Diamine Polyetheramine Market Size (2024 – 2030)

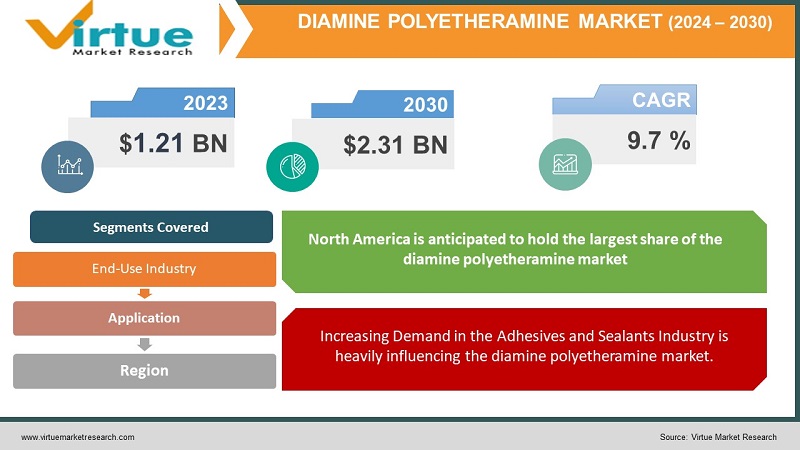

Diamine Polyetheramine Market was valued at USD 1.1 billion and is projected to reach a market size of USD 2.31 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 9.7%.

Diamine polyetheramines, which are a type of specialty amine compound, are commonly used as curing agents in the production of epoxy resins, in coatings, adhesives, and sealants. The diamine polyetheramine market has seen steady growth in recent years due to its versatile applications in various industries. These compounds are valued for their ability to enhance the performance of end products, providing improved flexibility, adhesion, and resistance to chemicals and corrosion. The demand for polyetheramines is rising in the construction, automotive, and wind energy sectors, driven by the need for advanced materials and coatings. Environmental regulations and the shift toward eco-friendly products have also contributed to the expansion of this market, with a growing emphasis on low-VOC and sustainable formulations. This market is expected to continue its growth trajectory as technological advancements and innovative applications further fuel the demand for diamine polyetheramines.

Key Market Insights:

The wind energy industry has emerged as a significant driver for the increased demand for polyetheramines. This surge is attributed to the global appetite for clean and sustainable energy sources. In past years, the cumulative global wind energy capacity reached 432.9 GW, with an additional 63 GW of newly installed wind power, reflecting an impressive annual market growth of 22%. Notably, China took the lead in new wind energy installations, contributing 30 GW to the total. This rapid expansion in wind power has spurred the manufacturing of large wind turbines, which rely on epoxy adhesives and epoxy resin composites for construction. Epoxy adhesives, used to bond wind turbine components, are enhanced with polyetheramines as curing agents, improving their static and dynamic fracture toughness. Polyetheramines bolster the fatigue resistance and burst strength of epoxy resin composites, further driving their demand in the wind energy sector.

A notable limitation lies in the poor UV/VIS (ultraviolet/visible) response of polyetheramines. These systems lack the necessary stability in UV/VIS spectra due to the presence of amine groups and the absence of strong chromophores. When exposed to the ambient atmosphere, the amine groups within polyetheramines undergo oxidation, transforming into nitro groups and causing a yellowish discoloration. Consequently, these materials may not be suitable for applications such as white coatings in the automotive industry, restricting their use to luxury or premium vehicle segments.

Diamine Polyetheramine Market Drivers:

Increasing Demand in the Adhesives and Sealants Industry is heavily influencing the diamine polyetheramine market.

Diamine polyetheramines are widely used as curing agents or hardeners in the production of epoxy adhesives and sealants. These products are essential in various industries, such as construction, automotive, aerospace, and electronics, for bonding and sealing applications. The growing demand for high-performance adhesives and sealants in these industries, driven by factors like the need for lightweight materials, improved durability, and enhanced bonding capabilities, has led to increased consumption of diamine polyetheramines. As a result, the rising demand for adhesives and sealants in various applications is a significant driver of the diamine polyetheramine market.

One significant driver of the diamine polyetheramine market is the expansion in the coatings and paints industry.

Diamine polyetheramines are also utilized in the coatings and paints industry as additives and curing agents. These products help enhance the performance of coatings and paints by improving their adhesion, durability, and resistance to chemicals and weathering. With the expansion of the construction, automotive, and industrial sectors, the demand for high-quality coatings and paints has increased. Stricter environmental regulations have driven the need for more sustainable and low-VOC (volatile organic compounds) coatings, in which diamine polyetheramines play a crucial role.

Diamine Polyetheramine Market Restraints and Challenges:

High production costs associated with the manufacturing of diamine polyetheramine could be challenging for businesses.

One of the primary challenges in the diamine polyetheramine market is the high production costs associated with manufacturing these chemicals. Diamine polyetheramines are complex compounds that require a series of chemical reactions and purification processes, which can be energy-intensive and time-consuming. The raw materials used in their production can also be expensive. This makes it difficult for manufacturers to maintain competitive pricing and may limit the accessibility of these chemicals to certain industries. The volatility of raw material prices, such as epichlorohydrin and amines, can further add to production cost uncertainties.

Environmental and regulatory constraints with the use of chemicals like diamine polyetheramine pose a hindrance to the growth of this market.

The production and use of diamine polyetheramines can have environmental implications, as these chemicals may release volatile organic compounds (VOCs) during manufacturing and application processes. Environmental regulations, especially regarding air and water quality, can impose restrictions and compliance requirements on manufacturers, which can increase operational costs and limit certain applications. Manufacturers need to invest in research and development to create more environmentally friendly alternatives or processes to comply with these regulations.

Diamine Polyetheramine Market Opportunities:

The diamine polyetheramine market presents significant opportunities for growth, driven by increasing demand in applications like epoxy coatings, adhesives, and composites due to their exceptional properties for enhancing product performance and durability. Additionally, the rising emphasis on sustainability and environmental regulations is propelling the development of eco-friendly formulations, opening doors for innovation and market expansion. As industries continue to seek advanced materials to meet their evolving needs while addressing environmental concerns, diamine polyetheramines are poised for increased adoption and market expansion in the coming years.

DIAMINE POLYETHERAMINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.7% |

|

Segments Covered |

By Application, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Huntsman Corporation, BASF SE, IRO Group Inc., Yangzhou Chenhua New Materials, Zibo Dexin Lianbang Chemical Industry, Zibo Xingtaizhong Chemical, Yantai Minsheng Chemicals, Evonik Industries |

Diamine Polyetheramine Market Segmentation: By Application

-

Epoxy Coatings

-

Adhesives and Sealants

-

Composites

-

Fuel Adhesives

-

Water Treatment

The largest segment by application is typically in epoxy coatings having a market share of 41%. This dominance is primarily attributed to the exceptional properties of these amines in epoxy formulations, where they serve as curing agents. Diamine polyetheramines enhance the performance of epoxy coatings by providing superior adhesion, corrosion resistance, and durability. As a result, they are extensively used in industries like construction, automotive, aerospace, and marine, where high-quality coatings are essential for protecting surfaces against environmental factors, making epoxy coatings the largest and most prominent application segment in the diamine polyetheramine market. The fastest-growing segment is also epoxy coatings growing at a CAGR of 20%. This is due to the increasing demand for high-performance coatings in industries such as construction, automotive, and marine, driven by the need for corrosion protection, enhanced durability, and the rising trend of eco-friendly and sustainable coating solutions. Diamine polyetheramines, with their exceptional adhesion and curing properties, are gaining prominence as essential components in epoxy coatings, making them a crucial factor in the growth of this segment.

Diamine Polyetheramine Market Segmentation: By End-Use Industry

-

Construction

-

Automotive

-

Aerospace

-

Marine

-

Oil and Gas

-

Water Treatment

The largest segment by end-user industry in the diamine polyetheramine market is the construction industry due to the widespread use of diamine polyetheramines in epoxy coatings and adhesives, which are essential for applications in the construction sector. Diamine polyetheramines are favored for their ability to provide durable and protective coatings for concrete surfaces, flooring systems, and structural bonding. With the constant demand for infrastructure development and maintenance, especially in rapidly growing urban areas, the construction industry continues to be the largest consumer of diamine polyetheramines, driving significant market growth and volume.

The fastest-growing segment is likely the aerospace industry growing at a CAGR of 17.4%. This growth can be attributed to the increasing demand for lightweight and high-strength composite materials in aircraft manufacturing to improve fuel efficiency and reduce emissions. Diamine polyetheramines are vital in the production of advanced composites and structural adhesives, enabling the aerospace sector to meet stringent performance and safety standards. As global air travel continues to expand and the focus on sustainable aviation intensifies, the aerospace industry's reliance on diamine polyetheramines is expected to drive robust growth in this segment.

Diamine Polyetheramine Market Segmentation: Regional Analysis

-

North America

-

Asia- Pacific

-

Europe

-

South America

-

Middle East and Africa

The largest segment by region in the diamine polyetheramine market is North America having a market share of 33%. This dominance can be attributed to the region's well-established manufacturing sectors, particularly in industries like automotive, aerospace, and construction, which extensively use diamine polyetheramines for various applications. North America has stringent environmental regulations, leading to increased demand for eco-friendly and sustainable formulations, wherein diamine polyetheramines play a significant role.

The fastest-growing segment by region in the diamine polyetheramine market is likely to be the Asia-Pacific region growing at a CAGR of 20.2%, due to the region's rapid industrialization, infrastructure development, and the increasing adoption of advanced coatings and adhesives in sectors such as construction, automotive, and electronics. As these industries expand and become more technologically advanced, the demand for diamine polyetheramines for applications such as epoxy coatings, adhesives, and composites is expected to surge. Additionally, the availability of cost-effective raw materials and a growing emphasis on environmental regulations and sustainability are driving the use of these amines, making the Asia-Pacific region a high-growth market for diamine polyetheramines.

COVID-19 Impact Analysis on the Global Diamine Polyetheramine Market:

The global diamine polyetheramine market experienced initial disruptions due to the COVID-19 pandemic, with factors like supply chain interruptions and reduced demand from key end-user industries like construction and automotive. However, the market showed resilience, driven by the increased use of these amines in healthcare-related applications, such as medical adhesives and composites for personal protective equipment. As the world adapts to the post-pandemic landscape, the market is anticipated to recover and even experience growth, as industries gradually rebound, and the need for high-performance materials in various applications remains strong, particularly in the context of economic recovery and continued focus on sustainability.

Latest Trends/ Developments:

There is a growing trend toward developing sustainable and eco-friendly formulations of diamine polyetheramines. Manufacturers are focusing on reducing the environmental impact of these chemicals by exploring greener synthesis methods and sourcing sustainable raw materials. Additionally, there is increased demand for low-VOC (volatile organic compound) and solvent-free formulations to meet stringent environmental regulations and the sustainability goals of various industries. This trend aligns with global efforts to reduce the carbon footprint of products and processes, making sustainable diamine polyetheramines a key driver in the market.

Diamine polyetheramines are finding new and expanding applications in the electronics industry. They are being used in the production of advanced electronic materials, including encapsulants, potting compounds, and attach adhesives for semiconductor packaging. This trend reflects the ongoing technological advancements and miniaturization in the electronics sector, driving the adoption of diamine polyetheramines in cutting-edge applications.

Key Players:

-

Huntsman Corporation

-

BASF SE

-

IRO Group Inc.

-

Yangzhou Chenhua New Materials

-

Zibo Dexin Lianbang Chemical Industry

-

Zibo Xingtaizhong Chemical

-

Yantai Minsheng Chemicals

-

Evonik Industries

In June 2022, BASF unveiled plans for a production capacity expansion at its North American Geismar site, targeting a mid-2023 completion. This expansion is dedicated to enhancing the production of crucial specialty amines, with a specific focus on increasing the output of polyetheramines marketed under the Baxxodur brand.

Chapter 1. Diamine Polyetheramine Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Diamine Polyetheramine Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Diamine Polyetheramine Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysi

Chapter 4. Diamine Polyetheramine Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Diamine Polyetheramine Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Diamine Polyetheramine Market – By Application

6.1 Introduction/Key Findings

6.2 Epoxy Coatings

6.3 Adhesives and Sealants

6.4 Composites

6.5 Fuel Adhesives

6.6 Water Treatment

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Diamine Polyetheramine Market – By End-User Industry

7.1 Introduction/Key Findings

7.2 Construction

7.3 Automotive

7.4 Aerospace

7.5 Marine

7.6 Oil and Gas

7.7 Water Treatment

7.8 Y-O-Y Growth trend Analysis By Industry

7.9 Absolute $ Opportunity Analysis By Industry, 2024-2030

Chapter 8. Diamine Polyetheramine Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Diamine Polyetheramine Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Huntsman Corporation

9.2 BASF SE

9.3 IRO Group Inc.

9.4 Yangzhou Chenhua New Materials

9.5 Zibo Dexin Lianbang Chemical Industry

9.6 Zibo Xingtaizhong Chemical

9.7 Yantai Minsheng Chemicals

9.8 Evonik Industries

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Diamine Polyetheramine Market was valued at USD 1.21 Billion and is projected to reach a market size of USD 2.31 Billion by the end of 2030. Over the outlook period of 2024-2030, the market is anticipated to grow at a CAGR of 9.7%.

Increasing Demand in the Adhesives and sealants Industry and expansion in the coatings and paints industry are drivers of the Diamine Polyetheramine market.

Based on application, the Global Diamine Polyetheramine Market is segmented into Epoxy Coatings, Adhesives and Sealants, Composites, Fuel Adhesives, and Water Treatment.

North America is the most dominant region for the Global Diamine Polyetheramine Market.

Huntsman Corporation, BASF SE, IRO Group Inc., and Yangzhou Chenhua New Materials are a few of the key players operating in the Global Diamine Polyetheramine Market.