Dairy Products Market Size (2024 – 2030)

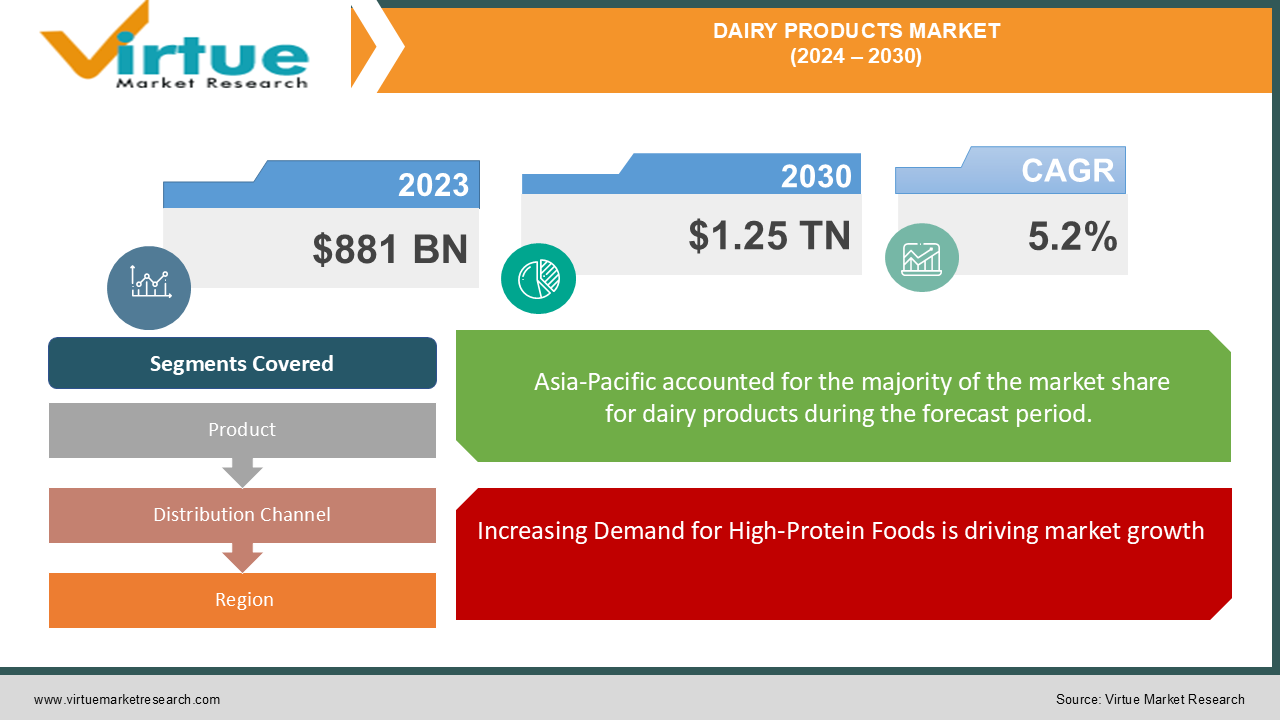

The Global Dairy Products Market was valued at approximately USD 881 billion in 2023 and is projected to grow at a CAGR of around 5.2% from 2024 to 2030. The market is expected to reach USD 1.25 trillion by 2030.

The Dairy Products Market is driven by increasing consumer awareness regarding the nutritional benefits of dairy products, the rising demand for high-protein diets, and the growing preference for convenience foods. The market is further supported by innovations in packaging and the introduction of fortified and flavored dairy products.

Key Market Insights

While dairy products remain popular, there is a noticeable shift towards plant-based alternatives, driven by dietary restrictions and ethical considerations.

The dairy products market is witnessing robust growth in emerging markets, particularly in Asia-Pacific and Latin America, due to rising disposable incomes and urbanization.

Companies are continuously innovating with new flavors, fortified products, and convenient packaging to attract consumers. The rise of e-commerce platforms has made dairy products more accessible to consumers, especially in urban areas, contributing to market growth.

Global Dairy Products Market Drivers

Increasing Demand for High-Protein Foods is driving market growth: The global trend towards high-protein diets has significantly bolstered the demand for dairy products, which are naturally high in protein. Consumers, particularly in developed countries, are incorporating dairy products like yogurt, cheese, and milk into their diets as a primary source of protein. This trend is also fueled by the growing popularity of fitness and bodybuilding, where protein-rich diets are essential for muscle growth and recovery. Additionally, dairy products are increasingly being used in sports nutrition and functional foods, further driving market growth.

Rising Urbanization and Changing Lifestyles is driving market growth: As more people migrate to urban areas, there is a noticeable shift in dietary habits, with consumers leaning towards ready-to-eat and convenience foods. Dairy products, especially those in convenient formats like packaged milk, cheese slices, and yogurt cups, cater to this demand. Urban consumers also tend to have higher disposable incomes, allowing them to spend more on premium and branded dairy products. Moreover, the fast-paced lifestyle in urban areas leads to a preference for on-the-go snacks, where dairy products like yogurt and cheese play a significant role.

Technological Advancements in Dairy Processing is driving market growth: Technological advancements in dairy processing and packaging have played a crucial role in enhancing the shelf life and safety of dairy products. Innovations such as ultra-high temperature (UHT) processing, aseptic packaging, and advanced refrigeration techniques have made it possible for dairy products to reach consumers in distant markets without compromising on quality. These advancements have also enabled the production of fortified and functional dairy products, which cater to the growing health-conscious consumer base. The development of lactose-free and reduced-fat dairy products is another significant driver, addressing the needs of consumers with specific dietary requirements.

Global Dairy Products Market Challenges and Restraints

Fluctuating Raw Material Prices is restricting market growth: The dairy industry is heavily dependent on the availability and price of raw materials, particularly milk. Fluctuations in the prices of milk, driven by factors such as feed costs, weather conditions, and global demand, can significantly impact the profitability of dairy producers. High milk prices can lead to increased production costs, which may not always be passed on to consumers, thereby squeezing profit margins. Additionally, volatility in the supply chain, including transportation and storage costs, further exacerbates this challenge. To mitigate these risks, companies are increasingly focusing on efficient supply chain management and exploring alternative sources of raw materials.

Rising Competition from Plant-Based Alternatives is restricting market growth: The growing popularity of plant-based alternatives poses a significant challenge to the traditional dairy products market. Consumers, especially those who are lactose intolerant, vegan, or environmentally conscious, are increasingly opting for plant-based milk, cheese, and yogurt. These alternatives are often perceived as healthier and more sustainable, leading to a gradual shift in consumer preferences. The dairy industry is responding to this challenge by launching hybrid products that combine dairy and plant-based ingredients, as well as by emphasizing the nutritional benefits of dairy over its plant-based counterparts. However, the competition remains fierce, particularly in developed markets where plant-based alternatives are gaining significant traction.

Market Opportunities

The Dairy Products Market is poised for significant growth, driven by several emerging opportunities. One of the most notable opportunities lies in the expansion of organic and clean-label dairy products. As consumers become more health-conscious and environmentally aware, there is a growing demand for dairy products that are free from artificial additives, hormones, and antibiotics. This trend is particularly strong in developed markets, where consumers are willing to pay a premium for organic and non-GMO dairy products. Companies that can cater to this demand by offering certified organic products and transparent labeling stand to gain a competitive edge. Another key opportunity is the increasing demand for functional and fortified dairy products. With the rising incidence of lifestyle-related diseases such as obesity, diabetes, and cardiovascular disorders, consumers are seeking dairy products that offer additional health benefits beyond basic nutrition. Products fortified with probiotics, omega-3 fatty acids, and other essential nutrients are gaining popularity, particularly in the health and wellness segment. This trend is also driving innovation in dairy-based beverages, such as functional milk drinks and yogurt smoothies, which are marketed as convenient and healthy options for busy consumers. The rapid growth of e-commerce and direct-to-consumer (DTC) channels presents another lucrative opportunity for dairy producers. The COVID-19 pandemic has accelerated the shift towards online grocery shopping, and this trend is expected to continue in the post-pandemic world. Dairy companies that invest in robust e-commerce platforms and efficient home delivery services can tap into a wider consumer base and enhance their market reach. Additionally, leveraging data analytics and personalized marketing strategies can help companies better understand consumer preferences and tailor their product offerings accordingly.

DAIRY PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Product, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nestlé S.A., Danone S.A., Fonterra Co-operative Group Limited, Arla Foods, Lactalis Group, Royal FrieslandCampina N.V., Dean Foods Company, Amul (Gujarat Cooperative Milk Marketing Federation), Saputo Inc., Dairy Farmers of America, Inc. |

Dairy Products Market Segmentation - By Product

-

Milk

-

Cheese

-

Butter

-

Yogurt

-

Ice Cream

In the product type category, milk remains the most dominant segment due to its widespread consumption across the globe. Milk is a staple food product in many households, and its demand is driven by its nutritional value and versatility in culinary applications.

Dairy Products Market Segmentation - By Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online Retail

In the distribution channel category, supermarkets/hypermarkets are the dominant segment, as they offer a wide variety of dairy products under one roof, making it convenient for consumers to shop for all their dairy needs. These retail outlets also frequently offer promotions and discounts, further driving consumer purchases.

Dairy Products Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region is the most dominant in the Dairy Products Market, driven by high consumption levels in countries like India and China. The region's growing population, rising disposable incomes, and increasing urbanization are contributing to the robust demand for dairy products. Additionally, traditional dairy consumption patterns, combined with the rising popularity of Western dairy products like cheese and yogurt, are further boosting market growth in this region.

COVID-19 Impact Analysis on the Dairy Products Market

The COVID-19 pandemic had a mixed impact on the Dairy Products Market. On one hand, the closure of foodservice outlets and disruptions in the supply chain led to a temporary decline in demand for certain dairy products, particularly those used in the hospitality and catering industries. On the other hand, the pandemic prompted a surge in consumer demand for packaged and long-shelf-life dairy products as people turned to home-cooked meals and stockpiling essential items during lockdowns. This shift in consumer behavior led to increased sales of products like UHT milk, cheese, and butter in retail channels. The pandemic also accelerated the adoption of online grocery shopping, with many consumers opting for home delivery services to avoid crowded stores. This trend benefited the dairy industry, as e-commerce platforms became a vital distribution channel for dairy products. However, the pandemic also highlighted vulnerabilities in the global supply chain, such as transportation delays and labor shortages, which impacted the timely delivery of dairy products. To mitigate these challenges, dairy companies are increasingly investing in digital supply chain solutions and exploring local sourcing strategies to ensure a more resilient supply chain in the future.

Latest Trends/Developments

The Dairy Products Market is currently experiencing several significant trends that are influencing its growth and development. One of the most prominent trends is the increasing consumer preference for organic and clean-label dairy products. With rising health consciousness, consumers are seeking dairy products that are free from artificial additives, hormones, and antibiotics. This has led to a surge in demand for organic milk, cheese, and yogurt, which are perceived as healthier and more environmentally friendly. Another key trend is the growth of plant-based dairy alternatives, driven by the rise in veganism, lactose intolerance, and environmental concerns. Companies are innovating with hybrid products that combine dairy and plant-based ingredients, catering to the diverse preferences of modern consumers. Sustainability is also a major focus within the dairy industry. Producers are adopting sustainable practices to reduce their environmental footprint, such as implementing water conservation techniques, reducing greenhouse gas emissions, and exploring renewable energy sources. Additionally, the industry is seeing advancements in dairy processing technology, which are enabling the production of fortified and functional dairy products. These products, which are enriched with probiotics, vitamins, and minerals, are gaining popularity due to their added health benefits. Finally, the rise of e-commerce and direct-to-consumer channels is reshaping the way dairy products are marketed and distributed, making it easier for consumers to access a wide range of dairy products.

Key Players

-

Nestlé S.A.

-

Danone S.A.

-

Fonterra Co-operative Group Limited

-

Arla Foods

-

Lactalis Group

-

Royal FrieslandCampina N.V.

-

Dean Foods Company

-

Amul (Gujarat Cooperative Milk Marketing Federation)

-

Saputo Inc.

-

Dairy Farmers of America, Inc.

Chapter 1. Dairy Products Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Dairy Products Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Dairy Products Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Dairy Products Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Dairy Products Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Dairy Products Market – By Product

6.1 Introduction/Key Findings

6.2 Milk

6.3 Cheese

6.4 Butter

6.5 Yogurt

6.6 Ice Cream

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Dairy Products Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Convenience Stores

7.4 Specialty Stores

7.5 Online Retail

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Dairy Products Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Dairy Products Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Nestlé S.A.

9.2 Danone S.A.

9.3 Fonterra Co-operative Group Limited

9.4 Arla Foods

9.5 Lactalis Group

9.6 Royal FrieslandCampina N.V.

9.7 Dean Foods Company

9.8 Amul (Gujarat Cooperative Milk Marketing Federation)

9.9 Saputo Inc.

9.10 Dairy Farmers of America, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Dairy Products Market was valued at approximately USD 881 billion in 2023 and is projected to grow at a CAGR of around 5.2% from 2024 to 2030. The market is expected to reach USD 1.25 trillion by 2030.

Key drivers include the increasing demand for high-protein foods, rising urbanization and changing lifestyles, and technological advancements in dairy processing, which enhance product shelf life and safety.

The market is segmented by product type (Milk, Cheese, Butter, Yogurt, Ice Cream, Others) and distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail).

The Asia-Pacific region is the most dominant market for dairy products, driven by high consumption levels in countries like India and China, along with rising disposable incomes and urbanization.

Leading players in the market include Nestlé S.A., Danone S.A., Fonterra Co-operative Group Limited, Arla Foods, and Lactalis Group, among others.