Data Centre Cables and Connectors Market Size (2024 – 2030)

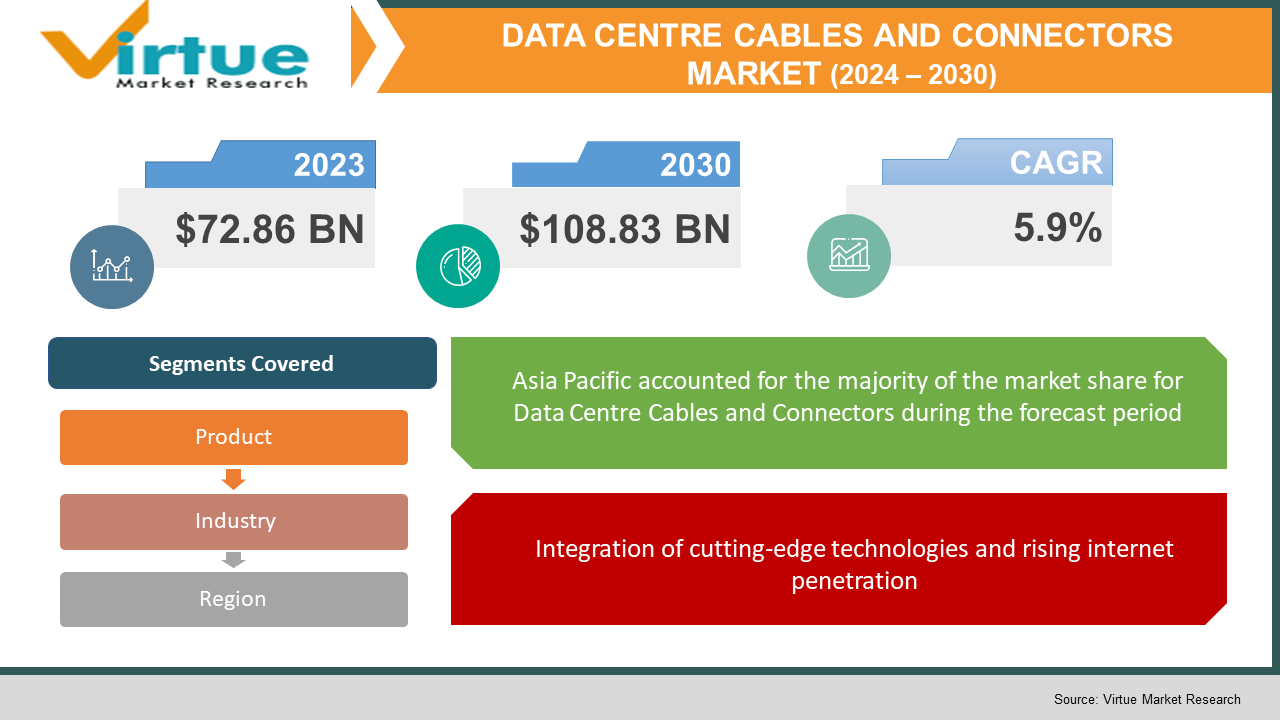

The Global Data Centre Cables and Connectors Market was valued at USD 72.86 Billion in 2023 and is projected to reach a market size of USD 108.83 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

Devices used to transport data, signals, and power supplies to various electronic devices and peripherals are connected by cables and connections. Electrical wires that are insulated from one another are called cables. Their high tensile strength and other characteristics enable them to withstand significant force and stress while still functioning as a regulated mechanism. Over the past few years, the global market for data centre cables and connectors has been expanding quickly. The global data centre industry is expanding due to two factors: the rising need for internet access. Structured cabling in data centres satisfies the need for increased power and bandwidth while lowering temperature rise, which significantly enhances network scalability and optimises connection performance.

Key Market Insights:

Fibre optic connectors are expected to develop at the quickest rate in the data centre cables and connectors market by 2025, reaching a potential market share of over 50%. This growth is driven by the requirement for high-bandwidth data transmission. A new opportunity is brought about by the emergence of edge computing. Flexible and dependable cabling solutions that are specially built to guarantee seamless data transfer between edge devices and centralised data centres are becoming more and more necessary. By 2027, businesses adopting Industry 4.0 technology may see a 20% boost in productivity, underscoring the potential growth opportunities for cable connections in this market. The industry is steadfastly committed to creating solutions to meet the rising bandwidth demands. 400G Ethernet and higher advancements require cables and connectors that can handle these blazingly rapid data transfers.

Global Data Centre Cables and Connectors Market Drivers:

Integration of cutting-edge technologies and rising internet penetration:

Due to the provider's quick, safe, and easy real-time internet and data processing, among other advantages, the global market for data centre cables and connectors has grown. In addition, the amalgamation of IoT and AI technologies has expanded the array of benefits it offers by streamlining and optimising data processing and retrieval. Thus, the increasing use of this technology for conducting and maintaining business by retailers in emerging economies contributes to the expansion of the global market.

The market is expanding due to industries' propensity for digital technology:

Organisations and businesses are entering a new era where digital technologies are playing a crucial role in boosting organisational growth in the wake of constantly changing technical advancements. The market is rising due to the extensive use of IoT-based products and devices in daily life, the constantly expanding number of mobile devices and applications, the massive volumes of data sets these devices create, and the increasing reliance of businesses on IoT solutions and products.

In developing countries, government policies and activities are in line with the objectives of the companies driving market expansion.

To enhance the overall industrial position of the economy, governments throughout the world are putting diverse plans into action to encourage and accelerate the adoption of automation and artificial intelligence (AI) technology. Thus, one of the key drivers of the worldwide data centre cables and connectors market's growth in the next years will be the government's propensity towards modern technologies and the creation of such policies and efforts to support them, particularly in developing countries.

Global Data Centre Cables and Connectors Market Restraints and Challenges:

Without question, developed nations have enabled the internet and ICT to reach every societal stratum and realise their limitless potential. As a result, their residents' standard of living had grown, and costs had been significantly reduced. However, for a variety of reasons, including inadequate technological infrastructure, gaps in the law, social hurdles, or a shortage of highly qualified human resources, many emerging and impoverished countries have yet to fully realise the potential of ICT. Large volumes of data are kept online, and as a result, processing and storing it have gotten more complicated, making accountability challenging. The intricacy of the internet combined with automation technology systems creates threats and difficulties for security breaches. The more IoT and cloud-based services are used by enterprises, the more security concerns arise.

Global Data Centre Cables and Connectors Market Opportunities:

Numerous causes contribute to this rise, such as the rapidly expanding data centre industry, especially in the Asia Pacific, and the ongoing demand for increased power and bandwidth in these establishments. Furthermore, there are plenty of prospects for businesses that create cutting-edge cables and connectors with enhanced efficiency, performance, and environmental friendliness. Solutions that improve data centre security will also be in great demand because data security is still of the utmost importance.

DATA CENTRE CABLES AND CONNECTORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Product, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Belden Inc., CommScope, Corning Inc., Furukawa Electric Co, Legrand, Panduit Corp, R&M Nexans S A, Schneider Electric, Siemon |

Global Data Centre Cables and Connectors Market Segmentation: By Product

-

Pcb Connectors

-

I/O Connectors

-

Circular Connectors

-

Fibre Optic Connectors

-

Rf Coaxial Connectors

-

Others

Fibre optic connections are the product category with the highest rate of growth in the global data centre cables and connectors market due to a surge in demand. The growing requirement for high-speed data transfer in data centres is the driving force behind this. Massive bandwidth is required for components like artificial intelligence, cloud computing, and 5G technologies, all of which are difficult to provide by conventional copper lines. In this regard, fibre optic connectors are superior since they have substantially larger bandwidth capacities. Furthermore, long-distance connections are frequently needed for data centres, and fibre optic cables perform better than copper in transmitting data over such distances with less signal loss. Considering that PCB connectors are widely used in internal data centre connections, they currently have the largest market share.

Global Data Centre Cables and Connectors Market Segmentation: By Industry

-

Automotive

-

Commercial

-

Energy & Power

-

Aerospace & Defense

-

Others

The data centre cables and connectors market has been divided into five segments: automotive, commercial, energy & power, aerospace & defence, and others. These divisions are based on the industry. Due to the rising popularity of electric cars, the automotive category currently maintains the dominant position in the market, has the greatest market share, and is expected to continue doing so during the projection period.

Modern vehicles are equipped with numerous sensors and connectivity features that generate vast amounts of data. This data needs to be processed and stored, creating a demand for robust data centre infrastructure, including high-quality cables and connectors. Moreover, as electric vehicles (EVs) gain popularity, there is a rise in the need for charging networks and supporting infrastructure. This expansion requires data centres to support charging station networks, necessitating reliable cables and connectors for data transmission.

Global Data Centre Cables and Connectors Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In the global market for data centre cables and connectors, Asia Pacific has the highest market share in 2023. due to the growing expenditures made in infrastructure development by significant corporations in nations like China and India. In comparison to places like North America, these regions have less costs and more demand for cloud computing and e-commerce technology, hence many data centre hubs are preparing to grow. Additionally, significant investments in energy, technology, and infrastructure will be crucial to the expansion of the sector.

COVID-19 Impact Analysis on the Global Data Centre Cables and Connectors Market:

A few economies and industries were significantly impacted by the COVID-19 outbreak because of lockdowns and company closures. The problem was made worse by reductions in people's financial flow and disruptions in demand-supply chain blockages. With a few exceptions, practically every sector had to deal with the pandemic's effects. The pandemic was very beneficial to the computer science sector because it saw a paradigm shift in consumer behaviour at the time. Digital technology has taken centre stage and will do so in the future. Businesses and organisations turned to technical innovations and began funding research and development (R&D) to make these technologies more operational and efficient, which expanded the market and sped up its expansion.

Recent Trends and Developments in the Global Data Centre Cables and Connectors Market:

The market for data centre cables and connectors is dynamically changing on a global scale. The unwavering emphasis on bandwidth and high speed is a major trend. 400G Ethernet and other technological advancements require cables and connectors that can accommodate these blazingly rapid data transfers. Another important factor is sustainability; cable and connection makers are emphasising the use of materials and designs that reduce heat generation and energy consumption, resulting in greener data centres. Exciting new prospects are presented by the rise of edge computing. In this case, robust and adaptable cabling solutions are needed to guarantee smooth data transfer between edge devices and centralised data centres. This trend creates opportunities for speciality cable and connector products made especially to meet the requirements of edge environments.

Key Players:

-

Belden Inc.

-

CommScope

-

Corning Inc.

-

Furukawa Electric Co

-

Legrand

-

Panduit Corp

-

R&M Nexans S A

-

Schneider Electric

-

Siemon

Chapter 1. DATA CENTRE CABLES AND CONNECTORS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. DATA CENTRE CABLES AND CONNECTORS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. DATA CENTRE CABLES AND CONNECTORS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. DATA CENTRE CABLES AND CONNECTORS MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. DATA CENTRE CABLES AND CONNECTORS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. DATA CENTRE CABLES AND CONNECTORS MARKET – By Product

6.1 Introduction/Key Findings

6.2 Pcb Connectors

6.3 I/O Connectors

6.4 Circular Connectors

6.5 Fibre Optic Connectors

6.6 Rf Coaxial Connectors

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. DATA CENTRE CABLES AND CONNECTORS MARKET – By Industry

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Commercial

7.4 Energy & Power

7.5 Aerospace & Defense

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Industry

7.8 Absolute $ Opportunity Analysis By Industry, 2024-2030

Chapter 8. DATA CENTRE CABLES AND CONNECTORS MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. DATA CENTRE CABLES AND CONNECTORS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Belden Inc.

9.2 CommScope

9.3 Corning Inc.

9.4 Furukawa Electric Co

9.5 Legrand

9.6 Panduit Corp

9.7 R&M Nexans S A

9.8 Schneider Electric

9.9 Siemon

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Data Centre Cables and Connectors Market size is valued at USD 72.86 billion in 2023.

The worldwide Global Data Centre Cables and Connectors Market growth is estimated to be 5.9% from 2024 to 2030.

The Global Data Centre Cables and Connectors Market is segmented By Product (Pcb Connectors, I/O Connectors, Circular Connectors, Fibre Optic Connectors, Rf Coaxial Connectors, Others); By Industry (Automotive, Commercial, Energy & Power, Aerospace & Defense, Others) and by region.

Future data centre cables and connectors will depend on achieving even faster speeds (imagine 400G Ethernet), concentrating on AI-powered efficiency optimisation, and carrying on with the development of safe and long-lasting edge computing solutions.

Due to supply chain problems and delayed data centre development, the COVID-19 pandemic temporarily disrupted the market for data centre cables and connectors. But in the end, the rise in cloud computing and remote work increased demand for high-bandwidth solutions, which caused the market to return.