Destination Wedding Market Size (2024 – 2030)

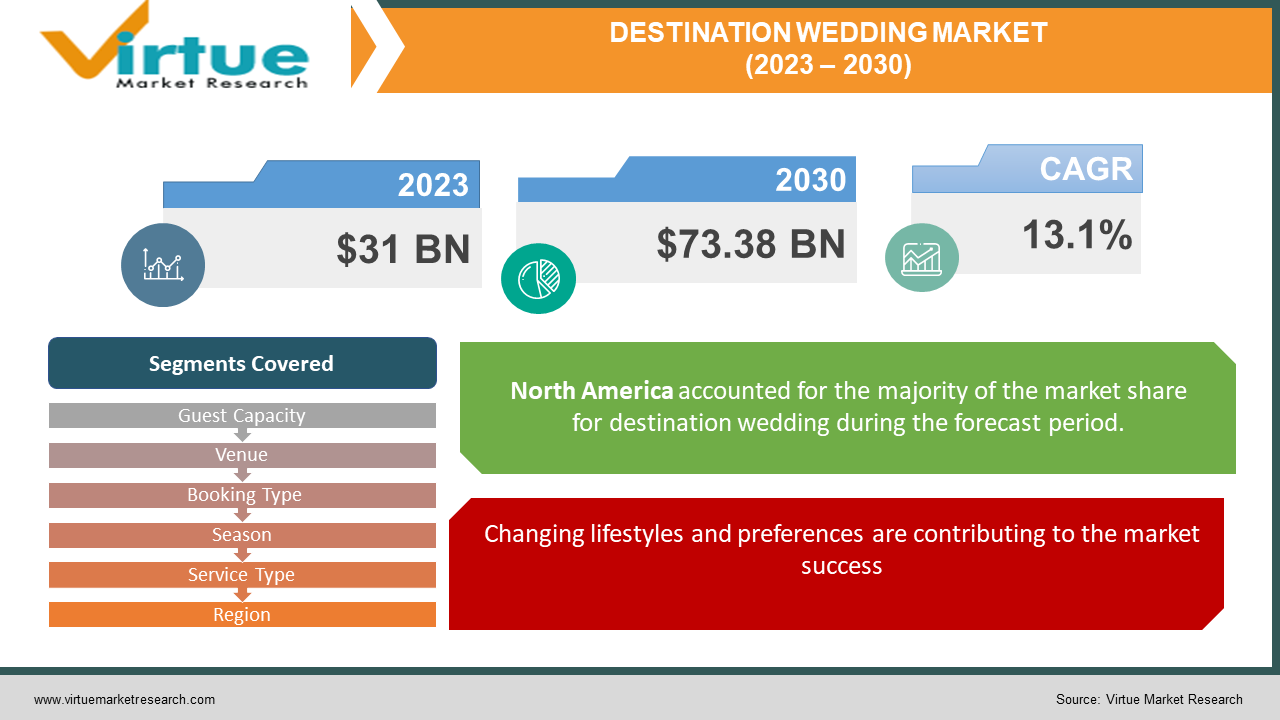

The global destination wedding market was valued at USD 31 billion and is projected to reach a market size of USD 73.38 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 13.1%.

A destination wedding is a kind of ceremony that takes place somewhere other than the hometown of the couple. It may be a lovely way to vow in front of loved ones in an aesthetic setting. The setting can range from beaches to mountains to religious places. In the past, this market had a limited presence owing to price and unpopularity. However, with urbanization and social media, this market has seen good progress. In the future, with the expansion of the travel and tourism industry as well as sustainable considerations, this market will witness considerable progress. During the forecast period, a notable growth rate is anticipated.

Key Market Insights:

18% of couples held a destination wedding in 2022, per a poll conducted by the wedding planning website The Knot.

Approximately half of the destination marriages took place in foreign countries.

With an estimated $16 billion in expenditures each year, destination weddings are a lucrative industry.

Every year, 340,000 destination weddings occur.

The average budget for a destination wedding comes up to $28,000. Measures are being taken by various organizations to make these more affordable by implementing effective cost-reduction solutions.

Destination Wedding Market Drivers:

Changing lifestyles and preferences are contributing to the market success.

Over the years, economic stability has been observed across many regions. Urbanization, the rising middle class, and an increasing disposable income are the reasons behind this. This has changed consumer choices, allowing them to easily access a luxurious lifestyle. Destination weddings are one of those privileges. Furthermore, the travel and tourism industry gains immense profits due to these weddings. Transportation, accommodation, and tourism are the few kinds of charges associated with this. This further helps strengthen the economies of nations due to the revenue generated.

An urge for unique experiences is boosting growth.

Couples are seeking choices that reflect a part of their personalities. This can include weddings at the beach, historic places, castles, mountains, and other views. Many surveys indicate that most of the youngsters of today's generation tend to have all ceremonies amidst nature. This ensures good pictures as well. Additionally, the couple and their relatives get to explore the place and learn about the culture, heritage, and other practices. Moreover, recent trends include having intimate gatherings. Destination weddings usually have a smaller percentage of people, thereby helping with cost reduction. Furthermore, they get to personalize their events as per their choices by using elements from their surroundings. This leads to memories, which they cherish for a lifetime.

Social media is helping with market expansion.

Social media platforms have gained immense attention over the past five years. Through various social apps like Instagram, Facebook, and YouTube, people can generate ideas and themes for their ceremonies. Reels and videos are released by content creators about cost-effective strategies, ideas, decorations, food options, etc. This helps in the effective planning of events beforehand by knowing the place in advance. Besides, many brands are endorsed through social media, which helps them promote their businesses and reach a wider audience. Furthermore, if individuals have a significant presence on social media, they would be able to monetize by uploading their content about the best destinations for weddings locally and internationally. This helps to create a broader consumer base interested in carrying out their rituals and events in a certain destination.

Destination Wedding Market Restraints and Challenges:

Costs, lack of coordination, environmental concerns, and travel restrictions are the main issues that the market is currently experiencing.

One of the biggest barriers in the market is the associated expenses. Local and international destinations can create a financial drain. People need to spend for travel, residence, event place, décor, food, etc. The price varies from region to region. Besides, if it is an international location, the charges can be even higher. Moreover, people need an exact attendance to adjust the prices accordingly. Cancellations by guests at the last minute can cause huge losses. Secondly, since it is not possible to meet up with the vendors every time, most of the meetings happen through calls. This can lead to confusion, misunderstandings, and a lack of satisfaction as well as trust. Thirdly, this increases the carbon footprint and pollution. Besides, certain individuals prefer a lavish wedding, which can involve the bursting of crackers. This further increases the damage. Furthermore, obtaining a visa at the right time can be a hindrance. People might miss the weddings due to delays in the procedure.

Destination Wedding Market Opportunities:

Emerging destinations have been providing the market with an ample number of possibilities. This includes a wide range of options, ranging from historic places to nature-themed places. Some popular destinations include Mexico, Italy, Hawaii, Thailand, Goa, and Istanbul. Therefore, the travel and tourism industry has been implementing various strategies to attract a greater number of populations. Additionally, affordable and budget-friendly options are being added. Secondly, personalization on the food menu is creating an upsurge. This includes vegan-based options since the number of people incorporating plant-based diets is on the rise. Furthermore, technology has been a boon for the market. People can continuously monitor the execution from the comfort of their houses. Apart from this, some advancements include virtual tours, event management software, chatbots, and other online planning tools.

DESTINATION WEDDING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

13.1% |

|

Segments Covered |

By Guest Capacity, Venue, Booking Type, Season, Service Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Knot Worldwide, Sandals Resorts International, Disney's Fairy Tale Weddings & Honeymoons, Destination Weddings Travel Group, Iberostar Group, WeddingWire, Thomas Cook Group Palace Resorts, Karisma Hotels & Resorts, Belmond Ltd. |

Destination Wedding Market Segmentation: By Guest Capacity

-

Greater than 100

-

Less than 100

The less than 100 segment is considered to be both the largest and fastest-growing segment in the market. This is because of the cost-effectiveness, trend of intimate gatherings, lesser environmental impact, easy accommodation, and fewer crowds. Besides, the pandemic played a huge role in setting the demand for a smaller number of people. However, the greater than 100 segment is showing good growth owing to economic advancements and a desire to share happiness with a greater percentage of the population.

Destination Wedding Market Segmentation: By Venue

-

International

-

National

The international segment is the largest segment by venue type, holding a share of around 66%. This is owing to views, demand, cultural elements, experience, photography, and economic stability. However, national-based destinations are the fastest-growing due to affordability, familiarity with the place, convenience, desire, cultural significance, and ease of travel as well as accommodation.

Destination Wedding Market Segmentation: By Booking Type

-

In-Person Booking

-

Online

-

Phone Booking

Based on booking type, the in-person booking segment is the largest, occupying a share of around 43% in this market. This is because of face-to-face interaction, trust, reviews, bargaining, demand, and convenience. However, online booking has been showing the fastest growth due to increased safety, secure transactions, ease, digitalization, accessibility, price comparison, and user-friendly updates.

Destination Wedding Market Segmentation: By Season

-

High Season

-

Mid-Season

-

Low Season

-

Mid-Peak Season

Based on seasons, the mid-peak segment is the largest in this market. The main reason for this is the need for good weather. Harsh climate conditions can cause disruptions in the events, leading to cancellations and discontinuations. This category holds a total share of around 26%. The high-season segment is the fastest growing due to favorable weather conditions, picturesque landscapes, availability of services, ease of travel, and alignment with holidays.

Destination Wedding Market Segmentation: By Service Type

-

Food Service

-

Accommodation Service

-

Butler Service

-

Others

The food service segment is the largest in the market owing to culinary varieties, experimentation, personalization, and need. Accommodation services are the fastest-growing owing to the necessity for a place to dwell, rest, and get ready. These services ensure customer satisfaction through their technologies, diverse options, and exclusive experiences.

Destination Wedding Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In this industry, North America is the largest region. This is because of demand, trends, the existence of important corporations, funding, and economic developments. Canada and the United States are the top two nations. Popular destinations in the North American region include California, New York, Florida, Banff, and Hawaii. An estimated 39% of the market is in this region. With a roughly 20% stake, Asia-Pacific is the region with the fastest growth. This is a result of rising demand, increased investments, expanding operations, improved economies, emerging startups, and other larger corporations’ collaborations. Leading nations include Indonesia, the Maldives, Thailand, and Malaysia. Europe is also seeing significant growth in this market. This is mainly because of the scenic views in Italy, France, and Spain. During the forecast period, this region is predicted to achieve a major boost.

COVID-19 Impact Analysis on the Global Destination Wedding Market:

The outbreak of the virus hurt the market. Lockdowns, social isolation, and movement restrictions were the new norm. This caused disruptions in the supply chain, logistics, and transportation. Before the pandemic, as per an article in The Times of India, a visitor would reserve between 150 and 200 rooms. For a wedding, the number of rooms was whittled down to roughly 100, and the elderly usually skipped the festivities. People were unable to travel because of various guidelines and protocols. There weren't many airlines, railways, and other road transport available for facilities. The tourism industry incurred enormous amounts of losses. Besides, people were losing their jobs due to uncertainty and budget restrictions. This caused an economic downfall. A few of the businesses were shut down due to all this damage. Furthermore, options like court marriage and home marriage garnered tremendous attention during the pandemic. People started to save their money for other causes instead of choosing to have grand ceremonies. Post-pandemic, with the upliftment of lockdowns and relaxations of rules, the market is picking up steadily.

Latest Trends/ Developments:

Companies in this industry are driven to increase their market share using a variety of tactics, including alliances, investments, and acquisitions. Along with maintaining competitive pricing, businesses are paying much to advance their existing technology and find better ones. This has also led to greater enlargement.

Recent trends in the market include sustainable and eco-friendly wedding practices. This includes the implementation of a zero-waste policy. The usage of recycled materials, jewels, invitations, built-in décor, outdoor spaces, vegan food, environmentally-friendly bags, candles, and natural purifiers has been emphasized through these practices. Additionally, upcycling options are being preferred.

Key Players:

-

The Knot Worldwide

-

Sandals Resorts International

-

Disney's Fairy Tale Weddings & Honeymoons

-

Destination Weddings Travel Group

-

Iberostar Group

-

WeddingWire

-

Thomas Cook Group

-

Palace Resorts

-

Karisma Hotels & Resorts

-

Belmond Ltd.

In August 2023, the Ministry of Tourism (MoT) launched a wedding tourism campaign, shortlisting 25 destinations. India will not only become more well-known as a popular destination for weddings due to this campaign, but it will also be a calculated effort to increase tourism in the nation.

In March 2023, Dayal Associates, an investment firm, declared its intention to use partnerships and strategic investments to enable startups and businesses. The company has already invested in several start-ups, including MF Transports, a logistics company that specializes in environmentally friendly shipping options, and Shadi Clicks, an online platform for wedding preparation. The goal of these investments is to support startups as they grow and realize their full potential.

In January 2023, to give Chennai couples hassle-free dream weddings, Weddings, and Marigolds Studio partnered with Potok's World Photography.

Chapter 1. Destination Wedding Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Destination Wedding Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Destination Wedding Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Destination Wedding Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Destination Wedding Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Destination Wedding Market – By Guest Capacity

6.1 Introduction/Key Findings

6.2 Stationary Scanners

6.3 Portable/Mobile Scanner

6.4 Y-O-Y Growth trend Analysis By Guest Capacity

6.5 Absolute $ Opportunity Analysis By Guest Capacity, 2024-2030

Chapter 7. Destination Wedding Market – By Venue

7.1 Introduction/Key Findings

7.2 Low Slice Scanner (<64 Slices)

7.3 Medium Slice Scanner (64 Slices)

7.4 High Slice Scanner (>64 Slices)

7.5 Y-O-Y Growth trend Analysis By Venue

7.6 Absolute $ Opportunity Analysis By Venue, 2024-2030

Chapter 8. Destination Wedding Market – By Booking Type

8.1 Introduction/Key Findings

8.2 Fluorodeoxyglucose (FDG)

8.3 62Cu ATSM

8.4 18 F Sodium Fluoride

8.5 FMISO

8.6 Gallium

8.7 Thallium

8.8 Others

8.9 Y-O-Y Growth trend Analysis By Booking Type

8.10 Absolute $ Opportunity Analysis By Booking Type, 2024-2030

Chapter 9. Destination Wedding Market – By Season

9.1 Introduction/Key Findings

9.2 Oncology

9.3 Neurology

9.4 Cardiology

9.5 Others

9.6 Y-O-Y Growth trend Analysis By Season

9.7 Absolute $ Opportunity Analysis By Season, 2024-2030

Chapter 10. Destination Wedding Market – By Service Type

10.1 Introduction/Key Findings

10.2 Hospitals

10.3 Diagnostic Centers

10.4 Research Institutes

10.5 Ambulatory Surgical Centers

10.6 Y-O-Y Growth trend Analysis By Service Type

10.7 Absolute $ Opportunity Analysis By Service Type, 2024-2030

Chapter 11. Destination Wedding Market , By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Guest Capacity

11.1.2.1 By Venue

11.1.3 By By Booking Type

11.1.4 By Service Type

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Guest Capacity

11.2.3 By Venue

11.2.4 By By Booking Type

11.2.5 By Season

11.2.6 By Service Type

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Guest Capacity

11.3.3 By Venue

11.3.4 By By Booking Type

11.3.5 By Season

11.3.6 By Service Type

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Guest Capacity

11.4.3 By Venue

11.4.4 By By Booking Type

11.4.5 By Season

11.4.6 By Service Type

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Guest Capacity

11.5.3 By Venue

11.5.4 By By Booking Type

11.5.5 By Season

11.5.6 By Service Type

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Destination Wedding Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 The Knot Worldwide

12.2 Sandals Resorts International

12.3 Disney's Fairy Tale Weddings & Honeymoons

12.4 Destination Weddings Travel Group

12.5 Iberostar Group

12.6 WeddingWire

12.7 Thomas Cook Group

12.8 Palace Resorts

12.9 Karisma Hotels & Resorts

12.10 Belmond Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Destination Wedding Market was valued at USD 31 billion and is projected to reach a market size of USD 73.38 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 13.1%.

Changing lifestyles and preferences, an urge for unique experiences, and social media are the main drivers propelling the Global Destination Wedding Market.

Based on Service Type, the Global Destination Wedding Market is segmented into Food Service, Accommodation Service, Butler Service, and Others.

North America is the most dominant region for the Global Destination Wedding Market.

The Knot Worldwide, Sandals Resorts International, and Disney's Fairy Tale Weddings & Honeymoons are the key players operating in the Global Destination Wedding Market.