GLOBAL DAIRY EVAPORATORS AND DRYING EQUIPMENT MARKET (2024 - 2030)

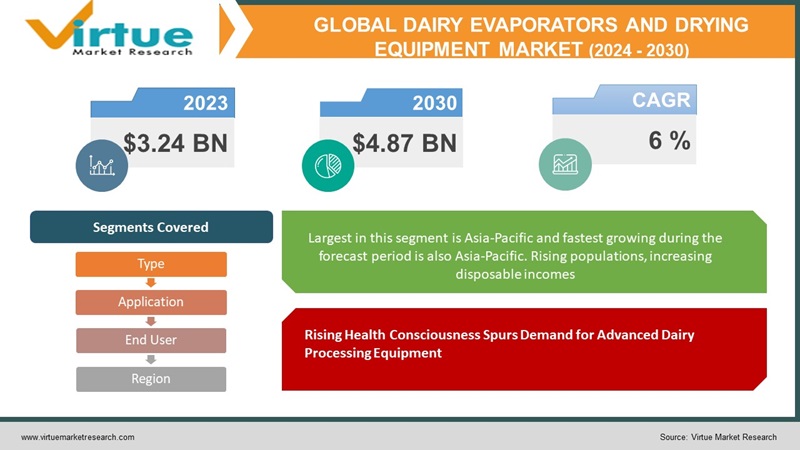

The Dairy Evaporators and Drying Equipment Market was valued at USD 3.24 billion in 2023 and is projected to reach a market size of USD 4.87 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6%.

The Dairy Evaporators and Drying Equipment Market has evolved from manual, slower processes to highly automated and efficient systems today. Technological advancements have driven increased productivity and improved product quality. Currently, the industry emphasizes sustainability and energy efficiency. Looking ahead, the market is anticipated to continue growing, fueled by ongoing technological innovation, a focus on environmentally friendly solutions, and the rising global demand for dairy products, necessitating enhanced processing capabilities to meet evolving consumer expectations.

Key Market Insights:

The annual growth rate for dairy product consumption in India is anticipated to be 2.3%, with a projected per capita consumption reaching 108kg by the year 2028.

A growing emphasis on sustainability and energy efficiency in the industry, with manufacturers and operators adopting environmentally friendly solutions to reduce the environmental impact of dairy processing operations.

The Food and Agriculture Organization of the United Nations reports that over 6 billion individuals globally partake in milk and milk-related products. The majority of the population, with a per capita consumption exceeding 150 kg annually, is distributed among developing economies, with some also found in developed regions.

The market is influenced by the increasing global demand for dairy products. Rising populations, changing dietary habits, and the popularity of dairy-based products contribute to the continuous growth of the Dairy Evaporators and Drying Equipment Market.

Dairy Evaporators and Drying Equipment Market Drivers:

Rising Health Consciousness Spurs Demand for Advanced Dairy Processing Equipment

The increasing awareness of the health and nutritional benefits associated with dairy products is driving a surge in demand. Dairy processing companies are responding by focusing on low-fat, organic, and nutrient-fortified products, necessitating advanced machinery. With a projected 36% increase in consumption of products like milk, cheese, and butter by 2024, particularly in emerging economies like India, China, and South American countries, the demand for innovative dairy processing equipment is on the rise.

Expansion of Dairy Consumption in Emerging Economies: Emerging Markets Propel Demand for Dairy Processing Equipment

The dairy industry is experiencing significant growth in emerging economies, fueled by factors such as population expansion, rapid urbanization, increased disposable income, and the modernization of cold chain facilities. In countries like China, where dairy consumption is projected to increase by 42%, the demand for efficient dairy processing equipment is critical. The International Farm Comparison Network (IFCN) anticipates a substantial rise in Chinese dairy demand, from 43 million tons in 2015 to 61 million tons by 2024, driving the need for advanced processing technologies.

Surge in International Trade of Processed Dairy Products: Globalization Boosts Demand for Dairy Evaporators and Drying Equipment

The escalating demand for dairy products globally has led to increased international trade, contributing to a burgeoning market for processing equipment. As consumers become more health-conscious and exhibit a growing preference for processed dairy products in international markets, the demand for efficient and advanced dairy processing equipment is on the rise. This trend is reshaping the dairy industry landscape, emphasizing the need for equipment that ensures the preservation of nutritional value and quality during processing and transportation.

Cutting-Edge Technologies Revolutionize Dairy Evaporators and Drying Equipment Market

A pivotal driver for the Dairy Evaporators and Drying Equipment Market is the relentless pursuit of technological advancements and innovation. Dairy processing companies are investing significantly in research and development to introduce cutting-edge technologies that enhance efficiency, reduce energy consumption, and improve overall processing capabilities. From smart automation to precision control systems, the industry is witnessing a transformative wave. These innovations not only cater to the demand for high-quality dairy products but also contribute to sustainable and environmentally friendly processing practices. As consumer expectations evolve, the market is propelled forward by the continuous integration of state-of-the-art technologies in dairy processing equipment.

Dairy Evaporators and Drying Equipment Market Restraints and Challenges:

Navigating Challenges in the Dairy Evaporators and Drying Equipment Market: Balancing Energy Costs and Capital Investments

The Dairy Evaporators and Drying Equipment Market face substantial restraints and challenges, with the increasing cost of power and energy standing as a prominent hindrance. The continuous escalation of energy costs poses a significant challenge for the dairy processing industry, impacting operational expenses for running plants, refrigeration, lighting, and mechanical processes. Thermal energy requirements, especially for processes like pasteurization and evaporation, contribute significantly to the overall energy consumption. The challenge is compounded by the high energy consumption of pasteurization compared to other processing equipment, creating a barrier for smaller dairy processors. To mitigate this restraint, industry players are urged to adopt energy-efficient practices, upgrade equipment, and explore new technologies through energy audits. Simultaneously, the market faces the challenge of high capital investment required for the installation and maintenance of dairy processing equipment. Manufacturers must navigate the delicate balance between ensuring efficient operations and managing the associated costs, particularly with membrane filtration technology, which incurs substantial setup costs. The high setup costs for membrane filtration technology pose a significant obstacle, particularly in developing countries where full penetration of this technology has not yet been achieved. As the market evolves, addressing these challenges becomes imperative to sustain growth and innovation in the Dairy Evaporators and Drying Equipment Market.

Dairy Evaporators and Drying Equipment Market Opportunities:

The Dairy Evaporators and Drying Equipment Market present a significant opportunity in responding to the increasing demand from dairy processors for comprehensive after-sales services. Manufacturers can go beyond installation by offering services like annual maintenance contracts, operator training, preventive maintenance, and timely support. This opportunity allows for the development of innovative services such as scheduled preventive maintenance and proactive machine failure notifications, contributing to smoother operations. In light of past food safety recalls, providing guidance on essential manufacturing practices becomes crucial. This strategic focus not only elevates operational efficiency for dairy processors but also builds brand trust and loyalty in this competitive market.

GLOBAL EVAPORATORS AND DRYING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6 % |

|

Segments Covered |

By Type, Application, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tetra Pak , GEA Group AG, Krones AG SPX Flow Inc. , Alfa Laval, JBT Corporation Feldmeier Equipment INC. , Scherjon Dairy Equipment Holland B.V. , Jimei Food Machine Co. Ltd. , Technal, Marlen International Inc. |

Dairy Evaporators and Drying Equipment Market Segmentation:

Market Segmentation: By Type:

- Evaporators

- Drying Equipment

Largest in this segment is Drying Equipment and fastest growing during the forecast period is Evaporators. Drying Equipment plays a pivotal role in the dairy industry by facilitating the conversion of liquid dairy products into stable and easily transportable powder forms. This process not only enhances the shelf life of dairy products but also caters to the demand for convenient storage and transportation. Evaporators are essential components in the dairy processing chain, responsible for removing water from liquid dairy products, resulting in concentrated solutions. The forecasted growth in the Evaporators segment is indicative of the dairy industry's inclination toward more efficient and advanced technologies for the concentration of dairy products, contributing to improved production processes and product quality.

Market Segmentation: By Application:

- Milk Powder

- Whey Powder

- Condensed Milk

- Other

Largest in this segment is Milk Powder and fastest growing during the forecast period is whey Powder. Milk powder is widely used in various food applications due to its longer shelf life, ease of storage, and versatility in formulations. The demand for milk powder is influenced by factors such as the growth of the infant formula market, the bakery and confectionery industry, and the increasing popularity of instant and convenience foods. Whey powder is used in sports nutrition products, functional beverages, and as an ingredient in a variety of food products. The emphasis on health and wellness, coupled with the exploration of whey protein's functional properties, contributes to the growth of this segment. While the growth in demand for condensed milk may not be as rapid as some other segments, it continues to have a stable market, especially in regions where condensed milk is a popular component in traditional cuisines.

Market Segmentation: By End User:

- Dairy Processing Plants

- Food and Beverage Industry

- Nutraceuticals Industry

- Others

Largest in this segment is Food and Beverage Industry and fastest growing during the forecast period is Nutraceuticals Industry. Dairy evaporators and drying equipment play a crucial role in transforming liquid dairy products into stable and transportable forms, such as powders, which are widely used as ingredients in the food and beverage sector. These technologies contribute to the production of items like bakery goods, confectionery, dairy-based beverages, and other processed foods. Dairy-based ingredients, processed using evaporators and drying equipment, find applications in the production of nutraceutical products. These may include protein powders, nutritional supplements, and fortified dairy products that offer health benefits beyond basic nutrition. The versatility of dairy ingredients makes them valuable in catering to the demands of the evolving nutraceutical market.

Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Largest in this segment is Asia-Pacific and fastest growing during the forecast period is also Asia-Pacific. Rising populations, increasing disposable incomes, and changing dietary preferences have led to a surge in demand for dairy products. As a result, dairy processing facilities in Asia-Pacific heavily invest in advanced evaporators and drying equipment to enhance production capacities and meet the diverse demands of the expanding consumer base. This accelerated growth is fueled by a combination of factors, including urbanization, a burgeoning middle class with an appetite for processed dairy products, and a heightened awareness of health and nutrition. Manufacturers in the region are keen on adopting modern processing technologies to cater to these evolving consumer trends, contributing to the rapid expansion of the Dairy Evaporators and Drying Equipment Market. North America represents a mature market with established dairy processing practices. In Europe, the Dairy Evaporators and Drying Equipment Market is characterized by technological sophistication and a focus on sustainable practices. The Middle East and Africa region witness a developing dairy industry, with a rising awareness of dairy consumption benefits.

COVID-19 Impact Analysis on the Dairy Evaporators and Drying Equipment Market:

The Dairy Evaporators and Drying Equipment Market, characterized by major players like Tetra Laval, GEA Group, SPX Flow, IMA, and The Krones Group, experienced the repercussions of the COVID-19 pandemic. While the global operations and supply chain of dairy processing equipment were not significantly disrupted, businesses faced challenges during the pandemic. Despite the impact on various aspects of their operations, key players maintained operational continuity with multiple manufacturing facilities remaining in operation. The resilience displayed by these Tier I and II suppliers underscored their adaptability and ability to navigate the challenges posed by the pandemic, ensuring a degree of stability in the Dairy Evaporators and Drying Equipment Market.

Latest Trends/ Developments:

The Dairy Evaporators and Drying Equipment Market are witnessing significant trends and developments, driven by the increasing demand for processed dairy products and a growing emphasis on sustainability. Shifts in consumer eating patterns, particularly in the consumption of cheese, cream, yogurt, and other dairy products, are contributing to market growth. The industry is experiencing a notable trend of balancing nourishment with taste and diversifying product offerings to meet evolving consumer preferences. Factors such as the declining cost of raw materials, a rising number of dairy processing industries, and increasing demand for enhanced production capabilities are propelling market growth. Furthermore, technological advancements have become a critical trend, with major companies in the sector focusing on developing innovative solutions to strengthen their position in the competitive Dairy Evaporators and Drying Equipment Market.

Key Players:

- Tetra Pak

- GEA Group AG

- Krones AG

- SPX Flow Inc.

- Alfa Laval

- JBT Corporation

- Feldmeier Equipment INC.

- Scherjon Dairy Equipment Holland B.V.

- Jimei Food Machine Co. Ltd.

- Technal, Marlen International Inc.

- Jan 2022: Lyras, Inc., a technology provider in the United States specializing in pasteurizing liquid foods, has unveiled a secure and eco-friendly cold pasteurization solution. This innovation deactivates bacteria without subjecting the liquid to heat, preserving its inherent flavor, extending shelf life, and concurrently reducing carbon dioxide emissions, water consumption, and the expenses associated with cleaning chemicals.

- Feb 2022: ProMach, a packaging company headquartered in the United States, acquired TechniBlend for an undisclosed sum. The incorporation of TechniBlend into ProMach's operations will substantially broaden its array of processing technologies, strengthening its capacity to offer comprehensive turnkey production lines.

Chapter 1. GLOBAL DAIRY EVAPORATORS AND DRYING EQUIPMENT MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL DAIRY EVAPORATORS AND DRYING EQUIPMENT MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL DAIRY EVAPORATORS AND DRYING EQUIPMENT MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL DAIRY EVAPORATORS AND DRYING EQUIPMENT MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL DAIRY EVAPORATORS AND DRYING EQUIPMENT MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL DAIRY EVAPORATORS AND DRYING EQUIPMENT MARKET – By Type

6.1. Evaporators

6.2. Drying Equipment

Chapter 7. GLOBAL DAIRY EVAPORATORS AND DRYING EQUIPMENT MARKET – By Application

7.1. Milk Powder

7.2. Whey Powder

7.3. Condensed Milk

7.4. Other

Chapter 8. GLOBAL DAIRY EVAPORATORS AND DRYING EQUIPMENT MARKET – By End User

8.1. Dairy Processing Plants

8.2. Food and Beverage Industry

8.3. Nutraceuticals Industry

8.4. Others

Chapter 9. GLOBAL DAIRY EVAPORATORS AND DRYING EQUIPMENT MARKET, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Type

9.1.3. By Application

9.1.4. By End User

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Type

9.2.3. By Application

9.2.4. By End User

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Type

9.3.3. By Application

9.3.4. By End User

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest South America

9.4.2. By Type

9.4.3. By Application

9.4.4. By End User

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Type

9.5.3. By Application

9.5.4. By End User

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL DAIRY EVAPORATORS AND DRYING EQUIPMENT MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Tetra Pak

10.2. GEA Group AG

10.3. Krones AG

10.4. SPX Flow Inc.

10.5. Alfa Laval

10.6. JBT Corporation

10.7. Feldmeier Equipment INC.

10.8. Scherjon Dairy Equipment Holland B.V.

10.9. Jimei Food Machine Co. Ltd.

10.10. Technal, Marlen International Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Dairy Evaporators and Drying Equipment Market was valued at USD 3.24 billion in 2023 and is projected to reach USD 4.87 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 6%.

The market is primarily influenced by technological advancements, a focus on sustainability and energy efficiency, and the rising global demand for dairy products, necessitating enhanced processing capabilities.

Asia-Pacific is the largest and fastest-growing segment due to rising populations, increasing disposable incomes, changing dietary preferences, and heavy investments in advanced evaporators and drying equipment to meet the diverse demands of the expanding consumer base.

Key trends include a growing emphasis on sustainability, the surge in international trade of processed dairy products, and the relentless pursuit of technological advancements. Balancing nourishment with taste, diversifying product offerings, and the declining cost of raw materials are also notable trends.

Rising health consciousness, the expansion of dairy consumption in emerging economies, the surge in international trade of processed dairy products, and cutting-edge technologies revolutionizing dairy processing equipment are the key drivers.