Courier, Express and Parcel (CEP) Market Size (2024-2030)

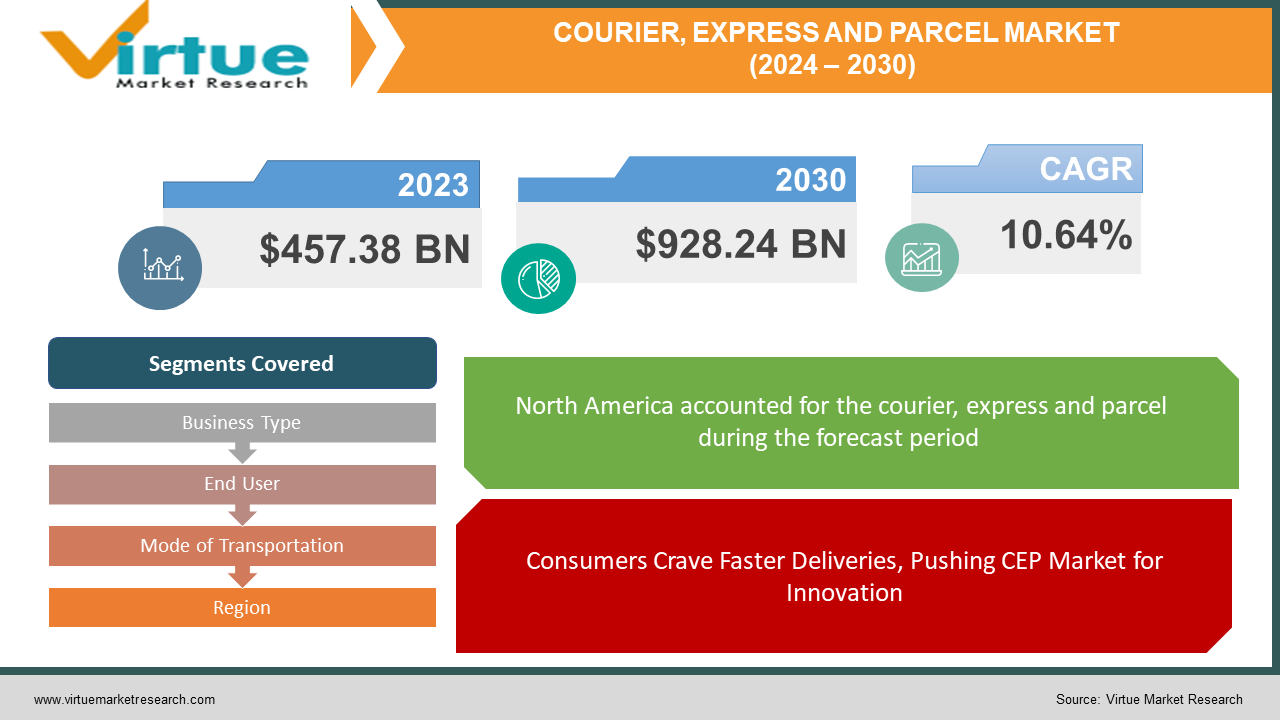

The Courier, Express and Parcel (CEP) Market was valued at USD 457.38 billion in 2023 and is projected to reach a market size of USD 928.24 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 10.64%.

The Courier, Express and Parcel (CEP) market plays a vital role in our world, ensuring documents and parcels reach businesses and consumers. It's the backbone of e-commerce, the reason you can get that package you ordered delivered to your doorstep. Fueled by the surge in online shopping, the CEP industry is constantly innovating to meet the ever-increasing demand for faster deliveries. Same-day and next-day delivery options are becoming more commonplace, while international shipping allows businesses to reach wider markets and consumers to access products from around the globe. The CEP market caters to various needs, segmenting its services by business type (B2B, B2C, C2C), destination (domestic or international), and even the industry using them (retail, manufacturing, etc.)

Key Market Insights:

The CEP market is the engine that keeps e-commerce running smoothly. Fueled by the ever-growing popularity of online shopping, the demand for fast and reliable deliveries is pushing the CEP industry to new heights. Consumers are no longer satisfied with waiting weeks for their purchases - same-day and next-day delivery options are becoming the norm. This obsession with speed extends beyond domestic borders as well. The rise of international trade means businesses is seeking wider markets, and the CEP market is responding with robust international shipping solutions.

But the CEP market isn't a one-size-fits-all solution. It's a complex network catering to a variety of needs. Businesses rely on B2B deliveries to keep their operations running, while individuals use C2C services to send packages to friends and family. Whether it's domestic deliveries within a city or international shipments across continents, the CEP market tailors its services to reach the right destination for the right customer. Different industries, from retail giants to manufacturers, all rely on CEP services to function efficiently. This segmentation ensures a targeted approach that meets the specific needs of each client.

Innovation is the name of the game in the CEP market. Companies are constantly seeking ways to optimize delivery routes, with software playing a key role. We're even seeing the rise of drone deliveries and automation in warehouses, all aimed at creating a faster, more cost-effective delivery experience. Sustainability is another major focus.

The Courier, Express and Parcel (CEP) Market Drivers:

Consumers Crave Faster Deliveries, Pushing CEP Market for Innovation

E-commerce has undeniably become the star player. The dramatic rise in online shopping creates a massive demand for CEP services. As more and more consumers purchase goods online, the need for swift and reliable deliveries to get those packages from stores directly to their doorsteps becomes paramount. This surge in e-commerce activity translates to a booming CEP market, constantly working to meet the ever-increasing delivery needs of online shoppers.

Globalization Creates Need for Robust International Shipping Solutions

Consumer patience is wearing thin. Today's online shoppers crave lightning-fast deliveries, and next-day or even same-day delivery options are becoming the norm rather than the exception. This obsession with speed has turned delivery windows into a battleground for CEP companies. They are relentlessly innovating to optimize delivery routes, leverage various transportation modes (think airplanes for same-day deliveries!), and streamline their processes to meet these ever-tightening deadlines.

CEP Market Segments Offerings to Cater to Diverse Clientele Needs

Businesses are shattering geographical barriers and reaching out to wider markets on a global scale. This international trade boom translates to a growing demand for international shipping solutions within the CEP market. Reliable and efficient cross-border deliveries are no longer a luxury, but a crucial element for businesses to compete in the global marketplace. The CEP market is responding to this demand by developing robust international shipping infrastructure and services to ensure seamless global deliveries.

Technological Advancements Drive Efficiency and Innovation in Deliveries

The CEP market caters to a diverse clientele, and a one-size-fits-all approach simply won't do. Businesses rely on B2B deliveries to keep their operations running smoothly, while individuals use C2C services to send packages to loved ones. Furthermore, specific industries, like healthcare or those dealing with perishable goods, necessitate specialized handling and temperature control. This understanding of the diverse needs within the market allows CEP companies to offer targeted services. By segmenting their offerings, they can ensure each customer receives delivery solutions tailored to their specific requirements.

The Courier, Express and Parcel (CEP) Market Restraints and Challenges:

While the CEP market flourishes alongside e-commerce, there are hurdles that can slow its progress. One key challenge is navigating the ever-changing regulatory landscape. The CEP sector is heavily regulated, and frequent modifications to laws can significantly impact business operations. These updates often translate to increased compliance costs and create administrative burdens for CEP companies.

Another obstacle lies in the competitive nature of the market. With established giants and new players vying for dominance, the CEP landscape is fierce. This cutthroat competition can lead to price wars, a race to the bottom that squeezes profit margins for all involved. Smaller players, especially, can find it difficult to compete effectively in such an environment.

Infrastructure limitations also pose a significant challenge. Dilapidated roads, traffic-clogged cities, and a lack of modern logistics facilities can significantly delay deliveries and inflate operational costs. This is particularly true in developing regions where infrastructure investment might lag. Finally, security is a constant concern. CEP companies handle a vast volume of packages, many containing valuables or sensitive documents. Ensuring the security of these parcels throughout the entire delivery journey is paramount. Implementing measures to prevent theft, damage, or loss adds to the operational complexity and cost for CEP companies.

The Courier, Express and Parcel (CEP) Market Opportunities:

The CEP market is brimming with opportunities as e-commerce and globalization continue to flourish. One exciting area is "last-mile delivery solutions." By focusing on the crucial final leg of getting packages to customers, CEP companies can develop innovative options like same-day deliveries, convenient pick-up/drop-off locations, and flexible delivery windows. This caters to the ever-growing consumer demand for speed and convenience. Technology is another goldmine. CEP companies can leverage data analytics to optimize delivery routes, automate warehouse processes with robotics, and even explore drone deliveries in certain areas. These advancements hold the promise of faster, more cost-effective, and potentially eco-friendly delivery models. The global landscape also presents exciting prospects. The e-commerce boom extends beyond established markets, with developing regions offering vast potential for CEP companies to expand their reach and cater to the growing demand for international shipping. This might involve partnerships with local players and investments in infrastructure development. But it's not just about speed and reach. The CEP market can cater to specific needs by offering specialized services. This could include temperature-controlled deliveries for pharmaceuticals or perishables, high-value items requiring extra security, or bulky items needing specialized handling. Finally, with environmental consciousness rising, there's an opportunity for CEP companies to embrace sustainability initiatives. Utilizing electric vehicles, implementing eco-friendly packaging, and optimizing routes to reduce carbon footprint can not only benefit the environment but also resonate well with today's eco-conscious consumers.

COURIER, EXPRESS AND PARCEL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.64% |

|

Segments Covered |

By Business Type, End User, Mode of Transportation, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Deutsche Post DHL Group, United Parcel Service (UPS), FedEx Corporation, SF Express (Group) Co. Ltd, Poste Italiane SpA, China Post Group, Yamato Transport Co., Ltd., Aramex |

Courier, Express and Parcel (CEP) Market Segmentation: By Business Type

-

B2B (Business-to-Business)

-

B2C (Business-to-Consumer)

-

C2C (Consumer-to-Consumer)

The dominant segment in the CEP market by Business Type is B2C (Business-to-Consumer), driven by the surge in e-commerce. B2C deliveries are what most people experience when they order online and receive packages at home. However, the fastest-growing segment is also B2C, as e-commerce continues to expand rapidly. This means CEP companies are constantly innovating to meet the rising consumer demand for faster and more convenient deliveries.

Courier, Express and Parcel (CEP) Market Segmentation: By End User

-

Services

-

Retail

-

Manufacturing

-

Construction and Utilities

-

Primary Industries

The dominant segment in the CEP market by End User is likely 'Retail' (B2C e-commerce is a major driver), driven by the surge in online shopping. However, the 'Manufacturing' segment is experiencing the most rapid growth due to the expanding e-commerce landscape and its complex supply chain requirements. These manufacturers rely on CEP services to transport raw materials, finished goods, and more to meet growing consumer demands.

Courier, Express and Parcel (CEP) Market Segmentation: By Mode of Transportation

-

Air

-

Land

-

Sea

-

Rail

By far, the most dominant mode of transportation in the CEP market is roadways. Trucks and vans deliver the bulk of packages due to their widespread availability, efficiency, and ability to handle door-to-door deliveries across various distances. However, the fastest-growing segment is likely airfreight. With the increasing demand for faster deliveries, especially for time-sensitive items, air transportation is becoming increasingly crucial for CEP companies.

Courier, Express and Parcel (CEP) Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America: This is a mature market with well-established giants like FedEx and UPS dominating the scene. E-commerce is booming, driving domestic B2C deliveries. However, infrastructure limitations in some rural areas can create challenges for efficient last-mile deliveries.

Europe: A highly developed market, Europe boasts a strong focus on e-commerce and benefits from well-developed infrastructure that facilitates smooth deliveries. However, navigating the complexities of regulations and fragmented markets across various European countries can add a layer of difficulty for CEP companies operating there.

Asia-Pacific: This region is experiencing the fastest growth within the CEP market, fueled by the explosion of the e-commerce sector, and rising disposable incomes among a growing middle class. However, underdeveloped infrastructure in some areas and complex customs procedures can hinder efficiency and create logistical bottlenecks.

South America: This region holds significant potential for CEP growth due to a burgeoning middle class and increasing internet penetration, making online shopping more accessible. Political instability and underdeveloped infrastructure in some countries can be hurdles that CEP companies need to overcome.

Middle East and Africa: Emerging as a promising market, the Middle East and Africa offer vast potential for e-commerce growth. However, limited infrastructure, political instability in some regions, and a preference for cash-on-delivery payments require innovative solutions from CEP companies to navigate these challenges and effectively serve this market. By understanding these regional nuances and adapting their approach accordingly, CEP companies can unlock the unique opportunities each region presents.

COVID-19 Impact Analysis on the Courier, Express and Parcel (CEP) Market:

The COVID-19 pandemic undeniably impacted the CEP market, bringing both challenges and unforeseen opportunities. Disrupted supply chains due to lockdowns and travel restrictions caused delays and created bottlenecks for CEP companies moving goods across borders. Rapidly changing regulations to control the pandemic further complicated logistics, adding confusion and hurdles. Additionally, the initial surge in panic buying and online shopping overwhelmed CEP companies as they scrambled to meet the dramatic increase in deliveries.

However, the pandemic also presented significant growth opportunities. The widespread closure of brick-and-mortar stores fuelled a boom in e-commerce, leading to a surge in demand for CEP services to deliver online purchases directly to consumers. This trend provided a much-needed boost to the CEP market. Furthermore, the need to cope with increased volume and navigate social distancing measures pushed CEP companies to accelerate their adoption of technology and automation in warehouses and delivery processes. This focus on innovation has the potential to create lasting improvements in efficiency and productivity. Finally, the pandemic highlighted the importance of efficient last-mile delivery solutions. CEP companies explored innovative approaches like contactless deliveries and pick-up/drop-off locations to cater to consumer concerns about safety during the pandemic.

In conclusion, the COVID-19 pandemic's impact on the CEP market was multifaceted. While it presented initial challenges, it also accelerated the adoption of e-commerce and pushed the CEP sector towards innovation and adaptation. As the world adjusts to a post-pandemic reality, the CEP market is likely to emerge stronger, more resilient, and better equipped to handle future fluctuations in demand.

Latest Trends/ Developments:

The CEP market is constantly buzzing with innovation as it strives to meet ever-shifting needs. A key trend is the focus on eco-friendly practices. CEP companies are utilizing electric vehicles, sustainable packaging, and optimized delivery routes to reduce their carbon footprint. Consumers are also demanding faster deliveries, and the concept of "hyperlocal deliveries" is gaining traction. This involves partnering with local stores to offer ultra-fast delivery options within minutes or hours. Technology is also playing a transformative role. Companies are exploring autonomous delivery solutions using drones and self-driving vehicles for last-mile deliveries, potentially leading to increased efficiency and contactless options. To build customer loyalty, subscription services with flat-rate or discounted delivery fees are becoming popular for frequent online shoppers. Finally, understanding the importance of customer experience, CEP companies are prioritizing features like real-time tracking, flexible delivery windows, convenient pick-up/drop-off locations, and seamless returns to create a smooth customer journey. Integration with e-commerce platforms is another hot trend, allowing customers to compare delivery options and schedule deliveries directly during checkout. As technology continues to evolve and consumer expectations shift, the CEP market is sure to see even more exciting developments that prioritize efficiency, sustainability, and ultimately, customer satisfaction.

Key Players:

-

Deutsche Post DHL Group

-

United Parcel Service (UPS)

-

FedEx Corporation

-

SF Express (Group) Co. Ltd

-

Poste Italiane SpA

-

China Post Group

-

Yamato Transport Co., Ltd.

-

Aramex

Chapter 1. Courier, Express and Parcel (CEP) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Courier, Express and Parcel (CEP) Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Courier, Express and Parcel (CEP) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Courier, Express and Parcel (CEP) Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Courier, Express and Parcel (CEP) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Courier, Express and Parcel (CEP) Market – By Business Type

6.1 Introduction/Key Findings

6.2 B2B (Business-to-Business)

6.3 B2C (Business-to-Consumer)

6.4 C2C (Consumer-to-Consumer)

6.5 Y-O-Y Growth trend Analysis By Business Type

6.6 Absolute $ Opportunity Analysis By Business Type, 2024-2030

Chapter 7. Courier, Express and Parcel (CEP) Market – By Mode of Transportation

7.1 Introduction/Key Findings

7.2 Air

7.3 Land

7.4 Sea

7.5 Rail

7.6 Y-O-Y Growth trend Analysis By Mode of Transportation

7.7 Absolute $ Opportunity Analysis By Mode of Transportation, 2024-2030

Chapter 8. Courier, Express and Parcel (CEP) Market – By End-Users

8.1 Introduction/Key Findings

8.2 Services

8.3 Retail

8.4 Manufacturing

8.5 Construction and Utilities

8.6 Primary Industries

8.7 Y-O-Y Growth trend Analysis By End-Users

8.8 Absolute $ Opportunity Analysis By End-Users, 2024-2030

Chapter 9. Courier, Express and Parcel (CEP) Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Business Type

9.1.3 By Mode of Transportation

9.1.4 By End-Users

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Business Type

9.2.3 By Mode of Transportation

9.2.4 By End-Users

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Business Type

9.3.3 By Mode of Transportation

9.3.4 By End-Users

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Business Type

9.4.3 By Mode of Transportation

9.4.4 By End-Users

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Business Type

9.5.3 By Mode of Transportation

9.5.4 By End-Users

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Courier, Express and Parcel (CEP) Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Deutsche Post DHL Group

10.2 United Parcel Service (UPS)

10.3 FedEx Corporation

10.4 SF Express (Group) Co. Ltd

10.5 Poste Italiane SpA

10.6 China Post Group

10.7 Yamato Transport Co., Ltd.

10.8 Aramex

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Courier, Express and Parcel (CEP) Market was valued at USD 457.38 billion in 2023 and is projected to reach a market size of USD 928.24 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 10.64%.

E-commerce Surge, Speed Obsession, Going Global, Segmentation and Customization.

B2B (Business-to-Business), B2C (Business-to-Consumer), C2C (Consumer-to-Consumer).

Asia-Pacific is the dominant region for the CEP market, driven by the surge in e-commerce and a growing middle class.

Deutsche Post DHL Group, United Parcel Service (UPS), FedEx Corporation, SF Express (Group) Co. Ltd, Poste Italiane SpA, China Post Group, Yamato Transport Co., Ltd., Aramex.