Dairy Processing Equipment Market Size (2024 –2030)

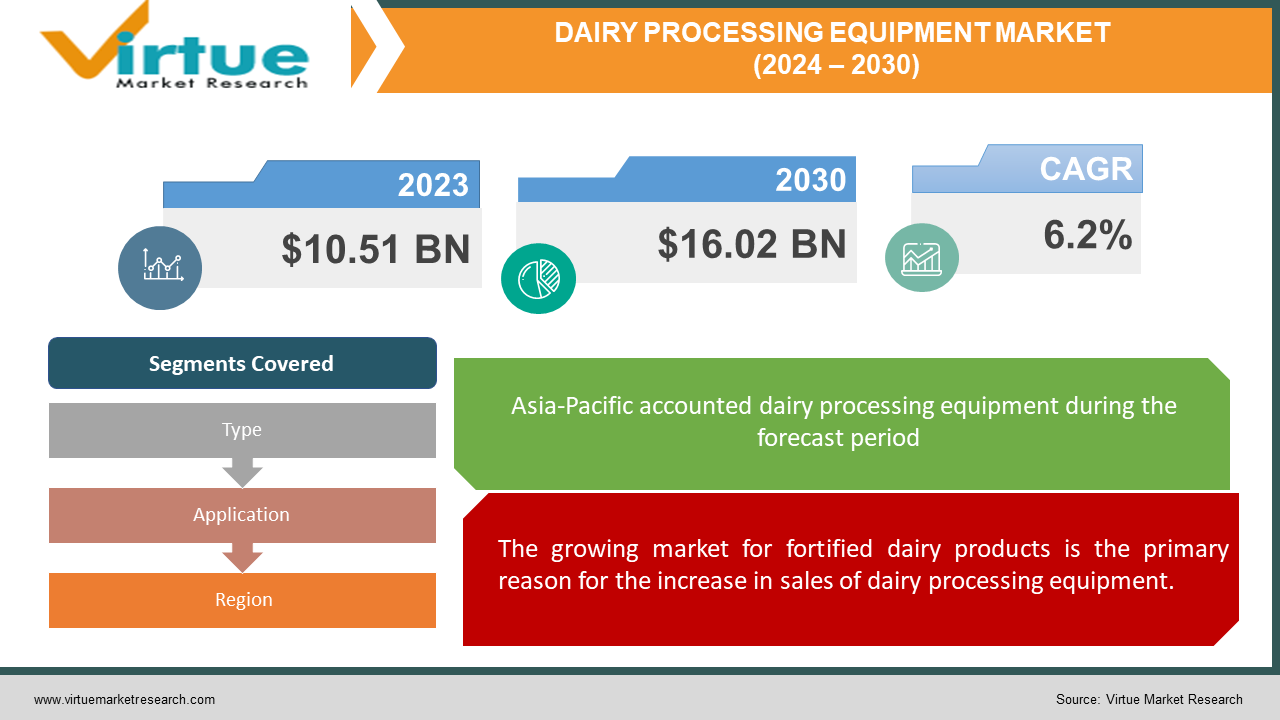

The Global Dairy Processing Equipment Market was estimated to be worth USD 10.51 billion in 2023 and is projected to reach a valuation of USD 16.02 billion by the end of 2030, growing at a rapid CAGR of 6.2% during the forecast period 2024-2030.

Dairy farms nowadays process milk effectively with the use of technology. This includes processes like homogenizing—which involves heating milk to kill dangerous bacteria—filtering—which involves removing impurities—and storing milk securely. Because it expedites the processing of milk, decreases the need for manual labor, and raises overall farm productivity, dairy processing equipment is becoming more and more popular. Dairy farms can run more smoothly and provide consumers with high-quality dairy products thanks to technology.

Key Market Insights:

Pasteurizers account for more than 40% of the market, demonstrating the extensive use of these machines in the dairy industry. Because of its high milk production and consumption, Asia-Pacific is the largest market region for dairy processing equipment, holding about 35% of the global market share. The market is defined by large investments in technological innovations, especially in robotics, automation, and equipment with a focus on sustainability. The dairy processing equipment market experiences a steady 6% annual growth rate. The dairy processing equipment market anticipates a 10% annual growth over the next five years. Growing dairy consumption and changing consumer preferences are driving up demand for dairy processing equipment in emerging markets like Latin America and parts of Africa.

Global Dairy Processing Equipment Market Drivers:

The growing market for fortified dairy products is the primary reason for the increase in sales of dairy processing equipment.

Extra vitamins, minerals, and other vital nutrients are added to dairy products that are fortified. People are searching for foods that are high in vitamins and minerals to improve their health, which is why this is growing in popularity. For the benefit of healthy bones, several dairy products, such as yogurt, cheese, and cream, are fortified with vitamins D and A. Dairy companies are beginning to offer milk that is additionally fortified with extra nutrients as more consumers choose fortified dairy products. This implies that the need for equipment to process fortified milk will increase. Consequently, it is anticipated that over time, the global market for these machines will expand.

In the market for dairy processing equipment, ultrafiltration is becoming more and more popular.

The ultrafiltration technique is used to extract materials from water and other solutions, including oils, colloids, emulsions, suspended particles, and other materials. It is used in the dairy industry to clean milk and make new dairy products that are much lower in carbohydrates and much higher in protein than milk. As part of the process, milk is transported through a membrane, which allows lactose, water, and a few soluble minerals to pass through and spread throughout. Proteins like casein and whey are trapped because their large molecular sizes prevent them from passing through the membrane. We'll ultrafilter the milk made with this retained stream. Moreover, ultrafiltered milk can be dried to create MPC powder. Some of the leading manufacturers of dairy processing equipment provide ultrafiltration equipment. The increasing availability and popularity of such ultrafiltration equipment in dairy processing facilities is expected to drive the market's expansion during the forecast period.

Dairy Processing Equipment Market Challenges and Restraints:

Every year, the dairy industry turns vast amounts of perishable milk into a variety of dairy products. Fuel and energy requirements for this production are high, which raises the cost of manufacturing as a whole. Compressed air, hot water, steam, and chilled water are just a few of the energy applications that lead to increased production costs. Pumps, motors, fans, and other equipment required for processing dairy products are also heavily powered by electricity in dairy processing facilities. Production costs are further increased by the cost of the fuel that boiler systems use to produce heat and steam. Additional costs associated with transporting milk products include receipt, labor, storage, cleaning, shipping, and processing operations like evaporation and separation. All of these things add up to increased operating costs for dairy processing plants, which over time may somewhat impede the expansion of the worldwide market.

Dairy Processing Equipment Market Opportunities:

There are numerous prospects for expansion and innovation in the dairy processing equipment market. Ongoing technological developments enable higher processing efficiency and better product quality, as demonstrated by the development of more effective homogenizers and pasteurizers. A greater emphasis is being placed on sustainability, which is driving up demand for environmentally friendly appliances that use less energy and water. Equipment that is adaptable and versatile is desired to satisfy a variety of processing requirements. Robotics and automation can reduce labor costs and streamline operations. There is room for growth by entering emerging markets like those in Latin America and Asia-Pacific. Investing in food safety technologies and creating specialized machinery for dairy products with added value are important opportunities. Working together with research centers and dairy farmers can spur innovation and adapt to changing consumer needs. Businesses can increase their market share and maintain their competitiveness in the dairy processing equipment sector by seizing these opportunities.

DAIRY PROCESSING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABL Technology Ltd., Alfa Laval Corporate AB, Feldmeier Equipment Inc., Goma Engineering Pvt. Ltd., Hillenbrand Inc., IDMC Ltd., IMA Industria Macchine Automatiche Spa, John Bean Technologies Corp., Paul Mueller Co. Inc., ProXES GmbH |

Global Dairy Processing Equipment Market Segmentation: By Application

-

Processed milk

-

Milk powder

-

Cream

-

Cheese

-

Others

The dairy processing industry's primary goal is to process milk so that, when properly packaged and stored, it lasts longer. Milk is processed using devices such as homogenizers, pasteurizers, and heat exchangers. The demand for milk is rising as major corporations develop more efficient ways to process it. HTST heating is a new technology that kills harmful germs in milk by heating it to a high temperature for a brief period. Global dairy processing industry growth will be propelled by companies that invest in state-of-the-art machinery to enhance their operations. Due in large part to the rising demand for cheese, particularly from the food service and retail sectors, the market for dairy processing equipment is expanding slowly. It is anticipated that the rising trend of cheese consumption in fast food and dining establishments will persist. Due to its high nutritional content—which includes protein, fat, minerals, and calcium—cheese is a common ingredient in meals like pizza, sandwiches, and snacks. Cheese production reduces costs, makes use of modular assembly methods, and produces higher-quality goods, all of which have an effect on market expansion.

Global Dairy Processing Equipment Market Segmentation: By Type

-

Pasteurizers

-

Homogenizers

-

Separators

-

Evaporators and dryers

-

Others

Pasteurization is the process of heating milk to a high temperature for a brief period in order to kill harmful germs and render it safe for consumption. Pasteurizers, which help increase the shelf life of milk and other dairy products, are highly popular in the dairy industry and are used for this purpose. People's desire for longer-lasting packaged dairy products and milk is driving up demand for pasteurizers. Furthermore necessary for the production of cheese, yogurt, and ice cream are pasteurizers. Another crucial piece of equipment in the dairy processing industry is the homogenizer. They prevent milk's fat globules from clumping together by breaking them down into smaller pieces. By going through this process, milk gains consistency, better texture and color, and more flavor. Homogenizers are widely used in the dairy industry and are essential for guaranteeing the quality of milk. Because homogenizers are so important to the processing of milk, the market for them is predicted to expand rapidly in the upcoming years.

Global Dairy Processing Equipment Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Asia-Pacific (APAC) region has a large market for dairy processing equipment due to the region's high levels of milk production and processing. Osteoporosis and other bone disorders affect a large number of females in this region, which increases demand for dairy products like milk, yogurt, butter, and cheese. In the APAC region, dairy products are also heavily consumed by the urban population. A sizable chunk of the worldwide market for dairy processing equipment is anticipated to be accounted for by Europe, home to numerous prominent businesses in the dairy equipment sector. The Common Agricultural Policy of the European Union, which does away with milk quotas, is increasing milk production and driving up demand for dairy processing machinery. Along with issues like a decline in the number of cows and a decline in the per capita consumption of dairy products, slower growth is anticipated in North America as a result of shifting consumer habits regarding the consumption of processed dairy products.

COVID-19 Impact on the Global Dairy Processing Equipment Market:

In the dairy processing equipment sector, Tetra Laval, IMA, GEA Group, SPX Flow, and The Krones Group are a few of the leading businesses. These multinational corporations have production sites and supply chains dispersed throughout Europe, North America, South America, Asia-Pacific, and other regions. These businesses have been able to maintain their global supply chains and operations despite the difficulties posed by COVID-19. Many of them are still in operation as manufacturing facilities and can supply the global demand for dairy processing equipment.

Latest Trend/Development:

The market for dairy processing equipment is changing due to important advancements and trends. Robotics and automation are being used more and more to improve productivity in jobs like packaging and processing milk. Manufacturers are putting a higher priority on sustainability by creating machinery with lower water and energy consumption and by implementing recycling techniques. A growing trend in automated cleaning and sanitation without disassembly is the use of Clean-in-Place (CIP) systems. With equipment able to handle a variety of dairy products, such as cheese, yogurt, and fluid milk, flexibility is increasing. Data analytics and smart technologies are being combined to track equipment performance and streamline processes. Dairy processors are beginning to require customized solutions that address their unique requirements, but features that reduce the risk of contamination and promote hygienic design continue to be of utmost importance. All of these trends point to a focus on efficiency, innovation, and satisfying the changing needs of the dairy industry.

Key Players:

-

ABL Technology Ltd.

-

Alfa Laval Corporate AB

-

Feldmeier Equipment Inc.

-

Goma Engineering Pvt. Ltd.

-

Hillenbrand Inc.

-

IDMC Ltd.

-

IMA Industria Macchine Automatiche Spa

-

John Bean Technologies Corp.

-

Paul Mueller Co. Inc.

-

ProXES GmbH

Market News:

-

The PLF Virtus linear vacuum filler is a new machine that was introduced in April 2022 by PLF International, a company owned by JBT Corporation that specializes in technology solutions for the food and beverage industry. This device is made to work with a variety of nutritional powders made from milk, such as infant formula and specialized medical nutrition.

-

The first electric milk truck in New Zealand, the Milk-E, was introduced by Fonterra, a dairy company, in July 2022. The 28,000-liter tank on this milk truck is the same size as a typical tanker truck used to transport milk.

Chapter 1. Dairy Processing Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Dairy Processing Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Dairy Processing Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Dairy Processing Equipment Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Dairy Processing Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Dairy Processing Equipment Market – By Application

6.1 Introduction/Key Findings

6.2 Processed milk

6.3 Milk powder

6.4 Cream

6.5 Cheese

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Dairy Processing Equipment Market – By Type

7.1 Introduction/Key Findings

7.2 Pasteurizers

7.3 Homogenizers

7.4 Separators

7.5 Evaporators and dryers

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Type

7.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Dairy Processing Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Dairy Processing Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ABL Technology Ltd.

9.2 Alfa Laval Corporate AB

9.3 Feldmeier Equipment Inc.

9.4 Goma Engineering Pvt. Ltd.

9.5 Hillenbrand Inc.

9.6 IDMC Ltd.

9.7 IMA Industria Macchine Automatiche Spa

9.8 John Bean Technologies Corp.

9.9 Paul Mueller Co. Inc.

9.10 ProXES GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Modern dairy farms use technology for dairy processing to carry out a variety of tasks from chilling raw milk, cream separation, and packing to making processed drinks, cultured goods, concentrates, and powders.

The Global Dairy Processing Equipment Market was estimated to be worth USD 10.51 billion in 2023 and is projected to reach a valuation of USD 16.02 billion by the end of 2030, growing at a rapid CAGR of 6.2% during the forecast period 2024-2030.

The expanding market for fortified dairy products and the growing acceptance of ultrafiltration are driving the Global Dairy Processing Equipment Market

Dairy product production costs are a significant barrier to the market expansion of dairy processing equipment.

The homogenizers type is the fastest growing in the Global Dairy Processing Equipment Market