GLOBAL CROWN CAPS MARKET (2023 -2030)

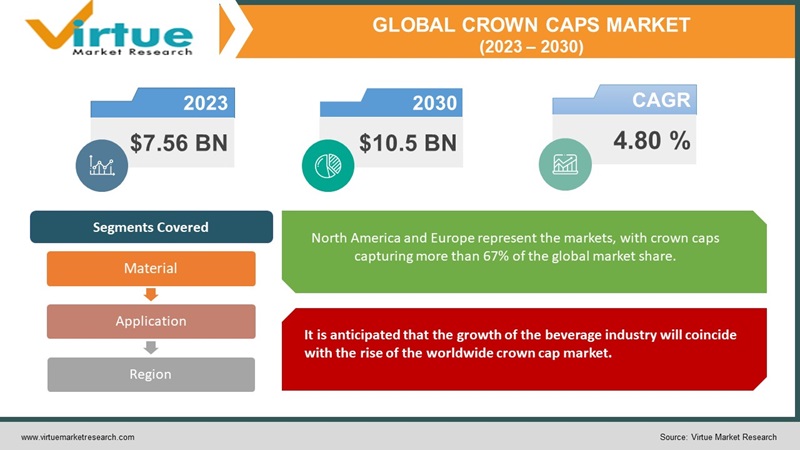

The Global Crown Caps Market was valued at USD 7.56 billion and is projected to reach a market size of USD 10.5 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 4.80%.

The top part of a crown is the component that occupies the space of a crown. Unlike crowns, which had no part it became customary during medieval times to fill the circular band with a velvet or similar fabric top often adorned with ermine at its base. In the pharmaceutical industry metal tops and closures are commonly used because they offer sterility and are typically made of materials. Steel and aluminum are the materials, for manufacturing metal tops with aluminum offering customization options such as colored finishes, as well, as plain or embossed designs. As a result, pharmaceutical packaging can be tailored to meet consumers' specific requirements.

Key Market Insights:

Based on the Aluminum Closures Group there has been an increase, in the utilization of aluminum closures within the wine industry. It is projected that over 30% of bottled still wine worldwide will now be sealed using aluminum. Crown caps and closures are favored for their disposal recycling benefits and ability to prolong shelf life.

Crown caps have a range of uses including in carbonated drinks, energy drinks, and alcoholic beverages. When it comes to beverages beer is the user of crown caps, for sealing both bottles and cans. In the food industry crown caps are also used on sauce bottles seasoning containers and condiment bottles although preferences may vary by region or country. Additionally, aluminum is increasingly being used in the wine industry for crown caps due to its ability to provide insulation, from oxygen and cost advantages when compared to cork.

The local companies, in the area are expanding their capabilities. Boosting production to meet the growing demand, in the food and beverage industry. As an example, Oricon Enterprises Ltd can produce 9,216 million units of aluminum crown caps every year.

The World Health Organization states that China has a per capita consumption of 7.6 liters of alcohol. Carlsberg recently introduced the ZerO2 cap in Vietnam, which is a crown cap technology designed to reduce oxygen levels in bottles. This innovation aims to provide consumers with beer by utilizing an oxygen scavenger liner within the cap.

Crown Caps Market Drivers:

It is anticipated that the growth of the beverage industry will coincide with the rise of the worldwide crown cap market.

Crown caps are commonly used for sealing glass bottles that contain beverages. Within the beverages market, there are nonalcoholic segments. The demand, for crown caps is primarily driven by the packaging of beverages. Over the forecast period, it is anticipated that the crown caps market will grow due to cap manufacturers offering a range of closures for industries such, as food and pharmaceuticals. Crown caps have become a choice, for sealing glass bottles and preventing any spillage. They are made from materials, such as tin and aluminum to cater to needs. The producers of crown caps have made sure to offer a range of colors and sizes to meet the requirements of end users. To ensure packaging these caps feature a crown shape with teeth along the edges. Not do they provide evidence of tampering? They also effectively prevent any spills. The growing demand for pack sizes has played a role in driving the global market for crown caps forward. Additionally, there has been an increase in the consumption of beer. Carbonated soft drinks (CSD), over recent years.

New Developments in the Industry for Crown Caps and Closures: Sustainability and Industry Changes

With the increasing number of customers aiming to reduce their consumption of carbonated drinks and alcohol, beer there is a growing trend, towards smaller-sized beverage bottles. This shift is expected to influence the demand for crown caps. The impact is projected to be more significant, in the Asia Pacific region. Consequently, it is anticipated that the global crown caps market will encounter some fluctuations during the projected timeframe. According to the Aluminum Closures Group, there has been an increase, in the use of aluminum closures in the wine industry. It is projected that over 30% of all bottled still wine will soon be sealed with aluminum. One of the reasons for the popularity of crown caps and closures is their disposal, recycling benefits, and longer shelf life. The beverage industry in the drink/carbonated drink market is also showing signs of potential growth in adopting these closures. Furthermore, as the mobile beer canning industry expands it is expected that the market, for these closures, will grow well.

Crown Caps Market Restraints and Challenges:

Crown caps are mainly used by manufacturers as a way to showcase their brand on their products, which helps create an impact. However, despite the outlook the global crown caps market is facing some challenges. For instance, the increasing trend, toward closure of less packaging is expected to hinder the growth of the crown caps market in the coming years. Additionally, consumers’ preference for bottles over glass bottles is anticipated to contribute to a slowdown, in the expansion of the crown caps market.

Crown Caps Market Opportunities:

With the increase, in incomes and the trend toward living, there has been a noticeable rise in the consumption of packaged beverages like bottled water, soda, and beer. To keep things simple and cost-effective many of these beverages are sealed with crown caps. Interestingly it's not just beer that’s driving this demand; the growing popularity of craft beer is also contributing to the increased need, for crown caps. Craft brewers frequently opt for crown caps to seal their bottles due, to their cost-effectiveness and user nature as compared to alternatives like cork stoppers. In general, the increasing demand for packaged beverages is a trend, for the market of crown caps.

CROWN CAPS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.80 % |

|

Segments Covered |

By Material, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Crown Holdings Inc., Astir Vitogiannis Bros SA, AMD Industries Inc., Finn-Korkki Oy Nippon Closures Co. Ltd., PELLICONI & C. SPA, Samhwa Crown & Closure, Supertech-Crown Caps, Viscose Closures Ltd |

Crown Caps Market Segmentation:

Crown Caps Market Segmentation: By Material:

-

Steel

-

Aluminum

-

Tin-plated

Aluminum is the material driving the growth of the global crown caps market due, to its properties. This versatile metal offers advantages, such as its nature and flexibility. It can be easily cast, melted, molded, machined, and extruded into shapes to cater to a range of applications. Moreover aluminum possesses corrosion resistance. Forms a protective layer when exposed to oxidizing environments. However contact, with atmospheres can result in the formation of a coating.

Crown Caps Market Segmentation: By Application:

-

Beverage

-

Alcoholic beverages

-

Non-Alcoholic beverages

-

Food

Based on its use the beverages segment appears to be the force, in the global crown caps market throughout the projected period. Non-alcoholic drinks are predicted to hold a market share. This category includes carbonated drinks, fizzy juices, and sparkling water among non-alcoholic beverages, which have become increasingly popular as consumer’s options for non-alcoholic drinks have expanded. Furthermore, there is a growing variety of these beverages suggesting that there may be a demand for crown caps in the future. Conversely, soft drinks play a role in this market due, to their appeal. Moreover, soft drinks come in a range of flavors and styles catering to diverse consumer preferences.

Market Segmentation: Regional Analysis:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America and Europe represent the markets, with crown caps capturing more than 67% of the global market share. This dominance can be attributed to the presence of beverage companies and the significant consumption of packaged beverages in these regions.

The crown caps market in Asia Pacific is experiencing growth primarily driven by the beverage industry in this area. On the hand although smaller, South American, Middle Eastern, and African markets are steadily expanding.

The Asia Pacific region is predicted to witness the development in the crown caps market due to its two populated countries, China and India. The growth in this region will be supported by an increase in income. Additionally, China’s per capita pure alcohol consumption stands at 7.6 liters according to data from the World Health Organization. Moreover, there has been a rise in consumer demand for low-alcohol beverages driven by healthy individuals and a wider selection of new varieties that are gaining popularity. Another contributing factor is that low-alcohol beers are now more affordable compared to their high-alcohol counterparts. Consequently, these factors are expected to drive growth, in the European crown caps market

COVID-19 Impact Analysis on the Global Crown Caps Market:

The global market, for crown caps is expected to see a decrease in its growth rate. Additionally, there has been an increase in demand for crown caps in the food and beverage industry as many people who have been staying at home have become reliant on ordering food. Furthermore with the threat of lockdowns people are. Stocking up on necessities and fresh food through online platforms has led to an increased demand for crown caps. Moreover, the consumption of energy drinks and soft drinks by the population has also contributed to the demand, for crown caps.

Latest Trends/ Developments:

As the range of alcoholic beverage options, for consumers has expanded beyond carbonated drinks other choices like carbonated juices and sparkling water have gained popularity in recent years. There has been a surge in the development of flavors creating a market for crown caps. However soft drinks continue to dominate the market due to their appeal. Soft drinks offer a range of flavors and formats that cater to drinking occasions. According to Unesda, calorie, and sugar-free beverages currently makeup around 30% of sales in European markets. In contrast, other countries have levels of soft drink consumption with added sugar. For instance, Argentina, the United States, and Chile top the list with per capita soft drink consumption rates of 155 liters, 154 liters, and 141 liters respectively. Soft drinks play a role in single-use plastic bottle usage; however several soft drink vendors are now transitioning back to glass bottles due to increasing government regulations. This shift necessitates the growth of crown caps, in a fashion. For example, Coca-Cola recently marked the anniversary of when they bottled their famous soft drink by releasing a limited edition 0.33 liter glass bottle with a charming vintage design. In August 2019 the company introduced six soda flavors in Canada packaged in glass bottles that had a premium appearance.

In July 2019 the Mannheim plant of the company invested EUR 30 million to expand its glass container bottling capabilities. This indicates a rise, in demand for crown caps from the company. Moreover, PepsiCo aims to reduce packaging in its drinks and has set a goal of eliminating up to 67 billion plastic bottles by 2025. The recent acquisition of SodaStream is expected to contribute to an increase in the use of glass bottle packaging, for its products.

Key Players:

-

Crown Holdings Inc.

-

Astir Vitogiannis Bros SA

-

AMD Industries Inc.

-

Finn-Korkki Oy

-

Nippon Closures Co. Ltd.

-

PELLICONI & C. SPA

-

Samhwa Crown & Closure

-

Supertech-Crown Caps

-

Viscose Closures Ltd

Crown Holdings Inc. has announced that it has received approval, from the Federal Competition Commission in Mexico, for its acquisition of Empaque, a company that specializes in manufacturing cans, bottles, and caps primarily for businesses in need of packaging solutions.

On July 15th, 2021 PELLICONI &C. SPA decided to agree, to invest in a production facility, with a packaging company located in Cho.

In March 2020 Pelliconi, a crown corks provider based in Ozzano (Bologna) was still operating in China despite the COVID-19 outbreak. Although several factories had permanently closed down Pelliconi remained committed, to continuing its operations. The decision to commence operations, in mid-February, has provided the company with benefits in terms of shipping flexibility. Being closer, to a market comprising approximately 1.6 1.7 million consumers.

Chapter 1. GLOBAL CROWN CAPS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL CROWN CAPS MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL CROWN CAPS MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL CROWN CAPS MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL CROWN CAPS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL CROWN CAPS MARKET – By Distribution Channel

6.1. Introduction/Key Findings

6.2. Supermarkets/Hypermarkets

6.3. Specialty Stores

6.4. Convenience stores

6.5. Online Retail

6.6. Y-O-Y Growth trend Analysis By Distribution Channel

6.7. Absolute $ Opportunity Analysis By Distribution Channel , 2023-2030

Chapter 7. GLOBAL CROWN CAPS MARKET – By End User

7.1. Introduction/Key Findings

7.2. Food and Beverage

7.3. Industrial

7.4. Consumer

7.5. Others

7.6. Y-O-Y Growth trend Analysis By End User

7.7 . Absolute $ Opportunity Analysis By End User , 2023-2030

Chapter 8. GLOBAL CROWN CAPS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Materials

8.1.3. By Application

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Materials

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Materials

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Materials

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Matrerials

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL CROWN CAPS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. 9Crown Holdings Inc.

9.2. Astir Vitogiannis Bros SA

9.3. AMD Industries Inc.

9.4. Finn-Korkki Oy

9.5. Nippon Closures Co. Ltd.

9.6. PELLICONI & C. SPA

9.7. Samhwa Crown & Closure

9.8. Supertech-Crown Caps

9.9. Viscose Closures Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Crown Caps Market was valued at USD 7.56 billion and is projected to reach a market size of USD 10.5 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 4.80%.

It is anticipated that the growth of the beverage industry will coincide with the rise of the worldwide crown cap market, New Developments in the Industry for Crown Caps and Closures: Sustainability and Industry Changes.

Based on Material, the Global Crown Caps Market is segmented by Steel, Aluminum, Tin-plated

North America is the most dominant region for the Global Crown Caps Market.

Crown Holdings Inc., Astir Vitogiannis Bros SA, Avon Crown Caps & Containers Nigeria Ltd., AMD Industries Inc., and Finn-Korkki Oy are the key players operating in the Global Crown Caps Market.