DCPD Resin Market Size (2024 – 2030)

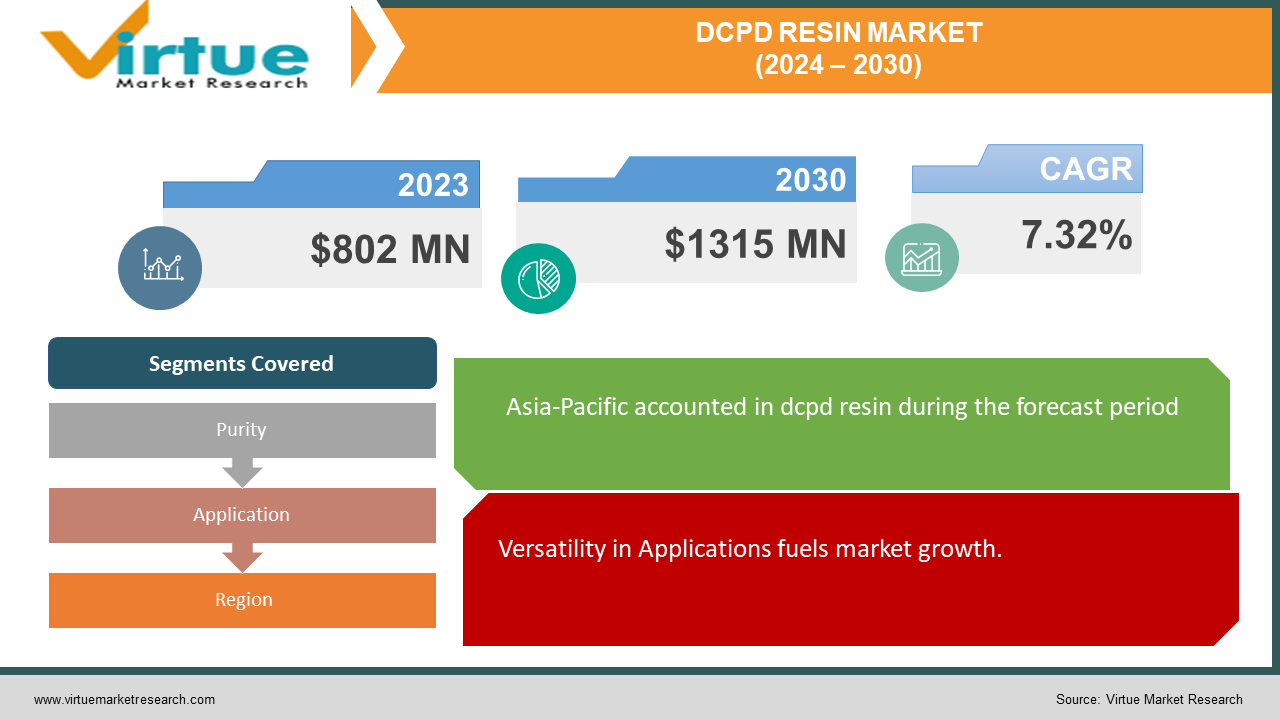

The Global DCPD Resin Market was valued at USD 802 million in 2023 and is projected to reach a market size of USD 1315 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.32%.

DCPD (dicyclopentadiene) Resin is a versatile thermosetting polymer known for its excellent thermal performance, chemical stability, and mechanical properties. DCPD resins are derived from hydrocarbon dicyclopentadiene and are widely used in a variety of industrial applications, including automotive materials, marine coatings, electrical insulation, and aerospace materials. Its unique molecular structure allows it to be optimized for different types of surfaces and allows it to be easily mixed with other resins and additives to improve performance properties. DCPD resin exhibits low shrinkage during curing, making it ideal for applications requiring high stability. It is also resistant to corrosion, wear, and moisture, making it suitable for harsh environments. With its wide range of properties and applications, DCPD resin remains the first choice of companies seeking high-performance materials for applications.

Key Market Insights:

DCPD resin finds extensive applications in automotive components, marine coatings, electrical insulation, and aerospace materials due to its exceptional heat resistance, chemical stability, and mechanical properties. Asia Pacific region has the largest and had almost USD 305 million total market share and is expected to show a CAGR of 9.68% whereas North American and European regions combined have USD 393 million in market share. The South American region is expected to witness a relatively lower CAGR of 5.39% due to logistical and price volatility challenges. The global DCPD resin market is characterized by the presence of several key players competing based on product innovation, pricing strategies, and market expansion initiatives. Market dynamics vary across regions, with developed economies focusing on high-performance applications, while emerging markets exhibit rapid growth potential driven by infrastructure development and industrialization.

DCPD Resin Market Drivers:

Versatility in Applications fuels market growth.

The versatility of DCPD resins is a major driver of the global market. Its special properties such as good thermal performance, chemical stability, and mechanical durability make it suitable for many industries and applications. For example, in the automotive industry, DCPD resin is used in products such as bumpers, body panels, and under-hood parts due to its durability and lightness. In the aviation industry, it is used in composites for aircraft interiors and equipment due to its strength-to-weight ratio. This quality makes DCPD resin suitable for different markets, increasing global demand.

Focus on Sustainable and Eco-friendly Solutions accelerate the market growth.

Environmental management and safety issues are increasing the demand for environmentally friendly and low VOC (volatile organic compounds) materials across the industry. DCPD resin is a thermosetting polymer that produces lower VOC emissions during curing than other resin systems. This makes it an attractive option for companies looking for an environmentally friendly alternative. Additionally, DCPD resin-based materials can often be recycled or reused, contributing to the sustainability of the market.

Technological Advancements and Product Innovation act as a Catalyst for the DCPD Resin market.

Ongoing research and development efforts in polymer chemistry are driving the development of advanced techniques and manufacturing processes for DCPD resins. These innovations lead to better performance, such as improved thermal stability, better connections, and improved processes. For example, developing DCPD resin formulations with customized products can enable manufacturers to meet specific requirements. These technological advances are accelerating the growth of the market by expanding the application range and improving the overall properties of DCPD resin products.

DCPD Resin Market Restraints and Challenges:

High Production Costs restrain the market growth.

One of the main challenges facing the global DCPD resin market is the high production costs associated with raw materials and manufacturing processes. Dicyclopentadiene (DCPD), the main raw material for DCPD resin production, is derived from oil or natural gas and is therefore sensitive to price changes in oil and gas products. In addition, the production process of DCPD resin often involves complex polymerization processes and specialized equipment, resulting in higher production costs. These high prices will limit the use of DCPD resins in the market and hinder the growth of the market.

Limited Availability of Raw Materials proves to be a challenge in the DCPD Resin sector.

The supply of dicyclopentadiene (DCPD), an important raw material for the production of DCPD resins, may be restricted and affected by supply chain disruptions. DCPD is usually obtained by cracking ethylene or petroleum in the refining process, and its availability can be affected by factors such as feedstock, production capacity, and characteristics of the region. A disruption or shortage of DCPD products could lead to price increases for DCPD resin manufacturers, affecting business stability and growth.

Competition from Alternative Materials hinders the market growth.

DCPD resin faces competition from other materials, including epoxy resins, other thermoset resins such as polyester and vinyl ester resins, and advanced materials such as carbon fiber composites. Each of these materials has unique properties and advantages for specific applications, and material selection is often based on factors such as performance, cost considerations, usability, and operating capacity. To remain competitive, DCPD resin manufacturers must continue to innovate and differentiate their products to meet the needs of the market and overcome the challenges of competing products.

DCPD Resin Market Opportunities:

The global DCPD (dicyclopentadiene) resin market offers various business opportunities driven by increasing demand and emerging trends across different sectors. The main opportunity lies in focusing on heavy equipment in sectors such as automotive and aerospace. The excellent strength-to-weight ratio of DCPD resins makes them the first choice for lightweight and allows them to be used in automobile and aircraft construction to improve fuel efficiency and reduce emissions. Moreover, the increasing demand for environmentally friendly and low-VOC materials offers huge market opportunities for DCPD resin. As global environmental regulations become more stringent, the need for replacement continues to increase, and DCPD resins offer an advantage in this regard due to their low organic compound (VOC) emissions during purification. In addition, technological advancement and research and development continue to expand the application potential of DCPD resins and improve their properties, opening new opportunities for commercial growth and innovation in various sectors.

DCPD RESIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.32% |

|

Segments Covered |

By Purity, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bracken, Cymetech (Sojitz), Reliance Industries, Henghe Petrochemical Co., Ltd, Shandong ShenxianRuisen Petroleum Resins Co., Ltd, OQ Chemicals, Mitsui Chemicals, Ineos Phenol, ExxonMobil, Zeon Corporation |

DCPD Resin Market Segmentation - by Purity

-

High

-

Medium

-

Low

In 2023, based on the Purity, Medium holds the largest market share with over 50% of the market. Medium-purity DCPD resin provides the perfect balance between performance and cost-effectiveness, making it a popular choice for many applications in the industry. It works well for businesses where precise purity requirements are not important, but product quality control and performance are. This market segment includes DCPD resin grades with moderate impurity levels suitable for applications such as automotive, marine, and industrial applications.

Medium-purity DCPD resin is more versatile and reliable, as well as more cost-effective than high-purity resin. Its widespread use in various applications has contributed to its prominent position in the global market. In addition, manufacturers frequently improve the production process to achieve an average level of purity, further supporting its position in the market.

DCPD Resin Market Segmentation - by Application

-

Automotive

-

Aerospace

-

Marine

-

Electrical and Electronics

-

Construction

-

Others

In 2023, based on the Application, Automotive holds a significant portion of the market share and is expected to grow at an 8.78% CAGR during the forecast period. The automotive industry uses DCPD resins for many applications such as body panels, bumpers, interiors, and accessories. This advantage comes from DCPD resin's light weight, better impact, and heat performance; This is important in increasing the performance and durability of the car. In addition, the large production in the automotive industry and the constant demand for new materials have enabled DCPD resin to have a large market share in this field.

In the aerospace industry, DCPD resins are used in composites for aircraft interiors, structural components, bodywork, and fairings. Its strength-to-weight ratio, fatigue and corrosion resistance, and ability to meet stringent aviation requirements make it ideal for use in light aircraft.

DCPD resins are used in marine applications such as boats, decks, and marine coatings due to their resistance to water, chemicals, and corrosion. It has excellent performance for fiberglass and other substrates commonly used in marine construction and provides long-term protection against the harsh marine environment.

DCPD resins are used in electrical and electronic products such as encapsulation, coating compounds, and insulation materials. Its thermal stability, electrical insulation properties, and moisture resistance make it suitable for the protection of electrical equipment and provide high performance in a variety of applications.

DCPD resin's unique combination of properties allows for customization to meet specific application requirements in diverse end-use sectors.

DCPD Resin Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023 based on Region, Asia-Pacific has the largest market share, with over 38% market share. The region includes countries such as China, Japan, South Korea, and India, which are major contributors to the global DCPD resin market. Asia Pacific is the market leader due to rapid commercialization, strong production capacity, and widespread use of DCPD resins in industries such as automotive, construction, electronics, and aerospace. Population and economic growth in countries such as China and India have driven significant demand for DCPD resins in home appliances, automobiles, and appliances. In addition, the presence of large companies and suppliers from countries such as Japan and South Korea further develops the regional market.

North America region includes countries such as the United States and Canada, where the DCPD resin market is driven by a strong automotive industry, aerospace industry, and strong material demand. Additionally, technological advancement and the use of lightweight materials in various industries have also contributed to the growth of the North American market.

European countries such as Germany, France, and the UK are major consumers of DCPD resin, especially in the automotive and aerospace sectors. The region's focus on sustainability and environmental regulations is also increasing the demand for eco-friendly resin solutions, further fueling the growth of the market.

While Asia Pacific mainly governs market size and consumption, other regions such as North America and Europe also play an important role, especially in terms of technological development, regulatory compliance, and high-value applications. Additionally, emerging markets in South America and the Middle East & Africa offer business growth and expansion opportunities for the DCPD Resin market.

COVID-19 Impact Analysis on the Global DCPD Resin Market:

The COVID-19 pandemic has had a significant impact on the global DCPD (dicyclopentadiene) resin market; disrupted supply chains, and limited demand impacted business dynamics. During the initial phase of the global pandemic, widespread lockdowns and movement restrictions slowed the economy, affected production, and caused disruptions in the production specifications and distribution of DCPD resins. Additionally, declining consumer demand and uncertainty in end-user industries such as automotive, aerospace, and construction have further reduced demand for DCPD resin products.

However, as the economy gradually reopened and profitability recovered, the DCPD resin industry also showed signs of recovery. The resumption of construction, a revival in automobile production, and increased infrastructure investments are expected to increase the demand for DCPD resins in key end-use segments. Additionally, greater exposure to lightweight materials, sustainability, and technological advancement provide opportunities for market growth and innovation amidst the post-pandemic recovery phase.

Latest Trends/ Developments:

In the global DCPD (dicyclopentadiene) resin market, several trends and innovations have shaped the market landscape. One of the most important factors is the increasing demand for sustainable and environmentally friendly products due to increasing environmental concerns and stringent regulations. To achieve sustainability goals and meet customer preferences, manufacturers are working to develop DCPD resin formulations with lower VOC emissions and improved recyclability.

Another thing to note is the increasing use of DCPD resins in composites for light-weighting applications. With industries such as automotive and aerospace emphasizing fuel efficiency and emissions reduction, DCPD resin's lightweight properties and high strength-to-weight ratio make it an attractive choice for replacing traditional materials like metals and plastics in structural components.

Additionally, research and development continue to develop new DCPD resin systems with properties tailored to specific applications, expanding market potential and driving advances. Overall, this new model reflects the industry's focus on sustainability, efficiency, and technological innovation in the global DCPD resin market.

Key Players:

-

Bracken

-

Cymetech (Sojitz)

-

Reliance Industries

-

Henghe Petrochemical Co., Ltd

-

Shandong ShenxianRuisen Petroleum Resins Co., Ltd

-

OQ Chemicals

-

Mitsui Chemicals

-

Ineos Phenol

-

ExxonMobil

-

Zeon Corporation

-

In October 2023, Braskem announced the opening of its Representative Office in Tokyo, Japan, one of the key markets for Braskem's I'm green bio-based Polyethylene (PE). This expansion represents the company’s continued development of biopolymer solutions based on renewable feedstock.

-

In September 2023, OQ Chemicals announced that the company is ready to supply ISCC PLUS certified Oxbalance TCD Alcohol DM (tricyclo decane methanol). This product is manufactured using the bio-circular precursor DCPD from Shell Chemicals Europe, a key player in the dicyclopentadiene resin market.

Chapter 1. DCPD Resin Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. DCPD Resin Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. DCPD Resin Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. DCPD Resin Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. DCPD Resin Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. DCPD Resin Market – By Purity

6.1 Introduction/Key Findings

6.2 High

6.3 Medium

6.4 Low

6.5 Y-O-Y Growth trend Analysis By Purity

6.6 Absolute $ Opportunity Analysis By Purity, 2024-2030

Chapter 7. DCPD Resin Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Aerospace

7.4 Marine

7.5 Electrical and Electronics

7.6 Construction

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. DCPD Resin Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Purity

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Purity

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Purity

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Purity

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Purity

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. DCPD Resin Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Bracken

9.2 Cymetech (Sojitz)

9.3 Reliance Industries

9.4 Henghe Petrochemical Co., Ltd

9.5 Shandong ShenxianRuisen Petroleum Resins Co., Ltd

9.6 OQ Chemicals

9.7 Mitsui Chemicals

9.8 Ineos Phenol

9.9 ExxonMobil

9.10 Zeon Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global DCPD Resin Market was valued at USD 802 million in 2023 and is projected to reach a market size of USD 1315 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.32%.

The segments under the Global DCPD Resin Market by Purity are High, Medium, and Low.

Asia-Pacific region is the dominant for Global DCPD Resin Market.

Braskem, Cymetech (Sojitz), Reliance Industries, Henghe Petrochemical Co., Ltd, Shandong ShenxianRuisen Petroleum Resins Co., Ltd, etc.

The COVID-19 pandemic has had a significant impact on the global DCPD (dicyclopentadiene) resin market; disrupted supply chains, and limited demand impacted business dynamics. During the initial phase of the global pandemic, widespread lockdowns and movement restrictions slowed the economy, affected production, and caused disruptions in the production specifications and distribution of DCPD resins.