Data Labeling Software Market Size (2023 - 2030)

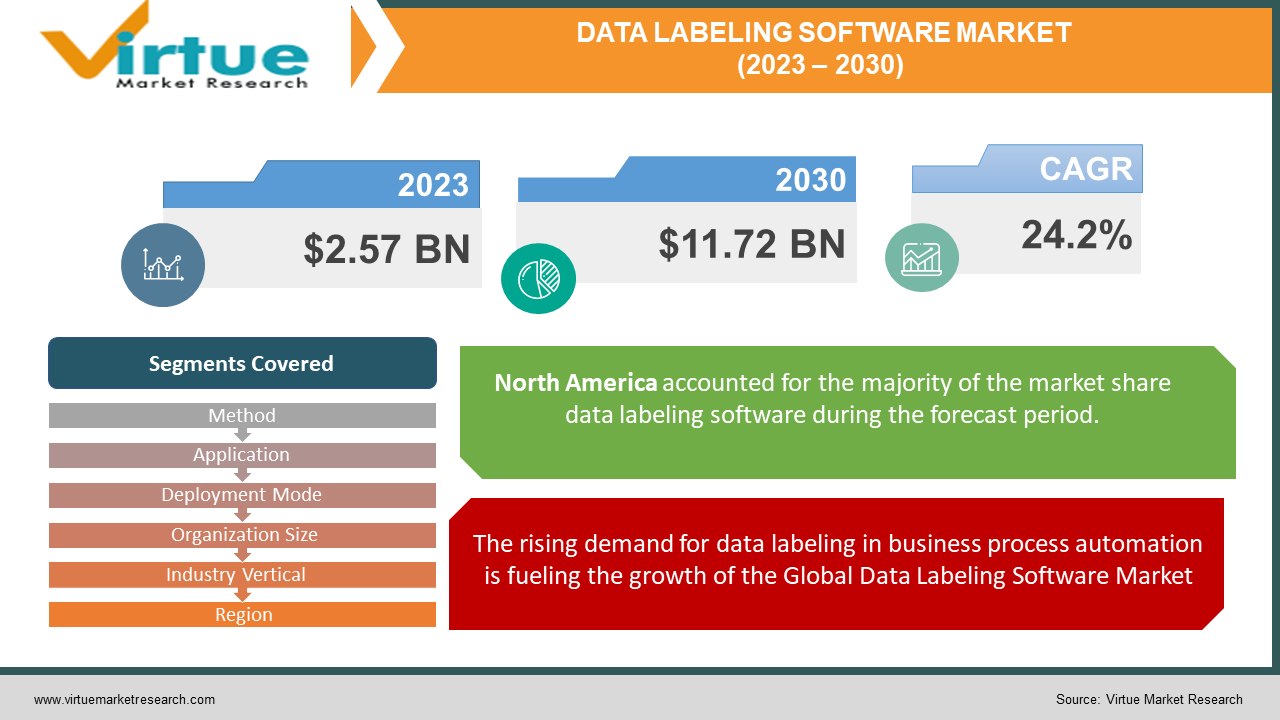

The Global Data Labeling Software Market valued at USD 2.57 Billion and is projected to reach a market size of USD 11.72 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 24.2%.

Data labeling software, which is also referred to as training data, data annotation, data tagging, or data classification software, offers businesses a set of tools to transform unlabeled data into labeled data and develop associated artificial intelligence algorithms. These software tools permit users to input a dataset, and through machine learning-assisted labeling, human labor, or user-driven efforts, the software assigns labels to the data. Certain platforms even allow for a medley of these methods, which enables users or the system itself to opt for the labeling approach based on factors like cost, quality, and speed. Data labeling tools support various types of data, encompassing images, videos, audio, and text, with subsets like satellite imagery or LIDAR. Additionally, the types of annotation available differ depending on the tool. For image data, annotations like image segmentation and object detection are commonly utilized, while text data may involve named entity recognition (NER) and sentiment detection. Speech annotation often comprises transcription and emotion recognition. To ensure the quality of labels, most tools employ metrics like consensus and ground truth. Labeled data is vital for supervised learning, a type of machine learning, to forge a foundation and make precise predictions based on input data. Consequently, data labeling software plays a critical role in numerous artificial intelligence projects. It often integrates with data science and machine learning platforms, enabling the labeled data generated by the data labeling software to train algorithms effectively.

Global Data Labeling Software Market Drivers:

The rising demand for data labeling in business process automation is fueling the growth of the Global Data Labeling Software Market.

Data labeling finds extensive applications, notably in the burgeoning field of business process automation. AI-driven business software solutions, including CRM systems and accounting suites, count heavily on labeled data. This enables machines to autonomously recognize and manage various business communications, including documents and emails. By leveraging high-quality labeled data, machines can make accurate decisions, which assists in minimizing the need for human involvement in various processes. As a result, employees can focus on tasks that necessitate their specific skills, which leads to diminished operating costs for businesses. Therefore, this factor propels the demand for data labeling software.

The increasing demand for versatile data labeling tools for diverse data types and annotation needs is another factor contributing to the growth of the Global Data Labeling Software Market.

Data labeling tools possess the ability to handle diverse types of data such as text, images, videos, and audio. This is particularly valuable because annotations can be applied to various forms of media. In the case of text, these tools enable tasks like sentiment analysis and named entity recognition. Image labeling functionalities support tasks such as object detection, image classification, and segmentation. Video annotation allows for tasks like action recognition and tracking, while audio annotation is apt for speech recognition and event detection. The flexibility and multifunctionality of these tools empower researchers and developers to address an extensive assortment of tasks and challenges. Therefore, this factor also propels the demand for data labeling software.

Global Data Labeling Software Market Challenges:

The Global Data Labeling Software Market is encountering challenges, primarily in terms of its expensive nature and prone to human error. Data labeling is a pricy and protracted process for machine learning models. Whether an enterprise chooses automation or manual labeling, data pipelines need to be set up by engineering teams. Manual labeling is particularly expensive and time-consuming. Moreover, human errors in labeling, such as coding or entry mistakes, can greatly affect data quality, leading to inaccurate processing and modeling. To ensure data quality, implementing quality assurance checks is essential. Thus, these challenges inhibit the growth of the Global Data Labeling Software Market.

Global Data Labeling Software Market Opportunities:

The Global Data Labeling Software Market is projected to offer profitable prospects for businesses operating in the AI, big data, and analytics domain, fostering partnerships, mergers, collaborations, and agreements during the forecasted period 2023-2030. Furthermore, there is a potential to make technological advancements and upgrades with novel business ideas for a competitive edge in the market by tapping into a profitable outcome.

COVID-19 Impact on the Global Data Labeling Software Market:

The COVID-19 pandemic positively impacted the growth of the Global Data Labeling Software Market. This was ascribed to the escalating volume of big data and the augmenting demand for efficient data labeling processes, propelled by the proliferation of substantial datasets. As remote employment became the norm and rigorous lockdown measures were implemented, organizations turned to data labeling software to foster collaboration and productivity in an off-site work environment. The pandemic expedited the implementation of digital transformation strategies that led to a higher adoption rate of data labeling software in diverse sectors.

Global Data Labeling Software Market Recent Developments:

-

In November 2022, V7, a startup focused on automating data labeling, successfully raised USD 33 million (GBP 27.4 million) in a Series A funding round, jointly led by Radical Ventures, a Canadian venture capital firm, and Temasek, a state-holding company headquartered in Singapore.

-

In June 2022, AWS introduced a new feature in Amazon SageMaker Ground Truth that permits users to generate labeled synthetic data. SageMaker Ground Truth is a service that streamlines the data labeling process and offers the flexibility to utilize human annotators from third-party suppliers, Amazon Mechanical Turk, or one's internal workforce.

-

In May 2022, Heartex, a startup positioning itself as an "open source" data labeling platform, unveiled its successful completion of a Series A funding round, securing USD 25 million. The funding was chiefly led by Redpoint Ventures, with additional participation from Unusual Ventures, Bow Capital, and Swift Ventures.

DATA LABELING SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

24.2% |

|

Segments Covered |

By Method, Application, Deployment Mode, Organization Size, Industry Vertical and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kili Technology (France), SuperAnnotate AI, Inc. (Armenia), Cord Technologies Limited (United Kingdom), V7 Ltd. (United Kingdom), Appen Limited (Australia), Dataloop Ltd. (Israel), Labelbox, Inc. (United States), Scale AI, Inc. (United States), Keymakr Inc. (United States), Datasaur, Inc. (United States) |

Global Data Labeling Software Market Segmentation: By Method

-

Crowdsourcing

-

Internal Labeling

-

Outsourcing

-

Synthetic Labeling

-

Programmatic Labeling

The Outsourcing segment held the highest market share in the year 2022. The growth can be ascribed to the rising adoption of outsourcing data labeling methods by large enterprises for extensive and complex projects that demand more resources than a company can allocate. By outsourcing data labeling solutions and services, organizations can shift their focus to critical operations like research and data collection. This approach offers greater flexibility in building annotation capabilities and guarantees robust security protocols are in place.

Global Data Labeling Software Market Segmentation: By Application

-

Computer Vision

-

Natural Language Processing (NLP)

-

Image and Speech Recognition

-

Others

The Natural Language Processing (NLP) segment held the highest market share in the year 2022. The growth can be ascribed to the extensive utilization of data labeling software by large enterprises and SMEs for tasks like spam detection, chatbots, and virtual assistants. In NLP, tagging specific elements of phrases or words aids algorithms in understanding the subtleties of human communication. By assigning labels to text, NLP algorithms identify special characters and employ the same idioms and expressions as humans with different dialects or accents.

Global Data Labeling Software Market Segmentation: By Deployment Mode

-

Cloud-Based

-

On-Premises

The Cloud-Based segment held the highest market share in the year 2022. The growth can be ascribed to the advantages that the cloud-based data labeling software offers in contrast to the on-premises software, including easy and swift data accessibility, immense storage availability, data-sharing capabilities, scalability, and the utmost data security. They firmly store data on remote servers instead of maintaining it on physical data storage devices like hard disks and USB flash drives. They proffer cost savings in contrast to on-site data centers and provide cutting-edge security compared to storing data on personal computers.

Global Data Labeling Software Market Segmentation: By Organization Size

-

Small and Medium-sized Enterprises (SMEs)

-

Large Enterprises

The Large Enterprises segment held the highest market share in the year 2022. The growth can be ascribed to the rising emphasis by large enterprises on adopting data labeling software to amplify their growth opportunities. Accurate data labeling techniques directly impact outcome precision and enhance the quality of machine learning applications, which leads to improved task performance for users. Additionally, large enterprises uncover revenue-generating opportunities by leveraging accurate data labeling combined with analytics.

Global Data Labeling Software Market Segmentation: By Industry Vertical

-

Banking, Financial Services, and Insurance (BFSI)

-

IT and Telecommunications

-

Retail and Digital Services

-

Automotive

-

Education

-

Healthcare

-

Others

The IT and Telecommunications segment held the highest market share. The growth can be ascribed to the rising adoption of data labeling software by IT companies for extensive artificial intelligence (AI) applications. IT companies combine software, processes, and data annotators to organize, refine, and tag data, forming the basis for training machine learning models. These annotations help analysts isolate specific variables in datasets, allowing for the selection of the most suitable data predictors for machine learning models. The labeled data assists in identifying the relevant data elements for model training, enabling the model to learn and make accurate predictions.

Global Data Labeling Software Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The region of North America dominated the Global Data Labeling Software Market in the year 2022. The growth can be ascribed to the early and vast adoption of cutting-edge technologies like data labeling software by numerous enterprises for extensive artificial intelligence and machine learning applications and the presence of high-established technological infrastructure in nations, such as the United States and Canada. Furthermore, North America is home to several prominent market players, including Labelbox, Inc., Scale AI, Inc., Keymakr Inc., Datasaur, Inc., and UBIAI Web Services. The region of Asia-Pacific is anticipated to expand at the quickest rate over the forecast period 2023-2030 owing to the abundance of data that drives demand for efficient data labeling services in ML and AI applications, a surge in AI and ML-focused startups and tech companies, and the strong presence of key market players, including Appen Limited, CloudFactory Limited, and Cogito Tech.

Global Data Labeling Software Market Key Players:

-

Kili Technology (France)

-

SuperAnnotate AI, Inc. (Armenia)

-

Cord Technologies Limited (United Kingdom)

-

V7 Ltd. (United Kingdom)

-

Appen Limited (Australia)

-

Dataloop Ltd. (Israel)

-

Labelbox, Inc. (United States)

-

Scale AI, Inc. (United States)

-

Keymakr Inc. (United States)

-

Datasaur, Inc. (United States)

Chapter 1. Data Labeling Software Market - Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Data Labeling Software Market - Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Data Labeling Software Market - Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Data Labeling Software Market - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 .Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Data Labeling Software Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Data Labeling Software Market - By Method

6.1 Crowdsourcing

6.2 Internal Labeling

6.3 Outsourcing

6.4 Synthetic Labeling

6.5 Programmatic Labeling

Chapter 7. Data Labeling Software Market - By Application

7.1 Computer Vision

7.2 Natural Language Processing (NLP)

7.3 Image and Speech Recognition

7.4 Others

Chapter 8. Data Labeling Software Market - By Deployment Mode

8.1 Cloud-Based

8.2 On-Premises

Chapter 9. Data Labeling Software Market - By Organization Size

9.1 Small and Medium-sized Enterprises (SMEs)

9.2 Large Enterprises

Chapter 10. Data Labeling Software Market - By Industry Vertical

10.1 Banking, Financial Services, and Insurance (BFSI)

10.2 IT and Telecommunications

10.3 Retail and Digital Services

10.4 Automotive

10.5 Education

10.6 Healthcare

10.7 Others

Chapter 11. Data Labeling Software Market - By Region

11.1 North America

11.2 Europe

11.3 Asia-Pacific

11.4 Latin America

11.5 The Middle East

11.6 Africa

Chapter 12. Data Labeling Software Market – key players

12.1 Kili Technology (France)

12.2 SuperAnnotate AI, Inc. (Armenia)

12.3 Cord Technologies Limited (United Kingdom)

12.4 V7 Ltd. (United Kingdom)

12.5 Appen Limited (Australia)

12.6 Dataloop Ltd. (Israel)

12.7 Labelbox, Inc. (United States)

12.8 Scale AI, Inc. (United States)

12.9 Keymakr Inc. (United States)

12.10 Datasaur, Inc. (United States)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Data Labeling Software Market is estimated to be worth USD 2.07 Billion in 2022 and is projected to reach a value of USD 11.72 Billion by 2030, growing at a CAGR of 24.2% during the forecast period 2023-2030.

The Global Data Labeling Software Market Drivers are the Rising Demand for Data Labeling in Business Process Automation and the Increasing Demand for Versatile Data Labeling Tools for Diverse Data Types and Annotation Needs.

Based on the Application, the Global Data Labeling Software Market is segmented into Computer Vision, Natural Language Processing (NLP), and Image and Speech Recognition.

The United States is the most dominating country in the region of North America for the Global Data Labeling Software Market.

Kili Technology, SuperAnnotate AI, Inc., and Cord Technologies Limited are the leading players in the Global Data Labeling Software Market.