Deodorants Market Size (2024 – 2030)

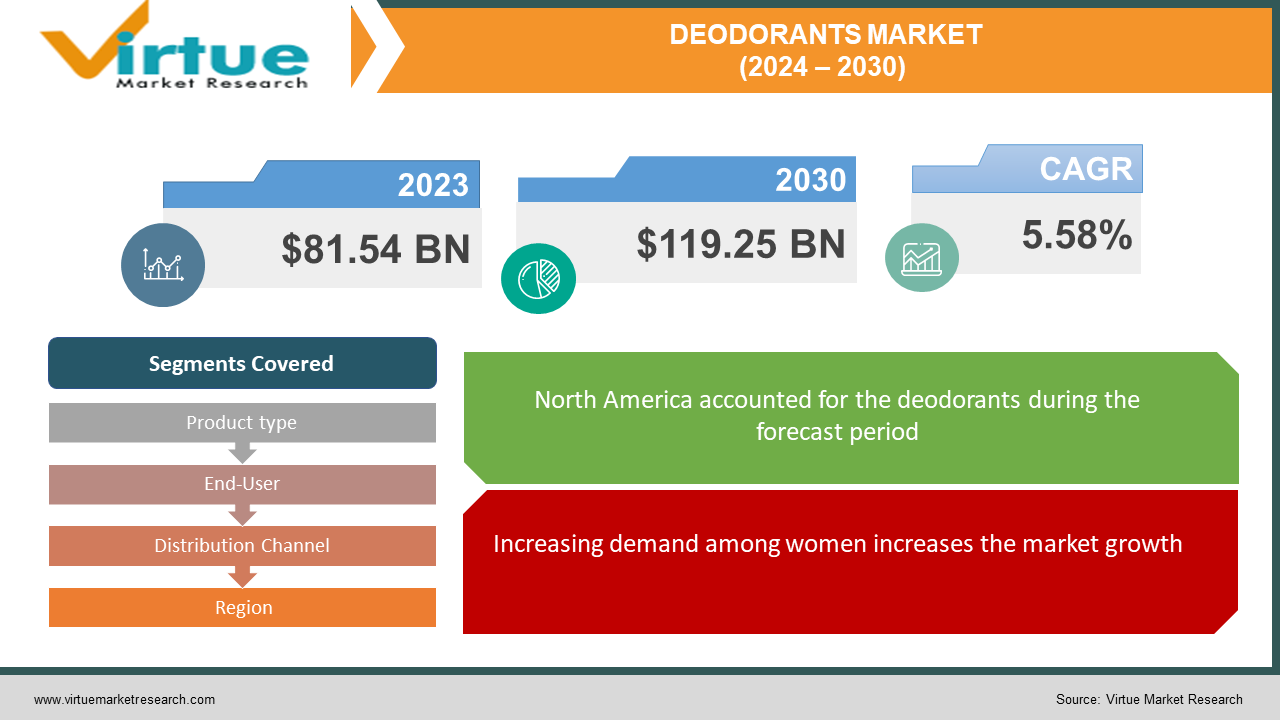

The deodorant market was valued at USD 81.54 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 119.25 billion by 2030, growing at a CAGR of 5.58%.

A deodorant serves as a substance administered on the human body to deter the occurrence of body odor resulting from the bacterial decomposition of perspiration in areas such as the groin, feet, armpits, and, in certain instances, vaginal secretions. Within the category of deodorants exists a subclass known as antiperspirants. Antiperspirants are specifically designed to impede the act of sweating within the human body, typically achieved by obstructing sweat glands. While various deodorants permit perspiration, they act to thwart bacterial activity on body sweat, ensuring that the discernible odor associated with human sweat only becomes apparent when bacteria undergo decay.

Key Market Insights:

Deodorants serve as fragrant substances utilized by individuals to transform bacterial growth into a more pleasant scent, thereby mitigating body odor. They play a crucial role in averting bacterial breakdown. Additionally, the rise in awareness regarding the advantages of therapeutic fragrances and advancements in product innovation are key factors driving the worldwide demand for herbal and organic deodorants. Furthermore, an escalating health consciousness concerning the presence of aluminum toxicity in deodorants is anticipated to contribute significantly to the continued expansion of the deodorant market.

Deodorants Market Drivers:

Increasing demand among women increases the market growth.

In recent years, women faced limited options when it came to exploring a diverse range of fragrances and deodorants designed for them. The growing population has significantly influenced women's preferences in deodorants, prompting companies in the deodorant industry to consider alternative perspectives. The introduction of a new array of products, encompassing various fragrance types, is expanding the choices available to consumers. This diversification is in response to the heightened demand and anticipated sales of deodorants, contributing to the overall growth of the market.

Organic deodorant increasing market growth.

The heightened emphasis on personal hygiene during the forecast period has led to an increased demand for natural and organic products, significantly boosting the market for organic deodorants. The surge in awareness of skin allergies and various side effects associated with the use of chemical-based products has further propelled the demand for organic deodorants. This trend has not only elevated the popularity of natural deodorants but has also contributed to an accelerated growth rate in the market.

Deodorants Market Restraints and Challenges:

Chemicals used in deodorant restrain the market growth.

The forecast period anticipates market growth challenges due to the presence of alternative substitute products. Additionally, the elevated cost of the product is expected to impact price-sensitive consumers, leading to a decline in the market growth rate. Furthermore, the composition of deodorants, which includes various types of chemicals like cyclomethicone, aluminum compounds, and others, poses a risk of skin irritation or allergic reactions. This factor is likely to serve as a significant market restraint, impeding the expansion of the market during the forecast period.

Deodorants Market Opportunities:

Pocket-based deodorant creates opportunities in the market.

Upon thorough examination of global price consciousness impacting deodorant sales, companies have identified key factors influencing consumer choices. The preference for convenience and ease of use has driven customers towards pocket-based deodorants. In response to this trend, leading market players have introduced cost-effective and compact pocket-sized deodorants. This innovation not only addresses the portability needs but also enhances fragrance quality, providing a long-lasting impact. Consequently, the increasing demand for pocket-based deodorants is poised to generate numerous opportunities for market growth throughout the forecast period.

New product launches create opportunities for market growth.

The continuous influx of product launches by market players presents significant opportunities for market growth in the forecast period. A notable example is the introduction by Unilever under the brand name REXONA in 2022, unveiling a new line of deodorants specifically designed for sports, particularly soccer. This limited-edition range encompasses various formats, including stick, aerosol, compressed spray, and roll-on, catering to diverse consumer preferences.

DEODORANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.58% |

|

Segments Covered |

By Product type, End-User, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Unilever PLC, The Estée Lauder Companies Inc., Procter & Gamble, Colgate-Palmolive Company, L’Oréal S.A., The Body Shop International Ltd., Beiersdorf AG, Knowlton Development Corporation (KDC), Mandom Corporation, Lion Corporation |

Deodorants Market Segmentation: By Product Type

-

Sprays

-

Creams Roll-On

-

Other Product Types

Leading companies such as Unilever and P&G are actively introducing deodorant sprays tailored to ensure the hygiene of females across different regions. The consistent trend of product innovation remains a significant driver for market growth. Furthermore, there is a notable production of specialized deodorants targeting athletes and individuals engaged in intense workouts, addressing concerns related to irritation and unpleasant odor.

Athletes, in particular, often opt for aluminum-free deodorants featuring odor-blocking formulas to uphold their hygiene standards. Consequently, the increasing adoption of deodorants spans consumers across various income levels and ethnic groups within the region, contributing to the overall market growth anticipated in the forecast period.

Deodorants Market Segmentation: By End-User

-

Men

-

Woman

The largest market share is currently held by the men's segment and women are the fastest-growing segment in the market. The market is highly popular and in-demand in both segments due to increasing physical workout trends and increasing personal care knowledge.

Deodorants Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Pharmacies and Drug Stores

-

Online Retail Stores

-

Other Distribution Channels

Anticipated over the assessment period is a noteworthy increase in the sales of deodorant sticks through online platforms. The emergence and widespread adoption of e-commerce platforms, coupled with the extensive reach of social media, present lucrative growth prospects for market players.

Consumers are increasingly drawn to online platforms due to the availability of a diverse product range and the convenience of doorstep delivery. Additionally, the option for customized packaging and a growing emphasis on environmental concerns has prompted key players to introduce eco-friendly products, further enhancing the appeal of online shopping for deodorant sticks.

Deodorants Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

In 2023, North America is projected to secure more than 29% of the overall market share. The United States is expected to witness increased sales, primarily driven by the substantial presence of leading personal care companies. These companies are making significant investments in promotional campaigns and marketing strategies to bolster their sales. Furthermore, they are introducing organic products featuring various flavors and ingredients to attract consumers. Key players in the United States are dedicated to enhancing their product aesthetics and packaging quality to maintain a competitive edge.

In Europe, the deodorant stick market currently commands the largest market share, and this trend is anticipated to persist throughout the forecast period. The growing preference for natural products in personal care is a key factor driving demand in the region.

Within Europe, the United Kingdom stands out as the most lucrative market for deodorant sticks. The surge in demand for organic hygiene products is a primary driver of growth. Consumers in the country exhibit a preference for eco-friendly and skin-friendly products. Key players in the United Kingdom are introducing deodorant sticks with glass packaging material and focusing on developing products containing natural ingredients like jojoba, coconut oil, and shea butter, among others, known for their skin-friendly benefits.

COVID-19 Pandemic: Impact Analysis

The trend of reduced deodorant use has experienced accelerated growth due to COVID-19 restrictions, witnessing a significant decline in application over the past years. A noteworthy 28% of deodorant and antiperspirant users have reported using these products less frequently since the onset of the pandemic. This decline in frequency is particularly pronounced among individuals under the age of 39, with just under half (45%) of Generation Z and 40% of Millennials now utilizing deodorant or antiperspirant less frequently.

Latest Trends/ Developments:

- In September 2022, Unilever introduced the Schmidt's brand, a new certified natural aerosol deodorant, in Australia and New Zealand. Concurrently, the company initiated its inaugural campaign, developed by the independent creative agency Emotive, in both countries to raise awareness of this new brand.

- In March 2022, P&G's Secret brand unveiled a novel weightless dry spray collection in the United States, encompassing both antiperspirant and aluminum-free options. The antiperspirant offers enduring sweat and odor protection for up to 48 hours, while the aluminum-free deodorant ensures long-lasting odor protection for up to 24 hours. The market has also observed an increasing focus on hygiene concerns, particularly among women.

Key Players:

These are the top 10 players in the deodorant market: -

-

Unilever PLC

-

The Estée Lauder Companies Inc.

-

Procter & Gamble

-

Colgate-Palmolive Company

-

L’Oréal S.A.

-

The Body Shop International Ltd.

-

Beiersdorf AG

-

Knowlton Development Corporation (KDC)

-

Mandom Corporation

-

Lion Corporation

Chapter 1. Deodorants Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Deodorants Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Deodorants Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Deodorants Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Deodorants Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Deodorants Market – By Product Type

6.1 Introduction/Key Findings

6.2 Sprays

6.3 Creams Roll-On

6.4 Other Product Types

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Deodorants Market – By End-User

7.1 Introduction/Key Findings

7.2 Men

7.3 Woman

7.4 Y-O-Y Growth trend Analysis By End-User:

7.5 Absolute $ Opportunity Analysis By End-User:, 2024-2030

Chapter 8. Deodorants Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Supermarkets/Hypermarkets

8.3 Convenience Stores

8.4 Pharmacies and Drug Stores

8.5 Online Retail Stores

8.6 Other Distribution Channels

8.7 Y-O-Y Growth trend Analysis By Distribution Channel

8.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Deodorants Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By End-User:

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By End-User:

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By End-User:

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By End-User:

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By End-User:

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Deodorants Market – Company Profiles – (Overview, By Product Type Portfolio, Financials, Strategies & Developments)

10.1 Unilever PLC

10.2 The Estée Lauder Companies Inc.

10.3 Procter & Gamble

10.4 Colgate-Palmolive Company

10.5 L’Oréal S.A.

10.6 The Body Shop International Ltd.

10.7 Beiersdorf AG

10.8 Knowlton Development Corporation (KDC)

10.9 Mandom Corporation

10.10 Lion Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

Deodorants serve as fragrant substances utilized by individuals to transform bacterial growth into a more pleasant scent, thereby mitigating body odor. They play a crucial role in averting bacterial breakdown. Additionally, the rise in awareness regarding the advantages of therapeutic fragrances and advancements in product innovation are key factors driving the worldwide demand for herbal and organic deodorants.

The top players operating in the Deodorants Market are - Unilever PLC, The Estée Lauder Companies Inc., Procter & Gamble, Colgate-Palmolive Company, L’Oréal S.A., The Body Shop International Ltd., Beiersdorf AG, Knowlton Development Corporation (KDC), Mandom Corporation, Lion Corporation.

The trend of reduced deodorant use has experienced accelerated growth due to COVID-19 restrictions, witnessing a significant decline in application over the past years.

The preference for convenience and ease of use has driven customers towards pocket-based deodorants. In response to this trend, leading market players have introduced cost-effective and compact pocket-sized deodorants. This innovation not only addresses the portability needs but also enhances fragrance quality, providing a long-lasting impact.

In Europe, the deodorant stick market currently commands the largest market share, and this trend is anticipated to persist throughout the forecast period. The growing preference for natural products in personal care is a key factor driving demand in the region.