Counter Drone System/C-UAS Market Size (2024-2030)

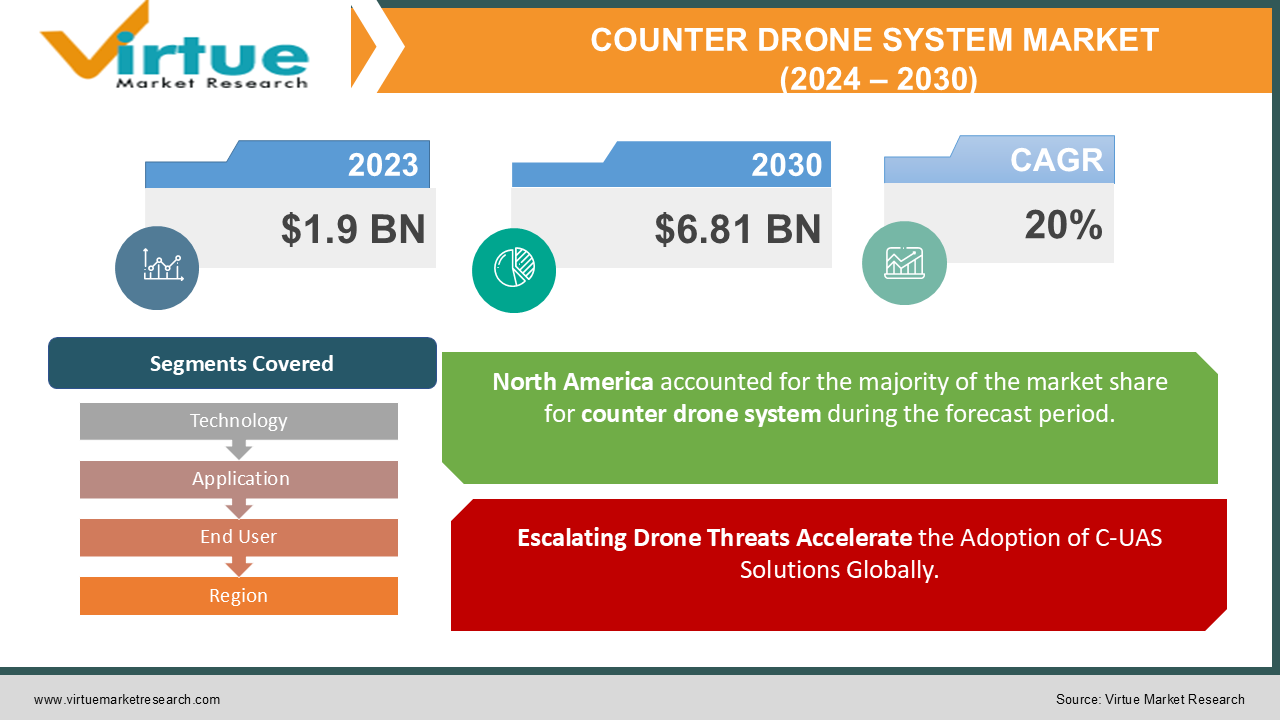

The Counter Drone System/C-UAS Market was valued at USD 1.9 billion in 2023 and is projected to reach a market size of USD 6.81 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 20%.

The Counter Drone System (C-UAS) market is on a fast track due to the growing number of drone threats. These threats range from malicious activities to disruptions at critical locations. The widespread use of drones for various purposes, coupled with a heightened awareness of potential dangers, is pushing governments and organizations to invest in C-UAS solutions. Furthermore, advancements in detection, jamming, and neutralization technologies are fueling market growth.

Key Market Insights:

With drone technology constantly evolving, the demand for C-UAS solutions is expected to continue its upward trajectory. Advancements in detection, jamming, and neutralization technologies are continuously improving the effectiveness of C-UAS systems.

The Counter Drone System/C-UAS Market Drivers:

Escalating Drone Threats Accelerate the Adoption of C-UAS Solutions Globally.

The increasing number of drone-related incidents, including malicious activities like terrorism and espionage, disruptions at critical infrastructure and events, is driving the demand for C-UAS solutions. Governments and organizations are prioritizing countermeasures to mitigate these threats.

Widespread commercial and recreational drone use raises awareness of potential misuse and the need for C-UAS solutions.

The widespread adoption of drones for various purposes, both commercial (e.g., deliveries, photography) and recreational, creates a growing potential for misuse. This heightened awareness of the potential dangers posed by drones fuels the need for C-UAS systems.

Advancements in detection, jamming, and neutralization technologies make C-UAS systems more effective and attractive.

Advancements in detection, jamming, and neutralization technologies are propelling the C-UAS market forward. New and improved methods for identifying and disabling unauthorized drones are constantly being developed, making C-UAS systems more effective and appealing to potential users.

Segmentation by technology, application, and end user ensures C-UAS caters to diverse needs in defense, security, and homeland security.

The C-UAS market caters to a wide range of users and applications through its segmentation based on technology, application, and end user. This allows for tailored solutions that address the specific needs of military defense, commercial security (airports etc.), and homeland security efforts.

Expanding awareness of drone threats leads to a wider user base, including critical infrastructure operators and private businesses.

As the awareness of drone threats grows, the user base for C-UAS systems is expanding beyond just government agencies. Critical infrastructure operators, such as airports and power plants, are recognizing the importance of protecting their airspace. Additionally, private businesses are increasingly investing in C-UAS solutions to safeguard their facilities and operations.

The Counter Drone System/C-UAS Market Restraints and Challenges:

While the C-UAS market is flourishing, there are hurdles to overcome. The high cost of C-UAS systems, encompassing procurement, installation, and maintenance, can be a barrier for some potential users. Budgetary constraints can limit adoption, especially for those who might not perceive an immediate and significant threat. Regulations governing airspace and electromagnetic spectrum usage add another layer of complexity. Integrating C-UAS systems with existing infrastructure to comply with these regulations presents additional challenges.

Technological limitations also exist. Current C-UAS systems might be susceptible to workarounds by malicious actors employing techniques like spoofing or jamming to bypass detection or disable the system. Effectively distinguishing authorized drones from unauthorized ones, particularly in dense urban areas, can be another hurdle. Furthermore, integrating C-UAS systems with existing air traffic control and security infrastructure can be complex, requiring significant modifications and potentially causing compatibility issues.

Perhaps the most ongoing challenge lies in keeping pace with the evolving threat landscape. As drone technology advances, C-UAS systems need to constantly adapt to counter new tactics and threats. This necessitates continuous development and upgrades to stay ahead of potential drone advancements employed by malicious actors.

The Counter Drone System/C-UAS Market Opportunities:

While the C-UAS market faces challenges like high costs and complex regulations, it also boasts a future brimming with exciting opportunities. Advancements in artificial intelligence (AI) and machine learning (ML) hold immense potential for C-UAS systems. AI can revolutionize threat detection and classification, making these systems faster and more accurate. Imagine C-UAS systems that can not only identify drones but also predict their flight paths and intentions, enabling a more proactive approach to security. Similarly, ML can empower C-UAS systems to learn and adapt to ever-evolving drone tactics employed by malicious actors. This continuous learning ensures C-UAS systems remain effective against the latest threats.

Furthermore, seamless integration with existing air traffic control and security infrastructure presents a significant opportunity. Improved interoperability standards and the development of user-friendly interfaces will pave the way for wider adoption. Imagine a future where C-UAS systems seamlessly integrate with existing security networks, creating a more robust and comprehensive defense system. Additionally, a focus on cost-effectiveness will attract a broader user base.

The evolving regulatory landscape surrounding drone usage and airspace management also presents opportunities. By collaborating with regulatory bodies, C-UAS manufacturers can develop compliant and user-friendly solutions that not only address current needs but also anticipate future regulations. This proactive approach ensures C-UAS systems remain aligned with the evolving legal landscape. Finally, the C-UAS market isn't restricted to developed nations. As drone use increases in emerging economies, there's a chance to tailor C-UAS solutions that fit their specific needs and budgets.

COUNTER DRONE SYSTEM/C-UAS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

20% |

|

Segments Covered |

By Technology, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Raytheon Technologies Corporation (RTX), Lockheed Martin Corporation, Leonardo S.p.A., Thales Group, Israel Aerospace Industries Ltd. (IAI), Rafael Advanced Defense Systems Ltd., Blighter Surveillance Systems Limited, DroneShield Ltd, Dedrone, DeTect Inc. |

Counter Drone System/C-UAS Market Segmentation: By Technology

-

Detection & Tracking

-

Neutralization

While definitive data can be elusive, experts predict the Detection & Tracking segment to be the dominant one in C-UAS technology due to the crucial need for comprehensive drone identification before neutralization. On the other hand, the Neutralization segment is expected to be the fastest growing as advancements in countermeasure technologies like lasers and jamming techniques continue to be developed at a rapid pace.

Counter Drone System/C-UAS Market Segmentation: By Application

-

Military & defence

-

Commercial

-

Homeland Security

The military & defence segment is currently the most dominant application sector in the C-UAS market due to the high priority governments place on protecting critical infrastructure and personnel. However, the commercial segment is expected to be the fastest-growing application sector. This is driven by the increasing use of drones for commercial purposes and the growing awareness of potential security risks at airports, stadiums, and other commercial facilities.

Counter Drone System/C-UAS Market Segmentation: By End User

-

Government Agencies

-

Critical Infrastructure Operators

-

Private Businesses

While the C-UAS market caters to various government and private entities, government agencies are currently the dominant end user segment due to their critical role in airspace security and defense. However, critical infrastructure operators, like airports and power plants, are expected to be the fastest-growing segment. As drone threats become more recognized and regulations evolve, these operators will prioritize C-UAS solutions to safeguard their vital assets and operations.

Counter Drone System/C-UAS Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America: Currently holding the top spot, North America boasts the largest market share. This dominance stems from significant investments by governments and critical infrastructure operators in this region. They prioritize safeguarding their airspace and vital assets from drone threats. Additionally, strong military spending on advanced defense technologies, including C-UAS systems, further fuels market growth in North America.

Europe: Not far behind, the European C-UAS market is experiencing rapid growth. This is driven by a heightened awareness of drone threats, prompting European nations to invest in countermeasures. Growing defense budgets across Europe also play a role. Furthermore, collaboration between European nations on security initiatives acts as a catalyst for market expansion, fostering research and development of C-UAS solutions.

Asia-Pacific: The Asia-Pacific region is projected to hold the highest CAGR (Compound Annual Growth Rate) in the coming years. This explosive growth is fueled by a potent mix of factors: rapid economic expansion across the region, rising military spending by countries like China and India, and a growing number of drone threats. With these factors converging, Asia-Pacific is poised to become a major player in the C-UAS market.

COVID-19 Impact Analysis on the Counter Drone System/C-UAS Market:

The impact of COVID-19 on the C-UAS market wasn't a straightforward story. While some areas saw unexpected benefits, others faced challenges. On the positive side, the pandemic heightened security concerns, particularly regarding bioterrorism. This raised awareness of the need for tighter border control and perimeter defence, potentially increasing demand for C-UAS systems to safeguard critical infrastructure and government facilities.

However, the pandemic also presented hurdles. Global lockdowns and travel restrictions disrupted supply chains for the electronic components and materials needed to manufacture C-UAS systems. This likely caused delays in system delivery and impacted manufacturers. Additionally, governments worldwide diverted resources towards fighting the pandemic and economic recovery. This could have led to delays in C-UAS procurement by some organizations, especially those with less pressing security concerns.

Overall, quantifying the exact impact of COVID-19 on C-UAS market growth is difficult. While short-term effects might have been dampened by supply chain issues and budgetary constraints, the long-term outlook remains positive. The increased focus on biosecurity and the potential for malicious drone use could fuel sustained growth in the C-UAS market in the coming years.

Looking ahead, some lingering questions remain. Will the post-pandemic reliance on automation and delivery drones necessitate more advanced C-UAS solutions for airspace management? How will advancements in drone technology in this new era influence the development of C-UAS systems? By carefully considering these trends, C-UAS market players can adapt their strategies to address the evolving security landscape in a post-pandemic world.

Latest Trends/ Developments:

The C-UAS market isn't just growing, it's rapidly innovating. One key trend is the integration of AI and machine learning (ML) into C-UAS systems. This allows for faster, more accurate threat detection and even prediction of drone flight paths. Imagine C-UAS systems that not only identify drones but also anticipate their movements, enabling a more proactive approach to security. Additionally, ML allows C-UAS systems to continuously learn and adapt to new drone tactics. Integration with existing infrastructure is another hot trend. Improved compatibility and user-friendly interfaces will encourage wider adoption. In the future, C-UAS systems could seamlessly communicate with existing security networks, creating a more robust defense system.

Directed energy weapons, like high-powered lasers, are also gaining ground. These offer a non-explosive way to disable drones, minimizing collateral damage. Advancements are making these lasers more compact, powerful, and weather-resistant, increasing their appeal. For budget-conscious users, a subscription-based model called Counter-UAS as a Service (CaaS) is emerging. CaaS eliminates the need for large upfront investments by having providers manage the entire C-UAS system operation. Finally, C-UAS technology is branching out beyond security. We're seeing its use in managing drone traffic for safe deliveries in urban areas and even for automated perimeter control in industries. These innovative applications open entirely new markets for C-UAS technology. By capitalizing on these trends, C-UAS manufacturers can develop cutting-edge solutions to address the ever-changing drone threat landscape.

Key Players:

-

Raytheon Technologies Corporation (RTX)

-

Lockheed Martin Corporation

-

Leonardo S.p.A.

-

Thales Group

-

Israel Aerospace Industries Ltd. (IAI)

-

Rafael Advanced Defense Systems Ltd.

-

Blighter Surveillance Systems Limited

-

DroneShield Ltd

-

Dedrone

-

DeTect Inc.

Chapter 1. Counter Drone System/C-UAS Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Counter Drone System/C-UAS Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Counter Drone System/C-UAS Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Counter Drone System/C-UAS Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Counter Drone System/C-UAS Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Counter Drone System/C-UAS Market – By Application

6.1 Introduction/Key Findings

6.2 Military & defence

6.3 Commercial

6.4 Homeland Security

6.5 Y-O-Y Growth trend Analysis By Application

6.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Counter Drone System/C-UAS Market – By Technology

7.1 Introduction/Key Findings

7.2 Detection & Tracking

7.3 Neutralization

7.4 Y-O-Y Growth trend Analysis By Technology

7.5 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Counter Drone System/C-UAS Market – By End User

8.1 Introduction/Key Findings

8.2 Government Agencies

8.3 Critical Infrastructure Operators

8.4 Private Businesses

8.5 Y-O-Y Growth trend Analysis By End User

8.6 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Counter Drone System/C-UAS Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Technology

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Technology

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Technology

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Technology

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Technology

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Counter Drone System/C-UAS Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Raytheon Technologies Corporation (RTX)

10.2 Lockheed Martin Corporation

10.3 Leonardo S.p.A.

10.4 Thales Group

10.5 Israel Aerospace Industries Ltd. (IAI)

10.6 Rafael Advanced Defense Systems Ltd.

10.7 Blighter Surveillance Systems Limited

10.8 DroneShield Ltd

10.9 Dedrone

10.10 DeTect Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Counter Drone System/C-UAS Market was valued at USD 1.9 billion in 2023 and is projected to reach a market size of USD 6.81 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 20%.

Rising Drone Threats, Widespread Drone Use, Technological Advancements, Segmented Market Catering to Diverse Needs, Expanding User Base.

Government Agencies, Critical Infrastructure Operators, Private Businesses.

The most dominant region for the C-UAS market is currently North America, driven by significant investments from governments and critical infrastructure operators.

Raytheon Technologies Corporation (RTX), Lockheed Martin Corporation, Leonardo S.p.A., Thales Group, Israel Aerospace Industries Ltd. (IAI), Rafael Advanced Defense Systems Ltd., Blighter Surveillance Systems Limited, DroneShield Ltd, Dedrone, DeTect Inc.