Dehydrating Breather Market Size (2024 – 2030)

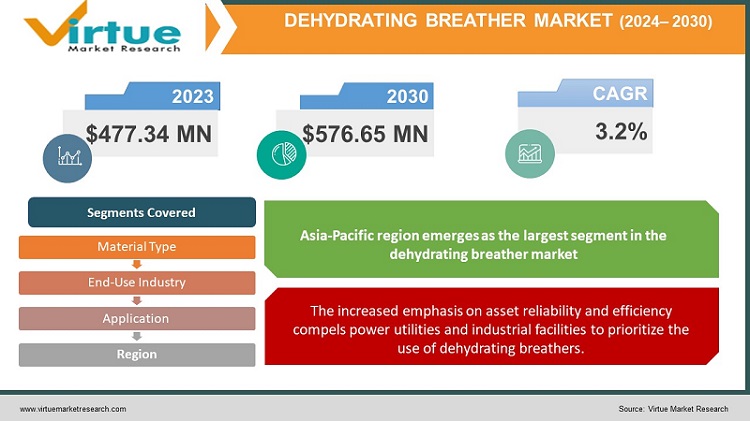

The Dehydrating Breather Market was valued at USD 477.34 Million and is projected to reach a market size of USD 576.65 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.2%.

Market Overview:

The dehydrating breather market is experiencing rapid expansion within the power and energy sector, driven by the escalating requirement for effective moisture control and particle filtration in electrical apparatus like transformers and reactors. These breathers play a crucial role in preserving the insulating properties of these devices by averting moisture ingress, thereby prolonging their operational lifespan and curbing maintenance expenses. Technological advancements, particularly the emergence of smart breathers offering real-time monitoring and predictive maintenance capabilities, contribute significantly to market growth. Key industry players are strategically broadening their product portfolios and global footprint to meet the escalating demand for dependable and economical solutions in power transmission and distribution systems.

Key Market Insights:

Maintaining the insulation system of power transformers remains pivotal in ensuring optimal performance throughout their operational life, with transformer oil serving as a critical component. Shielding transformer oil from impurities stands as a key task in preserving its intended functionality. Dehydrating breathers, available in various sizes, find primary application in oil-insulated transformers to safeguard the oil's insulating properties against airborne moisture. This protection proves especially advantageous for large-scale transformers utilized within the utility sector.

The Asia-Pacific region has witnessed substantial investments in gas-insulated and air-insulated substations, anticipated to bolster transformer demand in the region and subsequently foster growth within the dehydrating breather industry in the foreseeable future.

Dehydrating Breather Market Drivers:

The dehydrating breather market experiences significant influence from the surge in energy demand and ongoing infrastructure development.

The expanding electricity demand, driven by factors like population growth, urbanization, and industrialization, fuels the extension of power transmission and distribution infrastructure. Consequently, this surge in infrastructure development amplifies the deployment of transformers and related electrical equipment, consequently elevating the demand for dehydrating breathers to safeguard and elongate the lifespan of these assets.

The increased emphasis on asset reliability and efficiency compels power utilities and industrial facilities to prioritize the use of dehydrating breathers.

Protecting transformers and other high-value assets from moisture and contaminants can substantially minimize downtime and maintenance costs, presenting a compelling reason for organizations to invest in dehydrating breather technology. Stringent environmental regulations and the necessity for sustainable practices further drive the adoption of breathers, given their role in prolonging equipment life and reducing the environmental impact of premature replacements.

Dehydrating Breather Market Restraints and Challenges:

The cost implications associated with dehydrating breathers pose potential challenges for various businesses.

Despite offering considerable long-term benefits, the initial expense of purchasing and installing dehydrating breathers can be daunting, particularly for smaller utility companies and industries operating within constrained budgets. Additional ongoing expenses related to desiccant material replacement and periodic servicing contribute to the overall cost of ownership, potentially hindering widespread adoption, particularly in regions with limited financial resources or industries facing tight profit margins.

Environmental regulations and sustainability concerns present another challenge to the dehydrating breather market.

The disposal and management of breather waste, notably materials like silica gel classified as hazardous waste, require adherence to stringent environmental regulations. As sustainability becomes a more significant focus in industrial practices, companies face increasing pressure to explore environmentally friendly alternatives or develop recycling programs for breather components. Balancing adherence to strict environmental regulations with maintaining cost-effectiveness poses a complex challenge within the dehydrating breather market.

Dehydrating Breather Market Opportunities:

The dehydrating breather market offers substantial opportunities in line with the expanding generation of renewable energy and the modernization of power grids. The heightened adoption of renewable energy sources and the interconnectedness of grids elevate the need for reliable and efficient moisture control solutions to safeguard critical electrical infrastructure. Integrating smart technologies into dehydrating breathers, providing real-time monitoring and predictive maintenance capabilities, aligns with the evolving demands of the power and energy industry. As global grid infrastructure evolves to accommodate new energy sources, the dehydrating breather market is poised to capitalize on these opportunities by ensuring essential protection and reliability for electrical equipment.

DEHYDRATING BREATHER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.2% |

|

Segments Covered |

By Material Type, Application, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Des-Case Corporation, ABB Group, Siemens AG, Hubbell Incorporated, Eaton Corporation, Maschinenfabrik Reinhausen GmbH, Parker-Hannifin Corporation, Qualitrol Corporation, Smith Flow Control, Siemens Gamesa Renewable Energy |

Dehydrating Breather Market Segmentation: By Material Type

-

Silica Gel

-

Molecular Sieves

-

Activated Carbon

-

Others

The predominant material type within the dehydrating breather market tends to be Silica Gel, capturing a substantial share of 67%. This material stands out for its exceptional moisture absorption capabilities, cost-effectiveness, and extensive history of use in safeguarding electrical equipment. Its proficiency lies in adsorbing moisture from incoming air, thereby protecting equipment from potential damage and significantly prolonging its operational life. Silica gel's ease of procurement and relatively lower environmental risks compared to other alternatives make it a preferred choice across various applications in the dehydrating breather market. On the other hand, the Molecular Sieves segment demonstrates the highest growth rate, boasting a CAGR of 14.3%. This surge in demand can be attributed to their superior moisture absorption and particle filtration capabilities, surpassing traditional materials like silica gel and activated carbon. Their enhanced water adsorption capacity ensures better moisture control, crucial for preserving electrical equipment's insulating properties. The precise removal of contaminants, facilitated by their uniform pore structure, makes molecular sieves increasingly sought-after, especially in high-voltage electrical systems and smart grids where stringent moisture control and particle filtration are critical.

Dehydrating Breather Market Segmentation: By Application

-

Transformers

-

Reactors

-

Oil Storage Tanks

-

Other Electrical Equipment

The primary application segment dominating the dehydrating breather market typically centers around Transformers, commanding a significant market share of 48%. Transformers, pivotal in power transmission and distribution networks, represent essential and high-value assets within electrical infrastructure. Maintaining the insulation system's dryness and cleanliness is paramount for ensuring their efficient and dependable operation. Dehydrating breathers find extensive use in transformers to prevent moisture ingress, thereby elongating their operational lifespan and reducing maintenance costs. The substantial number of transformers deployed across global power grids contributes to this segment's dominance, driven by the ongoing industry necessity to protect these critical assets and sustain grid reliability. Meanwhile, among 'Other' applications, the fastest-growing segment is in Renewable Energy, encompassing various electrical equipment used in renewable energy generation, such as wind turbines, solar inverters, and associated substations. The rapid expansion of renewable energy projects, fueled by environmental concerns and the transition toward sustainable power sources, has led to increased installations of electrical infrastructure in challenging environments. Dehydrating breathers play a pivotal role in preserving the equipment's integrity, preventing moisture ingress, and ensuring long-term reliability, making it a high-growth sector within the market.

Dehydrating Breather Market Segmentation: By End-User Industry

-

Power Generation

-

Transmission and Distribution

-

Manufacturing and Processing

-

Renewable Energy

-

Oil and Gas

-

Others

The leading segment by end-user industry in the dehydrating breather market typically aligns with Transmission and Distribution, commanding a substantial market share of 43%. The prevalent usage of transformers and electrical equipment in power grid infrastructure contributes significantly to this dominance. Transformers play a critical role in voltage level regulation during power transmission from generation sources to end-users. To maintain these transformers' efficiency and longevity, dehydrating breathers are indispensable in preventing moisture ingress and preserving insulation integrity. Additionally, the growing emphasis on grid modernization and integration of renewable energy sources further propels the demand for dehydrating breathers in the transmission and distribution segment, making it the largest user of these devices. As for the fastest-growing segment, the Renewable Energy sector stands out with a growth rate of 15.6%. This growth is primarily driven by the global shift toward clean energy sources like wind and solar power. The electrical equipment utilized in renewable energy installations, such as wind turbines and solar farms, requires protection against moisture and contaminants. Dehydrating breathers play a crucial role in ensuring the reliability and longevity of this equipment, thus witnessing increasing demand within the renewable energy sector. The incorporation of smart technologies in breathers aligns with the innovative nature of the renewable energy industry, further fueling its growth.

Dehydrating Breather Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region emerges as the largest segment in the dehydrating breather market, holding a market share of 38%. This prominence primarily stems from rapid industrialization and urbanization witnessed in emerging economies such as China and India, leading to significant investments in power infrastructure to meet escalating energy demands. The increased integration of renewable energy sources and expansive power transmission and distribution networks in the region propel the demand for dehydrating breathers, safeguarding critical electrical assets and solidifying Asia-Pacific's position as the largest regional market for these products. Additionally, the Asia-Pacific region demonstrates the fastest-growing trajectory in the dehydrating breather market, poised to grow at a CAGR of 17.8%. This growth is predominantly driven by the rapid expansion of power infrastructure, especially in emerging economies like China and India. The escalating electricity demands, coupled with investments in power generation and grid modernization, necessitate efficient moisture control solutions for electrical equipment. The adoption of smart dehydrating breathers and the integration of renewable energy sources further accelerate market growth, as these technologies require advanced moisture control to ensure operational reliability and longevity.

COVID-19 Impact Analysis on the Global Dehydrating Breather Market:

The global dehydrating breather market encountered a mix of impacts due to the COVID-19 pandemic. While the initial outbreak disrupted supply chains and momentarily slowed down installation and maintenance activities, the market showcased resilience owing to the persistent need for reliable moisture control in electrical equipment. The surge in remote monitoring and maintenance solutions during the pandemic, alongside an increased emphasis on fortifying the reliability of critical infrastructure, propelled the interest in smart dehydrating breathers. As economies recover and infrastructure projects resume, the market is expected to regain momentum, fueled by a combination of deferred maintenance and the incorporation of advanced technologies, positioning it for growth in the post-pandemic era.

Latest Trends/Developments:

An eminent trend in the dehydrating breather market revolves around the integration of smart technologies into these devices. Smart dehydrating breathers incorporate sensors and communication capabilities to provide real-time monitoring and data-driven insights into electrical equipment condition and breather performance. These devices can detect moisture levels, particle contamination, and other critical parameters, transmitting this data for analysis to predict maintenance needs and optimize equipment performance. This aligns with the broader shift towards Industry 4.0 and the Internet of Things (IoT) in industrial applications, facilitating proactive maintenance and improved reliability. Consequently, smart dehydrating breathers assist organizations in reducing downtime, enhancing the lifespan of electrical assets, and streamlining maintenance operations.

A noteworthy development in the dehydrating breather market is the escalating emphasis on sustainability and environmentally responsible practices. Manufacturers and end-users are actively exploring alternatives to traditional desiccant materials, considering their potential as hazardous waste. Efforts are underway to develop eco-friendly desiccants and materials with reduced environmental impact. Additionally, there's a growing focus on implementing recycling programs for breather components to minimize waste and decrease the ecological footprint of these products. As environmental regulations become stringent and corporate sustainability goals gain prominence, these initiatives for sustainable materials and recycling programs are emerging as key developments in the dehydrating breather market, catering to the demand for greener solutions while maintaining effective moisture control.

Key Players:

-

Des-Case Corporation

-

ABB Group

-

Siemens AG

-

Hubbell Incorporated

-

Eaton Corporation

-

Maschinenfabrik Reinhausen GmbH

-

Parker-Hannifin Corporation

-

Qualitrol Corporation

-

Smith Flow Control

-

Siemens Gamesa Renewable Energy

Chapter 1. Dehydrating Breather Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Dehydrating Breather Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Dehydrating Breather Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Dehydrating Breather Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Dehydrating Breather Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Dehydrating Breather Market – By Material Type

6.1 Introduction/Key Findings

6.2 Silica Gel

6.3 Molecular Sieves

6.4 Activated Carbon

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Material Type

6.7 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 7. Dehydrating Breather Market – By Application

7.1 Introduction/Key Findings

7.2 Transformers

7.3 Reactors

7.4 Oil Storage Tanks

7.5 Other Electrical Equipment

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Dehydrating Breather Market – By End-User Industry

8.1 Introduction/Key Findings

8.2 Power Generation

8.3 Transmission and Distribution

8.4 Manufacturing and Processing

8.5 Renewable Energy

8.6 Oil and Gas

8.7 Others

8.8 Y-O-Y Growth trend Analysis By End-User Industry

8.9 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 9. Dehydrating Breather Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By End-User Industry

9.1.4 By Material Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By End-User Industry

9.2.4 By Material Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By End-User Industry

9.3.4 By Material Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By End-User Industry

9.4.4 By Material Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By End-User Industry

9.5.4 By Material Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Dehydrating Breather Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Des-Case Corporation

10.2 ABB Group

10.3 Siemens AG

10.4 Hubbell Incorporated

10.5 Eaton Corporation

10.6 Maschinenfabrik Reinhausen GmbH

10.7 Parker-Hannifin Corporation

10.8 Qualitrol Corporation

10.9 Smith Flow Control

10.10 Siemens Gamesa Renewable Energy

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Dehydrating Breather Market was valued at USD 477.34 Million and is projected to reach a market size of USD 576.65 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.2%.

Growing Energy Demand and Infrastructure Development and Emphasis on Asset Reliability and Efficiency are drivers of the Dehydrating Breather market.

Based on material type, the Dehydrating Breather Market is segmented into Silica Gel, Molecular Sieves, Activated Carbon, and Others.

Asia Pacific is the most dominant region for the Dehydrating Breather Market.

Des-Case Corporation, ABB Group, Siemens AG, Hubbell Incorporated, Eaton Corporation, Maschinenfabrik Reinhausen GmbH, Parker-Hannifin Corporation, Qualitrol Corporation, Smith Flow Control, Siemens Gamesa Renewable Energy are a few of the major players in the Dehydrating Breather Market.