Cumin Microgreens Market Size (2024 – 2030)

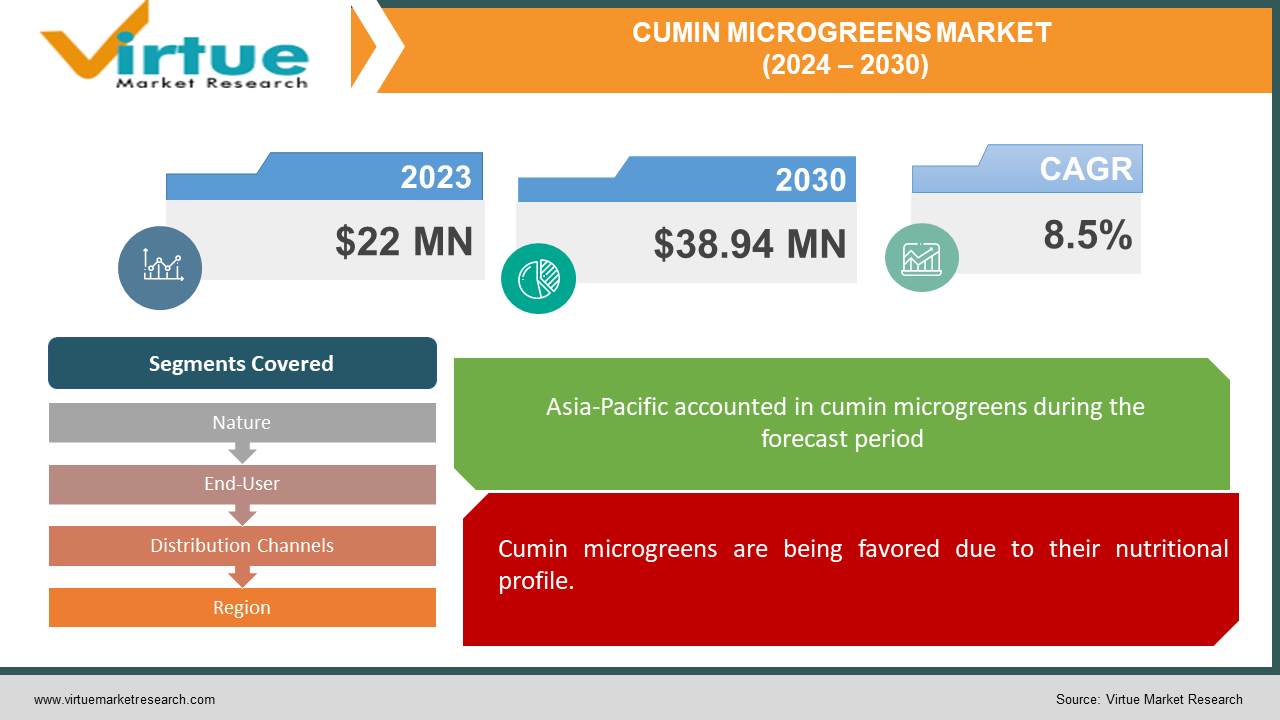

The global cumin microgreens market was valued at USD 22 million and is projected to reach a market size of USD 38.94 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.5%.

Young, tasty seedlings with crisp, spicy, nutty leaves are called cumin microgreens. They add a wonderful flavor to Indian and Mexican food. Dried cumin seeds provide the fresh flavor of microcumin, a spicy, earthy, and nutty microgreen. It belongs to the parsley family and has a high iron content. The leaves of micro cumin are small, narrow, and have a slim, straight appearance. The long, bright green leaves are tapering to a point at the tip. They feel smooth, supple, and delicate, and their consistency is crisp, succulent, and tender. Concentrated herbaceous, earthy, and vegetal flavors with subtle nutty, toasty, semi-sweet, and bitter undertones are found in microcumin. They were initially a niche product in the past. This was because of limited awareness and availability. Presently, they have seen a notable acceleration owing to increased cultivation and demand. In the future, with a focus on innovation and technological advancements, significant growth is anticipated.

Key Market Insights:

The growing popularity of cumin microgreens can be attributed to their high content of vital minerals, antioxidants, and anti-inflammatory qualities, all of which support the immune system and may have other health benefits like lowering cholesterol, promoting better digestion, and reducing inflammation. The market is beset with obstacles that prevent scalability and market penetration, including high production costs, short shelf life, low consumer awareness, and fierce competition from substitute products.Opportunities for market growth encompass investigating varied culinary uses, utilizing indoor farming innovations for continuous production, venturing into developing economies, and emphasizing the advantages of cumin microgreens in various dishes and drinks. According to market segmentation, conventional cumin microgreens are preferred because of their higher yields and ease of production; however, organic variants are growing at the quickest rate because of rising customer demand for produce that is both nutrient-dense and environmentally friendly.The market is dominated by the Asia-Pacific area, which is driven by nations with high rates of cultivation and rising investments in organic farming methods, such as China, Japan, and India.

Cumin Microgreens Market Drivers:

Cumin microgreens are being favored due to their nutritional profile.

Cumin microgreens are rich in copper, magnesium, zinc, and iron. These compounds are essential for strengthening the immune system. They are packed with antioxidants. Antioxidants have the potential to lessen inflammation and shield the body from the damaging effects of free radicals. Moreover, microgreens with cumin have anti-cancer qualities. Furthermore, they may reduce cholesterol. Studies have demonstrated that cumin can enhance digestion and reduce the incidence of food-borne infections. All these traits make it ideal to be incorporated into various food cuisines. In addition, it is added to drinks because of its unique flavor and anti-microbial and anti-fungal qualities. It even aids in reducing bloating issues and eliminating toxins from the body.

An increasing health consciousness has been enabling this development.

The standard of living has changed in several ways over the years. A greater percentage of people are being diagnosed with chronic illnesses due to an unhealthy diet and other environmental factors. As a result, a higher proportion of people have been focusing on prioritizing their physical and mental health. Customers are searching for wholesome products that support stronger immune systems. Besides this, an increasing population has elevated the need for innovative crops. The market for cumin microgreens has risen dramatically as a result of all these factors.

Cumin Microgreens Market Restraints and Challenges:

Associated costs, limited shelf life, a lack of consumer awareness, and intense competition are the main issues that the market is currently facing.

Cumin microgreen production frequently calls for specialized equipment, which can be costly to install and maintain. The cultivation requires lights, hydroponic systems, and climate-controlled conditions. This can be a major barrier for small-scale businesses, restricting the scalability of operations and impeding market expansion. Secondly, they have a shorter shelf life. It can be difficult to maintain freshness and quality during storage and transportation, which increases waste and reduces revenue for producers and retailers. Thirdly, the market may suffer significant losses if incorrect information about the crop is promoted. This variety's limited availability restricts the information. Therefore, spreading awareness of their advantages is crucial to building a larger client base. Furthermore, fresh herbs, salad greens, and other seasonings compete with cumin microgreens. Customers have many options, so it can be difficult to stand out in the market, leading to losses.

Cumin Microgreens Market Opportunities:

Expanding the applications in the culinary industry provides the market with an ample number of possibilities. Chefs and culinary experts are continuously working on introducing new food and beverage products to attract a broader consumer base. These spices are mainly used as garnishing agents for various salads, smoothies, stews, soups, and other curries. Additionally, their usage is being explored in tacos, dips, steaks, desserts, sushi, omelets, entrées, pizzas, etc. These crops are easy to grow. As such, indoor farming has gained prominence. Urban consumers can obtain fresh, locally grown microgreens throughout the year due to vertical farming, hydroponics, and aquaponics technology. Apart from this, expansion into emerging economies is beneficial. By highlighting the benefits of this spice in different countries, revenue generation can be increased.

CUMIN MICROGREENS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.5% |

|

Segments Covered |

By Nature, End-Users, Distribution Channels, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Gotham Greens, Plenty Unlimited Inc., AeroFarms, BrightFarms, Square Roots, Urban Produce LLC, Farm.One, Lufa Farms, Bowery Farming, Infarm |

Cumin Microgreens Market Segmentation: By Nature

-

Organic

-

Conventional

The conventional category is the largest growing type. This is primarily due to a larger yield over a shorter time frame. More crops are grown with the aid of fertilizers, growth hormones, and other chemicals. Because there are sophisticated technologies and processes for amenities like irrigation, this method is also simple. Additionally, this approach has been widely used for a long time, making it a popular choice. Besides, conventional crops are generally available in a variety of distribution methods and are usually affordable compared to organic produce. However, because there is a greater need for nutrient-dense spices, the organic category is expanding at the fastest rate. Numerous studies have proved that produce obtained this way lowers the risk of numerous chronic ailments, including cancer, diabetes, high cholesterol, and other heart problems. These crops are rich in nutritional content when compared to conventional ones. Moreover, their influence on our environment is favorable, as no harmful chemicals are used during cultivation.

Cumin Microgreens Market Segmentation: By End-Users

-

Commercial

-

Residential

Based on end users, the commercial sector is the largest growing segment. This is because of its extensive use in the food industry. These spices are commonly used in many cafés, restaurants, and other food retail facilities for various beverages and food products. Additionally, an increasing number of food establishments has contributed to the success. These restaurants have been making an effort to serve cuisine that is genuine and distinctive. Microgreens' distinct flavor and texture give them potential. The residential sector is growing at the fastest rate. Cumin microgreen is associated with several advantageous health effects. Constant fitness goals have led to an increase in demand. Additionally, increased awareness due to better availability through internet platforms has increased sales. This is a very common spice used in many Asian households. As such, the demand in this category has witnessed a boost.

Cumin Microgreens Market Segmentation: By Distribution Channels

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online Retail

-

Others

Supermarkets and hypermarkets are the largest growing distribution channel. Consumers can talk to the store owners, ask questions, and look at the products to gauge their quality visually. In addition, negotiating over the goods helps them alter the price. Additionally, people who are uncomfortable or unfamiliar with the Internet prefer to purchase in person, which increases demand. Besides, these stores are available in most of the colonies, making accessibility simpler. The industry's fastest-growing distribution channel is online retail. The main cause of this is availability. Because it is so convenient, customers go with this alternative. They will also have greater access to a greater variety of domestic and foreign types. Customers might profit from online websites by getting free delivery and discounts. Furthermore, the industry has expanded due to the growing trend of digitalization.

Cumin Microgreens Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest and fastest-growing market. This market is led by nations like China, Japan, and India. These regions account for half of the total world's revenue due to their high cultivation, resulting in greater yields. As a result, this region imports and exports a sizable portion of this product. Furthermore, the concentration on organic farming practices is facilitating the expansion. Many Asian countries use cumin microgreens as a daily spice in a lot of their food products. Customers have access to a wide variety of options because of the widespread presence of e-commerce. Additionally, the growing investments made through different government initiatives and corporate partnerships are helping the market.

COVID-19 Impact Analysis on the Global Cumin Microgreens Market:

The outbreak of the virus had a mixed impact on the market. Lockdowns, social exclusion, and restricted movement became the new normal. The logistics, transportation, and supply chain were all severely disrupted as a result. Activities related to import-export trade were impacted by this. Due to regulations, hotels, restaurants, and other food establishments were temporarily shuttered. This had an impact on the product's sales. Besides, sickness and uncertainty prevented enough manpower from being available to complete the end-to-end operations. Numerous nations had a decline in their economies. As per the Economic Times, due to the coronavirus outbreak in China, a major importer of spice, and expectations of a bumper harvest, the price of cumin fell by 20% during the first half of the pandemic. However, on the other hand, a lot of people started emphasizing their health. Individuals began searching for products that improved their immunity. Cumin is associated with enhancing the immunity of an individual. People began to incorporate this spice into their food and beverages for a healthier body. A DSM survey stated that 60% of consumers globally believe the epidemic has increased their awareness of the importance of living a healthy lifestyle to avert health issues. Boredom led to the creation of new pastimes and pursuits, such as indoor farming. Vendors began to focus on establishing a virtual presence to increase profits. People started to depend on online trade due to its convenience. Post-pandemic, the market has continued to grow owing to the relaxation of rules and regulations.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this. Consumers who care about the environment may be won over by highlighting sustainable agriculture methods, including organic farming, regenerative agriculture, and water-saving strategies. Cumin microgreens can be positioned as an environmentally friendly food option by emphasizing their compostable ingredients, eco-friendly packaging, and carbon footprint reduction initiatives.

Key Players:

-

Gotham Greens

-

Plenty Unlimited Inc.

-

AeroFarms

-

BrightFarms

-

Square Roots

-

Urban Produce LLC

-

Farm.One

-

Lufa Farms

-

Bowery Farming

-

Infarm

In August 2023, a room in the house at Little Farm at Jomo Kenyatta University of Agriculture and Technology (JKUAT) in Juja was transformed into a thoughtfully planned microgreen oasis, with each plant thoughtfully planted in its location. From cumin and chives to basil, Samuel Kamau had established a little herb and vegetable garden. The idea was to use microgreens to close the nutrient deficit.

Chapter 1. Cumin Microgreens Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cumin Microgreens Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cumin Microgreens Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cumin Microgreens Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cumin Microgreens Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cumin Microgreens Market – By Nature

6.1 Introduction/Key Findings

6.2 PROFIBUS

6.3 Organic

6.4 Conventional

6.5 Y-O-Y Growth trend Analysis By Nature

6.6 Absolute $ Opportunity Analysis By Nature, 2024-2030

Chapter 7. Cumin Microgreens Market – By Distribution Channels

7.1 Introduction/Key Findings

7.2 Supermarkets & Hypermarkets

7.3 Specialty Stores

7.4 Online Retail

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Distribution Channels

7.7 Absolute $ Opportunity Analysis By Distribution Channels, 2024-2030

Chapter 8. Cumin Microgreens Market – By End User

8.1 Introduction/Key Findings

8.2 Commercial

8.3 Residential

8.4 Y-O-Y Growth trend Analysis By End User

8.5 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Cumin Microgreens Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Nature

9.1.3 By Distribution Channels

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Nature

9.2.3 By Distribution Channels

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Nature

9.3.3 By Distribution Channels

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Nature

9.4.3 By Distribution Channels

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Nature

9.5.3 By Distribution Channels

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Cumin Microgreens Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Gotham Greens

10.2 Plenty Unlimited Inc.

10.3 AeroFarms

10.4 BrightFarms

10.5 Square Roots

10.6 Urban Produce LLC

10.7 Farm.One

10.8 Lufa Farms

10.9 Bowery Farming

10.10 Infarm

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global cumin microgreens market was valued at USD 22 million and is projected to reach a market size of USD 38.94 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.5%.

The nutritional profile and increased health consciousness are the main factors propelling the global cumin microgreens market.

Based on distribution channels, the global cumin microgreens market is segmented into supermarkets & hypermarkets, specialty stores, online retail, and others.

Asia-Pacific is the most dominant region for the global cumin microgreens market.

Gotham Greens, Plenty Unlimited Inc., and AeroFarms are the key players operating in the global cumin microgreens market.