Dairy Food Market Size (2024-2030)

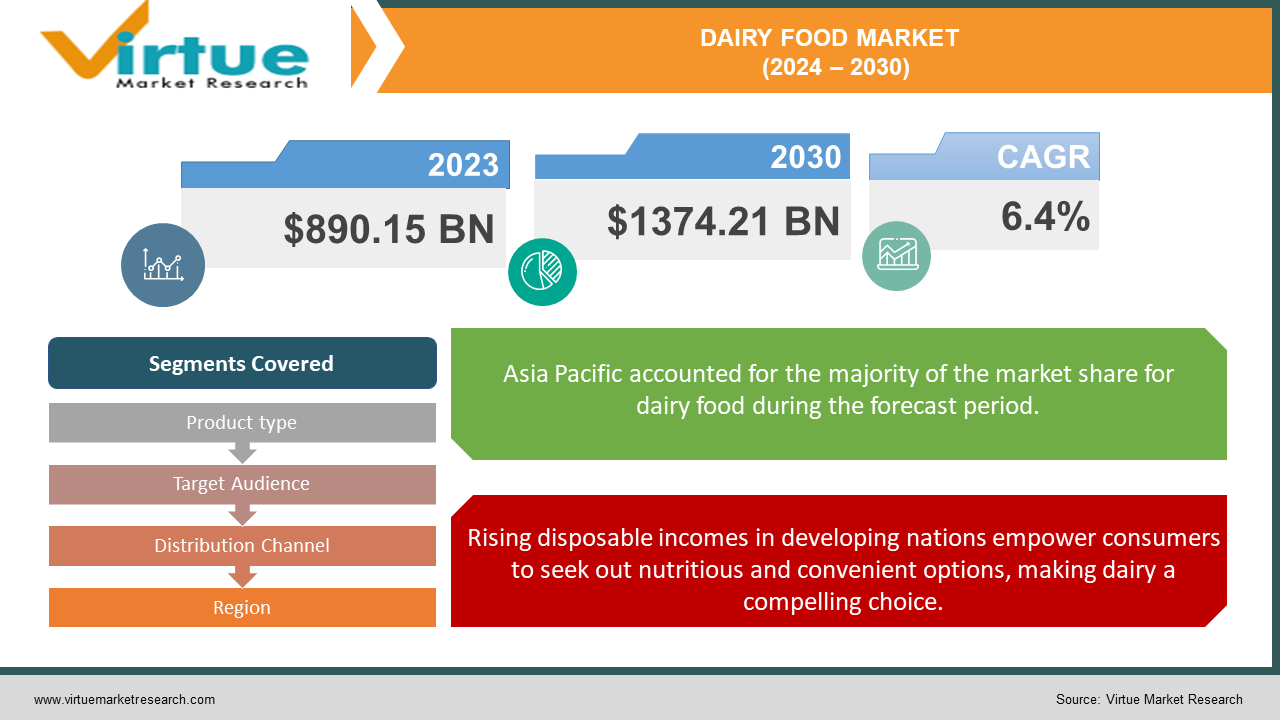

The Dairy Food Market was valued at USD 890.15 billion in 2023 and is projected to reach a market size of USD 1374.21 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.4%.

The dairy food market is a powerhouse industry that shows no signs of slowing down. Driven by rising disposable income and busier lifestyles, consumers are turning to convenient and nutritious dairy products. Manufacturers are keeping pace with this demand by introducing innovative options like probiotic yogurts and functional dairy items. However, the market also faces challenges like lactose intolerance and environmental concerns. This has paved the way for plant-based alternatives to gain traction.

Key Market Insights:

Lactose intolerance and other allergies limit consumption for some, creating a market of around 65% of the global population who experience some level of lactose intolerance. Additionally, environmental concerns surrounding dairy production are a growing factor for consumers. This has opened the door for plant-based alternatives, which are experiencing significant growth.

Looking regionally, the Asia Pacific market is positioned for the most significant growth. This is fuelled by a confluence of factors: a large and growing population, rapid urbanization, rising disposable incomes, and a growing awareness of the health benefits of dairy. This trend positions the region as a key battleground for major dairy players like Nestle and Danone.

Dairy Food Market Drivers:

Rising disposable incomes in developing nations empower consumers to seek out nutritious and convenient options, making dairy a compelling choice.

As economies in developing countries like China and India experience significant growth, disposable income rises in tandem. This translates to a population with more money to spend on nutritious and convenient food options. Dairy products, packed with essential nutrients like protein and calcium, and often boasting extended shelf life, become a natural choice for these consumers looking to upgrade their diets.

Heightened focus on health and wellness drives innovation in the dairy industry, with products catering to a population prioritizing overall well-being.

Consumers are increasingly prioritizing their health and well-being, actively seeking out foods that provide essential nutrients and support overall health. Dairy products have long been recognized for their role in promoting bone health due to their high calcium content. This growing health consciousness fuels innovation within the dairy industry, with manufacturers responding by introducing a wave of new products. From probiotic yogurts teeming with gut-friendly bacteria to functional dairy items fortified with additional vitamins and minerals, these innovative offerings cater directly to the health-focused consumer.

The convenience craze of our fast-paced world positions dairy products perfectly, offering easy-to-grab, versatile options for busy consumers.

Modern lifestyles are characterized by busy schedules and limited time for meal preparation. This has fueled a surge in demand for convenient food options that are easy to grab and go. Dairy products, with their inherent versatility and often requiring minimal preparation, perfectly fit this need. Consumers are increasingly turning to pre-packaged cheese slices for quick sandwiches, single-serve yogurt cups for a protein-packed snack, and ready-to-drink milk beverages for a nutritious on-the-go breakfast.

A constant stream of exciting new products keeps the dairy industry relevant, with manufacturers introducing novel flavors, textures, and functionalities.

The dairy industry is not resting on its laurels. Manufacturers are constantly innovating and pushing the boundaries of what's possible with dairy products to keep pace with ever-evolving consumer preferences. This translates to a constant stream of exciting new offerings, with a focus on introducing novel flavors, textures, and functionalities. From lactose-free options catering to those with dietary restrictions to plant-based yogurt alternatives appealing to vegans and flexitarians, the dairy landscape is constantly evolving to ensure there's something for everyone.

Dairy Food Market Restraints and Challenges:

The dairy food market, despite its strength, faces headwinds that require attention. A growing concern for the environment casts a shadow on dairy production, with consumers increasingly conscious of its impact on greenhouse gas emissions and water usage. This has led to a rise in the popularity of plant-based alternatives that offer similar tastes and functionality without the perceived environmental drawbacks. These alternatives, made from ingredients like soy, almond, or oat, pose a significant competitive threat to traditional dairy products.

Furthermore, the dairy market grapples with price volatility. Milk prices can fluctuate significantly, making it difficult for producers to plan and invest effectively. Additionally, disruptions in production due to weather events or disease outbreaks can further complicate matters. This volatility can also impact consumers, as fluctuating prices translate to uncertainty at the grocery store.

Finally, navigating the ever-changing regulatory landscape can be a challenge for dairy producers, particularly smaller ones. Stringent regulations regarding food safety, labeling, and animal welfare add another layer of complexity to the industry.

Dairy Food Market Opportunities:

The dairy food market isn't just about churning butter anymore. To stay relevant in a dynamic consumer landscape, innovation and addressing evolving needs are key. A major opportunity lies in the burgeoning demand for personalized nutrition. Imagine manufacturers crafting lactose-free options for those with dietary restrictions, or probiotic yogurts with targeted strains to address specific gut health concerns. The concept could even extend to custom cheese blends, allowing consumers to tailor their cheese platters to individual preferences. Furthermore, the industry can leverage the popularity of plant-based alternatives by creating exciting hybrid products that combine the goodness of dairy with plant-based ingredients. This would offer consumers a middle ground, allowing them to enjoy the taste and functionality of dairy products they know and love, potentially with a reduced environmental footprint – a win for both health and the planet. Looking beyond established markets, emerging nations in developing countries present a significant opportunity for growth. By understanding the specific needs and preferences of these regions, dairy producers can tailor their offerings and marketing strategies to maximize their reach and impact. This could involve introducing smaller portion sizes or single-serve options to cater to busy lifestyles, or even developing products with specific flavor profiles or nutrient content to resonate with local tastes. Overall, the dairy food market's future hinges on its ability to adapt, innovate, and cater to the evolving needs of a diverse and health-conscious consumer base. By embracing these opportunities, the industry can ensure its continued relevance and churn out a bright future for dairy products.

DAIRY FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.4% |

|

Segments Covered |

By Product type, Target Audience, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nestle, Danone, Lactalis, Fonterra, Yili Group, FrieslandCampina, Arla Foods, Saputo Inc., Amul, Mengniu Dairy |

Dairy Food Market Segmentation: By Product Type

-

Milk

-

Cheese

-

Yogurt

-

Butter & Spreads

-

Ice Cream & Frozen Desserts

-

Other Dairy Products

Segmenting the dairy market by product type reveals some interesting trends. Milk remains the dominant player, encompassing various options like whole, low-fat, and lactose-free varieties. However, the fastest-growing segment is yogurt, driven by the increasing popularity of products with health benefits like probiotics and protein enrichment, as well as the rise of convenient single-serve options.

Dairy Food Market Segmentation: By Distribution Channel

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Discount Stores

-

Specialty Stores

- Online Sales

When it comes to distribution channels, supermarkets, and hypermarkets reign supreme, offering the widest variety of dairy products. This makes them the most dominant segment, catering to one-stop shoppers seeking everything from milk to specialty cheeses. However, online sales are experiencing the most explosive growth, fueled by the convenience of home delivery and the ability to find niche dairy options not readily available in brick-and-mortar stores.

Dairy Food Market Segmentation: By Target Audience

-

Health-Conscious Consumers

-

Convenience Seekers

-

Environmentally Conscious Consumers

-

Children

-

Lactose Intolerant Consumers

Within target audiences, health-conscious consumers likely represent the most dominant segment, driven by the rise of functional dairy products and the focus on gut health. However, the fastest-growing segment is likely convenience seekers, fueled by busy lifestyles and the increasing popularity of ready-to-eat dairy options like single-serve yogurts and pre-packaged cheese slices.

Dairy Food Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America has a mature market with high per capita consumption of dairy products, particularly cheese and milk. Consumers here are increasingly health-conscious, driving demand for options like lactose-free milk and yogurt with added protein or probiotics. However, concerns about saturated fat and the rise of plant-based alternatives are creating some headwinds.

Asia Pacific is the fastest-growing dairy market globally, fueled by rising disposable income, urbanization, and a growing population. Milk consumption is high in this region, with growing interest in value-added dairy products like yogurt and cheese. Lactose intolerance is a factor here, but lactose-free options are gaining popularity. The market is ripe for innovation to cater to evolving tastes and preferences.

COVID-19 Impact Analysis on the Dairy Food Market:

The COVID-19 pandemic churned the dairy food market like never before, throwing unforeseen challenges into the mix. Lockdowns and restrictions on movement disrupted the carefully calibrated flow of dairy products from farms to processors and ultimately to consumers. This disruption caused temporary shortages and price fluctuations in some regions, leaving consumers scrambling to find their favorite dairy staples. While restaurant closures caused a sharp decline in demand for bulk dairy products typically used by these establishments, retail sales experienced a surge. Consumers, stockpiling groceries and cooking more meals at home, flocked to stores to purchase milk, yogurt, and cheese. This shift in buying habits highlighted the need for a robust online presence within the dairy industry. As consumers increasingly turned to e-commerce platforms to fulfill their daily needs, a strong online presence proved to be a lifeline for many producers. The focus on health during the pandemic also played a role in shaping consumer choices. There was a rise in demand for dairy products perceived to benefit immunity, such as yogurt with probiotics. However, heightened concerns about hygiene and food safety led some consumers to be more cautious about fresh dairy products. This potentially benefited shelf-stable alternatives like UHT milk, which boasts an extended shelf life due to ultra-high-temperature treatment. As the dairy industry navigates the post-pandemic landscape, its ability to adapt to these changing consumer habits will be essential for long-term success. Investing in innovative products and distribution channels that cater to the evolving needs of a health-conscious and convenience-seeking population will be key to ensuring the dairy food market continues to churn out a bright future.

Latest Trends/ Developments:

The dairy food market continues to churn out exciting new developments. One key trend is the focus on creating more realistic plant-based alternatives. This means tastier, more texturally pleasing options that mimic the experience of dairy products, like plant-based cheese that melts perfectly or pea milk that froths beautifully for coffee drinks. Sustainability remains a major concern for consumers, so expect to see dairy brands highlighting their commitment to eco-friendly practices and ethical sourcing. Furthermore, precision fermentation technology is emerging as a game-changer. By embracing these trends and catering to the evolving needs of a health-conscious and sustainability-focused population, the dairy food market looks set to continue thriving.

Key Players:

-

Nestle

-

Danone

-

Lactalis

-

Fonterra

-

Yili Group

-

FrieslandCampina

-

Arla Foods

-

Saputo Inc.

-

Amul

-

Mengniu Dairy

Chapter 1. Dairy Food Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Dairy Food Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Dairy Food Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Dairy Food Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Dairy Food Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Dairy Food Market – By Product Type

6.1 Introduction/Key Findings

6.2 Milk

6.3 Cheese

6.4 Yogurt

6.5 Butter & Spreads

6.6 Ice Cream & Frozen Desserts

6.7 Other Dairy Products

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Dairy Food Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets & Hypermarkets

7.3 Convenience Stores

7.4 Discount Stores

7.5 Specialty Stores

7.6 Online Sales

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Dairy Food Market – By Target Audience

8.1 Introduction/Key Findings

8.2 Health-Conscious Consumers

8.3 Convenience Seekers

8.4 Environmentally Conscious Consumers

8.5 Children

8.6 Lactose Intolerant Consumers

8.7 Y-O-Y Growth trend Analysis By Target Audience

8.8 Absolute $ Opportunity Analysis By Target Audience, 2024-2030

Chapter 9. Dairy Food Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Distribution Channel

9.1.4 By Target Audience

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Distribution Channel

9.2.4 By Target Audience

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Distribution Channel

9.3.4 By Target Audience

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Distribution Channel

9.4.4 By Target Audience

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Distribution Channel

9.5.4 By Target Audience

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Dairy Food Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nestle

10.2 Danone

10.3 Lactalis

10.4 Fonterra

10.5 Yili Group

10.6 FrieslandCampina

10.7 Arla Foods

10.8 Saputo Inc.

10.9 Amul

10.10 Mengniu Dairy

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Dairy Food Market was valued at USD 890.15 billion in 2023 and is projected to reach a market size of USD 1374.21 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.4%.

Surging Disposable Incomes in Developing Markets, Heightened Focus on Health and Wellness, The Convenience Craving in a Fast-Paced World, and Product Innovation Frenzy.

Health-Conscious Consumers, Convenience Seekers, Environmentally Conscious Consumers, Children, Lactose Intolerant Consumers.

While the Asia Pacific region is experiencing the fastest growth, the most dominant region for the Dairy Food Market is currently Europe.

Nestle, Danone, Lactalis, Fonterra, Yili Group, FrieslandCampina, Arla Foods, Saputo Inc., Amul, Mengniu Dairy.