Desiccant Dryer Market Size (2024 – 2030)

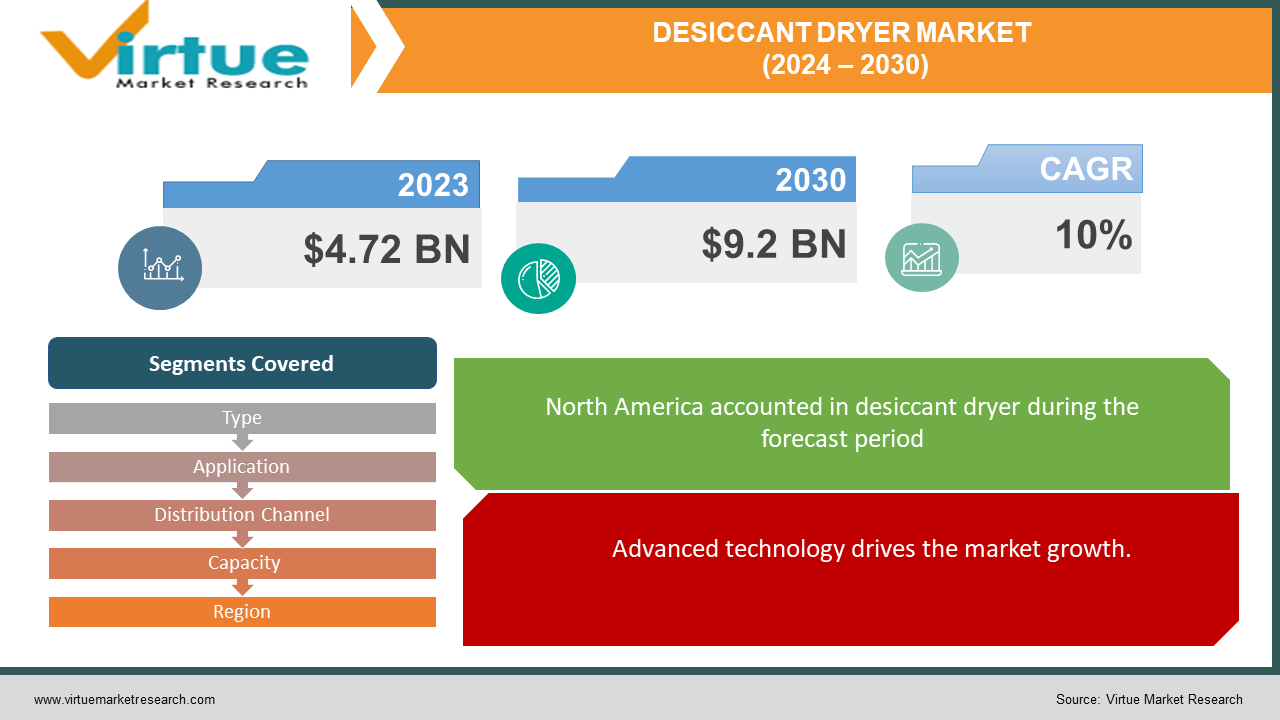

The Desiccant Dryer Market was valued at USD 4.72 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 9.2 billion by 2030, growing at a CAGR of 10%.

A desiccant is a material or substance possessing the capability to absorb moisture from its environment. It finds frequent application in diminishing humidity or moisture levels present in the atmosphere, gasses, or solids, effectively mitigating issues such as corrosion, mold formation, and other undesirable consequences linked to elevated humidity. An industrial apparatus known as a desiccant dryer or adsorption dryer employs desiccant materials to eliminate moisture from the air passing through it.

Key Market Insights:

The National Policy on Electronics (NPE), sanctioned by India's Union Cabinet, aims to facilitate the expansion of the nation's electronics manufacturing sector to approximately USD 400 billion by the year 2025.

Desiccant Dryer Market Drivers:

Advanced technology drives the market growth.

The anticipated expansion of the global desiccant dryer market is attributed to a rising need for energy-efficient and economically viable drying technologies. Additionally, heightened awareness among end-users regarding environmental concerns serves as a significant factor fostering this growth. The considerable expenses linked to conventional approaches to air or water drying have prompted organizations across diverse sectors, including pharmaceuticals and the construction industry, to embrace environmentally friendly alternatives like desiccant dryers. Consequently, there has been a notable surge in the global adoption of these products.

Desiccant Dryer Market Restraints and Challenges:

High costs hinder the market growth.

Certain businesses may be deterred from adopting modern filtration and drying equipment due to the substantial initial costs involved. Economic downturns can exacerbate this situation by causing delays in the acquisition of new machinery, thereby impacting the market for filters and dryers. Additionally, for enterprises operating large-scale systems, the maintenance and replacement of filter elements can prove to be both time-consuming and costly.

Desiccant Dryer Market Opportunities:

Numerous companies have introduced inventive concepts for air compressor dryers, establishing a lucrative market for global compressed air filtration and drying systems. A notable example is the rising demand for Painting Desiccant Dryers in local markets. The proximity of the air filter sector is anticipated to experience substantial growth by supplying air compressor filters to smaller units, serving as a foundational material for subsequent value addition.

DESICCANT DRYER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Type, Application, Distribution Channel, Capacity, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ingersoll Rand, Atlascopco, Kaeser , Parker, Sullair, Q Inc Compressor, Hankison (SPX FLOW), DRI-AIR Industries, MATSUI, Gardner Denver |

Desiccant Dryer Market Segmentation: By Type

-

Hot Air Dryers

-

Compressed Air Dryers

-

Other

Heatless dryers operate based on the principle of heat transfer through convection. In this process, the fluid (air) undergoes heating and is conveyed over other surfaces using a fan or blower, drawing air through external vents within a closed system. Commonly employed in the drying of food, pharmaceuticals, and electronics, heatless desiccant dryers are widely utilized. On the other hand, heated purge desiccant dryers function on the premise that heat is essential to release moisture from a solid. This type of dryer finds applications in industries such as oil and gas, construction, pharmaceuticals, and food & beverage. Notably, they exhibit enhanced effectiveness compared to other dryer types in these specific applications. A key advantage lies in their ability to operate without relying on external sources of natural or artificial heating energy, resulting in lower operational costs and minimized air pollution through reduced carbon dioxide emissions during their operation.

Desiccant Dryer Market Segmentation: By Application

-

Electronics

-

Food & Beverage

-

Oil & Gas

-

Pharmaceuticals

-

Construction Industry

-

Chemicals

-

Paper & Pulp

-

Textile

-

Aviation

The electronics sector stands as one of the largest consumers of desiccant dryers, employing these products to eliminate moisture from circuits and other components before their integration into devices. This practice significantly extends the lifespan of electronic devices, prompting manufacturers in the electronics industry to make substantial investments in desiccant dryer technology.

In the construction industry, desiccant dryers play a crucial role in extracting moisture from plywood, which is subsequently utilized for exterior siding or interior paneling in buildings. This process mitigates the risk of rot during prolonged storage and prevents damage arising from mold growth due to water accumulation when exposed to moist conditions over an extended period. The escalating cost of timber on a global scale has contributed to a noteworthy surge in the demand for these products within the construction industry.

Desiccant Dryer Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors

-

Online Retail

Direct Sales is the dominating segment in the market. Direct sales can help buyers understand the quality and information about the product. This can help consumers make connections which can be beneficial to both buyer and seller. Online Retail is expected to grow in the forecasted period.

Desiccant Dryer Market Segmentation: By Capacity

-

Low

-

Medium

-

High

High-capacity desiccant dryers are the segment holding the majority of the market shares in 2023. This type of dryer features two towers, each uniformly packed with hygroscopic materials. Upon saturation of the desiccant in the absorptive tower and adequate drying of the material in the second tower, a control unit automatically initiates a reversal of its functions. In this transitional phase, the fully saturated desiccant tower enters a regenerative mode, while the freshly regenerated material in the second tower is employed to extract moisture from the incoming supply air. It is also anticipated to be the segment that will grow at the fastest rate throughout 2024-2030.

Desiccant Dryer Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

In North America, the market is anticipated to exhibit steady growth throughout the forecast period, driven by the region's advanced technology and substantial investments made by major players, including Air Products & Chemicals. This area holds a notable share of global desiccant dryer production, with numerous manufacturing facilities operated by leading producers.

Latin America, particularly Brazil, plays a significant role in both production and consumption within the desiccant dryer market. Projections suggest a consistent growth trajectory in the region, supported by substantial investments by construction companies aiming to enhance productivity in large-scale projects.

In Europe, Germany emerged as a key player in desiccant dryer production and consumption, attributed to a skilled and cost-effective labor force, coupled with stringent government regulations preventing imports from external regions. These factors contribute to Germany's prominence in manufacturing these products.

The Asia Pacific region, with China at the forefront, is expected to witness rapid growth in the desiccant dryer market. China, characterized by a large population and robust economic growth, is identified as a low-cost producer with expanded production capabilities due to significant investments. Moreover, construction companies in the region are investing substantially to improve productivity, particularly in projects like skyscrapers that require desiccant dryers during construction phases.

The Middle East and Africa are projected to experience relatively stable market conditions in the coming years, with consistent production, consumption, and exports. This stability is attributed to a cost-effective labor force and government regulations that restrict imports into countries like Saudi Arabia and the UAE. Additionally, manufacturers in the region are investing significantly in research and development for products used in construction phases, along with exploring alternative energy sources such as solar power generators, ensuring sustainable growth prospects in the future.

COVID-19 Pandemic: Impact Analysis

The onset of the COVID-19 outbreak initially resulted in the suspension of non-essential commercial activities for an extended period, significantly impacting various industries, including the chemical and industrial sectors. The Desiccant Dryer Market experienced adverse effects as a consequence. Moreover, the manufacturing and distribution of filter dryers designed for industrial-grade compressors encountered significant challenges. These difficulties were primarily attributed to disruptions in the supply chain and scarcities in raw materials. The abrupt shutdown of numerous enterprises, coupled with challenges in sourcing alternative raw materials, contributed to a decline in demand for compressed air dryers during this period.

Latest Trends/ Developments:

-

In the year 2023, a groundbreaking structured desiccant dryer, developed and patented by Atlas Copco, has significantly altered the landscape of compressed air dryer design and performance. This innovation has introduced a new option for customers in need of a smaller adsorption dryer, with the Atlas Copco CD+ now offering a flow range from 5 to 30 l/s.

-

In November 2022, Atlas Copco made a strategic move by acquiring Aircel, LLC, a U.S.-based company specializing in air treatment and air purification solutions. Aircel is actively engaged in the production and sales of air treatment and air purification equipment, encompassing desiccant and refrigerant dryers, filtration systems, and condensate equipment. This acquisition enhances Atlas Copco's capabilities in the air treatment sector and broadens its product portfolio.

Key Players:

These are the top 10 players in the Desiccant Dryer Market:-

-

Ingersoll Rand

-

Atlascopco

-

Kaeser

-

Parker

-

Sullair

-

Q Inc Compressor

-

Hankison (SPX FLOW)

-

DRI-AIR Industries

-

MATSUI

-

Gardner Denver

Chapter 1. Desiccant Dryer Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Desiccant Dryer Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Desiccant Dryer Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Desiccant Dryer Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Desiccant Dryer Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Desiccant Dryer Market – By Type

6.1 Introduction/Key Findings

6.2 Hot Air Dryers

6.3 Compressed Air Dryers

6.4 Other

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Desiccant Dryer Market – By Application

7.1 Introduction/Key Findings

7.2 Electronics

7.3 Food & Beverage

7.4 Oil & Gas

7.5 Pharmaceuticals

7.6 Construction Industry

7.7 Chemicals

7.8 Paper & Pulp

7.9 Textile

7.10 Aviation

7.11 Y-O-Y Growth trend Analysis By Application

7.12 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Desiccant Dryer Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Distributors

8.4 Online Retail

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Desiccant Dryer Market – By Capacity

9.1 Introduction/Key Findings

9.2 Low

9.3 Medium

9.4 High

9.5 Y-O-Y Growth trend Analysis By Capacity

9.6 Absolute $ Opportunity Analysis By Capacity, 2024-2030

Chapter 10. Desiccant Dryer Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Type

10.1.3 By Application

10.1.4 By Distribution Channel

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Type

10.2.3 By Application

10.2.4 By Distribution Channel

10.2.5 By Capacity

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Type

10.3.3 By Application

10.3.4 By Distribution Channel

10.3.5 By Capacity

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Type

10.4.3 By Application

10.4.4 By Distribution Channel

10.4.5 By Capacity

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Type

10.5.3 By Application

10.5.4 By Distribution Channel

10.5.5 By Capacity

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Desiccant Dryer Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Ingersoll Rand

11.2 Atlascopco

11.3 Kaeser

11.4 Parker

11.5 Sullair

11.6 Q Inc Compressor

11.7 Hankison (SPX FLOW)

11.8 DRI-AIR Industries

11.9 MATSUI

11.10 Gardner Denver

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The anticipated expansion of the global desiccant dryer market is attributed to a rising need for energy-efficient and economically viable drying technologies. Additionally, heightened awareness among end-users regarding environmental concerns serves as a significant factor fostering this growth.

The top players operating in the Desiccant Dryer Market are - Ingersoll Rand, Atlascopco, Kaeser, Parker, Sullair, Q Inc Compressor, Hankison (SPX FLOW), DRI-AIR Industries, MATSUI, Gardner Denver.

The onset of the COVID-19 outbreak initially resulted in the suspension of non-essential commercial activities for an extended period, significantly impacting various industries, including the chemical and industrial sectors. The Desiccant Dryer Market experienced adverse effects as a consequence.

Numerous companies have introduced inventive concepts for air compressor dryers, establishing a lucrative market for global compressed air filtration and drying systems. A notable example is the rising demand for Painting Desiccant Dryers in local markets and may be a trend in the global desiccant dryer market.

The Asia Pacific region, with China at the forefront, is expected to witness rapid growth in the desiccant dryer market. China, characterized by a large population and robust economic growth, is identified as a low-cost producer with expanded production capabilities due to significant investments.