Crowdfunding Market Size (2024 – 2030)

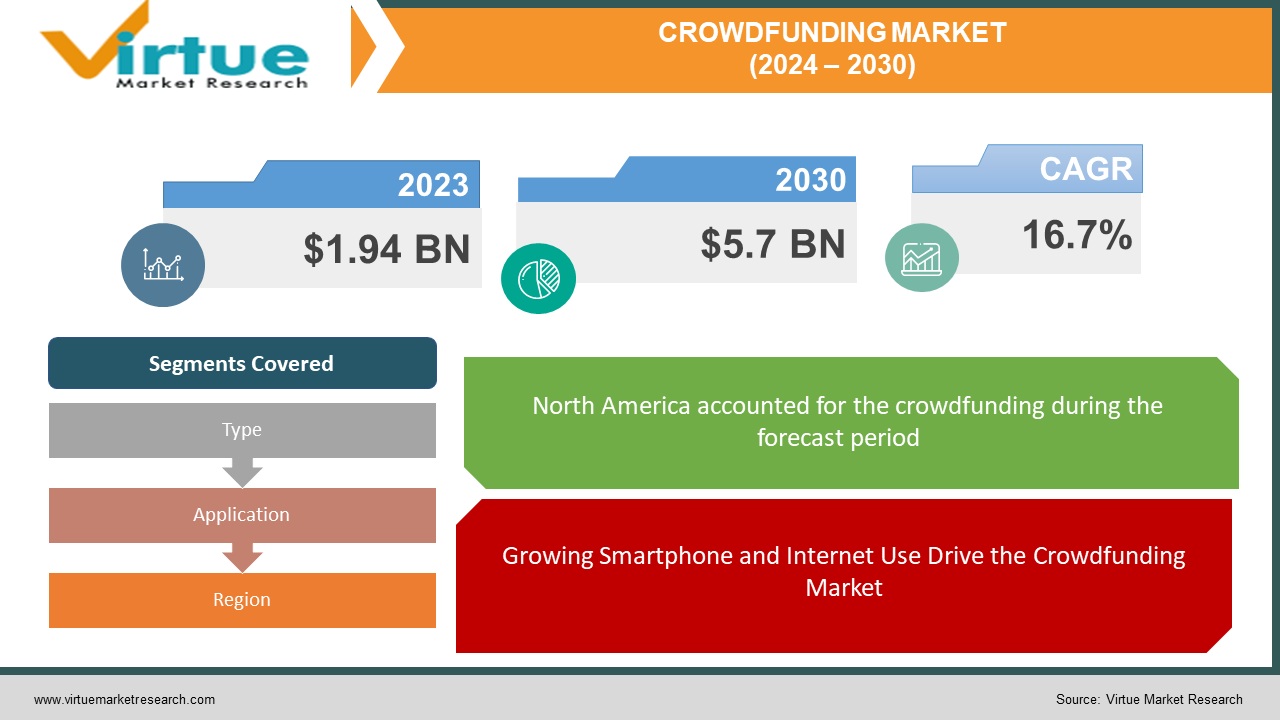

The Global Crowdfunding Market was valued at USD 1.94 Billion and is projected to reach a market size of USD 5.7 Billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 16.7% between 2024 and 2030.

One major driver propelling the market expansion is the increase in crowdfunding activities on social media platforms, which raise demand and make new initiatives more visible. Crowdfunding operations are increasingly using social media sites like Facebook, Twitter, Reddit, Instagram, and LinkedIn to gather donations from investors and raise money. Simultaneously, the market is expanding due in large part to the increasing technological developments in crowdfunding platforms that employ machine learning and artificial intelligence (AI). Globally, a lot of companies that offer crowdfunding platforms are concentrating on growing their reach to assist new businesses in raising capital from investors. To further aid in the market's expansion, governments all over the world are eager to assist in the introduction of new products linked to crowdfunding platforms. The platform for crowdsourcing ideas and projects assisted residents of Dubai in launching their own companies.

Key Market Insights:

The industry is expanding as a result of crowdfunding platforms' increasing use of AI, Blockchain, and machine learning technology to allay investor fears. AI tools are used by crowdfunding platforms to assist users in initiating online campaigns, forecasting investor behavior, producing creative material, spotting fraud, displaying targeted advertisements, and authenticating campaigners. Crowdfunding platforms have also begun experimenting with AI-driven chatbots to help campaigners close deals and quickly get their campaigns off the ground. Throughout the projection period, the market players should benefit from these technological adoptions as they present lucrative growth prospects. Crowdfunding platforms are being used by the gaming industry to facilitate successful fundraising initiatives. Nonetheless, the absence of a regulatory structure ensuring safe transactions on crowdfunding platforms can impede business expansion. Financial authorities from all around the world are working to increase fundraisers' awareness of the cutting-edge crowdfunding platforms, which are helping the business expand.

Global Crowdfunding Market Drivers:

Growing Smartphone and Internet Use Drive the Crowdfunding Market.

Crowdfunding has transformed with the global boom in internet and smartphone usage, bringing in an unparalleled era of accessibility and engagement. The increased accessibility of these technologies has resulted in a significant decrease in the obstacles faced by crowdfunding campaigns. Fundraising has become more accessible to people from a wider range of backgrounds and places, making it easier for people to support causes and projects. Due to the ease of access provided by internet-connected devices, people may browse campaigns, investigate crowdfunding platforms, and make financial contributions with little effort. Additionally, the widespread use of social media platforms makes it easier for crowdfunding projects to spread quickly, increasing their visibility and drawing in a larger audience. As a result, rising internet and smartphone usage has enabled people to participate actively in crowdfunding, promoting a culture of grassroots finance and group support.

Social Media has a growing impact on the Crowdfunding Market.

The increasing ubiquity of social media platforms has made them an effective means of bringing crowdfunding campaigns in front of large audiences, thereby revolutionizing the way creators and entrepreneurs raise funds. By utilizing social media's wide audience and interactive features, people can efficiently increase the visibility of their crowdfunding projects and connect with a variety of possible backers. Social media sites such as Facebook, Instagram, and Twitter present unrivaled chances for promoting campaigns via influencer partnerships, natural sharing, and customized advertising. Creators and entrepreneurs may connect with a worldwide audience and get support for their projects and endeavors with unprecedented simplicity and efficiency by utilizing social media to bypass traditional hurdles to financial access.

Global Crowdfunding Market Restraints and Challenges:

The crowdfunding industry is beset by a variety of problems that present formidable obstacles to investors and producers alike. The absence of a uniform regulatory framework among nations breeds uncertainty and may discourage involvement on account of worries about investment protection and fraud. Since fraudulent advertising and data breaches erode confidence and put customers' financial security at risk, security is still a top priority. Furthermore, for campaigns to stand out and obtain awareness in the increasingly congested crowdfunding sector, strong marketing methods are required. Even with a successful campaign, investors might still have trouble selling their interests before the project is finished, which could limit their liquidity. The widespread ignorance about crowdfunding contributes to these problems, underscoring the necessity of ongoing outreach and education initiatives to promote market expansion. Furthermore, investors find it difficult to perform in-depth due diligence on projects, especially if they lack financial experience. This emphasizes the significance of platforms that offer easily available tools and information to support decision-making. For crowdfunding to continue evolving sustainably as a practical method of investing and gaining access to funds, these challenges must be overcome.

Global Crowdfunding Market Opportunities:

Several significant factors, such as the expanding use of social media and the internet, the growing need for alternate forms of finance, and the ongoing growth of crowdfunding platforms, are driving the current amazing boom in the worldwide crowdfunding business. Significant obstacles including unclear regulations, security flaws, and increased competitiveness, however, come along with this expansion. Notwithstanding these challenges, crowdfunding has a bright future ahead of it for many different players. The platform's potential to promote community participation and its worldwide reach might be advantageous for creators. Investors can take advantage of chances to support startups and diversify their holdings. The platforms themselves can enter new markets and focus on specific niches. Traditional financial institutions can also look into joint ventures with crowdfunding platforms to take advantage of newly developed secondary markets. To overcome current obstacles and realize the full potential of the changing crowdfunding scene, cooperation between these stakeholders will be essential. This will open the door for creative financing options and long-term growth in the years to come.

CROWDFUNDING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

16.7% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kickstarter, PBC, Indiegogo, Inc., GoFundMe, Fundable, Crowdcube, SeedInvest Technology, LLCFundly, RealCrowd, RM Technologies LLC., Wefunder |

Crowdfunding Market Segmentation: By Type

-

Equity-based

-

Debt-based

The Global Crowdfunding Market Segmented by Type, Debt-Based held the largest market share last year and is poised to maintain its dominance throughout the forecast period. One of the main factors driving the segment growth is the increasing demand from startup companies for debt-based crowdfunding in comparison to traditional banks as a quick way to raise capital. Through debt-based crowdfunding, new businesses can obtain capital at a reduced cost without having to deal with the convoluted processes of traditional banking. Additionally, investors might benefit from lower interest rates when sponsoring projects through debt-based crowdfunding and paying for them in monthly installments. It is expected that these elements will propel the segment's expansion in the upcoming years. Throughout the forecast period, the equity-based crowdfunding category is expected to grow at the fastest rate. One major driver propelling the expansion of this market is equity-based crowdfunding's capacity to gather capital from individuals in exchange for an equity portion from the company. Equity-based crowdfunding provides fundraisers with many advantages, including the ability to raise more money by selling shares to different investors, the elimination of debt-based credit checks and loan payback, and the ability to grow businesses with a single investment. In addition, equity-based crowdfunding provides advantages for investors, including the opportunity to acquire a portion of the firm, customize investments to meet their needs, and select companies that pique their interest.

Crowdfunding Market Segmentation: By Application

-

Food & Beverage

-

Technology

-

Media

-

Healthcare

-

Real Estate

The Global Crowdfunding Market Segmented by Application, Food & Beverage held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The increasing number of food and beverage startups worldwide is responsible for the segment's rise. To gain more traction in the market, food companies are growing their businesses. For instance, the macaroni and cheese producer 8 Myles started an equity crowdfunding campaign in November 2022 to seek capital for business expansion, the purchase of production equipment to boost capacity, and brand awareness. In addition, beverage companies like Waku started a crowdfunding initiative to help finance their growth objectives. Throughout the projection period, the technology area is expected to experience significant expansion. Cutting-edge technologies like artificial intelligence (AI), blockchain, and machine learning are gaining traction in the end-user sector. For example, blockchain technology improves security and transparency in several sectors, such as the Internet of Things, cybersecurity, healthcare, and finance. Fundraising efforts for technology businesses are anticipated to rise in tandem with the growing demand for these cutting-edge products across a range of industries, consequently bolstering the segment's growth.

Crowdfunding Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Global Crowdfunding Market Segmented by Region, North America held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The existence of notable entities like Kickstarter, Indiegogo, Patreon, and Seed&Spark presents a significant opportunity for crowdfunding endeavors inside the North American continent. According to data from software company Demandsage, the greatest concentration of unicorn businesses is found in North America. For example, there are 72,560 startups in the United States and 3,446 in Canada. More new businesses would therefore present a tremendous possibility for crowdfunding initiatives, supporting regional growth in the process. Throughout the projected period, Asia Pacific is anticipated to develop at the fastest rate among regional markets. Because crowdfunding sites are now more accessible due to increased internet usage, the expansion in the region can be explained. Furthermore, the Asia Pacific market is expanding due to the excellent economic conditions and growing digitization that present more growth potential for online crowdfunding platforms. More prospects for regional market expansion are also created by the abundance of crowdfunding sites in this area, including Wujudkan.com, ArtisteConnect.com, pitchIN.my, and To Gather.

COVID-19 Impact Analysis on the Global Crowdfunding Market:

The COVID-19 pandemic has had a beneficial effect on the market expansion for crowdsourcing. Crowdfunding was used by small organizations to raise money for their ongoing projects. Among the purposes that crowdfunding platforms accomplish are donations to organizations that help and empower individuals. Simultaneously, there has been an increase in online donations reported by several retailers worldwide. For example, during the second wave of the COVID-19 pandemic, crowdfunding sites like ImpactGuru.com, Milaap, and Ketto saw a spike in the number of online donations.

Latest Trends/ Developments:

The main companies in the crowdfunding space are concentrating on creating tools that will facilitate the fundraising of capital for non-profits, businesses, charities, and academics. To make the funding process easier, many suppliers are also concentrating on creating crowdfunding systems that run on blockchain technology. For example, the crowdfunding solution provider Rare introduced Rare FND, a blockchain-based crowdfunding platform, in August 2022. Throughout the forecast period, further growth possibilities for the market are expected to arise as a result of such blockchain-based product launches. Because crowdfunding solutions are flexible, scalable, and successful means of raising capital, their demand is growing. To better meet the evolving needs of investors, market participants are concentrating on expanding the range of products they offer. Vendors also concentrate on commercial tactics including alliances, mergers, and acquisitions.

Key players:

-

Kickstarter, PBC

-

Indiegogo, Inc.

-

GoFundMe

-

Fundable

-

Crowdcube

-

SeedInvest Technology, LLC

-

Fundly

-

RealCrowd

-

RM Technologies LLC.

-

Wefunder

Chapter 1. CROWDFUNDING MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. CROWDFUNDING MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. CROWDFUNDING MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. CROWDFUNDING MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. CROWDFUNDING MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. CROWDFUNDING MARKET – By Application

6.1 Introduction/Key Findings

6.2 Food & Beverage

6.3 Technology

6.4 Media

6.5 Healthcare

6.6 Real Estate

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. CROWDFUNDING MARKET – By Type

7.1 Introduction/Key Findings

7.2 Equity-based

7.3 Debt-based

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. CROWDFUNDING MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. CROWDFUNDING MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Kickstarter, PBC

9.2 Indiegogo, Inc.

9.3 GoFundMe

9.4 Fundable

9.5 Crowdcube

9.6 SeedInvest Technology, LLC

9.7 Fundly

9.8 RealCrowd

9.9 RM Technologies LLC.

9.10 Wefunder

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Crowdfunding market is expected to be valued at USD 1.94 billion.

Through 2030, the Global Crowdfunding market is expected to grow at a CAGR of 16.7%.

By 2030, the Global Crowdfunding market is expected to grow to a value of USD 5.74 billion.

North America is predicted to lead the market of Crowdfunding.

The Global Crowdfunding market has segments Types, Applications, and Region.