Chapter 1. DAIRY BLENDS MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

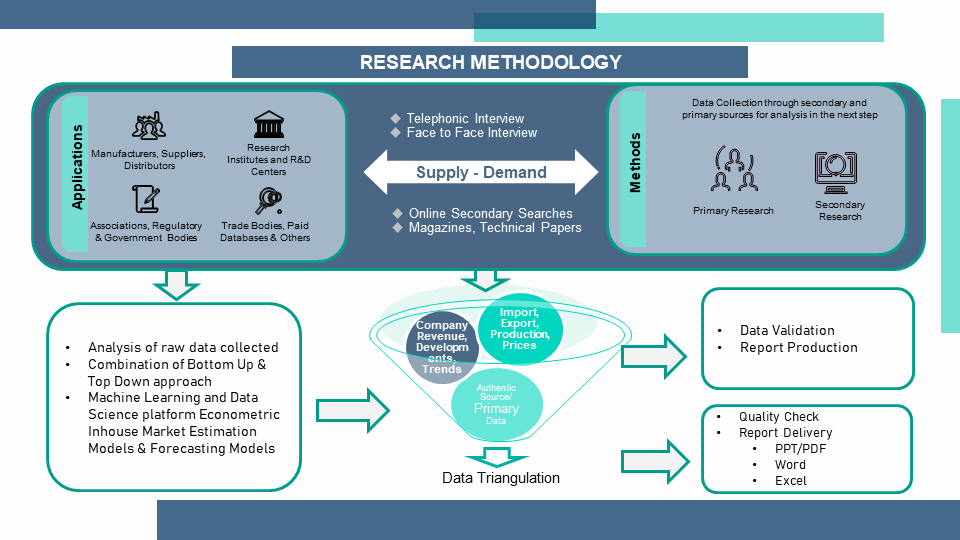

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. DAIRY BLENDS MARKET– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-110 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. DAIRY BLENDS MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. DAIRY BLENDS MARKET- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

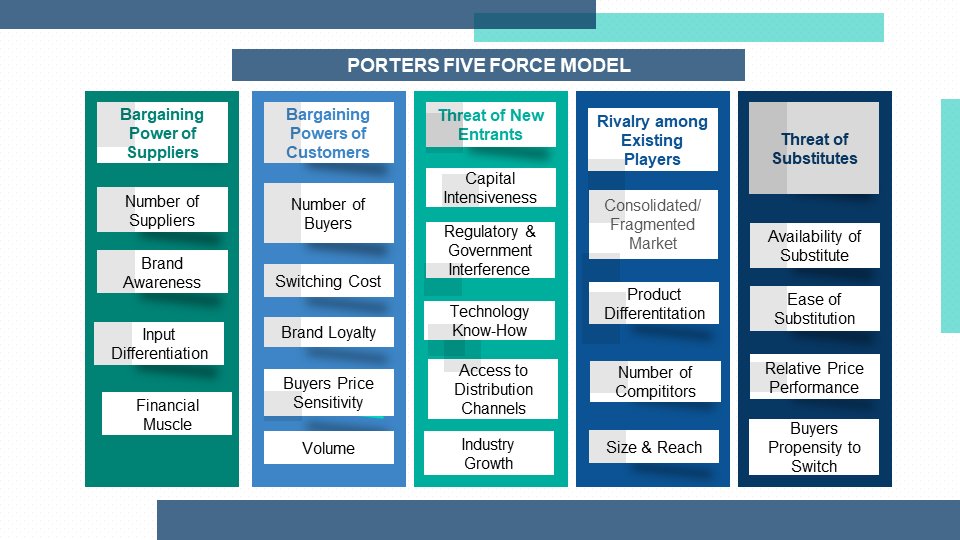

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. DAIRY BLENDS MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

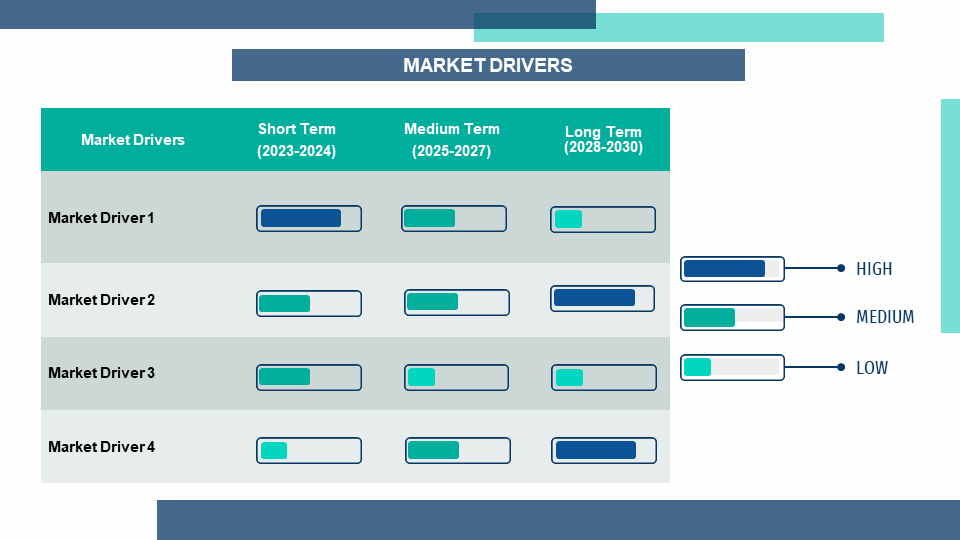

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

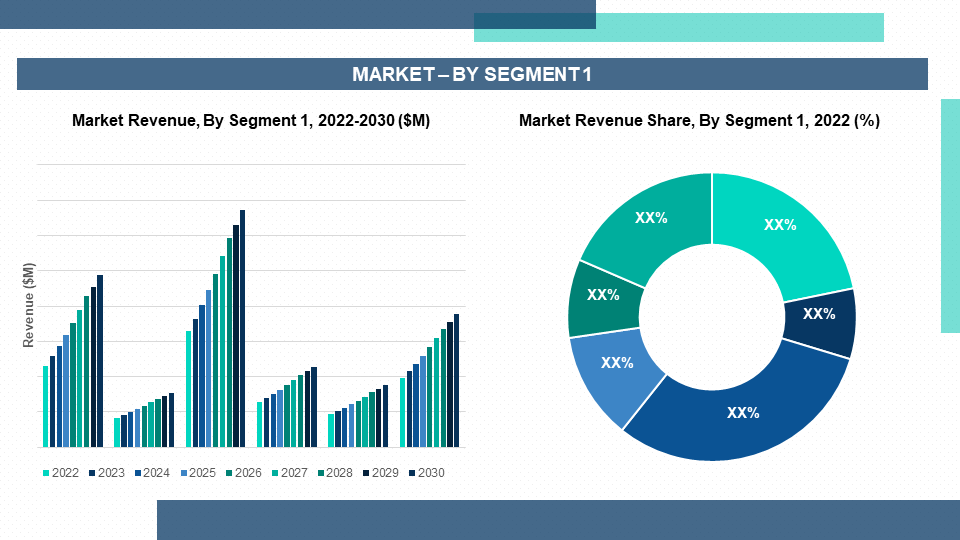

Chapter 6. DAIRY BLENDS MARKET– By Type

6.1. Dairy/Non-Dairy Ingredients

6.2. Dairy as Carrier

6.3. Dairy Mixtures

Chapter 7. DAIRY BLENDS MARKET– By Formulation

7.1. Spreadable

7.2. Powdered

7.3. Liquid

Chapter 8. DAIRY BLENDS MARKET– By Application

8.1. Bakery and Confectionery Products

8.2. Infant Formula

8.3. Sports and Functional Foods

8.4. Beverages

8.5. Dairy Products

8.6. Others

Chapter 9. DAIRY BLENDS MARKET– By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. Middle-East and Africa

Chapter 10. DAIRY BLENDS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Company 1

10.2. Company 2

10.3. Company 3

10.4. Company 4

10.5. Company 5

10.6. Company 6

10.7. Company 7

10.8. Company 8

10.9. Company 9

10.10. Company 10

Download Sample

Choose License Type

2500

4250

5250

6900