Diabetic Food Products Market Size (2024 - 2030)

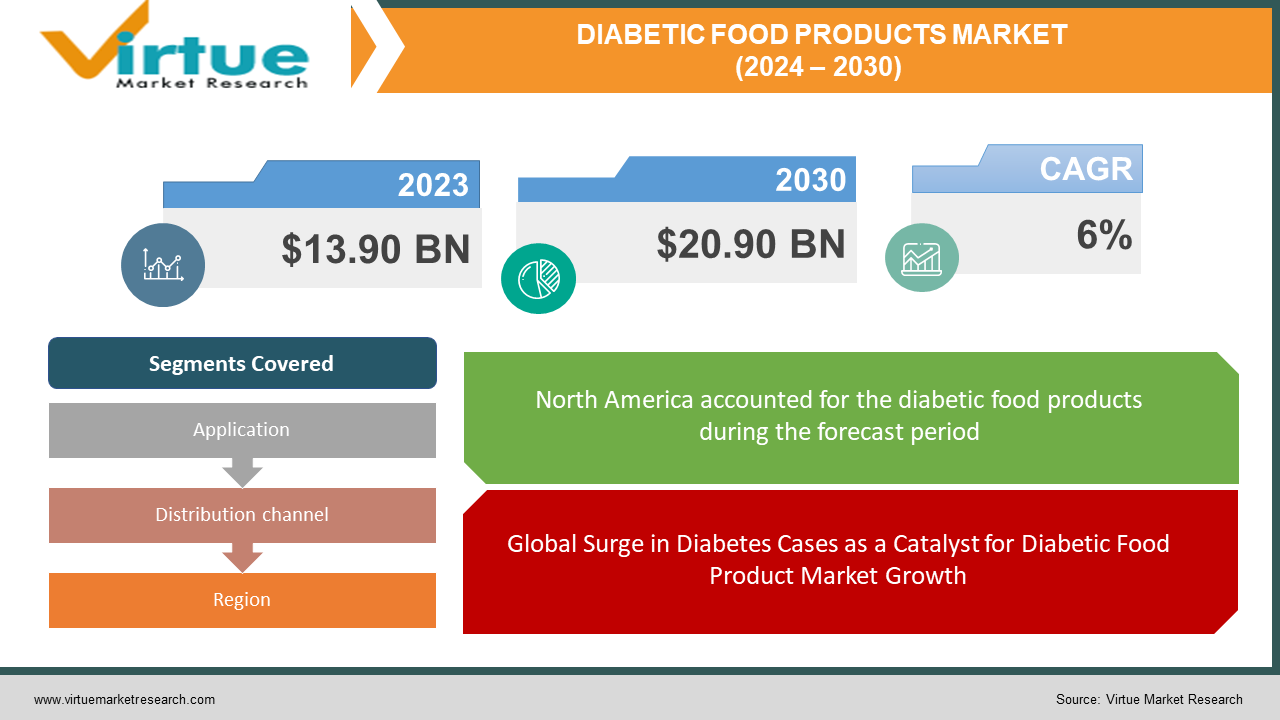

The Global Diabetic Food Products Market was valued at USD 13.90 Billion and is projected to reach a market size of USD 20.90 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6%.

The global Diabetic Food Products market presents a comprehensive overview marked by dynamic growth and evolving consumer trends. With a heightened focus on health and wellness, the market is witnessing significant expansion, driven by several key factors. The market's projected growth is underlined by a substantial CAGR, indicating its resilience and adaptability to changing consumer preferences. This upward trajectory is propelled by an increasing diabetic population, coupled with a broader societal shift towards healthier lifestyles. Manufacturers and industry stakeholders are responding to this demand by innovating and introducing diabetic-friendly products across various categories, including dietary beverages, dairy products, baked goods, ice cream and jellies, confectionery, and other specialized items.

Key Market Insights:

The global diabetic food products market is thriving, buoyed by the increasing prevalence of diabetes and a growing awareness of healthy dietary choices. Factors contributing to this growth include rising disposable income, urbanization, and lifestyle changes. The market is further boosted by the popularity of plant-based and functional ingredient-enriched diabetic food products, aligning with evolving consumer preferences and advancements in technology for personalized dietary solutions.

Recent developments in the diabetic food products market reveal a significant uptick in demand for plant-based and functional alternatives. Plant-based offerings are experiencing a remarkable CAGR of 12.3%, contributing substantially to overall market growth. This surge is driven by heightened consumer interest in sustainability, veganism, and the perceived health benefits of plant-based diets. Simultaneously, the integration of functional ingredients like probiotics and prebiotics is gaining traction, offering consumers not only diabetic-friendly options but also enhanced functionality and improved gut health.

Major players, including Nestlé and Unilever, play pivotal roles in shaping the global diabetic food products market. Nestlé, with a market share of 18.5% and revenue exceeding USD 2.5 billion, offers a diverse range of diabetic-friendly products. Unilever, holding a market share of 16.2% and generating revenue exceeding USD 2.2 billion, focuses on innovation and functionality in its diabetic food options. Other significant contributors, such as Kellogg Company, Conagra Brands, Fifty 50 Foods, Mars, Danone, PepsiCo, and Coca-Cola, collectively contribute to market diversification. Continuous innovation and expansion efforts by these players highlight their commitment to meeting the evolving demands of the diabetic population and driving the market's continued growth.

Diabetic Food Products Market Drivers:

Global Surge in Diabetes Cases as a Catalyst for Diabetic Food Product Market Growth.

The ongoing global surge in the prevalence of diabetes is proving to be a decisive factor propelling the demand for diabetic food products. The ever-increasing number of diagnosed cases worldwide is generating a substantial market demand for specialized food items meticulously crafted to cater to the unique dietary requirements of individuals managing diabetes. This surge in demand reflects a growing recognition of the pivotal role nutrition plays in diabetes management, driving innovation and expansion in the diabetic food products market.

Heightened Diabetes Awareness Leading to Health-Conscious Consumer Choices.

The intensifying awareness surrounding diabetes and its management is steering consumers towards actively seeking out and wholeheartedly embracing healthier food alternatives. This heightened consciousness stems from a multifaceted approach involving education, advocacy, and readily available information about the intricate relationship between dietary choices and diabetes. As a result, individuals are making more informed decisions about their food selections, contributing significantly to the burgeoning demand for a diverse range of diabetic-friendly food products.

Economic Empowerment Driving Dietary Choices and Boosting Diabetic Food Products.

The continuous rise in disposable income levels on a global scale is empowering individuals to make conscious and proactive decisions regarding their dietary choices. This economic empowerment is a pivotal driver behind the increasing popularity of diabetic food products, as consumers are not only willing but also financially capable of allocating resources to support their overall well-being and specific dietary needs. The intersection of economic prosperity and health consciousness is creating a conducive environment for the sustained growth of the diabetic food products market, with consumers increasingly recognizing the value of investing in their long-term health through thoughtful dietary decisions.

Diabetic Food Products Market Restraints and Challenges:

Financial Barriers Impacting Access to Diabetic Food Products: Challenges Arising from Elevated Costs in Low-Income Settings

The formidable financial hurdle posed by the elevated cost of diabetic food products is rooted in the necessity for specialized ingredients and additional processing. This economic challenge is notably pronounced in low-income countries, where the affordability of these essential dietary options for managing diabetes becomes a critical factor. The intersection of economic constraints and health needs underscores the complexity of accessing diabetic-friendly foods in regions where financial resources are limited, emphasizing the urgent need for targeted interventions to address this pervasive issue.

Culinary Constraints in the Diabetic Diet Landscape: Navigating Limited Variety Amidst Advances in Diabetic Food Products

Despite commendable strides in recent years, the culinary landscape for individuals managing diabetes is marked by persistent constraints. The array of available diabetic food products, while advancing, lags behind the extensive options found in the regular food market. This scarcity of variety poses a significant challenge for consumers seeking not only nutritional adherence but also a broad selection of enjoyable and satisfying diabetic-friendly foods. As innovations continue, the industry must grapple with the ongoing task of diversifying options to cater to the evolving tastes and preferences of this specific consumer segment.

Underestimated Benefits of Diabetic Food Products: Mitigating Market Growth Through Addressing Lack of Awareness

The impediment to the growth of the diabetic food products market is compounded by a pervasive lack of awareness regarding the substantial benefits linked to these specialized food items. Many individuals remain insufficiently informed about the positive impact these products can have on the nuanced management of diabetes and the enhancement of overall well-being. This prevailing lack of awareness underscores a critical need for comprehensive education and outreach efforts. By fostering a deeper understanding and appreciation of the advantages associated with diabetic food options, stakeholders can pave the way for increased market penetration and consumer adoption. Educational initiatives should target both healthcare professionals and the wider public to bridge the information gap and empower individuals to make informed dietary choices that align with their health goals.

Diabetic Food Products Market Opportunities:

Focus on Personalized Nutrition: Nurturing Opportunities for Tailored Diabetic Food Plans.

The surging interest in personalized nutrition marks a paradigm shift in dietary preferences, emphasizing the need for tailoring dietary recommendations to individual needs and preferences. Within the diabetic food product sector, this trend presents a unique opportunity for the development of personalized diabetic food plans and products. By understanding and addressing the distinct nutritional requirements and taste preferences of individuals managing diabetes, the industry can carve out a niche by offering tailored solutions that go beyond generic offerings, catering to the diverse and evolving needs of consumers.

Emerging Technologies: Revolutionizing Diabetic Food Product Development.

The advent of ground-breaking technologies, including 3D printing and artificial intelligence, is ushering in a new era of possibilities for the development of diabetic food products. These technologies serve as catalysts for innovation by enabling the creation of customized food products. Through 3D printing, intricate shapes and textures can be achieved, enhancing the visual and sensory appeal of diabetic-friendly foods. Artificial intelligence plays a pivotal role in optimizing nutritional content, ensuring precise adherence to dietary guidelines, and continually improving product quality and taste. The integration of these emerging technologies not only streamlines production processes but also opens avenues for the creation of diabetic food products that meet the highest standards of quality, taste, and nutritional efficacy. As technology continues to advance, the diabetic food product market stands at the forefront of leveraging these tools to enhance both the form and function of its offerings, ultimately providing consumers with innovative and effective solutions for managing diabetes through their dietary choices.

DIABETIC FOOD PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Application, Distribution channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nestlé, Unilever, Kellogg Company, Conagra Brands, Inc., Fifty 50 Foods, Inc. Mars, Incorporated, Danone, PepsiCo, Coca-Cola, Abbott Laboratories |

Diabetic Food Products Market Segmentation: By Application

-

Dietary beverages

-

Dairy products

-

Baked products

-

Ice cream and jellies

-

Confectionery

-

Others

In the realm of market segmentation by application, a comprehensive analysis reveals distinct trends and growth dynamics. Among the various applications, dietary beverages emerge as the largest segment, commanding a substantial market share of 40% in 2023. This dominance underscores the significant consumer preference for diabetic-friendly beverages, reflecting a heightened awareness of the role beverages play in managing diabetes. The robust market share of dietary beverages emphasizes their integral position within the diabetic food product landscape, offering consumers a diverse range of liquid options designed to align with their specific dietary requirements.

Simultaneously, the fastest-growing segment within this market panorama is the "Others" category. This segment exhibits a notable growth rate of 10% during the forecast period, indicating a surge in demand for diverse and specialized diabetic food products beyond conventional categories. The rapid expansion of the "Others" segment suggests an evolving consumer landscape, characterized by a willingness to explore innovative and niche offerings within the diabetic food market. This growth trajectory highlights the dynamic nature of consumer preferences and the industry's capacity to cater to emerging needs, fostering a market environment that embraces diversity and innovation. As this segment continues to flourish, it presents manufacturers and stakeholders with exciting opportunities to diversify their product portfolios and stay attuned to evolving consumer demands.

Diabetic Food Products Market Segmentation: By Distribution channel

-

Supermarkets and hypermarkets

-

Pharmacies

-

Convenience stores

-

Online retailers

-

Direct sales

In the context of market segmentation by distribution channel, a discerning analysis illuminates key trends shaping the landscape of diabetic food product accessibility. Foremost among these channels are supermarkets and hypermarkets, emerging as the largest contributors with a commanding market share of 50% in 2023. This dominance underscores the pivotal role played by traditional brick-and-mortar retail establishments in catering to the needs of consumers seeking diabetic food products. Supermarkets and hypermarkets serve as vital hubs where individuals can easily access a diverse array of diabetic-friendly options, facilitating widespread availability and convenience for consumers navigating specific dietary requirements.

Concurrently, the fastest-growing distribution channel is online retailers, manifesting a notable growth rate of 15% over the forecast period. This surge in growth reflects a paradigm shift in consumer behavior, with an increasing number of individuals opting for the convenience and accessibility afforded by online platforms. The flourishing growth of online retailers in the diabetic food product market signifies a growing digital presence and the rising acceptance of e-commerce as a preferred avenue for procuring specialized dietary items. This trend not only aligns with broader shifts in consumer shopping habits but also presents a dynamic opportunity for manufacturers and retailers to strategically leverage online platforms, ensuring a seamless and efficient reach to a burgeoning market segment. As online retail gains momentum, it stands as a catalyst for enhancing market accessibility, convenience, and choice in the realm of diabetic food products.

Diabetic Food Products Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In the realm of regional market segmentation, a nuanced analysis delineates the distinctive patterns shaping the landscape of the diabetic food product market. North America emerges as the largest regional contributor, commanding a notable market share of 35% in 2023. This prominence underscores the mature and well-established market for diabetic food products in North America. The region's substantial market share reflects a robust consumer base with a heightened awareness of dietary health, driving the demand for specialized food items tailored to diabetes management. The prevalence of lifestyle-related health conditions and a proactive approach to wellness contribute to North America's leadership in the diabetic food product market.

Simultaneously, the title of the fastest-growing region is bestowed upon Asia-Pacific, demonstrating a remarkable growth rate of 18% throughout the forecast period. This surge in growth signifies a burgeoning market for diabetic food products in the Asia-Pacific region, propelled by evolving consumer lifestyles, increasing disposable incomes, and a growing awareness of health and nutrition. The region's dynamic economic landscape, coupled with a rising prevalence of diabetes, positions Asia-Pacific as a focal point for market expansion. The burgeoning middle-class population, coupled with a heightened focus on preventive healthcare, contributes to the rapid growth of the diabetic food product market in the region. As Asia-Pacific continues to witness these transformative trends, it stands poised as a key driver of future growth, offering lucrative opportunities for stakeholders aiming to tap into the expanding market for diabetic-friendly dietary options.

COVID-19 Impact Analysis on the Global Diabetic Food Products Market:

The COVID-19 pandemic exerted a complex and multifaceted impact on the global diabetic food products market. Initially, disruptions in the supply chain, driven by lockdowns and travel restrictions, posed significant challenges. Shortages of ingredients and packaging materials led to increased costs and logistic complications. Furthermore, decreased consumer spending, prompted by economic uncertainties and stay-at-home orders, directly impacted the sales of diabetic food products. Shifting consumer priorities towards essential items and home-cooked meals also potentially reduced the demand for ready-to-eat diabetic food products.

On a positive note, the pandemic fostered increased health awareness globally. With a spotlight on managing chronic diseases and adopting healthier lifestyles, awareness about diabetic food products saw a notable uptick. The shift to online grocery shopping provided a convenient avenue for consumers to access diabetic-friendly options, compensating for limitations in physical mobility. The demand for immunity-boosting foods during the pandemic benefited certain diabetic food products enriched with essential vitamins and minerals. The focus on home cooking, as a consequence of lockdowns, encouraged consumers to prepare healthier meals, aligning with the goals of the diabetic food market.

Latest Trends/ Developments:

-

In the ever-evolving landscape of the diabetic food products market, several noteworthy trends and developments are shaping the industry. The emergence of the plant-based revolution is marked by a projected market size of USD 5.5 billion by 2030, reflecting a robust Compound Annual Growth Rate (CAGR) of 12.3%. This shift towards plant-based alternatives aligns with the preferences of 35% of consumers with diabetes, indicating a growing interest in diverse and sustainable dietary choices.

-

The rise of personalized nutrition represents a paradigm shift, with an expected market valuation of USD 6.8 billion by 2025, growing at an impressive CAGR of 15.1%. This trend is poised to generate significant annual revenue, reaching USD 3.2 billion by 2030. Furthermore, 55% of consumers demonstrate an interest in personalized nutrition plans tailored for effective diabetes management, reflecting a demand for individualized dietary solutions.

-

In tandem, technological advancements are set to contribute substantially to the market's total value, estimated at USD 4.7 billion by 2028. Notably, these innovations are projected to generate USD 1.8 billion in cost savings through automation and efficiency improvements. A consumer base open to technology-driven solutions for diabetes management and dietary guidance, at 60%, signifies a positive reception to these advancements.

Key Players:

-

Nestlé

-

Unilever

-

Kellogg Company

-

Conagra Brands, Inc.

-

Fifty 50 Foods, Inc.

-

Mars

-

Incorporated

-

Danone

-

PepsiCo

-

Coca-Cola

-

Abbott Laboratories

Chapter 1. DIABETIC FOOD PRODUCTS MARKET– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. DIABETIC FOOD PRODUCTS MARKET– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. DIABETIC FOOD PRODUCTS MARKET– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. DIABETIC FOOD PRODUCTS MARKET- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. DIABETIC FOOD PRODUCTS MARKET– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. DIABETIC FOOD PRODUCTS MARKET– By Distribution channel

6.1 Introduction/Key Findings

6.2 Supermarkets and hypermarkets

6.3 Pharmacies

6.4 Convenience stores

6.5 Online retailers

6.6 Direct sales

6.7 Y-O-Y Growth trend Analysis By Distribution channel

6.8 Absolute $ Opportunity Analysis By Distribution channel, 2024-2030

Chapter 7. DIABETIC FOOD PRODUCTS MARKET– By Application

7.1 Introduction/Key Findings

7.2 Dietary beverages

7.3 Dairy products

7.4 Baked products

7.5 Ice cream and jellies

7.6 Confectionery

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. DIABETIC FOOD PRODUCTS MARKET, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Distribution channel

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Distribution channel

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Distribution channel

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Distribution channel

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. DIABETIC FOOD PRODUCTS MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Nestlé

9.2 Unilever

9.3 Kellogg Company

9.4 Conagra Brands, Inc.

9.5 Fifty 50 Foods, Inc.

9.6 Mars, Incorporated

9.7 Danone

9.8 PepsiCo

9.9 Coca-Cola

9.10 Abbott Laboratories

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Diabetic Food Products Market was valued at USD 13.90 Billion and is projected to reach a market size of USD 20.90 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6%.

. The Global Diabetic Food Products Market caters to diverse applications, including dietary beverages, dairy products, baked goods, ice cream & jellies, confectionery, and others like protein bars and meal replacements.

COVID-19 initially disrupted supply chains and consumer spending, but ultimately increased demand for diabetic food products due to rising health awareness and the shift to home cooking

Key market players include Nestlé, Unilever, Kellogg Company, Conagra Brands, Inc., Fifty 50 Foods, Inc., Mars, Incorporated, Danone, PepsiCo, Coca-Cola, Abbott Laboratories.

Rising diabetes prevalence and growing health consciousness fuel the Global Diabetic Food Products Market