GLOBAL CUSTOMER DATA PLATFORMS (CDP) MARKET (2024 - 2030)

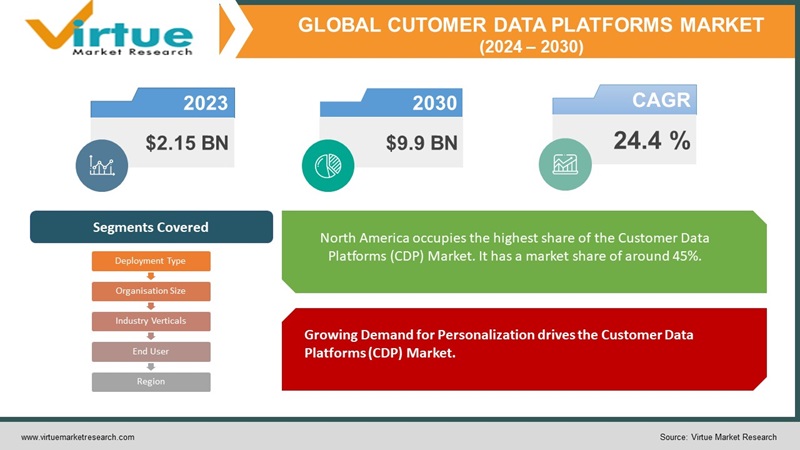

The Global Customer Data Platforms (CDP) Market was valued at USD 2.15 billion and is projected to reach a market size of USD 9.9 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 24.4%.

Customer Data Platforms (CDP) are designed to consolidate and integrate customer data from various sources into a unified customer profile. This provides a 360-degree view of the customer and thus enables businesses to deliver more personalized and targeted marketing campaigns. The Customer Data Platforms (CDP) Market is expected to grow significantly in the coming years due to technological AI advancements and the increasing importance of leveraging customer data for improved marketing strategies in businesses. The major well-established key players in the Customer Data Platforms (CDP) Market are Salesforce, Adobe, Segment, Tealium, and Optimizely.

Key Market Insights:

Customer Data Platforms were often integrated with other marketing technologies such as marketing automation platforms, CRM systems, and analytics tools. This enhances the overall marketing and enables more effective data-driven decision-making for businesses.

Regulatory compliance and data privacy, the rise of E-commerce and digital channels, real-time data processing, cross-channel marketing, AI and Machine Learning integration, increasing competition and customer expectations are propelling the Customer Data Platforms (CDP) Market. The restraints to the Customer Data Platforms (CDP) Market include data security and privacy concerns.

North America occupies the highest share of the Customer Data Platforms (CDP) Market. The United States is expected to have the largest market share and according to Treasure Data, there are 72 CDP suppliers headquartered in the United States. The presence of key players like Salesforce, Oracle, and Tealium is propelling the market in this region.

Customer Data Platforms (CDP) Market Drivers:

Growing Demand for Personalization drives the Customer Data Platforms (CDP) Market.

The increasing demand for personalized customer experiences is the primary driver for the adoption of Customer Data Platforms. Businesses recognize the importance of delivering personalized content, recommendations, and offers to enhance customer engagement and satisfaction. Customer Data Platforms play a crucial role by aggregating and unifying customer data from various sources, creating a comprehensive customer profile. This profile contains customer information including demographic information, behavioral data, and preferences. This enables marketers to organize highly targeted and personalized campaigns. Businesses seek to stay updated in a competitive landscape where customer personalization is extremely important.

Rise in Data Volume and Complexity are propelling the Customer Data Platforms (CDP) Market.

The digital landscape is witnessing a substantial increase in the volume and complexity of data generated by customers across multiple channels. This data, including information from websites, mobile apps, social media, and offline interactions, created a challenge for businesses to effectively manage and derive insights from the vast amount of customer information. Customer Data Platforms solves this challenge. Customer Data Platforms provide a unified and comprehensive view of customer data.CDPs enable businesses to make more informed decisions, understand customer behavior across channels, and extract valuable insights. The rising complexity of data ecosystems and the need to derive actionable insights from diverse data sources were key drivers of the Customer Data Platforms (CDP) Market.

Customer Data Platforms (CDP) Market Restraints and Challenges

The major challenges faced by the Customer Data Platforms (CDP) Market is the data privacy and compliance concerns. Data privacy regulations such as GDPR (General Data Protection Regulation), CCPA (California Consumer Privacy Act), and others may raise concerns for companies. Businesses had to be cautious about how they collected, stored, and used customer data. Handling information during the process may raise concerns for companies. Companies should implement security measures to protect user data. Another challenge is the high ongoing costs related to maintenance, updates, and integration with other systems. The other restraints to the Customer Data Platforms (CDP) Market include integration with existing systems and organizational change management.

Customer Data Platforms (CDP) Market Opportunities:

The Customer Data Platforms (CDP) Market has various opportunities in the market. With the integration of AI and machine learning (ML) capabilities Customer Data Platforms (CDP) Market is anticipated to witness significant growth in the coming years. This provides more personalized customer behavior, identifies trends, and optimizes marketing campaigns. Customer Data Platforms can empower businesses to deliver real-time, personalized experiences to customers like interactions, providing personalized content, offers, and recommendations. Customer Data Platforms enable businesses to unify customer data from various channels such as websites, mobile apps, social media, and offline stores. This helps in more cohesive and effective multi-channel marketing strategies.

GLOBAL CUSTOMER DATA PLATFORMS (CDP) MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

24.4 % |

|

Segments Covered |

By Deployment Type, Organisation Size, Industry Vehicles, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Adobe, Salesforce, Segment, Tealium, mParticle Optimizely, BlueConic, Redpoint Global, Lytics Treasure Data, Exponea, Zaius, BlueVenn, Arm Treasure Data, Acquia |

Customer Data Platforms (CDP) Market Segmentation

Customer Data Platforms (CDP) Market Segmentation: By Deployment Type:

- On-Premises

- Cloud-Based

In 2023, based on market segmentation by deployment type, Cloud-based occupies the highest share of the Customer Data Platforms (CDP) Market. This is mainly due to the flexibility, scalability, and accessibility offered by cloud-based CDP solutions. Cloud-based CDPs eliminate the need for on-premises infrastructure, reduce upfront costs, and provide the agility to scale resources as needed.

Cloud-based is also the fastest-growing segment during the forecast period and is projected to grow at a higher CAGR of 20 %. This is due to the increasing preference for cloud-based deployments as cloud security continues to advance. The concerns about data security in the cloud are diminishing.

Customer Data Platforms (CDP) Market Segmentation: By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

In 2023, based on market segmentation by Organization Size, the Large Enterprises segment occupies the highest share of the Customer Data Platforms (CDP) Market. Larger enterprises, with more complex data ecosystems, tend to adopt CDPs to manage and leverage vast amounts of customer data.

However, the Small and Medium-sized Enterprises (SMEs) are the fastest-growing segment during the forecast period. This is mainly due to the increasing need for streamlining customer data management and enhancing marketing efforts.

Customer Data Platforms (CDP) Market Segmentation: By Industry Verticals:

- Retail and E-commerce

- Financial Services

- Healthcare

- Telecommunications

- Travel and Hospitality

- Media and Entertainment

- Others

In 2023, based on market segmentation by Industry Verticals, the Retail and E-commerce segment occupies the highest share of the Customer Data Platforms (CDP) Market. CDPs in this sector help businesses understand customer behavior, preferences, and purchase patterns. They enable personalized marketing campaigns, and recommendations, and improve overall customer experiences.

However, Financial Services is the fastest-growing segment during the forecast period. CDPs can be used for customer segmentation, personalized financial product recommendations, fraud detection, and improving customer engagement through targeted communication.

The healthcare sector is also expected to grow significantly as CDPs help to manage patient data, enhance patient engagement, and improve healthcare outcomes. This includes personalized communication, appointment reminders, and treatment plan adherence.

CDPs in the Media and entertainment sector also show positive growth as they assist with audience segmentation, content personalization, and targeted marketing for media and entertainment services.

Customer Data Platforms (CDP) Market Segmentation: By End-User:

- B2B (Business-to-Business)

- B2C (Business-to-Consumer)

In 2023, based on market segmentation by the end users, the B2C (Business-to-Consumer) segment occupies the highest share of the Customer Data Platforms (CDP) Market. This is mainly due to the increasing demand for CDPs to collect and analyze data from individual consumers to create personalized marketing strategies and enhance customer engagement. This involves personalized recommendations, targeted advertising, and tailoring marketing messages to specific consumer segments.

Also, B2C (Business-to-Consumer) is the fastest-growing segment during the forecast period. B2C companies, particularly in retail, e-commerce, and entertainment, use CDPs to enhance customer experiences and personalize marketing efforts.

The B2B segment has seen significant adoption of CDPs especially those in industries like technology, finance, and manufacturing.

Customer Data Platforms (CDP) Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2023, based on market segmentation by region, North America occupies the highest share of the Customer Data Platforms (CDP) Market. It has a market share of around 45%. This growth is due to the high adoption rate of advanced technologies, and many key players in the CDP space are headquartered in North America. North America is a technologically advanced region with nations like the U.S. having higher growth and expected to grow at a high CAGR during the forecast period. The United States has been a major hub for CDP adoption. Amplitude, Inc. introduced Amplitude CDP, an insights-driven CDP that focuses on proactively improving data quality for product and marketing teams. This aims to identify new audiences and synchronize data across marketing and data stacks. Blueshift raised USD 30 million for its AI-based integrated marketing approach and offered the SmartHub CDP platform, allowing the aggregation of data from various sources.

However, Asia-Pacific is the fastest-growing segment during the forecast period. This is mainly due to the increasing importance of data-driven strategies. Businesses are investing in technologies like CDPs to enhance customer experiences and drive marketing effectiveness. The market in countries like India, China, and Japan is expected to grow faster due to the increasing

number of online users. Sectors such as BFSI (Banking, Financial Services, and Insurance), Retail, and e-commerce are rapidly adopting CDPs.

COVID-19 Impact Analysis on the Global Content Curation Software Market:

There were lockdowns and other preventive restrictions. This accelerated the adoption of remote work. The pandemic also led to changes in consumer behavior, with increased online interactions and e-commerce activities. This increased the demand for CDPs to better understand and engage with customers online. Businesses use CDPs to analyze and respond to customer shifts, enhancing their ability to provide personalized and relevant customer experiences. The pandemic also accelerated the adoption of cloud-based CDP solutions for remote and digital work. Thus, the pandemic accelerated certain trends in the Customer Data Platforms (CDP) Market.

Latest Trends/ Developments:

One of the developments, in the Customer Data Platforms (CDP) Market is the rise in integration of artificial intelligence (AI) and machine learning (ML) capabilities. This enhances data analysis, enabling predictive modeling, automation, and more advanced customer segmentation. Real-time data processing capabilities are becoming a crucial aspect of CDPs as businesses seek to leverage up-to-the-minute insights for personalized marketing, dynamic customer interactions, and timely decision-making. There is a rise of Customer Data Platforms as a Service (CDPaaS). This provides a cloud-based, scalable, and subscription-based model, especially for smaller businesses with limited resources. Convergence of CDP with Customer Experience (CX) Platforms is also becoming popular as it connects with other tools for a unified customer experience.

Key Players:

- Adobe

- Salesforce

- Segment

- Tealium

- mParticle

- Optimizely

- BlueConic

- Redpoint Global

- Lytics

- Treasure Data

- Exponea

- Zaius

- BlueVenn

- Arm Treasure Data

- Acquia

Market News:

- In July 2022, Tealium released its specialized solution, Tealium for Pharma, within its independent customer data platform (CDP). This aims to meet the unique challenges posed by the continually evolving privacy and security regulations in the pharmaceutical industry. Tealium's vertically integrated platform automates a superior customer experience specifically for Pharma audiences.

- In August 2022, mParticle, a prominent player in customer data infrastructure, made strategic strides by acquiring Vidora, an AI customization platform. mParticle partner network with over 300 API connections, teams now create and deploy advanced models. This enhances decision-making, segmentation, and personalization.

Chapter 1. Global Customer Data Platforms Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Customer Data Platforms Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Global Customer Data Platforms Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Customer Data Platforms Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Customer Data Platforms Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Customer Data Platforms Market – By Deployment Type

6.1. On – Premises

6.2. Cloud Based

Chapter 7. Global Customer Data Platforms Market – By Organisation Size

7.1. Small and Medium-sized Enterprises (SMEs)

7.2. Large Enterprises

Chapter 8. Global Customer Data Platforms Market – By Industry Verticals

8.1. Retail and E-commerce

8.2. Financial Services

8.3. Healthcare

8.4. Telecommunications

8.5. Travel and Hospitality

8.6. Media and Entertainment

8.7. Others

Chapter 9. Global Customer Data Platforms Market – By End User

9.1. B2B (Business-to-Business)

9.2. B2C (Business-to-Consumer)

Chapter 10. Global Customer Data Platforms Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Deployment Type

10.1.3. By Organisation Size

10.1.4. By Industry Verticals

10.1.5. End User

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Deployment Type

10.2.3. By Organisation Size

10.2.4. By Industry verticals

10.2.5. End User

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.2. By Country

10.3.2.2. China

10.3.2.2. Japan

10.3.2.3. South Korea

10.3.2.4. India

10.3.2.5. Australia & New Zealand

10.3.2.6. Rest of Asia-Pacific

10.3.2. By Deployment Type

10.3.3. By Organisation Size

10.3.4. By Industry Verticals

10.3.5. End User

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.3. By Country

10.4.3.3. Brazil

10.4.3.2. Argentina

10.4.3.3. Colombia

10.4.3.4. Chile

10.4.3.5. Rest of South America

10.4.2. By Deployment Type

10.4.3. By Organisation Size

10.4.4. By Industry Verticals

10.4.5. End User

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.4. By Country

10.5.4.4. United Arab Emirates (UAE)

10.5.4.2. Saudi Arabia

10.5.4.3. Qatar

10.5.4.4. Israel

10.5.4.5. South Africa

10.5.4.6. Nigeria

10.5.4.7. Kenya

10.5.4.10. Egypt

10.5.4.10. Rest of MEA

10.5.2. By Deployment Type

10.5.3. By Organisation Size

10.5.4. By Industry Verticals

10.6.5. End User

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Customer Data Platforms Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1. Adobe

11.2. Salesforce

11.3. Segment

11.4. Tealium

11.5. mParticle

11.6. Optimizely

11.7. BlueConic

11.8. Redpoint Global

11.9. Lytics

11.10. Treasure Data

11.11. Exponea

11.12. Zaius

11.13. BlueVenn

11.14. Arm Treasure Data

11.15. Acquia

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Customer Data Platforms (CDP) Market was valued at USD 2.15 billion and is projected to reach a market size of USD 9.9 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 24.4 %.

Growing demand for personalization, rise in data volume and complexity, and technological advancements are the market drivers of the Global Customer Data Platforms (CDP) Market.

On-premises and Cloud-Based are the segments under the Global Customer Data Platforms (CDP) Market by Deployment Type.

North America is the most dominant region for the Global Customer Data Platforms (CDP) Market.

Adobe, Salesforce, Segment, Tealium, and mParticle are the key players in the Global Customer Data Platforms (CDP) Market.