Cyber Warfare Market Size (2025 – 2030)

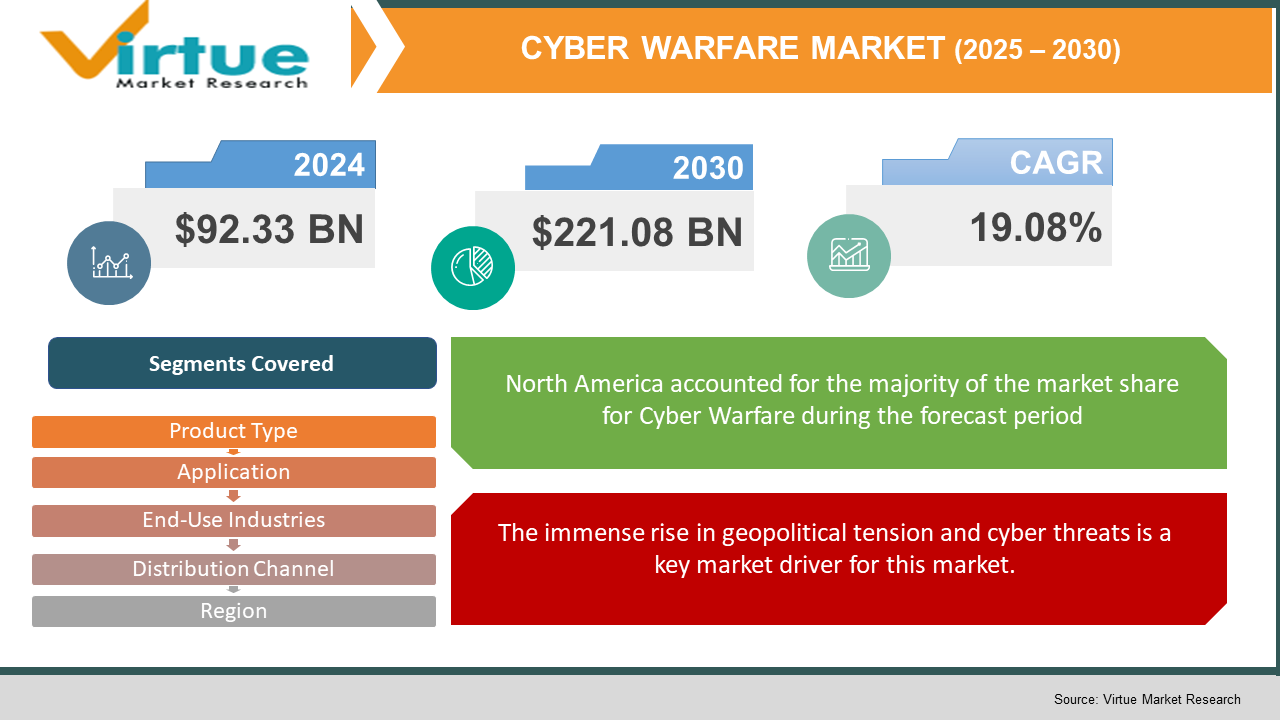

The Global Cyber Warfare Market was valued at USD 92.33 billion and is projected to reach a market size of USD 221.08 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 19.08%.

Geopolitical stress, sophisticated cyber threats, and digital evolution are all increasing worldwide, which is driving the rapid growth of the global cyber warfare market. Including both aggressive and defensive cyber systems, meant to detect, prevent, and minimize cyberattacks, the market covers a vast array of goods and solutions. Demand for sophisticated cyber warfare tools is driven by growing investments in cybersecurity infrastructure by businesses and governments, as well as by the mounting frequency and complexity of cyberattacks. The demand for strong cyber intelligence, surveillance, and fast-response systems has never been greater as national security and critical infrastructure become more and more exposed. Constantly changing, driven by cutting-edge technologies, government-sponsored cyber operations, and changing legislations, this market is evolving.

Key Market Insights:

- More than 70% of government departments stated that rising cyber threats are fueling quick market expansion.

- Enhancing system reliability and nearly 40% improving threat detection accuracy could be achieved with AI and machine learning.

- Among developed countries, investment in cyber defense has soared by 35%.

- Geopolitical disputes drive a 30% rise in the need for offensive and defense systems.

Cyber Warfare Market Drivers:

The immense rise in geopolitical tension and cyber threats is a key market driver for this market.

Driven by state-sponsored activities and organized cybercriminal organizations, global cyber threats have grown in sophistication as well as in number. Increasing political tensions in areas including Eastern Europe, the Middle East, and East Asia have forced governments to rethink their national defense policies by devoting a lot to cyber warfare potential as these changing threats now target essential infrastructure, financial systems, government networks, and military possessions. Reflecting a world urgency to shield vital systems against disruptive cyberattacks, defense and security budgets have experienced major rises in this atmosphere. Across the industry, the need for strong surveillance, threat intelligence, and quick response abilities is driving technological development. This pressure has increased both offensive and defensive cyber capacities, therefore driving market expansion since governments and big multinational firms extend their cyber defense portfolios to safeguard their economic and strategic interests.

The rapid advancements in the field of technology and the increase in digital integration are considered major market growth drivers.

Far more sophisticated defense and offensive maneuvers than previously available are made possible by technological innovation, which is changing cyber warfare. Key in increasing the accuracy of threat detection and boosting general system responsiveness are artificial intelligence-driven analytics, machine learning algorithms, and digital twin simulations. Real-time monitoring and pattern recognition made possible by these sophisticated tools could predict possible assaults before they actually happen. State-of-the-art processing tools and flexible cloud infrastructures have also lowered the total expense of data analysis and connection as data volumes rise. This convergence of advancing technologies has not only enhanced operational efficiencies but also created an environment where constant investments in next-generation cyber solutions are both possible and required, therefore growing market acceptance across numerous industries, including government, defense, and critical infrastructure.

The rise in investment levels by the government and the corporate sector is driving the growth of this market.

Both businesses and public agencies are increasing their cybersecurity spending quite dramatically in reaction to the increasing threat environment. Driven by the pressing need to protect sensitive information and safeguard vital infrastructure, public and private spending is funneling more resources into advanced cyber defense systems. High-profile cyberattacks and continual hacking attempts have highlighted the flaws in traditional security systems, therefore driving a constant rise in expenditure on cyber warfare tools. Strategic projects such as public-private partnerships and digital transformation efforts, which seek to modernize and protect national cyber infrastructures, only serve to reinforce this trend. The strong investment environment is driving an innovation cycle whereby more R&D, advanced technology adoption, and market expansion support one another, therefore guaranteeing long-term cyber warfare market growth.

The recent advancement in IoT and network connectivity is considered a major market growth driver.

The explosion of the Internet of Things (IoT) has dramatically increased the number of connected devices across industries, from industrial control systems to consumer electronics, creating new vulnerabilities but also prompting new security demands. The interconnectivity of devices means that a breach in one area can result in general network vulnerability as digital infrastructures grow more sophisticated. To reduce these dangers, it is vitally important that IoT security solutions include strong encryption techniques, real-time monitoring, and the incorporation of blockchain advances. Improved network connectivity enabled by technologies including 5G has given the capacity demanded for real-time data transmission and ideal operation of sophisticated threat detection systems. The demand for advanced cyber warfare solutions that may protect these networks is increasing as IoT environments develop, so driving fast market acceptance of state-of-the-art technologies and combined security frameworks.

Cyber Warfare Market Restraints and Challenges:

The high level of capital investment and operational costs is a great challenge faced by the market.

Creating and installing sophisticated cyber warfare systems calls for substantial monetary investment. Companies have to fund cutting-edge equipment (such as sophisticated sensors, processors, and communication devices), special software systems, and total cybersecurity solutions. These costs cover the continual cybersecurity monitoring, software updates, system maintenance, and other expenses, as well as the original purchase of these systems. For example, millions of dollars in investment might be needed to set up reliable communication systems and incorporate AI-powered threat detection. Companies in developing nations and smaller ones sometimes find these large initial and operating expenses handicapping, since they prevent widespread acceptance. This financial obstacle slows down competitive dynamics and restricts market penetration since firms with bigger budgets would have a substantial edge in improving and deploying their cyber defense architecture.

The market faces issues related to interoperability and the complexity of the system, hindering its growth.

Significant technical issues arise from the incorporation of many different cyber weaponry systems into current IT environments. Many companies run older systems that were created to enable contemporary digital security solutions. This sets a challenging scene whereby modern systems have to integrate smoothly with older infrastructure. Different system performance, compromised security coverage, and problems in data exchange might all result from variations in technology standards and a lack of global interoperability standards. Deploying multi-vendor solutions exacerbates integration issues because differences in communication protocols, data formats, and software compatibility require great customization and occasionally proprietary middleware solutions. Longer implementation times, more operational interruptions, and increased costs resulting from these issues all serve to slow down quick adoption and therefore impede the general efficiency of cyber defense plans.

The concerns related to the regulatory environment pose a great challenge for the market.

The cyber warfare sector works in a vastly changing and fractured legislative environment. Legal systems and compliance demands differ widely across jurisdictions, with rules controlling both offensive and defensive cyber operations sometimes changing frequently. Data gathering, processing, and storage are all subject to rigorous criteria under privacy laws like the European Union's GDPR and a number of national cybersecurity standards. Furthermore, increasing the complexity of ethical issues regarding the use of offensive cyber tools, such as possible collateral effects and effects on civilian infrastructure, is their deployment. To guarantee their systems meet ever-shifting legal and moral norms, manufacturers and operators must assign large resources. By forcing businesses to negotiate many compliance terrains, which might act as a barrier to quick market expansion, this continuous regulatory uncertainty raises operating costs, slows down product launches, and may restrict innovation.

The market faces a major challenge from the risks related to cybersecurity and data privacy, hence affects the growth of the market.

The sector emphasizing network security has a built-in exposure to cyber threats and data privacy. Sophisticated cyberattacks find appealing objectives in cyber warfare systems that grow increasingly interconnected and integrated. A company's reputation can be seriously compromised, and substantial financial losses can follow should high-profile breaches or system intrusions occur. Businesses need to keep financial loss, regulatory fines, higher liability, and other risks under control by ongoing substantial investment in strong encryption, safe data storage, and real-time threat detection technologies. Particularly if one is trying to protect broad and varied digital infrastructures, the expense and difficulty of keeping strict security standards can be significant. Additionally, the sensitive character of the data these systems handle, from military intelligence to private company information, means that any breach threatens operational integrity and invites strong government scrutiny and possible legal liabilities as well. Particularly in areas with limited cybersecurity resources, the persistent demand for sophisticated security measures and proactive threat management presents an ongoing difficulty that could stifle technological adoption and market expansion.

Cyber Warfare Market Opportunities:

The market has an opportunity to expand its operations as developing nations are considered to be the emerging markets.

Under rising cyber risks, growing markets in areas such as Latin America, Africa, and Asia - Asia-Pacific are fast modernizing their digital infrastructure. To safeguard vital national defense and economic sectors, governments in these areas are spending much on strong cybersecurity programs. This encouraging atmosphere is generating fresh consumer groups in the private as well as the public domain. Developing customized cyber warfare solutions that fit local dangers, legal subtleties, and particular threat profiles will help businesses capture unused market share. Countries with fast digital transformation and increasing internet penetration, for example, need inexpensive, scalable cyber defense systems to guard expanding digital ecosystems. By tailoring items to fit local demands, that is, localized threat intelligence and region-specific data protection procedures, businesses may achieve great expansion and build a solid presence in previously ignored markets.

The integration with AI and Predictive Analytics presents an opportunity to improve threat detection capability.

Threat detection and response ability is being transformed by the combination of AI-powered predictive analytics and machine learning techniques into cyber warfare systems. These technologies enable early spotting of possible breaches and proactive defense measures by means of real-time monitoring and fast analysis of huge quantities of security data. Through the prediction of system weaknesses and simulation of several attack scenarios, digital twin simulations and sophisticated analytics models improve the general reliability and robustness of cyber defense infrastructure. This creative integration not only enhances operational efficiency but also shortens reaction times and limits possible damage from cyberattacks. The rising appeal of investment in these technologies, driven by falling computing power costs and growing data processing capabilities, pushes higher government department and multinational corporation acceptance for cutting-edge security solutions.

The existence of a strategic partnership between the public and private sectors poses a great opportunity for the market to come up with great innovations.

By means of cooperative efforts among research institutions, private businesses, and governments, great potential exists for the development of cyber warfare tools. Strategic public-private partnerships can help lower standardization efforts, share R&D costs, and create interoperable security frameworks that tackle challenging cyber threats. Cooperation helps to combine knowledge and resources, therefore speeding innovation cycles and product development. Furthermore, of great importance for increasing worldwide acceptance are their key part in defining industry norms and regulatory convergence. Furthermore, partnerships between established cybersecurity companies and budding technology startups might produce innovative solutions addressing both offensive and defensive cyber activities, therefore raising consumer confidence and investor hope.

The recent innovation in the products and their diversification is seen as a great opportunity for the market to grow.

Another important opportunity in the cyber warfare industry is expanding the product portfolio via diversification. The growing complexity of cyber threats calls for a spectrum of responses from offensive cyber powers and intelligence surveillance technologies to extremely integrated defensive systems. Modular, adaptable product architectures that enable customization based on consumer demands and threat profiles are receiving investment from manufacturers. Companies can meet a wider range of government and industry requirements by creating differentiated goods, platforms with sophisticated incident response, extensive network monitoring, and real‑time threat intelligence. By providing several revenue streams, this diversification helps to reduce risks and enables businesses to reach premium market segments. Essential for keeping a competitive advantage in an ever-changing threat environment is constant innovation in product design and technology.

CYBER WARFARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

19.08% |

|

Segments Covered |

By Product Type, application, end user industries, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cisco System, IBM, Palo Alto Networks, Fortinet, Check Software Technologies, McAfee, Symantec (Broadcom), Juniper Networks, Dell Technologies, Honeywell |

Cyber Warfare Market Segmentation:

Cyber Warfare Market Segmentation: By Product Type

- Cybersecurity Solutions

- Offensive Cyber Weapons

- Defensive Cyber Systems

- Intelligence & Surveillance Tools

The cybersecurity solutions segment dominates the market, as this segment is dominant due to its wide application in safeguarding critical infrastructure and corporate networks. Encompasses a variety of defensive tools for real-time monitoring and threat mitigation. The intelligence and surveillance tools segment is the fastest-growing segment. Rapid growth for this sector results from proactive threat hunting and strategic intelligence investments by businesses and governments.

Systems and techniques intended for proactive, hostile cyber operations come under the offensive cyber weapons segment. Defensive Cyber Systems consists of systems activated against cyberattacks meant to stop, detect, and respond to such attacks.

Cyber Warfare Market Segmentation: By Application

- Government Defense

- Critical Infrastructure Protection

- Corporate Security

- Cybercrime Prevention

The government defense segment dominates the market because of continued high spending on national security and defense budgets. It is used by official agencies to protect sensitive infrastructure and national security. The cybercrime prevention segment is the fastest-growing segment, which is due to the increased incidence of global cyber threats and the shift to remote work and digital operations. It emphasizes proactive monitoring and threat deterrence to keep cybercrimes at bay.

In the critical infrastructure protection segment, it is applied in protecting transportation networks, water systems, and power grids. Whereas, in the corporate security segment, large companies use corporate security to safeguard sensitive corporate assets and information.

Cyber Warfare Market Segmentation: By End-Use Industries

- Defense

- Government

- Finance

- Healthcare

- IT &Telecom

Here, the defense segment dominates the market because of high strategic value and large budgets. It entails advanced cyber warfare capabilities being employed by government agencies and the military. The IT & Telecom segment is the fastest-growing segment of the market as a result of enhanced digital transformation and the great risk of cyberattacks in data‑intensive sectors. Companies are heavily relying on digital infrastructure in this segment.

The government segment includes law enforcement and emergency response, as well as other public sector organizations apart from defense. Financial institutions are using the Internet of Things and sophisticated data security tools to guard transactions. Healthcare systems are using IoT-based cybersecurity to guard patient data.

Cyber Warfare Market Segmentation: By Distribution Channel

- Direct Sales

- Distributors

- Online Retail

The direct sales segment is the dominant one here. High-value, personalized products are usually distributed by direct sales. Sometimes entail direct agreements with the government, big businesses, and military services. The online retail segment is the fastest-growing segment, as digital procurement and e-commerce become prevalent. The distributors segment includes local middlemen who help in penetrating the market in various regions.

Cyber Warfare Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is the leader of the market due to continuous cybersecurity investments and proactive state-sponsored projects. The Asia-Pacific region is the fastest-growing region in this market. Rapid industrialization and digital transformation drive considerable development, especially in developing countries throughout the region. Notable technical investments, increasing digital infrastructure, and changing government regulations cause Asia-Pacific to be the fastest-growing region.

The European region is characterized by strict regulations and a great focus on data privacy defines the area, and strong cybersecurity efforts. Increasing cyber risks and growing digital infrastructure in developing countries provide untapped growth possibilities for the MEA and South American regions.

COVID-19 Impact Analysis on the Global Cyber Warfare Market:

The digital evolution of companies and governments was sped up by the COVID-19 epidemic, which in turn raised the risk level for cyber warfare. Adversaries leveraged rising digital infrastructure weaknesses as remote work and virtual collaboration became the standard, causing advanced cyberattacks to explode. This has caused governments and businesses to increase their cybersecurity investments and real-time risk detection capacity. In reaction, next-generation cyber warfare tools such as AI-driven analysis, sophisticated intrusion detection devices, and improved data encryption techniques have been quickly accepted. The epidemic also drove regulatory changes and public–private collaboration meant to reinforce national cyber defense systems, therefore guaranteeing a more robust digital ecology that keeps changing in reaction to modern threats.

Latest Trends/ Developments:

Threat detection and operational efficiency are quickly improving with advanced analytics and predictive algorithms.

Increasingly used to model, monitor, and optimize network operations in real time are digital twin simulations.

Combining edge and cloud computing enhances data availability, thus raising security levels and quickening response times.

Efforts are underway to synchronize standards for IoT and cybersecurity, therefore enabling easier cross-border integration and faster time-to-market.

Key Players:

- Cisco Systems

- IBM

- Palo Alto Networks

- Fortinet

- Check Software Technologies

- McAfee

- Symantec (Broadcom)

- Juniper Networks

- Dell Technologies

- Honeywell

Chapter 1. Cyber Warfare MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Cyber Warfare MARKET– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Cyber Warfare MARKET– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Cyber Warfare MARKET- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Cyber Warfare MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Cyber Warfare MARKET– By Product Type

6.1 Introduction/Key Findings

6.2 Cybersecurity Solutions

6.3 Offensive Cyber Weapons

6.4 Defensive Cyber Systems

6.5 Intelligence & Surveillance Tools

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Cyber Warfare MARKET– By Application

7.1 Introduction/Key Findings

7.2 Government Defense

7.3 Critical Infrastructure Protection

7.4 Corporate Security

7.5 Cybercrime Prevention

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. Cyber Warfare MARKET– By End-Use Industries

8.1 Introduction/Key Findings

8.2 Defense

8.3 Government

8.4 Finance

8.5 Healthcare

8.6 IT &Telecom

8.7 Y-O-Y Growth trend Analysis End-Use Industries

8.8 Absolute $ Opportunity Analysis End-Use Industries , 2025-2030

Chapter 9. Cyber Warfare Market– By Distribution Channel

9.1 Introduction/Key Findings

9.2 Private Individuals

9.3 Commercial Operators

9.4 Government and Defense

9.5 Y-O-Y Growth trend Analysis Distribution Channel

9.6 Absolute $ Opportunity Analysis Distribution Channel, 2025-2030

Chapter 10. Cyber Warfare MARKET, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Product Type

10.1.3. By End-Use Industries

10.1.4. By Application

10.1.5. Distribution Channel

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Product Type

10.2.3. By End-Use Industries

10.2.4. By Application

10.2.5. Distribution Channel

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Product Type

10.3.3. By Distribution Channel

10.3.4. By Application

10.3.5. End-Use Industries

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Distribution Channel

10.4.3. By Application

10.4.4. By Product Type

10.4.5. End-Use Industries

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By End-Use Industries

10.5.3. By Distribution Channel

10.5.4. By Application

10.5.5. Product Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. CYBER WARFARE MARKET– Company Profiles – (Overview, Portfolio, Financials, Strategies & Developments)

11.1 Cisco Systems

11.2 IBM

11.3 Palo Alto Networks

11.4 Fortinet

11.5 Check Software Technologies

11.6 McAfee

11.7 Symantec (Broadcom)

11.8 Juniper Networks

11.9 Dell Technologies

11.10 Honeywell

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Strong government spending, digital transformation, and advanced threat escalation are some of the key market drivers for this market, which are helping it to grow

Digital threats and remote employment were accelerated by COVID-19, which increased cyber defense spending

Advanced threat detection depends on artificial intelligence, machine learning, and real-time data analysis are some of the technologies that are important for the market

Some of the challenges faced by this market are interoperability problems, regulatory intricacies, high capital expenses, and changing cyber threats

North America leads this market since it has a better research and development sector, robust regulations, and major investments