industrialization, foreign direct investment, and electric vehicle adoption have further strengthened the region’s position. In India, for example, the government's “Make in India” program has led to increased investment in manufacturing facilities, including foundries. Southeast Asian countries like Vietnam and Thailand are also emerging as significant hubs due to their growing automotive assembly operations. Moreover, the region benefits from abundant raw material availability and growing technological capabilities. Local manufacturers are increasingly adopting automated and environmentally friendly die casting systems to meet international quality standards. The combination of high-volume production, favorable economic conditions, and a growing domestic market ensures that Asia-Pacific will continue to be the epicenter of die casting demand and innovation over the next decade.

COVID-19 Impact Analysis on the Die Casting Market

Nationwide lockdowns, manufacturing plant closures, and supply chain disruptions led to a temporary halt in die casting operations across automotive, electronics, and industrial sectors. The automotive industry, which represents the largest end-user segment, saw a sharp decline in vehicle production and sales, directly affecting die casting demand. Workforce shortages and logistics challenges further delayed raw material supply and equipment maintenance, reducing production efficiency. However, the pandemic also accelerated certain changes in manufacturing strategies. Many die casting companies began investing in automation, remote monitoring, and digital process control to reduce dependence on manual labor and improve operational resilience. As economies began to recover in late 2020 and early 2021, pent-up demand in automotive and electronics led to a rapid rebound in die casting activity. The rise in electric vehicle sales post-pandemic has helped offset earlier losses. Additionally, reshoring efforts and supply chain diversification have driven new investment in regional die casting facilities, particularly in North America and Southeast Asia. Overall, while COVID-19 caused short-term disruptions, it also led to long-term modernization of the industry, making it more resilient and technology-driven.

Latest trends/Developments

The die casting industry is undergoing rapid transformation through innovation and market evolution. One of the key trends is the increasing use of automation and robotics, which allows for faster cycle times, greater consistency, and reduced labor dependency. Integration of real-time data analytics, process simulation, and digital twins is improving efficiency and quality. The use of lightweight alloys is expanding beyond aluminum to include magnesium and even hybrid materials, which offer superior performance for specific applications. Sustainability is another major trend, with manufacturers investing in closed-loop recycling systems, energy-efficient melting furnaces, and environmentally safe lubricants. Die casting is also playing a central role in electric vehicle design, with larger structural components being cast as single pieces, reducing the need for welding and assembly. New techniques such as high-vacuum and semi-solid die casting are being explored to improve material properties and surface finishes. In the consumer electronics space, miniaturization and thermal performance demands are driving the development of micro die casting solutions. Finally, industry players are consolidating through mergers and strategic partnerships to increase capacity, enter new markets, and expand technical capabilities. These trends point to a future where die casting is smarter, greener, and more deeply integrated into next-generation manufacturing.

Key Players:

- Dynacast

- Georg Fischer

- Nemak

- Endurance Technologies

- Ryobi Die Casting

- Shiloh Industries

- Aisin Seiki

- HITACHI KOKI Metal

- Linamar Corporation

- Martinrea International

Chapter 1. Die Casting Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary source

1.5. Secondary source

Chapter 2. DIE CASTING MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. DIE CASTING MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. DIE CASTING MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. DIE CASTING MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. DIE CASTING MARKET – By Process

6.1 Introduction/Key Findings

6.2 High Pressure Die Casting

6.3 Low Pressure Die Casting

6.4 Vacuum Die Casting

6.5 Squeeze Die Casting

6.6 Gravity Die Casting

6.7 Y-O-Y Growth trend Analysis By Process

6.8 Absolute $ Opportunity Analysis By Process , 2025-2030

Chapter 7. DIE CASTING MARKET – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Electrical & Electronics

7.4 Industrial Machinery

7.5 Aerospace & Defense

7.6 Consumer Goods

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. DIE CASTING MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Process

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Process

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Process

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Process

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Process

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. DIE CASTING MARKET – Company Profiles – (Overview, Product Process , Portfolio, Financials, Strategies & Developments)

9.1 Dynacast

9.2 Georg Fischer

9.3 Nemak

9.4 Endurance Technologies

9.5 Ryobi Die Casting

9.6 Shiloh Industries

9.7 Aisin Seiki

9.8 HITACHI KOKI Metal

9.9 Linamar Corporation

9.10 Martinrea International

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Die Casting Market was valued at USD 69.72 billion in 2024 and is projected to grow at a CAGR of 5.17% from 2025 to 2030. By the end of 2030, the market is expected to reach USD 89.71 billion.

Key drivers include growing demand for lightweight automotive parts, expansion into electronics and industrial uses, and tech advancements

The market is segmented by process (e.g., high pressure, vacuum, gravity) and by application (e.g., automotive, electronics, aerospace).

Asia-Pacific is the dominant region due to its strong automotive and electronics manufacturing base.

Key players include Dynacast, Georg Fischer, Nemak, Ryobi Die Casting, and Endurance Technologies.