Data Centre Equipment Market Size (2024 – 2030)

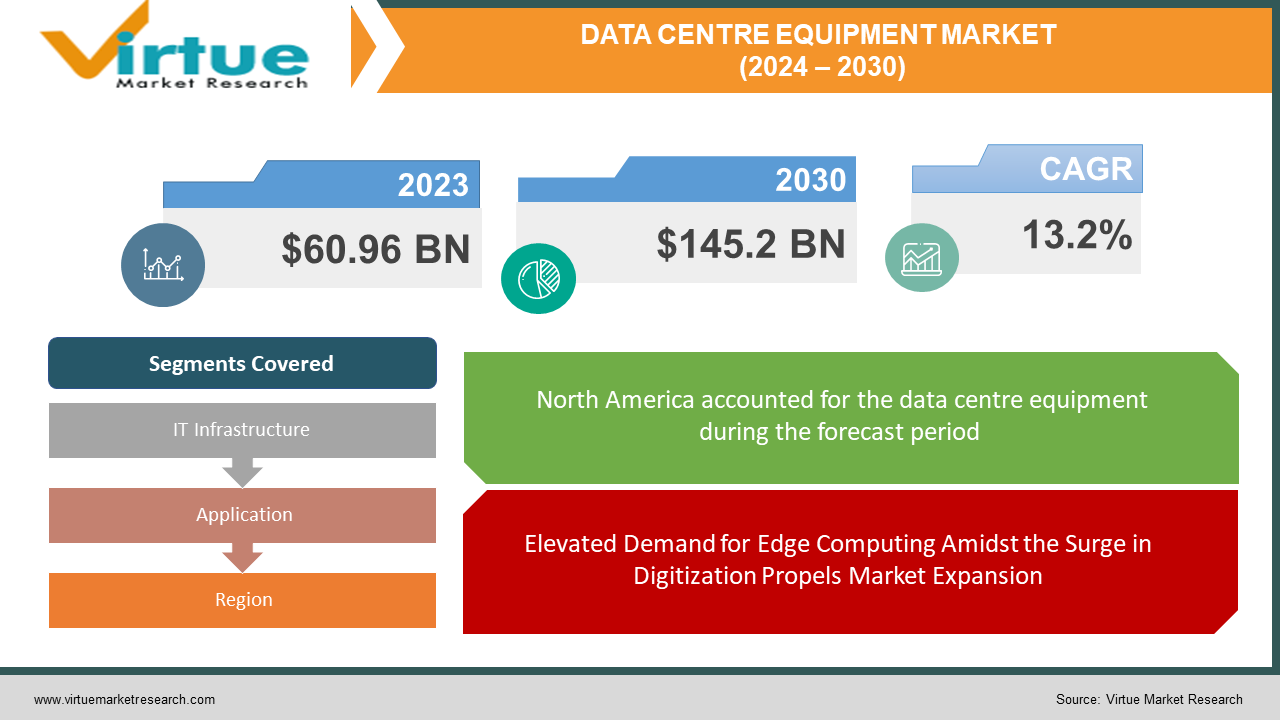

The Global Data Centre Equipment Market size was exhibited at USD 60.96 billion in 2023 and is projected to hit around USD 145.2 billion by 2030, growing at a CAGR of 13.2% during the forecast period from 2024 to 2030.

Data center equipment comprises the physical hardware and devices employed within data centers to store, control, process, and transmit data. These components encompass servers, storage systems, networking devices, power distribution units, cooling systems, and security equipment, among other essential elements. Data centers play a pivotal role for businesses necessitating efficient management of extensive data volumes, such as cloud service providers, telecommunications firms, and large enterprises.

The prospective trajectory of the data center equipment market is optimistic, driven by escalating digitization and the increasing adoption of cloud computing on a global scale. The surge in data from diverse origins like social media, connected devices, and the Internet of Things (IoT) underscores the imperative need for enhanced storage and processing capacities. Furthermore, the heightened demand for data centers is accentuated by advancements in technologies like artificial intelligence and machine learning.

Key Market Insights:

The global growth of data center equipment is propelled by the widespread embrace of cloud computing and IoT, attributable to their inherent advantages. Concurrently, the escalating global data generation, propelled by the pervasive expansion of the Internet, accentuates the need for an efficient data storage and processing infrastructure, thereby stimulating the anticipated expansion of the global data center equipment market.

The spectrum of data center equipment encompasses the tangible hardware and foundational components employed to facilitate and supervise data center operations. These specialized spaces are designed to accommodate computer systems, storage, and telecommunications infrastructure. Additionally, they house indispensable networking equipment for seamless data exchange with other networks and the Internet.

Data center equipment, including servers, storage systems, and networking components, is meticulously engineered for continuous, uninterrupted operation, ensuring consistent and reliable performance for supported applications and services. As technology evolves, data centers systematically integrate new equipment and technologies to optimize performance, enhance energy efficiency, and augment overall functionality.

Global Data Centre Equipment Market Drivers:

Elevated Demand for Edge Computing Amidst the Surge in Digitization Propels Market Expansion

Edge computing, characterized by a decentralized computing model, strategically situates data processing and storage closer to the originating devices and sensors, deviating from the reliance on centralized data centers. This configuration enables swift data processing and diminishes network latency, particularly crucial for applications such as real-time analytics, autonomous vehicles, and smart cities. To accommodate edge computing, manufacturers of data center equipment are innovating specialized solutions tailored for deployment in remote and challenging environments.

These solutions encompass micro data centers, robust servers, and networking equipment designed explicitly for edge computing. The upswing in the demand for edge computing is attributed to various factors, including the proliferation of connected devices and sensors, the imperative for real-time processing and analytics, and the constraints posed by traditional cloud computing models.

Expeditious Adoption of the Internet of Things (IoT) and Interconnected Devices Fuels Market Advancement

The Internet of Things (IoT) constitutes a network of interconnected devices and sensors designed for data collection and transmission. The expansion of IoT drives the requisition for data center equipment, given the necessity to store, process, and analyze the data generated. IoT mandates specialized data center equipment capable of managing the substantial volumes of data emanating from interconnected devices and sensors.

This entails solutions such as high-density storage systems, energy-efficient processors, and networking equipment specifically tailored for edge computing. The surge in IoT is steered by diverse factors, including the increasing accessibility of cost-effective sensors and devices, the escalating demand for real-time data processing and analytics, and the emergence of innovative business models and services leveraging IoT data. With the continual proliferation of IoT adoption, the anticipation is for an augmented demand for data center equipment adept at supporting these evolving workloads.

Global Data Centre Equipment Market Restraints and Challenges:

A Principal Challenge Confronting the Data Center Equipment Market is the Escalating Energy Costs and the Imperative to Curtail Energy Consumption

Data centers necessitate substantial energy consumption for the operation and cooling of equipment, rendering energy costs a notable expense for operators. In addressing this challenge, operators are incorporating energy-efficient technologies and methodologies, such as server virtualization, advanced cooling systems, and the integration of renewable energy sources. However, the adoption of these technologies may entail considerable initial investments, presenting a potential hurdle for certain organizations. Furthermore, the surging demand for data center equipment and the increasing intricacy of data center environments can pose difficulties in optimizing energy usage and reducing costs. This predicament is particularly pronounced for older data center facilities that were not originally designed with energy efficiency as a primary consideration.

In essence, the imperative to curtail energy consumption and minimize operational expenses stands as a pivotal constraint for the data center equipment market. With the continual rise in energy costs and a growing emphasis on environmental considerations, data center operators must invest in energy-efficient solutions to sustain competitiveness and ensure long-term sustainability.

Global Data Center Equipment Market Opportunities:

A Noteworthy Trend Influencing the Data Center Equipment Market is the Transition Towards Software-Defined Infrastructure

Software-defined infrastructure involves the utilization of software to oversee and automate the provisioning and management of data center resources, including computing power, storage, and networking. This trend is propelled by the imperative for heightened agility, adaptability, and efficiency in data center operations. Employing software-defined infrastructure allows operators to swiftly and efficiently allocate and manage resources, enabling them to promptly respond to evolving business requirements and workload fluctuations.

Furthermore, software-defined infrastructure facilitates the establishment of more intelligent, self-regulating data center environments capable of optimizing resource utilization and diminishing operational costs. For instance, software-defined storage solutions can autonomously transfer data among different storage tiers based on usage patterns, while software-defined networking solutions dynamically adjust network bandwidth and routing to enhance performance.

An additional catalyst for the shift towards software-defined infrastructure is the increasing embrace of hybrid cloud models. Hybrid cloud entails the utilization of both public and private cloud resources to support diverse workloads and business demands. Software-defined infrastructure offers the requisite flexibility and control to effectively manage and optimize hybrid cloud environments.

In summary, the move towards software-defined infrastructure stands out as a pivotal trend shaping the data center equipment market. As operators seek avenues to enhance agility, efficiency, and flexibility, continued growth in the adoption of software-defined infrastructure is anticipated.

DATA CENTRE EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.2% |

|

Segments Covered |

By IT Infrastructure, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Huawei Technologies Co. Ltd, Cisco Systems Inc, Nokia Corporation, Avaya Inc., Dell Inc., Juniper Networks, F5, NetApp Inc., EMC Corporation, Hewlett Packard Co, IBM Corporation, Oracle Corporation, Fujitsu Corporation, QNAP Systems Inc |

Global Data Centre Equipment Market Segmentation: By IT Infrastructure

-

Networking Equipment

-

Server

-

Storage

The global data center equipment market is categorized based on IT infrastructure into networking equipment, servers, and storage. The predominant segment in this classification is servers. A data center server refers to a high-performance computing system designed to efficiently manage and process data within a data center. Data centers are specialized facilities that house numerous servers and associated components, including telecommunications and storage systems. Their purpose is to address the diverse computing and networking needs of various businesses.

The primary function of a data center server is to host and execute applications, manage and process data, and facilitate communication within the data center and with external networks. These servers are meticulously designed to provide exceptional performance, reliability, and scalability, catering to the demands of contemporary computing environments. Data center servers come in various form factors, designs, and capabilities, with common types including rack-mounted servers, blade servers, tower servers, and enterprise servers.

Global Data Centre Equipment Market Segmentation: By Application

-

IT and Telecom

-

BFSI

-

Government and Defense

-

Healthcare

-

Energy

The global data center equipment market is segmented based on applications, including IT and telecom, BFSI, government and defense, healthcare, and energy. Notably, the IT and telecom segment holds the predominant market share. This segment is anticipated to undergo substantial growth owing to its widespread adoption of cloud computing and the Internet of Things (IoT). The demand for data centers is propelled by these technologies, providing a platform for various services such as software, platforms, and infrastructure delivered over the Internet. The increase is further fueled by the global proliferation of smartphones and the escalating number of internet users.

Additionally, the introduction of 5G technology had a significant impact on this category in 2020, and this influence is expected to persist in the years to come. The advent of Network Function Virtualization (NFV) and Software-Defined Networks (SDN) supporting Over-The-Top (OTT) Platforms, Machine-to-Machine (M2M) communication, and online gaming is poised to drive the expansion of this segment, leading to heightened investments in data centers in the foreseeable future.

Global Data Centre Equipment Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America has asserted its dominance in the global market, attributed to the rising per capita income in both developed and developing countries within the region. The technological advancements and flourishing telecommunications industry contribute significantly to North America holding the largest market share. The region is poised for substantial growth due to the introduction of various business operations and applications for data creation, such as e-discovery, the expanding utilization of cloud services, and the widespread adoption of server virtualization. Factors such as increased reliance on online banking, electronic stock trading, and the shift towards electronic medical records in healthcare contribute to heightened requirements for data storage and management. The rise of applications like e-discovery and server virtualization in business operations and data generation positions North America as the leading regional segment.

On the other hand, Asia Pacific is anticipated to emerge as the fastest-growing region in the forecast period. The escalating demand for portable electronics and smart wearable devices propels the growth of the data center equipment market in the region. Data center equipment is integral to various portable electronic devices like tablets, smartphones, laptops, smart pens, and portable gaming consoles. Moreover, the use of data center equipment in wearable smart gadgets and watches enhances the overall user experience. The increasing prevalence of portable electronic devices and smart wearables is a key driving force for the global data center equipment market in the Asia-Pacific region.

COVID-19 Impact on the Global Data Centre Equipment Market:

The influence of the COVID-19 pandemic on the data center equipment market is rated as moderate to low. Notably, numerous manufacturers have reported consistent growth during the pandemic. The imposition of restrictions on physical movements prompted many businesses to shift towards online tools and services, consequently generating a robust demand for data centers globally to manage substantial volumes of customer data. Additionally, heightened concerns about secure data storage and backup further contributed to the increased demand for data center equipment during the pandemic.

As digitalization continues to advance and the use of e-commerce rises, the anticipation is for an increased demand for data centers, subsequently fueling the need for data center equipment in the foreseeable future.

Recent Trends and Innovations in the Global Data Centre Equipment Market:

In September 2023, VVDN Technologies disclosed a collaborative venture with Axiado Corporation focused on the development of Open Compute Platform (OCP)-compliant data center and telco Open Radio Access Network (Open RAN) servers.

By December 2023, Moore Threads, a prominent Chinese GPU manufacturer, unveiled the MTT S4000, a high-performance graphics card specifically crafted for applications in artificial intelligence (AI) and data center operations.

Key Players:

-

Huawei Technologies Co. Ltd

-

Cisco Systems Inc

-

Nokia Corporation

-

Avaya Inc.

-

Dell Inc.

-

Juniper Networks

-

F5

-

NetApp Inc.

-

EMC Corporation

-

Hewlett Packard Co

-

IBM Corporation

-

Oracle Corporation

-

Fujitsu Corporation

-

QNAP Systems Inc

Chapter 1. Data Centre Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Data Centre Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Data Centre Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Data Centre Equipment Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Data Centre Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Data Centre Equipment Market – By IT Infrastructure

6.1 Introduction/Key Findings

6.2 Networking Equipment

6.3 Server

6.4 Storage

6.5 Y-O-Y Growth trend Analysis By IT Infrastructure

6.6 Absolute $ Opportunity Analysis By IT Infrastructure, 2024-2030

Chapter 7. Data Centre Equipment Market – By Applications

7.1 Introduction/Key Findings

7.2 IT and Telecom

7.3 BFSI

7.4 Government and Defense

7.5 Healthcare

7.6 Energy

7.7 Y-O-Y Growth trend Analysis By Applications

7.8 Absolute $ Opportunity Analysis By Applications, 2024-2030

Chapter 8. Data Centre Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By IT Infrastructure

8.1.3 By Applications

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By IT Infrastructure

8.2.3 By Applications

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By IT Infrastructure

8.3.3 By Applications

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By IT Infrastructure

8.4.3 By Applications

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By IT Infrastructure

8.5.3 By Applications

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Data Centre Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Huawei Technologies Co. Ltd

9.2 Cisco Systems Inc

9.3 Nokia Corporation

9.4 Avaya Inc.

9.5 Dell Inc.

9.6 Juniper Networks

9.7 F5

9.8 NetApp Inc.

9.9 EMC Corporation

9.10 Hewlett Packard Co

9.11 IBM Corporation

9.12 Oracle Corporation

9.13 Fujitsu Corporation

9.14 QNAP Systems Inc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Data Centre Equipment Market size is valued at USD 60.96 billion in 2023.

The worldwide Global Data Centre Equipment Market growth is estimated to be 13.2% from 2024 to 2030.

The Global Data Centre Equipment Market is segmented By IT Infrastructure (Networking Equipment, Server, Storage), By Applications (IT and Telecom, BFSI, Government and Defense, Healthcare, Energy).

The Global Data Centre Equipment Market is poised for growth with anticipated future trends such as increased adoption of edge computing, expanding applications of artificial intelligence, rising demand for energy-efficient solutions, and continuous advancements in software-defined infrastructure. These trends present lucrative opportunities for innovation and market expansion.

The COVID-19 pandemic moderately impacted the Global Data Centre Equipment Market. While some sectors experienced steady growth due to heightened demand for online services, data storage, and backup, the overall effect remained moderate. The evolving landscape, digitalization, and increased reliance on data centers are expected to influence future market dynamics.