Cylindrical Lithium Battery Pack Market Size (2025 – 2030)

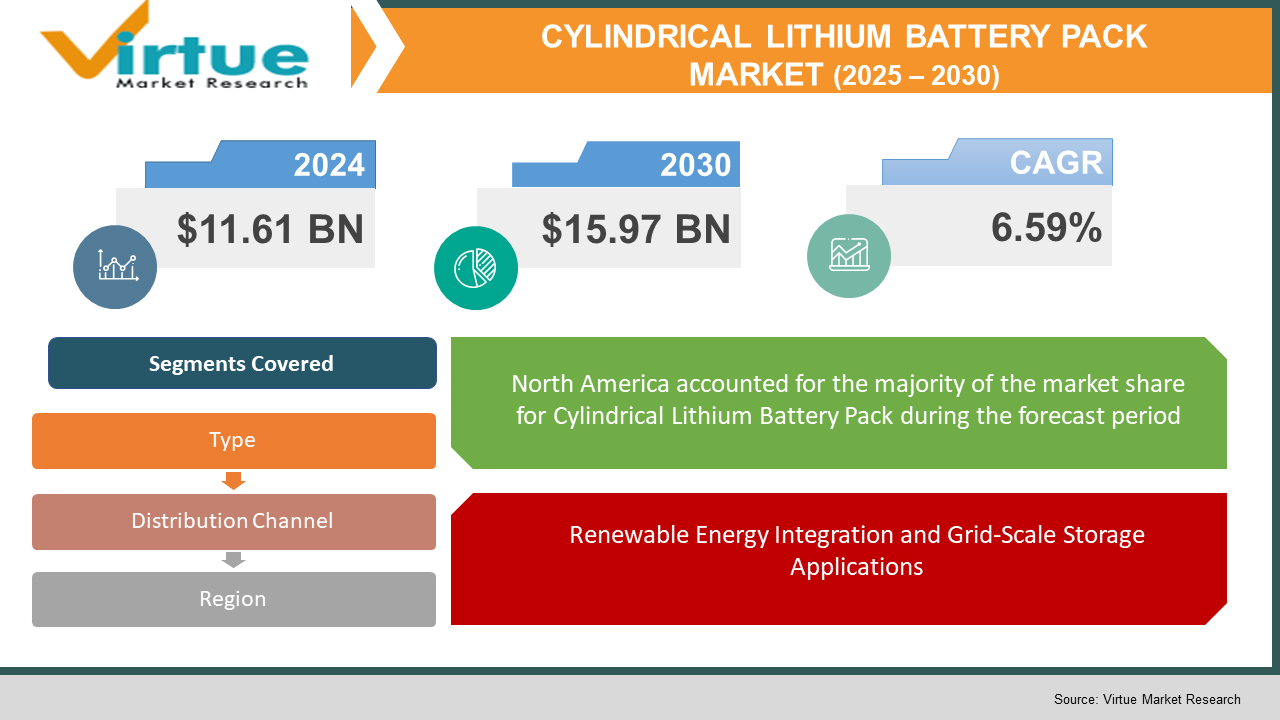

The Cylindrical Lithium Battery Pack Market was valued at USD 11.61 Billion in 2024 and is projected to reach a market size of USD 15.97 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6.59%.

The cylindrical lithium battery pack market has emerged as a cornerstone of the global energy storage landscape in 2024, driven primarily by accelerating electric vehicle adoption and expanding renewable energy integration. These cylindrical cells, characterized by their distinctive form factor and high energy density, have become the preferred power solution across diverse applications ranging from consumer electronics to industrial machinery. The market has witnessed remarkable transformation as manufacturers innovate with advanced materials, improved thermal management systems, and enhanced safety features to meet increasingly demanding performance requirements. The industry landscape is characterized by intensifying competition among established battery giants and emerging specialists focused on proprietary cell chemistries and pack designs. Manufacturing processes have undergone significant refinement, with automated assembly lines and precision engineering contributing to improved quality control and reduced production costs. This manufacturing evolution has enabled producers to scale operations while maintaining consistent performance standards across their cylindrical battery portfolio.

Key Market Insights:

The worldwide production capacity of cylindrical lithium cells exceeded 11.2 billion units in 2024. The 21700-cell format accounted for 42% of all cylindrical lithium batteries manufactured in 2024.

Electric vehicles consumed 68% of all cylindrical lithium battery production in 2024.

The average energy density of commercial cylindrical lithium cells reached 285 Wh/kg in 2024.

Manufacturing costs for cylindrical lithium cells decreased by 7.8% in 2024 compared to the previous year.

The average lifespan of cylindrical lithium battery packs increased to 3,200 charge cycles in 2024. Recycling operations recovered approximately 18,500 metric tons of lithium from cylindrical cells in 2024.

Consumer electronics applications utilized 1.9 billion cylindrical lithium cells in 2024.

Research and development investments in cylindrical battery technology totaled $4.2 billion globally in 2024.

Market Drivers:

Accelerating Electric Vehicle Adoption and Energy Density Requirements

The rapid expansion of the electric vehicle (EV) market has emerged as the foremost driver of the cylindrical lithium battery pack industry in 2024. Automotive manufacturers have increasingly gravitated toward cylindrical cell architectures for their combination of scalability, thermal efficiency, and structural integrity under the demanding conditions of vehicle operation. This preference has been reinforced by the demonstrated reliability of cylindrical formats in pioneering EV models that have now accumulated billions of miles of real-world operational data, providing invaluable insights for continuous refinement and optimization. The automotive sector's specific requirements have catalyzed substantial innovation in cylindrical cell design, particularly concerning energy density improvements. Manufacturers have responded by developing specialized high-capacity variants that balance power delivery capabilities with the extended range demands of modern electric vehicles. The cylindrical format's inherent advantages in manufacturing consistency have enabled production lines to achieve unprecedented yields of automotive-grade cells that meet stringent quality and performance parameters. This manufacturing predictability has been instrumental in helping EV producers scale production while maintaining cell-to-cell uniformity, a critical factor in pack-level performance and longevity.

Renewable Energy Integration and Grid-Scale Storage Applications

The accelerating global transition toward renewable energy systems has emerged as a powerful secondary driver for the cylindrical lithium battery pack market in 2024. As intermittent generation sources like solar and wind constitute an increasing proportion of the energy mix, the demand for reliable, scalable storage solutions has intensified across residential, commercial, and utility applications. Cylindrical lithium battery packs have demonstrated suitability for these deployments due to their modular architecture, consistent performance characteristics, and adaptability to varying capacity requirements. Utility-scale energy storage systems have increasingly adopted cylindrical cell configurations for their inherent redundancy advantages, where the failure of individual cells has minimal impact on overall system performance. This architectural resilience is particularly valuable in critical infrastructure applications where uninterrupted availability is essential. The standardized dimensions of cylindrical cells have facilitated the development of modular storage units that can be rapidly deployed and easily expanded, enabling project scaling without complete system redesigns. This modularity has proven especially valuable for phased deployment strategies that allow storage capacity to grow in tandem with renewable generation assets.

Market Restraints and Challenges:

Despite its robust growth trajectory, the cylindrical lithium battery pack market confronts several significant challenges that could potentially constrain its expansion and technological evolution. Raw material supply vulnerabilities remain perhaps the most pressing concern, with continued uncertainty surrounding critical mineral availability, particularly regarding lithium, nickel, and cobalt resources. These supply chain pressures have intensified as demand has accelerated across multiple industries, creating competitive procurement environments that contribute to price volatility and potential production disruptions. Geopolitical factors affecting mining operations and refining capacity have further complicated the supply landscape, with resource nationalism and trade restrictions emerging as material considerations in strategic planning. The recycling infrastructure for cylindrical lithium batteries remains underdeveloped relative to production volumes, creating potential bottlenecks in circular material flows that could affect long-term sustainability and resource availability. Current recycling processes often struggle with the economic recovery of materials from cylindrical formats, particularly when dealing with mixed chemistry collections typical in consumer applications. These recycling challenges could potentially impact the format's environmental credentials and regulatory standing as sustainability considerations become increasingly central to market development.

Market Opportunities:

The cylindrical lithium battery pack market stands at the threshold of transformative opportunities that extend beyond traditional applications and into emerging domains that promise substantial growth potential. Advanced manufacturing technologies represent perhaps the most immediate opportunity, with automated production systems, artificial intelligence-driven quality control, and digital twin modeling enabling unprecedented manufacturing precision and cost reduction. These production innovations are poised to transform the economics of cylindrical cell manufacturing, potentially reducing costs by up to 35% while simultaneously improving consistency and reducing defect rates. The integration of these smart manufacturing approaches with circular material sourcing creates a compelling pathway toward sustainable, localized production ecosystems that minimize environmental impacts while maximizing resource efficiency. Specialized application development for cylindrical formats continues to uncover niche opportunities with substantial aggregate potential, from medical devices requiring exceptional reliability to aerospace systems where the format's pressure containment characteristics provide safety advantages. The standardization around common cell dimensions facilitates adaptation to these diverse applications without requiring fundamental redesigns, allowing specialized pack configurations while maintaining manufacturing economies of scale for the underlying cells.

CYLINDRICAL LITHIUM BATTERY PACK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.59% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Panasonic Energy, Tesla, LG Energy Solution, Samsung SDI, and Contemporary Amperex Technology Co. Limited (CATL) |

Cylindrical Lithium Battery Pack Market Segmentation:

Cylindrical Lithium Battery Pack Market Segmentation by Type:

- 18650 Cylindrical Cells

- 21700 Cylindrical Cells

- 4680 Cylindrical Cells

- 26650 Cylindrical Cells

- 32650 Cylindrical Cells

- Custom Proprietary Formats

The 21700 format has emerged as the dominant cylindrical cell type in 2024, accounting for approximately 42% of global production volume. This format has established itself as the preferred standard across multiple industries due to its optimal balance of energy density, manufacturing scalability, and thermal management characteristics. The automotive sector has been particularly instrumental in driving 21700 adoption, with multiple major electric vehicle manufacturers standardizing on this format for their production models.

The 4680 format represents the fastest-growing segment, albeit from a smaller base, with production volumes increasing 127% year-over-year. This larger-format cell has gained significant momentum through its adoption by several leading electric vehicle manufacturers who value its potential for simplified pack assembly and enhanced thermal management capabilities. The format's larger dimensions enable manufacturers to reduce the total cell count in battery packs by approximately 80% compared to 18650-based designs, significantly simplifying assembly processes and reducing connection points that represent potential failure modes.

Cylindrical Lithium Battery Pack Market Segmentation by Distribution Channel:

- Direct OEM Supply Contracts

- Specialized Battery Distributors

- Electronic Component Wholesalers

- Online B2B Marketplaces

- Retail Electronics Channels

- System Integrator Procurement

Direct OEM supply contracts represent the dominant distribution channel, accounting for approximately 72% of total market value in 2024. This channel has strengthened its position through vertical integration initiatives and long-term strategic partnerships between cell manufacturers and major end-users, particularly in the automotive and energy storage sectors.

Online B2B marketplaces have emerged as the fastest-growing distribution channel, with volume through these platforms increasing 41% in 2024. These digital procurement platforms have gained traction among medium-sized manufacturers and system integrators who lack the volume requirements for direct manufacturing relationships but require reliable access to quality-verified cells.

Cylindrical Lithium Battery Pack Market Segmentation by Regional Analysis:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

The global cylindrical lithium battery pack market exhibits distinct regional characteristics shaped by manufacturing capabilities, demand patterns, and regulatory frameworks. Asia-Pacific continues to dominate with approximately 68% market share, cementing its position as the manufacturing epicentre for cylindrical lithium cells and integrated pack systems. Within this region, China maintains leadership with 41% of global production capacity, leveraging its integrated supply chain that spans from raw material processing to finished pack assembly.

North America represents 17% of the global market but has demonstrated the fastest regional growth rate at 34% year-over-year in 2024. This expansion has been driven by aggressive domestic manufacturing investments catalyzed by policy support mechanisms including production incentives, clean energy credits, and strategic mineral initiatives. The region's focus on large-format cylindrical cells (particularly 4680 and proprietary designs) for electric vehicle applications differentiates its manufacturing profile from Asian production that remains more diversified across different formats and applications.

COVID-19 Impact Analysis:

The cylindrical lithium battery pack market experienced multifaceted disruptions from the COVID-19 pandemic that continue to reverberate through industry structures and strategic priorities in 2024. The initial pandemic phase triggered severe supply chain dislocations that exposed vulnerabilities in global manufacturing networks, with factory shutdowns, logistics breakdowns, and workforce limitations creating production bottlenecks across the entire value chain. Cell manufacturers with concentrated production facilities faced particular challenges during regional lockdowns, resulting in delivery delays that cascaded through dependent industries and accelerated interest in geographical diversification strategies that remain influential in current capacity planning decisions. Raw material supply constraints emerged as a critical vulnerability during the pandemic, with mining operations and processing facilities experiencing significant disruptions that affected material availability and pricing. These challenges highlighted the strategic importance of resource security and catalyzed renewed focus on recycling pathways, alternative chemistries, and vertical integration initiatives that have fundamentally altered industry structures. Consumer electronics experienced substantial demand acceleration as remote work and digital lifestyle shifts increased reliance on powered devices, while initial electric vehicle sales disruptions were followed by accelerated adoption as government recovery packages prioritized clean technology investments.

Latest Trends and Developments:

The cylindrical lithium battery market in 2024 is characterized by several transformative trends that are reshaping both technological approaches and business models across the ecosystem. Silicon-augmented anode formulations have progressed from experimental to commercial implementations, with leading manufacturers now incorporating precisely engineered silicon composites that increase energy density by 15-20% compared to traditional graphite anodes. These advanced formulations address historical cycling stability limitations through nanoscale structural engineering and specialized electrolyte additives that manage volume expansion dynamics during charge cycles. The successful commercialization of these silicon-enhanced cells represents a significant step toward higher energy densities without requiring fundamental format changes or manufacturing process redesigns. Thermal management innovation continues to advance rapidly, with phase-change materials, immersion cooling systems, and directional heat transfer technologies enabling faster charging capabilities while maintaining safe operating temperatures. These thermal systems are increasingly designed as integral elements of the pack architecture rather than as supplementary components, creating unified thermal-mechanical-electrical designs that optimize overall system performance under varying operational conditions.

Key Players in the Market:

- Panasonic Energy

- Tesla

- LG Energy Solution

- Samsung SDI

- Contemporary Amperex Technology Co. Limited (CATL)

- Molicel (E-One Moli Energy Corporation)

- Murata Manufacturing Co.

- BAK Power Battery Co.

- Northvolt AB

- A123 Systems

Chapter 1. CYLINDRICAL LITHIUM BATTERY PACK MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. CYLINDRICAL LITHIUM BATTERY PACK MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. CYLINDRICAL LITHIUM BATTERY PACK MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. CYLINDRICAL LITHIUM BATTERY PACK MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. CYLINDRICAL LITHIUM BATTERY PACK MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. CYLINDRICAL LITHIUM BATTERY PACK MARKET – By Type

6.1 Introduction/Key Findings

6.2 18650 Cylindrical Cells

6.3 21700 Cylindrical Cells

6.4 4680 Cylindrical Cells

6.5 26650 Cylindrical Cells

6.6 32650 Cylindrical Cells

6.7 Custom Proprietary Formats

6.8 Y-O-Y Growth trend Analysis By Type

6.9 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. CYLINDRICAL LITHIUM BATTERY PACK MARKET – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct OEM Supply Contracts

7.3 Specialized Battery Distributors

7.4 Electronic Component Wholesalers

7.5 Online B2B Marketplaces

7.6 Retail Electronics Channels

7.7 System Integrator Procurement

7.8 Y-O-Y Growth trend Analysis By Distribution Channel

7.9 Absolute $ Opportunity Analysis By Distribution Channel , 2025-2030

Chapter 8. CYLINDRICAL LITHIUM BATTERY PACK MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution Channel

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Distribution Channel

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Distribution Channel

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Distribution Channel

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Distribution Channel

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. CYLINDRICAL LITHIUM BATTERY PACK MARKET – Company Profiles – (Overview, Packaging Product Portfolio, Financials, Strategies & Developments)

9.1 Panasonic Energy

9.2 Tesla

9.3 LG Energy Solution

9.4 Samsung SDI

9.5 Contemporary Amperex Technology Co. Limited (CATL)

9.6 Molicel (E-One Moli Energy Corporation)

9.7 Murata Manufacturing Co.

9.8 BAK Power Battery Co.

9.9 Northvolt AB

9.10 A123 Systems

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growth of the cylindrical lithium battery pack market is driven by rising electric vehicle adoption, increasing demand for consumer electronics, advancements in battery technology, enhanced energy density, longer lifecycle, and the expanding need for efficient renewable energy storage solutions.

The main concerns in the cylindrical lithium battery pack market include raw material shortages, rising production costs, environmental impact from battery disposal, safety risks like thermal runaway, and supply chain disruptions. Additionally, technological limitations in energy density and lifecycle present ongoing challenges.

Panasonic Energy, Tesla, LG Energy Solution, Samsung SDI, and Contemporary Amperex Technology Co. Limited (CATL) stand among the foremost global manufacturers with vertically integrated operations spanning cell production through pack assembly.

Asia Pacific currently holds the largest market share, estimated around 35%.

North America has shown significant room for growth in specific segments.