Dental Disposables Market Size (2025-2030)

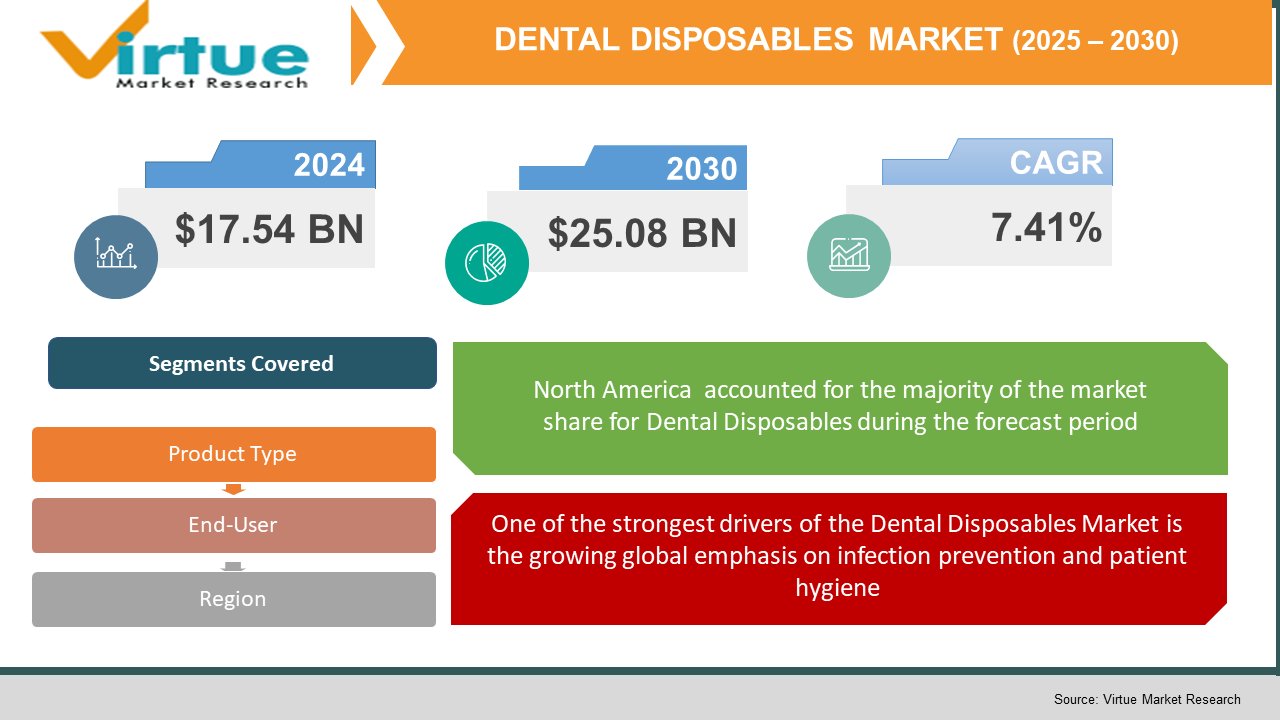

The Dental Disposables Market was valued at USD 17.54 billion in 2024 and is projected to reach a market size of USD 25.08 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.41%.

Dental disposables are one of the most crucial segments in the global dental care market about single-use products ensuring hygiene, infection control, and patient safety. Gloves, face masks, bibs, saliva ejectors, and syringe tips form a small, yet most commonly used portion of disposable products in dental clinics, hospitals, and specialty care centers. The rising awareness of patients, as well as a stringent act with which health regulations will come to has brought many patients under the roof of demand for high-quality disposables. Setting up a growing post-pandemic trend in the market, accompanied by intensified infection control in all dental practices, increasing demands worldwide for dental visits, technological advancements in the field, and more and more safe yet cost-effective solutions for disposable dental items.

Key Market Insights:

Disposable gloves and face masks together account for approximately 45% of product usage in dental clinics. Nitrile gloves are gaining popularity due to their durability and allergy-free properties.

Nearly 30% of dental practices have started adopting biodegradable or recyclable disposables. This is in response to increasing pressure from environmental bodies and eco-conscious patients.

Dental Disposables Market Drivers:

One of the strongest drivers of the Dental Disposables Market is the growing global emphasis on infection prevention and patient hygiene.

The rising global concern over infection control and patient hygiene has surged as one of the greatest driving factors for the Dental disposables market. Most dental procedures involve blood, saliva, and aerosols, which increases the likelihood of cross-contamination between patients and staff. In such cases, clinics will turn to single-use disposables, such as gloves, face masks, suction tips, and bibs, to reduce risk. These issues have become more acute post-COVID, so disposables are no longer luxury items but essentials. Regulatory bodies such as the CDC and WHO have also laid down strict sterilization guidelines, stimulating clinics toward disposables for the above purposes. Furthermore, they are now closely tied to visible hygiene practices. Those ending up in clinics using fresh, sealed disposable items applied to every patient are seen as more trusted and safe, thus leading to preference and loyalty. Such a trend is evident in urban and high-traffic dental centers, where speed, safety, and compliance matter the most.

Environmental concerns are reshaping demand in the Dental Disposables Market, with clinics and suppliers moving toward eco-conscious, biodegradable alternatives.

The Dental Disposables Market is developing a demand spectrum for plastic and synthetic-based disposables. Before that, plastic or synthetic disposable items had come under the spotlight for contributing to the growing mountain of medical waste. Manufacturers were now developing greener options like compostable bibs, recyclable trays, and biodegradable gloves. The initiatives taken toward this green phase have also resulted from governmental policies and dental associations promoting eco-friendly practices. Dental clinics in Europe and North America have started to integrate these products into the microbial dentifix trend to achieve their Environmental, Social, and Governance (ESG) objectives. Furthermore, today's patients are becoming aware of the ecological impact of healthcare and are actively seeking out companies with proven sustainability achievements. This is also changing the consumer mindset is opening up the market for premium eco-disposables with more recognition. Continuous focus on innovation and creation of the brand in this part of the sector would open the door for sustainability to become a major long-term growth driver.

Dental Disposables Market Restraints and Challenges:

One of the primary restraints in the Dental Disposables Market is the growing concern over environmental waste caused by the widespread use of single-use products.

Having one theme called 'the restraint' would be growing environmental concerns related to the increased application of single-use implements. Dentists dispose of these items, an aspect of dental practice that generates millions of tons of waste, into non-biodegradable polyethylene and latex gloves, gowns, masks, saliva ejectors, and plastic bibs. Given that millions of patients undergo treatments daily, the cumulative environmental burden becomes considerable, especially in large urban areas and high-volume dental chains. With regulatory scrutiny intensifying, some parts are considering developing bans or stringent regulations on selected plastic-based disposables. The other side of the challenge is that a proper disposal and recycling system is absent in many developing countries, which complicates the issue. The environmental challenge, therefore, raises public cognizance, and its manufacturing needs to innovate, thereby adding cost on the production side and slowing down market entry in cost-sensitive markets. Balancing safety and sustainability remains a huge impediment to the growth of the industry.

Dental Disposables Market Opportunities:

The Dental Disposables Market is set for enormous opportunities owing to advancements in materials, dental tourism, and increasing access to oral health care in developing economies. An important area of opportunity development is in eco-friendly and biodegradable disposables, which offer opportunities for new consumers who want more sustainable dental practices. Furthermore, digitization through online commerce platforms provides a market channel direct from the supplier level to the clinic level in terms of reach and cost efficiency, most importantly for small and mid-sized sizes of dental setups. Another main opportunity is in mobile and portable dental care units; disposables are highly important in this area, considering the limited sterilization infrastructure. Also, increased oral health awareness campaigns are expected to contribute to these rising numbers of patients, especially in Asia and Latin America, thus enhancing the demand for hygienic disposables. Most particularly as national regulatory frameworks turn more hygiene-focused globally, so will the innovating end-users in safety, convenience, and environmental adherence be best placed in the eventual market construct.

DENTAL DISPOSABLES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.41% |

|

Segments Covered |

By Product Type, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M Company, Dentsply Sirona Inc., Henry Schein, Inc., Patterson Dental, Kerr Corporation, Mydent International, and Septodont Holding |

Dental Disposables Market Segmentation:

Dental Disposables Market Segmentation: By Product Type

- Face Masks

- Gloves

- Dental Bibs

- Saliva Ejectors

- Syringe Needles & Tips

- Disposable Trays & Covers

- Cotton Rolls & Gauze

The market of dental disposables has been diversified into different product categories based on hygienic needs and procedures. Adolescents and adults face the most common disposal products, which are those used with face masks and gloves. Nitrile is in demand because of its toughness and hypoallergenic properties, while 3-ply and N95 masks will continue to dominate owing to their filter efficiency. Dental bibs, usually made of waterproof material, protect patients during procedures. Saliva ejectors and syringe tips are single-use tools that provide oral dryness and assist in rinsing or anesthetizing delivery, extremely important aspects of safety and precision. Disposable trays and covers organize instruments and maintain a sterile environment. Innovations will lead to more biodegradable and pre-sterilized alternatives across all these categories, which will be the driving force for product diversification and market growth until 2030.

Dental Disposables Market Segmentation: By End-User

- Dental Clinics

- Hospitals

- Academic & Research Institutes

- Mobile Dental Units

The segmentation of end-users tells us how dental disposables are used in various healthcare settings. The biggest of these end-users is a dental clinic which uses heaps of disposables in its operations because these has a high patient turnover and usually many procedures. Due to the inadequacy of sterilization alternatives and the need to save time, disposables fit the bill as they're easy to use. Hospitals, especially those with specialized oral care departments or surgical units, have a wide spectrum of disposables during complex dental surgeries and even emergencies. Academic and research institutes largely use disposables to train dental students, practice procedures, and conduct oral care under safe, controlled experimental conditions. Mobile dental units prove an emerging segment where disposables become more important without on-site sterilization for quick, safe treatment within the rural or underserved areas. Indeed, as dental care goes beyond traditional facilities, demand across user categories is expected to remain bright and varied.

Dental Disposables Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

North America remains the strongest market, supported by sophisticated dental practices, firm infection control measures, and very high disposable use per patient. Europe closely follows, keeping a strong emphasis on sustainable disposables and eco-innovations, complemented by government policies and patient expectations. The Asia-Pacific area is growing rapidly due to the rise of dental tourism, an increase in disposable income, and access to oral health care in countries such as India, China, and Southeast Asia. South America is growing gradually, driven by enhanced public dental health initiatives and increased private dental clinics. The Middle East & Africa are undergoing increased investments in health-care infrastructures such as hospitals and clinics, gradually increasing awareness regarding dental hygiene and safety, and therefore increasing penetration and opportunities for growth.

COVID-19 Impact Analysis on the Dental Disposables Market:

The Dental Disposables Market has faced tremendous short- and long-term consequences due to the COVID-19 pandemic. In the early phases, lockdowns or restrictions across the board meant that dental clinics and hospitals were observing low demand for routine procedures and low-use scenarios. Exceedingly high consumption of disposable items was observed just when practices were reopening due to the increased infection-control protocol. Items such as gloves, face masks, and protective bib towels became imperative to any patient encounter, hence the great increase in consumption. The resort to single-use hygienic dental tools dictated an increased dependency on disposables; things were no longer up to choice-they became compulsory. An innovation in virus-killing and antimicrobial disposables was promoted during the pandemic, along with an upsurge in demand for prepackaged sterile kits. However, the general impact of COVID-19 was to bring about a hastening of a long-term march of increasing safety and regulatory compliance and disposable use that still drives market trends and direction even in the post-COVID scenario.

Latest Trends/ Developments:

The Dental Disposables Market is ever-changing due to increasing concerns regarding sustainability, infection control, and technological innovations. One of the key trends is the introduction of environment-friendly and biodegradable disposables, with many clinics and manufacturers substituting their plastic-based products with compostable alternatives to comply with environmental regulations and to meet patients' expectations. Around the same time, the antimicrobial coating of products such as gloves or face masks is on the rise to provide better protection against bacteria and viruses. Other budding trends include RFID tags and smart packaging to track use and ensure sterility while within these highly trafficked dental environments. Also, automation and AI-supported manufacturing of disposables have picked up pace and benefit suppliers through improving their scaling process while limiting human error and wastage. Similarly, investments are being made in customized disposable dental kits, bringing as much convenience and safety as possible for special procedures. These innovations indicate a wider trajectory toward safer, equally greener, and more efficient dental care practices on a global scale.

Key Players:

- 3M Company

- Dentsply Sirona Inc.

- Henry Schein, Inc.

- Patterson Dental

- Kerr Corporation

- Mydent International

- Septodont Holding

- Young Innovations, Inc.

- Coltene Holding AG

- The KaVo Kerr Group

- GC Corporation

- Envista Holdings Corporation

Chapter 1. Dental Disposables Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary End-User

1.5. Secondary End-User

Chapter 2. DENTAL DISPOSABLES MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. DENTAL DISPOSABLES MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. DENTAL DISPOSABLES MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. DENTAL DISPOSABLES MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. DENTAL DISPOSABLES MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Face Masks

6.3 Gloves

6.4 Dental Bibs

6.5 Saliva Ejectors

6.6 Syringe Needles & Tips

6.7 Disposable Trays & Covers

6.8 Cotton Rolls & Gauze

6.9 Y-O-Y Growth trend Analysis By Product Type

6.10 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 7. DENTAL DISPOSABLES MARKET – By End-User

7.1 Introduction/Key Findings

7.2 Dental Clinics

7.3 Hospitals

7.4 Academic & Research Institutes

7.5 Mobile Dental Units

7.6 Y-O-Y Growth trend Analysis By End-User

7.7 Absolute $ Opportunity Analysis By End-User , 2025-2030

Chapter 8. DENTAL DISPOSABLES MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End-User

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product Type

8.2.3. By End-User

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product Type

8.3.3. By End-User

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product Type

8.4.3. By End-User

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product Type

8.5.3. By End-User

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. DENTAL DISPOSABLES MARKET – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 3M Company

9.2 Dentsply Sirona Inc.

9.3 Henry Schein, Inc.

9.4 Patterson Dental

9.5 Kerr Corporation

9.6 Mydent International

9.7 Septodont Holding

9.8 Young Innovations, Inc.

9.9 Coltene Holding AG

9.10 The KaVo Kerr Group

9.11 GC Corporation

9.12 Envista Holdings Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Dental Disposables Market was valued at USD 17.54 billion in 2024 and is projected to reach a market size of USD 25.08 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.41%.

The Dental Disposables Market is driven by rising awareness of infection control and the increasing demand for single-use, hygienic dental products. Additionally, the growth of dental tourism and expanding access to oral healthcare in emerging economies are fueling market expansion.

Based on Service Provider, the Dental Disposables Market is segmented into material manufacturers, Raw Material Suppliers, Lab information management systems, Distributors & Wholesalers, End-to-End Solution Providers.

North America is the most dominant region for the Dental Disposables Market.

3M Company, Dentsply Sirona Inc., Henry Schein, Inc., Patterson Dental, Kerr Corporation, Mydent International, and Septodont Holding are the key players in the Dental Disposables Market.