Diagnostic Imaging Market Size (2023-2030)

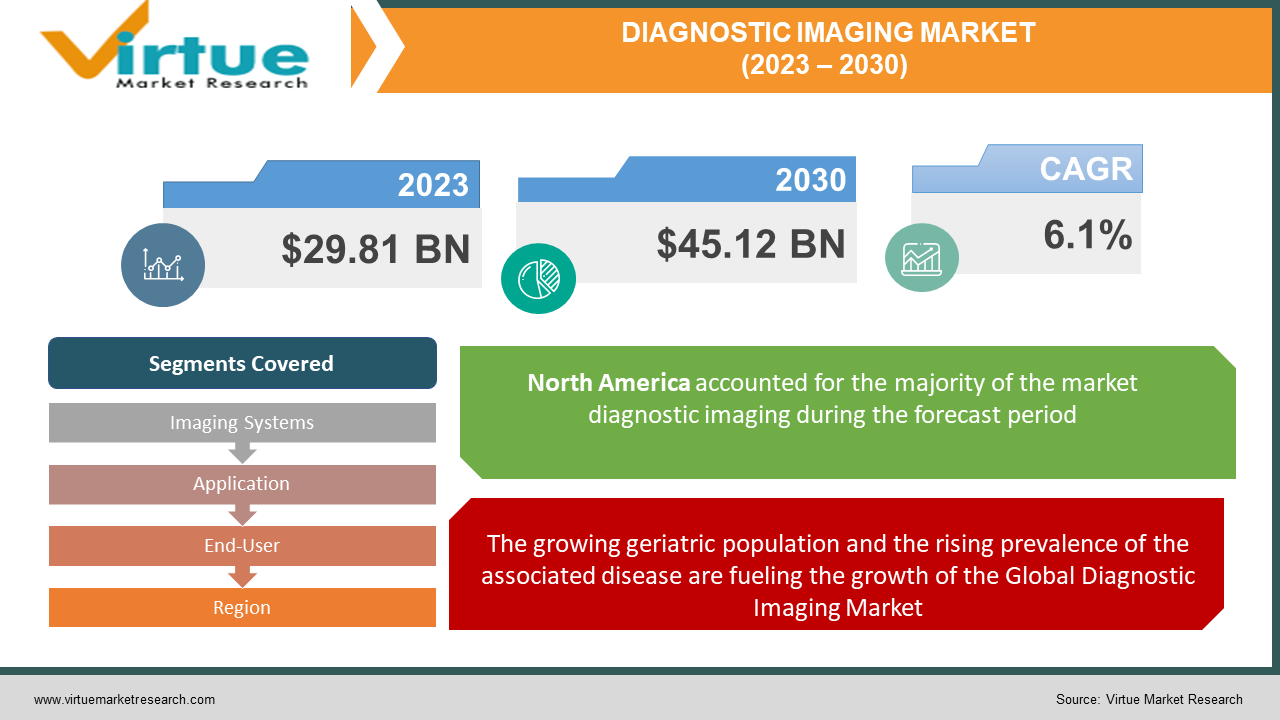

The Global Diagnostic Imaging Market was valued at USD 29.81 billion and is projected to reach a market size of USD 45.12 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.1%.

Imaging is a process and advanced technique used to produce images of internal body structure and visual representation for the physiological study of tissues and organs. Diagnostic imaging uses a range of techniques that are used to visualize the human body, which aids in the diagnosis, monitoring, and treatment of medical conditions. Different types of diagnostic technology provide various information about the body part being examined, such as sickness, injury, or the efficacy of medical intervention. Moreover, these imaging devices have provided access to direct internal organ visualization without the need for surgical operations. This advancement greatly facilitates the early detection of diseases and the treatment of anomalies, leading to cost reduction and accurate outcomes.

The global market is driven by various factors, including a growing aging population, a significant prevalence of chronic diseases, advancements in technology, and an increasing awareness of healthcare leading to a demand for early disease detection. Furthermore, the market's growth is bolstered by ample opportunities in developing countries, supported by investments, collaborations, and funds from governmental and public organizations.

Global Diagnostic Imaging Market Drivers:

The growing geriatric population and the rising prevalence of the associated disease are fueling the growth of the Global Diagnostic Imaging Market.

The risk of developing disease increases proportionately with age. Nearly 80% of the elderly in the US suffer from at least one chronic condition and at least 60% of individuals aged 65 and above will be living with more than one chronic condition by 2030. The prevalence of age-associated diseases such as Alzheimer’s, Parkinson, and Arthritis, along with CVDs and cancer is estimated to rise which is set to rise the demand for improved and advanced healthcare facilities, treatment, and medications.

Increasing demand for technologically improved equipment and advanced diagnostic imaging is also another factor contributing to the growth of the Global Diagnostic Imaging Market.

Imaging techniques play a crucial role in identifying structural abnormalities and pathological alterations in the body, especially considering the prevalence of common and frequent traumatic injuries that is not visible to the naked eye. By utilizing advanced diagnostic systems, healthcare professionals can achieve precise diagnoses, facilitating the selection of the most effective treatment approach for patients. Thus the market is expanding due to the rise in cancer patients is expanding the market as the patients prefer sophisticated imaging reagents and diagnostic imaging techniques for a more precise diagnosis.

Global Diagnostic Imaging Market Challenges.

The market has witnessed a decline in adoption rates of advanced imaging technology due to reduced imaging volumes and economic challenges. This has resulted in staff reductions at radiology centers and hospitals, with a simultaneous increase in the utilization of teleradiology services. Despite the technical advancements and the growing use of sophisticated imaging tools, the market has experienced a downturn. However, the high cost of diagnostic imaging devices and the unfavorable reimbursement environment has constrained the market expansion of advanced imaging equipment. Also, the hospital's selective behavior regarding the procedures carried out to prevent cross-infection to the patient and the medical staff negatively impacts the market. To minimize the risk of disease transmission, hospitals opted to avoid routine checkups and follow-ups, prioritizing only severe cases. Consequently, orthopedic patients underwent imaging procedures less frequently. Moreover, the increasing concern about potential infections from using the same imaging equipment as infected patients has significantly constrained the market's growth.

Global Diagnostic Imaging Market Opportunities.

AI-based imaging techniques are being developed to help medical professionals accurately assess patients' conditions and provide the best medical care. Teaching hospitals have taken several measures to make sure that the medical staff is properly trained to use advanced technology, which is crucial to the healthcare industry. Governmental standards and policies related to reimbursement services for medical imaging have played a pivotal role in boosting the market. The introduction of attractive reimbursement options by insurance companies has substantially contributed to the market's growth. Insurance providers strive to entice customers by offering excellent amenities and larger policies, further driving the expansion of the market.

COVID-19 Impact on Global Diagnostic Imaging Market.

Medical image processing plays a crucial role in illness detection, treatment, and diagnosis. Amid the COVID-19 pandemic, cutting-edge technologies, including AI, machine learning, and deep learning, have been extensively utilized in medical image processing, driving the expansion of the market. With an increasing demand for effective solutions to improve patient outcomes, diagnostic and research institutes are estimated to become key end-users of image analysis solutions. As these institutes often outsource imaging services from hospitals, they may initially account for lesser revenue shares.

Global Diagnostic Imaging Market Recent Developments.

- In May 2021, Spectral CT 7500, the latest flagship CT scanner from Koninklijke Philips N.V., was introduced to conduct spectral imaging as a routine part of medical procedures

- March 2021, at the European Congress of Radiology, Hitachi, Ltd. unveiled two new permanent MRI systems: the APERTO Lucent Plus, a 0.4T permanent open MRI, and the AIRIS Vento Plus, a 0.3T MRI.

- July 2020-FUJIFILM Sonosite, Inc. launched the Sonosite PX ultrasound system. Sonosite PX represents the next generation in Sonosite POCUS, boasting the highest level of image clarity and advancement.

DIAGNOSTIC IMAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Imaging Systems, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GE Healthcare, Koninklijke Philips N.V., Hitachi Medical Corporation, Hologic, Inc., Siemens Healthcare, Samsung Medison, Shimadzu Corporation, Toshiba Medical Systems Corporation, Esaote S.P.A, Fujifilm Corporation |

Global Diagnostic Imaging Market Segmentation: By Imaging Systems

-

MRI

-

Less than 1 Ton

-

1.5 – 3 Ton

-

More than 3 Ton

-

Ultrasound

-

2D Ultrasound

-

3D Ultrasound

-

Others

-

CT Scanners

-

Low-End Scanners

-

Mid-Range Scanners

-

High-End Scanners

-

-

Nuclear Imaging Systems

-

Positron Emission Tomography (PET)

-

Single Photon Emitted Computed Tomography (SPECT)

-

-

X-Rays

-

Analog Systems

-

Digital Systems

-

-

Mammography Systems

As of 2022, the ultrasound segment held a substantial market share of around 30%. This is due to the increasing adoption of ultrasound equipment in the healthcare sector owing to its cost-effectiveness and advanced features like rapid and accurate results, safety, radiation-free imaging, and non-invasiveness. This has made Ultrasound the most dominant equipment in the market and also increased its popularity in the Global Diagnostic Imaging Market. On the other hand, the computed tomography (CT) segment is also projected to increase its market size during the forecast period as the integration of high-end CT scanners and AI is estimated to boost the growth of this segment. In 2022, the CT segment experienced strong growth, mainly driven by its increased adoption in diagnosing COVID-19 patients.

Global Diagnostic Imaging Market Segmentation: By Application

-

General Radiology

-

Vascular Imaging

-

Dental Care

-

Fluoroscopy

-

Cardiology

-

Oncology

-

Neurology

-

Other Applications

In 2022, the oncology segment has been the dominant application in the global diagnostic imaging market by having the highest revenue share and is projected to maintain its dominance throughout the forecast period. This can be attributed to the increasing cases of cancer among the population, with lung cancer being the most prominent type for having the highest number of cancer-related deaths worldwide. The rising demand for oncology diagnostic imaging has significantly contributed to the growth of this segment. Furthermore, the orthopedics segment is also estimated to be one of the fastest-growing segments during the forecast period. Factors such as a growing geriatric population in the world and a rise in road accident cases have fueled the demand for orthopedic diagnostic imaging. Additionally, the availability of technologically advanced devices for diagnostics has further facilitated the market's growth in this segment.

Global Diagnostic Imaging Market Segmentation: By End-User

-

Hospitals/Clinics

-

Home Care Settings

-

Other End Users

In 2022, the hospital segment secured the largest market share, primarily driven by an increased number of imaging procedures. Hospitals are progressively embracing fully automated and digitalized technology, which has resulted in greater acceptance of non-invasive procedures and improved workflow efficiency. The widespread presence of public and private hospitals worldwide has significantly contributed to the substantial growth of this segment. Furthermore, the growing adoption of advanced imaging modalities in hospital settings has played a pivotal role in driving the market's expansion in this segment.

Global Diagnostic Imaging Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

North America emerged as the leading market with the highest share in 2022. The adoption of advanced technologies in the healthcare sector and the increasing need for people to be checked up in advanced diagnostic imaging solutions have contributed to the growth of the region. Furthermore, the Asia Pacific region is also estimated to offer a significant rise during the forecast period. This is mainly due to the growing number of private hospitals and diagnostic centers in the region and the growing awareness among the population about the advanced diagnostic systems is estimated to drive the growth of the Diagnostic Imaging Market in the Asia-Pacific region

Global Diagnostic Imaging Market Segmentation: Key Players

-

GE Healthcare

-

Koninklijke Philips N.V.

-

Hitachi Medical Corporation

-

Hologic, Inc.

-

Siemens Healthcare

-

Samsung Medison

-

Shimadzu Corporation

-

Toshiba Medical Systems Corporation

-

Esaote S.P.A

-

Fujifilm Corporation

Chapter 1. Diagnostic Imaging Market - Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Diagnostic Imaging Market - Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Diagnostic Imaging Market - Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Diagnostic Imaging Market - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Diagnostic Imaging Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Diagnostic Imaging Market - By Imaging Systems

6.1 MRI

6.1.1 Less than 1 Ton

6.1.2 1.5 – 3 Ton

6.1.3 More than 3 Ton

6.2 Ultrasound

6.2.1 2D Ultrasound

6.2.2 3D Ultrasound

6.2.3 Others

6.3 CT Scanners

6.3.1 Low-End Scanners

6.3.2 Mid-Range Scanners

6.3.3 High-End Scanners

6.4 Nuclear Imaging Systems

6.4.1 Positron Emission Tomography (PET)

6.4.2 Single Photon Emitted Computed Tomography (SPECT)

6.5 X-Rays

6.5.1 Analog Systems

6.5.2 Digital Systems

6.6 Mammography Systems

Chapter 7. Diagnostic Imaging Market - By Application

7.1 General Radiology

7.2 Vascular Imaging

7.3 Dental Care

7.4 Fluoroscopy

7.5 Cardiology

7.6 Oncology

7.7 Neurology

7.8 Other Applications

Chapter 8. Diagnostic Imaging Market - By End-User

8.1 Hospitals/Clinics

8.2 Home Care Settings

8.3 Other End Users

Chapter 9. Diagnostic Imaging Market – By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Latin America

9.5 The Middle East

9.6 Africa

Chapter 10. Diagnostic Imaging Market – Key players

10.1 GE Healthcare

10.2 Koninklijke Philips N.V.

10.3 Hitachi Medical Corporation

10.4 Hologic, Inc.

10.5 Siemens Healthcare

10.6 Samsung Medison

10.7 Shimadzu Corporation

10.8 Toshiba Medical Systems Corporation

10.9 Esaote S.P.A

10.10 Fujifilm Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Diagnostic Imaging Market size was valued at $28.1 Billion in 2022 and is estimated to reach a value of $45.13 Billion by 2030, growing at a CAGR of 6.1% in the forecast (2023-2030).

Global Diagnostic Imaging Market drivers include the rising geriatric population in the world and the demand for technologically improved diagnostic equipment.

Based on Imaging Systems, the Global Diagnostic Imaging Market is segmented into MRI, Ultrasound, CT Scanners, Nuclear Imaging Systems, X-Rays, and Mammography Systems.

The United States is the most dominating country in the region of North America for the Global Diagnostic Imaging Market.

GE Healthcare, Koninklijke Philips N.V., Hitachi Medical Corporation, Hologic, Inc., Siemens Healthcare, Samsung Medison, Shimadzu Corporation, Toshiba Medical Systems Corporation, Esaote S.P.A, Fujifilm Corporation.