Crystalline Fructose Market Size (2025 – 2030)

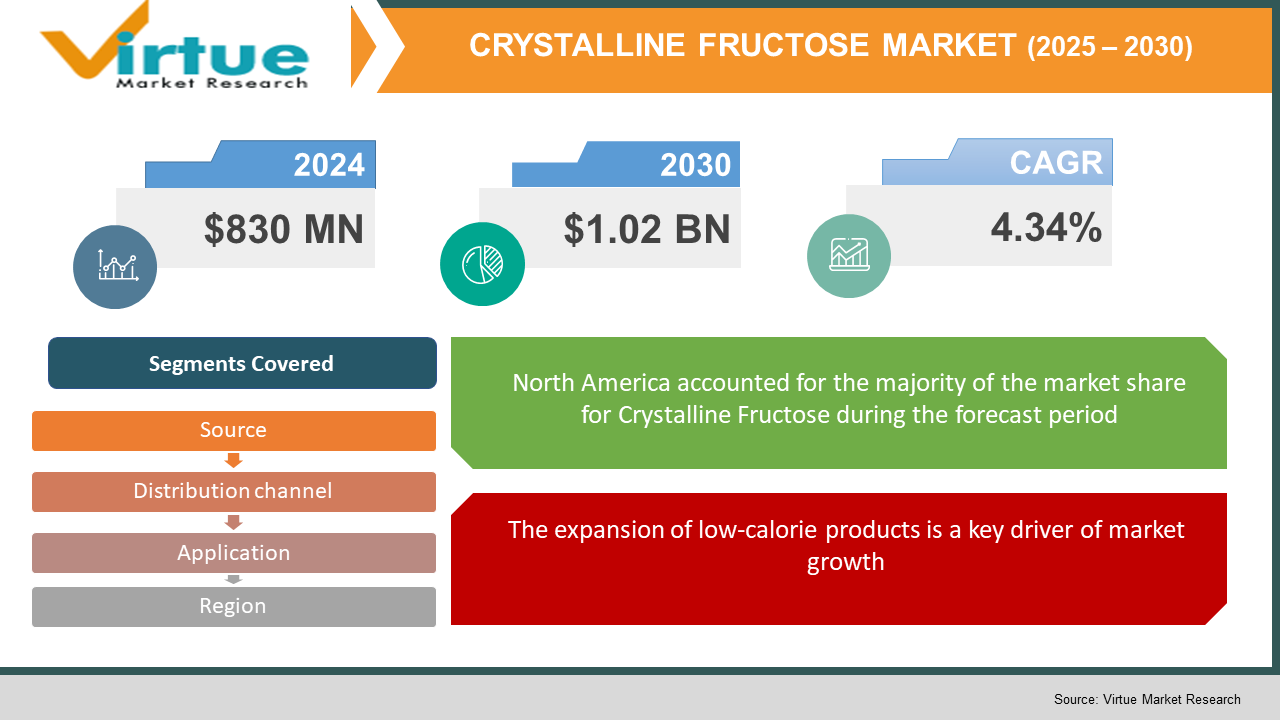

The Crystalline Fructose Market was valued at USD 830 million in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 1.02 billion by 2030, growing at a CAGR of 4.34%.

Crystalline fructose is a naturally occurring sugar derived from fructose, present in fruits and honey. It is created through the fermentation process of glucose and has a white, crystalline granular form. Being sweeter than sucrose, it is commonly utilized as a sweetener in various food and beverage products. It provides advantages such as a lower glycemic index, moisture retention, and enhanced flavor and texture.

Key Market Insights:

- The demand for crystalline fructose is predominantly fueled by its widespread use in the food and beverage sector, where it serves as a key sweetener and functional ingredient. With the increasing prevalence of lifestyle-related health issues such as obesity and diabetes, there is a growing preference for low-calorie sweeteners, driving the consumption of crystalline fructose as an alternative to conventional sugar. The rising demand for clean-label products and the shift towards natural ingredients have further accelerated the adoption of crystalline fructose in the food and beverage industry. Additionally, the growth of the confectionery and bakery sectors, particularly in emerging markets, has significantly contributed to the expansion of the crystalline fructose market.

- Ongoing advancements in the industry focus on enhancing production efficiency and lowering costs. Improvements in enzymatic processes have facilitated better conversion of glucose to fructose, resulting in higher yields and increased purity. Techniques such as membrane filtration and crystallization are being refined to produce superior-quality crystalline fructose with fewer impurities. Moreover, research into sustainable sourcing and green chemistry is promoting environmentally friendly production methods. Innovations in formulation technologies are also enhancing the functionality of crystalline fructose across various applications, from beverages to

- pharmaceuticals. These technological developments aim to cater to the rising demand for healthier, low-calorie sweeteners while addressing environmental sustainability concerns.

- Manufacturers in the crystalline fructose market face considerable challenges, mainly due to the high production costs. The process of producing high-purity crystalline fructose from glucose requires sophisticated enzymatic treatments and energy-intensive purification stages. Furthermore, sourcing premium raw materials and ensuring strict quality control measures contribute to increased costs, which in turn affect profitability and pricing competitiveness.

Crystalline Fructose Market Drivers:

Initiatives focused on sugar reduction are significantly driving the growth of the market.

Sugar reduction initiatives are accelerating as food and beverage companies adapt to regulatory pressures and the increasing consumer demand for healthier alternatives. With the rise in obesity and related health concerns, manufacturers are reformulating their products to reduce sugar content.

Crystalline fructose has gained popularity as an effective sugar substitute, offering enhanced sweetness that allows for the use of smaller quantities while preserving flavor. This shift not only enables companies to meet regulatory requirements but also aligns with consumer preferences for lower-calorie and healthier products.

The expansion of low-calorie products is a key driver of market growth.

The retail market for low-calorie and reduced-sugar products is expanding rapidly as more health-conscious consumers seek healthier alternatives. Crystalline fructose, a natural sweetener, is becoming increasingly popular in a variety of applications, including beverages, snacks, and desserts, to meet this growing demand. Its higher sweetness level allows manufacturers to use smaller amounts, effectively reducing overall sugar content while preserving flavor. For example, Coca-Cola's "Coca-Cola Life," which is sweetened with a combination of cane sugar and stevia, often includes crystalline fructose in similar formulations to lower the calorie count while maintaining the desired sweetness.

Crystalline Fructose Market Restraints and Challenges:

Health concerns related to the excessive consumption of sugar and artificial sweeteners are restraining market growth.

Studies linking high fructose intake to a range of health issues, including obesity, diabetes, and metabolic disorders, have heightened consumer concerns. These apprehensions have prompted increased scrutiny from health organizations and regulatory bodies. Consequently, some food and beverage manufacturers are exercising caution when incorporating fructose into their products, which may hinder market growth. This growing caution is driving the search for alternative sweeteners that offer similar benefits without the associated health risks.

Crystalline Fructose Market Opportunities:

The shift toward organic and clean-label products is creating significant opportunities in the market.

The rising consumer preference for organic and clean-label products presents a substantial opportunity for the crystalline fructose market. As consumers become more health-conscious and environmentally aware, there is a growing demand for natural, organic sweeteners. Manufacturers can leverage this trend by creating organic crystalline fructose products and highlighting their natural origins. This shift aligns with the clean-label movement, offering opportunities for market expansion within premium product categories and appealing to health-conscious consumers who prioritize transparent ingredient lists.

Regulatory support for sugar reduction is creating significant opportunities in the market.

As governments and health organizations recognize the health risks linked to excessive sugar consumption, such as obesity and diabetes, initiatives aimed at reducing sugar intake are gaining momentum. These efforts encourage food and beverage companies to reformulate their products to lower sugar content.

This supportive regulatory environment fosters the adoption of alternatives like crystalline fructose, which provides a sweeter taste with fewer calories. As companies respond to these guidelines, crystalline fructose is becoming an appealing option for creating healthier products that align with public health objectives and meet consumer demand for better-for-you choices.

CRYSTALLINE FRUCTOSE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4.34% |

|

Segments Covered |

By Source, application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tate & Lyle, Now Foods and Shijiazhuang Huaxu Pharmaceutical Co. Ltd. |

Crystalline Fructose Market Segmentation:

Crystalline Fructose Market Segmentation By Source:

- Sugar Cane

- Sugar Beet

- Corn

Corn is the dominant source in the crystalline fructose industry due to its high availability and cost-effectiveness. The widespread cultivation of corn ensures a reliable supply of raw materials, essential for large-scale production. Its high starch content is effectively converted into fructose through enzymatic hydrolysis, making it an ideal source. The well-established infrastructure for corn processing, including advanced technologies and robust supply chains, further strengthens its market position. Moreover, corn-based fructose benefits from economies of scale, which help reduce production costs and enable competitive pricing. These economic advantages and extensive use make corn the leading source in the crystalline fructose market.

Crystalline Fructose Market Segmentation By Application:

- Food and Beverages

- Baked Goods

- Confectionery

- Dairy Products

- Beverages

- Cereals and Breakfast Bars

- Pharmaceuticals

- Medicinal Syrups

- Oral Care Products

- Nutraceuticals and Dietary Supplements

- Personal Care Products

- Skincare

- Cosmetics

The food and beverage sector dominates the crystalline fructose market due to its strong demand for low-calorie, high-intensity sweeteners. Crystalline fructose's superior sweetness and low glycemic index make it an ideal ingredient for enhancing the flavor of various products, including soft drinks, baked goods, and processed foods. Its ability to deliver a sweeter taste with fewer calories aligns perfectly with consumer preferences for healthier options. The sector's substantial growth, driven by increasing health awareness and the push for reduced sugar content, further strengthens crystalline fructose's key role in product formulations and supports market expansion.

Crystalline Fructose Market Segmentation By Distribution channel:

- Online

- E-commerce Platforms

- Company Websites

- Offline

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies

- Retail Stores

The dominance of the offline distribution channel in the crystalline fructose industry can be attributed to its strong presence in traditional retail environments. Supermarkets, hypermarkets, and specialty stores offer direct access to a wide consumer base, making them essential channels for distributing crystalline fructose products. These outlets enable in-store promotions and provide consumers with the opportunity to make immediate purchasing decisions. Furthermore, well-established relationships between manufacturers and distributors ensure consistent product availability and support. While online shopping continues to grow, the offline channel remains crucial due to its extensive reach and ability to cater to consumers who prefer shopping in physical stores.

Crystalline Fructose Market Segmentation- by region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

North America leads the crystalline fructose market, driven by its well-established food and beverage industry, which generates significant demand for low-calorie sweeteners. The region’s high consumer awareness and growing preference for healthier alternatives to traditional sugars contribute to this demand. Advanced technological infrastructure enables efficient production and continuous innovation in crystalline fructose manufacturing. Additionally, North America's strong regulatory framework ensures product safety and quality, enhancing consumer confidence. Major industry players in the region benefit from robust distribution networks and substantial investments in research and development, further cementing North America's dominance in the market.

The Asia Pacific region holds the second-largest market share for crystalline fructose, primarily due to its increasing use in pharmaceuticals and the food and beverage industry. China leads the market due to the presence of key industry players and the country's large population, while India is the fastest-growing market, driven by innovative production techniques and rising income levels. The growth of the food and beverage sector in the region, along with a rising demand for low-calorie and nutritional supplements, has significantly boosted the demand for crystalline fructose, with expectations for continued market expansion in the region.

COVID-19 Pandemic: Impact Analysis

The global COVID-19 pandemic, which began in early 2020, significantly disrupted the global economy and had a negative impact on the growth of the food and beverage industry. Food manufacturers scaled back the production of many major food products, while the sales of food service restaurants plummeted as consumer demand for outside food diminished. The production of crystalline fructose, primarily derived from corn, was also adversely affected as trade activities and the processing of agricultural products were halted to curb the spread of the virus. As a result, the COVID-19 outbreak led to a moderate disruption in the movement of food-grade crystalline fructose.

Latest Trends/ Developments:

In January 2023, Universal Biosensors, Inc. launched the fourth test on its Sentia wine testing platform, the fructose biosensor test. This test measures the amount of sugar available to yeast for conversion into ethanol, with glucose and fructose levels serving as key indicators of grape quality.

In September 2022, Cargill opened a corn wet mill in Pandaan, Pasuruan, Surabaya, Indonesia, with an investment of USD 100 million (IDR 1.3 trillion). This facility is designed to meet the increasing demand for starches, sweeteners, and feed products in the Asian and Indonesian markets. The mill is also expected to provide a significant economic boost to the local community by creating up to 4,000 new jobs and employment opportunities.

Key Players:

These are top 10 players in the Crystalline Fructose Market :-

- Tate & Lyle

- Now Foods

- Shijiazhuang Huaxu Pharmaceutical Co. Ltd.

- Foodchem

- Bell Chem

- H&Z INDUSTRY CO. LTD.

- Ingredion

- Guangzhou ZIO Chemical Co. Ltd.

- Farbest Brand

- Sinofi

Chapter 1. Crystalline Fructose Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Application s

1.5. Secondary Application s

Chapter 2. Crystalline Fructose Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Crystalline Fructose Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Application Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Crystalline Fructose Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Crystalline Fructose Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Crystalline Fructose Market – By Source

6.1 Introduction/Key Findings

6.2 Sugar Cane

6.3 Sugar Beet

6.4 Corn

6.5 Y-O-Y Growth trend Analysis By Source :

6.6 Absolute $ Opportunity Analysis By Source :, 2025-2030

Chapter 7. Crystalline Fructose Market – By Application

7.1 Introduction/Key Findings

7.2 Food and Beverages

7.2.1 Baked Goods

7.2.2 Confectionery

7.2.3 Dairy Products

7.2.4 Beverages

7.2.5 Cereals and Breakfast Bars

7.3 Pharmaceuticals

7.3.1 Medicinal Syrups

7.3.2 Oral Care Products

7.4 Nutraceuticals and Dietary Supplements

7.5 Personal Care Products

7.5.1 Skincare

7.5.2 Cosmetics

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. Crystalline Fructose Market – By Distribution channel

8.1 Introduction/Key Findings

8.2 Online

8.2.1 E-commerce Platforms

8.2.2 Company Websites

8.3 Offline

8.3.1 Supermarkets/Hypermarkets

8.3.2 Specialty Stores

8.3.3 Pharmacies

8.3.4 Retail Stores

8.4 Y-O-Y Growth trend Analysis Distribution channel

8.5 Absolute $ Opportunity Analysis Distribution channel , 2025-2030

Chapter 9. Crystalline Fructose Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Application

9.1.3. By Distribution channel

9.1.4. By Source

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Application

9.2.3. By Distribution channel

9.2.4. By Source

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Application

9.3.3. By Distribution channel

9.3.4. By Source

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By DISTRIBUTION CHANNEL

9.4.3. By Application

9.4.4. By Source

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By DISTRIBUTION CHANNEL

9.5.3. By Application

9.5.4. By Source

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Crystalline Fructose Market – Company Profiles – (Overview, Packaging Automation Portfolio, Financials, Strategies & Developments)

10.1 Tate & Lyle

10.2 Now Foods

10.3 Shijiazhuang Huaxu Pharmaceutical Co. Ltd. Foodchem

10.4 Bell Chem

10.5 H&Z INDUSTRY CO. LTD.

10.6 Ingredion

10.7 Guangzhou ZIO

10.8 Chemical Co. Ltd.

10.9 Farbest Brand

10.10. Sinofi

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The demand for crystalline fructose is predominantly fueled by its widespread use in the food and beverage sector, where it serves as a key sweetener and functional ingredient.

The top players operating in the Crystalline Fructose Market are - Tate & Lyle, Now Foods and Shijiazhuang Huaxu Pharmaceutical Co. Ltd.

The global COVID-19 pandemic, which began in early 2020, significantly disrupted the global economy and had a negative impact on the growth of the food and beverage industry.

The shift toward organic and clean-label products is creating significant opportunities in the market.

The Asia Pacific is the fastest-growing region in the Crystalline Fructose Market.