Crochet Dress Market Size (2025 – 2030)

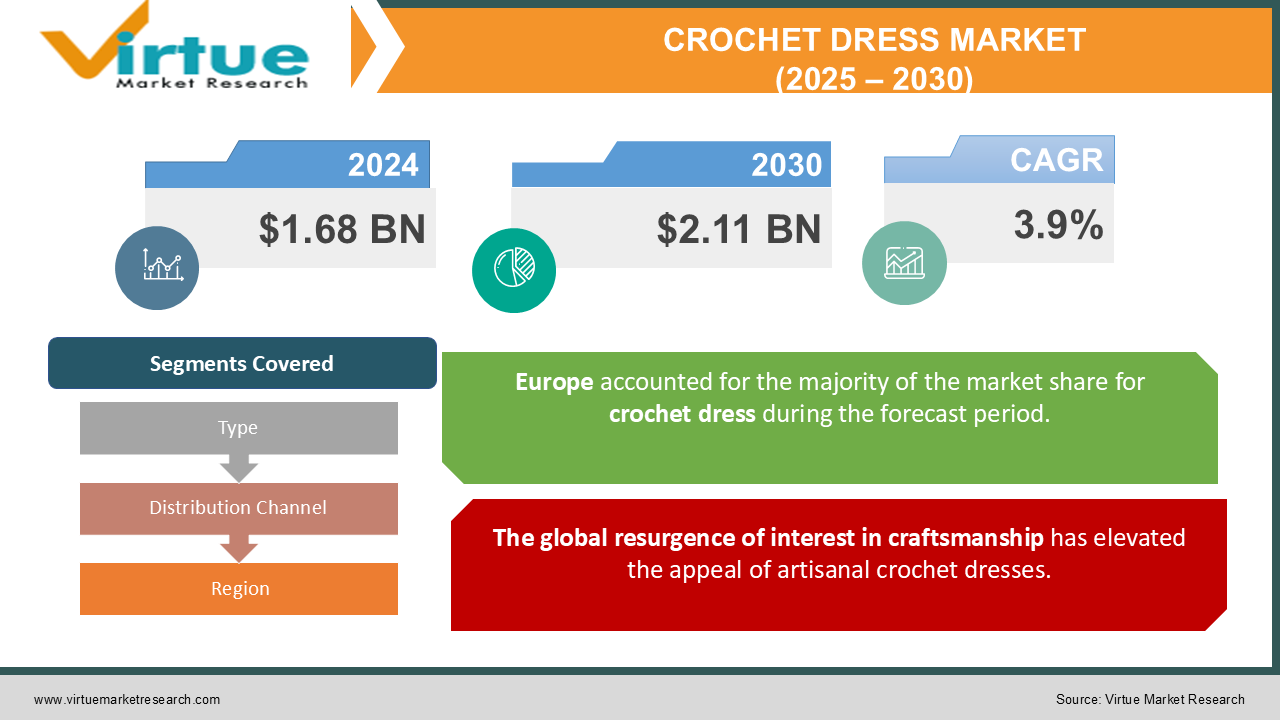

The Crochet Dress Market was valued at USD 1.68 Billion in 2024 and is projected to reach a market size of USD 2.11 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 3.9%.

The crochet dress market has emerged as a dynamic and culturally rich segment within the broader apparel industry, captivating consumers who value artisanal craftsmanship, sustainability, and bespoke fashion. Crochet dresses, characterized by intricate hand-knitted or machine-simulated patterns, have transcended their traditional roots to become a contemporary fashion statement. This market, fueled by rising consumer demand for unique and personalized garments, has witnessed robust growth in recent years. The appeal of crochet dresses lies in their versatility, as they cater to a diverse audience across age groups, genders, and occasions.

Key Market Insights:

-

Over 2.8 million crochet dresses were sold worldwide in 2023, marking a notable increase in demand.

-

Approximately 45% of global crochet dress purchases were made through online channels in 2023.

-

Handcrafted crochet dresses accounted for 37% of the market's total revenue in 2023.

-

Over 60% of consumers purchasing crochet dresses cited sustainability as a key motivator.

-

Consumer spending on crochet dresses increased by 19% compared to 2022.

-

The global crochet dress market recorded a total revenue exceeding $1.2 billion in 2023.

-

Eco-friendly and organic crochet dresses saw a 25% rise in sales in 2023.

Market Drivers:

Sustainability has become a cornerstone of modern consumer behavior, influencing purchase decisions across all segments of the apparel industry.

Crochet dresses, typically associated with eco-friendly production processes and materials, align perfectly with this trend. Unlike mass-produced garments, crochet dresses often involve meticulous handcrafting or the use of low-impact manufacturing techniques, which appeal to environmentally conscious buyers. The desire for sustainable fashion is further fueled by increasing awareness of the environmental impact of fast fashion. Reports reveal that consumers are now willing to pay a premium for clothing that ensures reduced carbon footprints and ethical production practices. As crochet dresses are frequently made from natural fibers like cotton, hemp, and bamboo, they embody these ideals. Moreover, slow fashion emphasizes quality over quantity, a philosophy that resonates deeply with crochet dress buyers. These dresses, known for their durability and timeless designs, reflect the principles of mindful consumption. Social media platforms have amplified this movement, with influencers and activists advocating for the adoption of eco-conscious apparel.

The global resurgence of interest in craftsmanship has elevated the appeal of artisanal crochet dresses.

In a world dominated by automated manufacturing, consumers are increasingly drawn to the human touch evident in handmade products. This sentiment is particularly strong among millennials and Gen Z shoppers, who value individuality and authenticity. Artisanal crochet dresses offer a level of customization and uniqueness that mass-produced garments cannot match. Whether it’s intricate patterns, bespoke sizing, or personalized colors, these dresses cater to a niche yet growing audience. Platforms like Etsy and Instagram have become pivotal in connecting artisans with global consumers, expanding market reach beyond local communities. Collaborations between high-fashion brands and local artisans have further mainstreamed crochet dresses. These partnerships not only highlight the skill involved in creating such garments but also provide a platform for preserving cultural heritage. As a result, artisanal crochet dresses have transcended their traditional role to become symbols of luxury and sophistication.

Market Restraints and Challenges:

Despite its promising growth trajectory, the crochet dress market faces several hurdles. These include high production costs, scalability issues, and fluctuating consumer trends, which create a complex operating environment for market players. One of the primary challenges lies in the labor-intensive nature of crochet production. Handcrafted crochet dresses require significant time and expertise, which limits scalability. Skilled artisans are essential to maintaining quality, but their availability is often limited, leading to production bottlenecks. This reliance on manual labor also contributes to higher costs, making these dresses less accessible to budget-conscious consumers. Another major restraint is the volatility of fashion trends. While crochet dresses are currently in vogue, the market remains susceptible to shifts in consumer preferences. The fast-paced nature of the fashion industry demands continuous innovation, which can strain smaller businesses and independent artisans. Moreover, the lack of standardization in sizing and design presents logistical challenges. Unlike machine-made apparel, handcrafted dresses may have slight variations, leading to inconsistencies that affect customer satisfaction. For mass-market retailers, this poses a significant barrier to scaling operations.

Market Opportunities:

Amid these challenges, the crochet dress market is ripe with opportunities, particularly in the realms of technological innovation, regional expansion, and collaborative ventures. The integration of technology into traditional crochet techniques offers a pathway to scale production while maintaining quality. Advanced knitting machines capable of mimicking hand-crafted patterns have emerged as a game-changer, enabling manufacturers to cater to larger audiences. These innovations also opened the door to experimenting with complex designs that were previously unfeasible. Regional markets, especially in Asia and Africa, hold untapped potential for growth. Both regions boast rich cultural traditions in handcrafting textiles, providing a wealth of inspiration for unique crochet designs. Additionally, the rising disposable incomes in these regions present an opportunity to introduce premium crochet dresses to a new demographic of consumers. Collaborations between artisans and established brands represent another promising avenue. By leveraging the resources and market reach of large companies, artisans can scale their operations while retaining their creative integrity. Such partnerships not only expand market access but also enhance the credibility and value of artisanal products.

CROCHET DRESS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

3.9% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Free People, Zara, Anthropologie, Forever 21, H&M, Mango, Urban Outfitters, ASOS, Revolve, Etsy, ModCloth, Boohoo Shein, PrettyLittleThing, Nordstrom |

Crochet Dress Market Segmentation: By Type

-

Mini dresses

-

Midi dresses

-

Maxi dresses

-

Bridal wear

-

Casual wear

Bridal wear is witnessing the fastest growth, driven by a surge in demand for sustainable and personalized wedding attire. Maxi dresses dominate the market, owing to their versatility and widespread appeal across different demographics.

Crochet Dress Market Segmentation: By Distribution Channel

-

Online retail

-

Offline retail

-

Direct-to-consumer (DTC) channels.

Online retail is the fastest-growing channel, fueled by the convenience of e-commerce and the influence of social media marketing. Offline retail continues to hold a significant share, as consumers value the tactile experience of shopping for handmade garments.

Crochet Dress Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

Europe holds the largest market share, accounting for around 30% of the global crochet dress market. The region’s long-standing appreciation for artisanal craftsmanship and sustainable clothing significantly contributes to this dominance. Countries such as France, Italy, and Germany are at the forefront of this trend, with a strong demand for handmade and luxury crochet dresses. European consumers are also inclined towards slow fashion, emphasizing quality over quantity. High-end brands and boutique stores in the region often collaborate with artisans to create exclusive collections, reinforcing the market's premium appeal. The cultural integration of crochet designs in seasonal and festive wear also bolsters demand.

Asia-Pacific is the fastest-growing region in the crochet dress market, representing approximately 22% of the market share. This rapid growth is fueled by increasing disposable incomes, the influence of Western fashion trends, and the region’s rich tradition in textile artistry. Countries such as India, China, and Japan are key contributors, offering both a growing consumer base and skilled artisans. E-commerce platforms have played a pivotal role in driving sales, particularly among younger demographics. The fusion of traditional crochet techniques with contemporary designs has become a significant trend, catering to diverse consumer tastes. Additionally, government initiatives promoting local craftsmanship and exports have created new opportunities for market expansion.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a profound impact on the crochet dress market. Lockdowns and supply chain disruptions initially hampered production, particularly for small-scale artisans reliant on local markets. However, the crisis also spurred a surge in demand for handmade products as consumers sought meaningful, high-quality purchases during uncertain times. E-commerce platforms became lifelines for many crochet dress sellers, enabling them to reach global audiences despite physical store closures. Additionally, the pandemic accelerated the adoption of sustainable fashion, as consumers became more conscious of their purchasing choices. This shift has created a lasting positive impact on the market, setting the stage for long-term growth.

Latest Trends and Developments:

Recent trends in the crochet dress market reflect a blend of tradition and innovation. Designers are experimenting with bold color palettes, unconventional patterns, and mixed materials to appeal to modern aesthetics. Sustainability remains a key focus, with brands introducing eco-friendly yarns and biodegradable packaging. Digital platforms continue to play a crucial role, with influencers and virtual fashion shows showcasing the versatility of crochet dresses to global audiences.

Key Players in the Market

-

Free People

-

Zara

-

Anthropologie

-

Forever 21

-

H&M

-

Mango

-

Urban Outfitters

-

ASOS

-

Revolve

-

Etsy

-

ModCloth

-

Boohoo

-

Shein

-

PrettyLittleThing

-

Nordstrom

Chapter 1. Crochet Dress Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Crochet Dress Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Crochet Dress Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Crochet Dress Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Crochet Dress Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Crochet Dress Market – By Type

6.1 Introduction/Key Findings

6.2 Mini dresses

6.3 Midi dresses

6.4 Maxi dresses

6.5 Bridal wear

6.6 Casual wear

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Crochet Dress Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Online retail

7.3 Offline retail

7.4 Direct-to-consumer (DTC) channels.

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Crochet Dress Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Crochet Dress Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Free People

9.2 Zara

9.3 Anthropologie

9.4 Forever 21

9.5 H&M

9.6 Mango

9.7 Urban Outfitters

9.8 ASOS

9.9 Revolve

9.10 Etsy

9.11 ModCloth

9.12 Boohoo

9.13 Shein

9.14 PrettyLittleThing

9.15 Nordstrom

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Consumers increasingly prioritize sustainability and eco-friendly products, which align perfectly with the artisanal nature of crochet dresses. Handmade clothing appeals to environmentally conscious buyers as it reduces reliance on mass-produced, resource-intensive manufacturing processes.

One of the most pressing concerns in the crochet dress market is its inherently labor-intensive production process. Crochet garments are typically handcrafted, requiring significant time and skilled labor to create even a single piece. This limits the scalability of production, making it difficult for manufacturers to meet rising demand during peak seasons or expand operations to new markets.

Free People, Zara, Anthropologie, Forever 21, H&M, Mango, Urban Outfitters, ASOS.

Europe currently holds the largest market share, estimated at around 35%.

Asia Pacific has shown significant room for growth in specific segments.