Cosmetic Lasers Market Size (2025 – 2030)

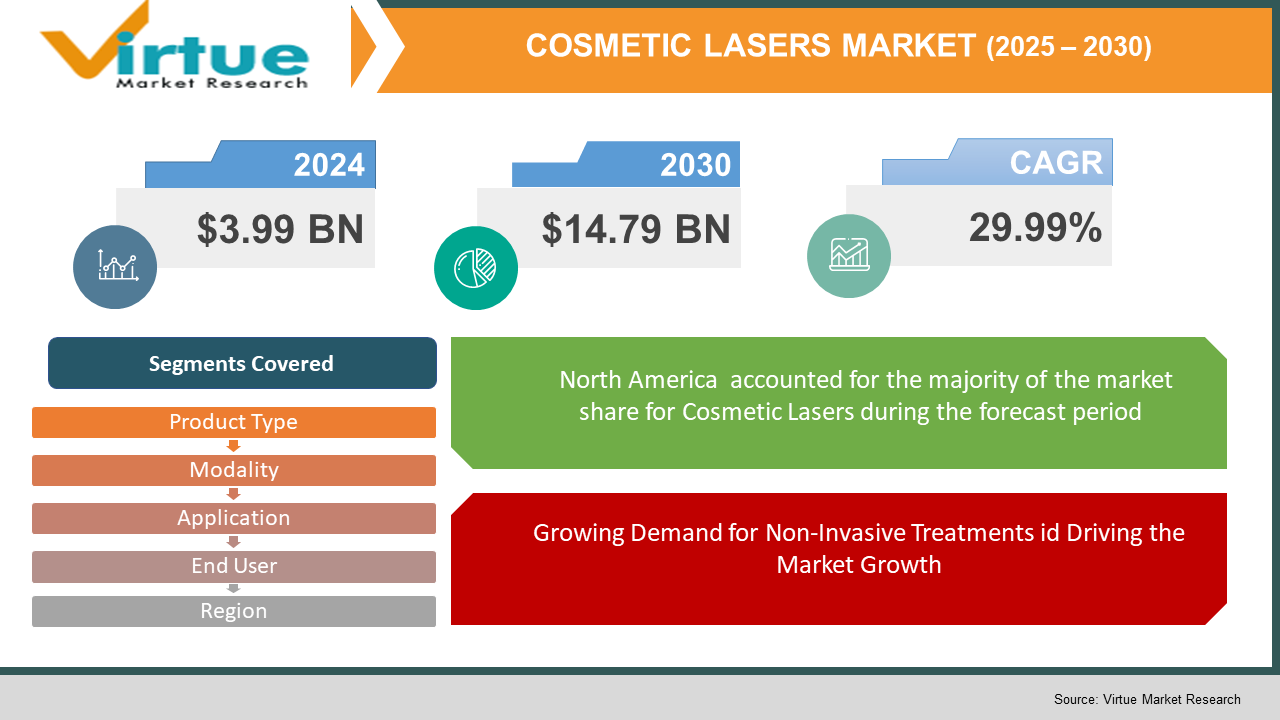

The Cosmetic laser market was valued at USD 3.99 billion and is projected to reach a market size of USD 14.79 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 29.99%.

The cosmetics laser market deals with the innovation and use of laser technology in aesthetic procedures that improve physical appearance. These procedures correct skin and body issues such as hair removal, skin resurfacing, correction of vascular lesions, reduction of scars and acne, and body sculpting. The market provides a variety of laser products, mostly divided into ablative lasers, which peel off layers of skin, and non-ablative lasers, which stimulate the underlying skin tissue without damaging the surface. Improvements in laser technology have made the procedures more accurate, efficient, and less invasive, making them more popular among people who want cosmetic improvements. Major players in this market are firms like Lumenis Ltd., Candela Corporation, Cynosure, Inc., Alma Lasers, Ltd., and Sciton, Inc.

The market growth is driven by trends like increasing consumer consciousness of cosmetic treatments, an aging population looking for anti-aging treatments, and the evolution of sophisticated laser technologies with enhanced safety and effectiveness. The shift towards minimally invasive treatments has also expanded the market, attracting consumers looking for effective treatments with less downtime. The major players are emphasizing product development and strategic acquisitions to leverage these opportunities, further driving market growth.

Key Market Insights:

- All the market growth can be credited to the increasing occurrence of skin issues, an intensified focus on how one looks, and the increased availability of better and more sophisticated laser technology.

- North America presently dominates the market, thanks largely to the aggressive uptake of the latest cosmetic interventions and the prevalence of major players in the market.

- The region of Asia-Pacific, though, is predicted to experience the quickest growth with growth driven by growing disposable incomes and greater consciousness regarding aesthetic procedures.

- Major players in the market are emphasizing product development and strategic alliances to solidify their position in the market and address changing consumer demand for effective and safe cosmetic laser procedures.

- Innovations like fractional lasers, picosecond lasers, and AI-powered laser devices are improving treatment outcomes, reducing recovery times, and increasing patient safety.

Cosmetic Lasers Market Key Drivers:

Growing Demand for Non-Invasive Treatments id Driving the Market Growth:

Consumers are also increasingly choosing non-invasive aesthetic treatments because they have less downtime, fewer chances of complications, and natural appearance. Cosmetic lasers provide efficient treatment for a variety of aesthetic problems without surgical intervention, thus improving their uptake.

Technological Developments in Laser Equipment:

Ongoing technological advancements in laser technology have resulted in the creation of more accurate, effective, and safer cosmetic laser equipment. These developments have increased the scope of conditions that can be treated and enhanced patient results, rendering laser treatments more attractive to practitioners and patients alike.

Increased Urbanization and Beauty Awareness:

The worldwide trend of urbanization has increased the emphasis on personal beauty and appearance. With more people living in cities with greater exposure to media and beauty trends, there is increased demand for aesthetic treatments, including those involving cosmetic lasers.

Cosmetic Lasers Market Restraints and Challenges:

The cosmetic laser market is confronted with various restraints and challenges that affect its growth and availability. Expensive treatment, including the capital expenditure for sophisticated laser equipment and maintenance, represents a major economic hurdle for both patients and providers. Moreover, strict regulatory measures require substantial compliance efforts, which may slow the entry of new technologies and complicate operations. The industry also struggles with a lack of trained professionals who can handle advanced laser technology, which can restrict service quality and availability. In addition, possible side effects of laser treatments, including skin irritation or changes in pigmentation, can discourage potential clients. Restricted reimbursement policies for aesthetic procedures also limit patient access, as out-of-pocket costs are high. Together, these factors pose significant obstacles to the mass acceptance and development of cosmetic laser procedures.

Cosmetic Lasers Market Opportunities:

The rising preference for minimally invasive cosmetic treatments is driving the adoption of laser technologies. Innovations in laser precision, safety, and efficiency, such as AI-powered and multi-wavelength lasers, are expanding treatment options. Affordable cosmetic laser treatments in emerging economies are attracting international patients, boosting market growth. The demand for at-home cosmetic laser devices is increasing due to convenience and cost-effectiveness. The growing aging population and rising social media influence are fueling demand for laser-based anti-aging treatments.

COSMETIC LASERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

29.99% |

|

Segments Covered |

By Product Type, modality, application, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lumenis Ltd., Candela Corporation, Cynosure, Inc., Alma Lasers, Ltd., Sciton, Inc., Solta Medical, Syneron Medical Ltd., Cutera, Inc., and El.En. S.p.A., and Aerolase Corporation. |

Cosmetic Lasers Market Segmentation:

Cosmetic Lasers Market Segmentation By Product Type:

- Ablative Lasers

- Non-Ablative Lasers

The market for cosmetic lasers is chiefly divided into non-ablative and ablative lasers. Non-ablative lasers are the leading and highest-growing segment with a market share of about 65% in 2024. This leadership is due to their capability of offering efficient treatments with less downtime, as they treat deeper layers of skin without harming the outer layer. Uses of non-ablative lasers are skin tightening, rejuvenation, pigmentation problems, and acne scar treatment. They are a choice among consumers who want cosmetic enhancements due to their non-invasive nature, less risk of complications, and shorter downtime.

Cosmetic Lasers Market Segmentation By Modality:

- Pulsed Dye Laser (PDL)

- YAG Laser

- Carbon Dioxide (CO₂) Laser

- Erbium Laser

- Intense Pulsed Light (IPL)

- Radiofrequency and Infrared

In the cosmetic laser industry, the Pulsed Dye Laser (PDL) modality has the largest market share in the world today. This is due to the efficacy of PDL in the treatment of vascular lesions and skin rejuvenation. The YAG Laser segment, however, is growing at the highest rate, with an estimated Compound Annual Growth Rate (CAGR) of 14% during the forecast period. This quick growth is attributed to the versatility of YAG Laser in treatments like tattoo removal, hair removal, and skin resurfacing, which has made it more popular in aesthetic procedures.

Cosmetic Lasers Market Segmentation By Application:

- Hair Removal

- Skin Resurfacing

- Vascular Lesions

- Scar and Acne Removal

- Body Contouring

Among cosmetic lasers, hair removal is the leading application with a market share of about 33.2% in 2024. This is because the demand for non-surgical and long-lasting hair reduction has been on the rise. At the same time, the scar and acne removal segment is growing at the fastest rate with a projected compound annual growth rate (CAGR) of 4.88%. This increase is due to technological improvements in laser devices and an increasing interest in skin aesthetics.

Cosmetic Lasers Market Segmentation By End User:

- Hospitals

- Skin Care Clinics

- Cosmetic Surgery Centers

- Medical Spas

Skin care clinics represent the leading end-user segment within the cosmetic lasers market, controlling 54.3% of the overall market share in 2024. This is largely due to their specialized skin treatments and access to sophisticated laser technology. The medical spa segment is also growing aggressively, fueled by the popularity of non-invasive aesthetic treatments being provided in a spa setting. The blend of medical knowledge and a soothing environment in medical spas attracts a wide range of clients who are looking for cosmetic laser treatments.

Cosmetic Lasers Market Regional Analysis:

The international market for cosmetic lasers is anticipated to witness tremendous growth in 2024, owing to the rising demand for non-surgical aesthetic treatments and advancements in laser technology. Regionally, North America dominated the market in 2024 with 35% of the global market share, owing to the presence of key industry players and high consumer awareness. Europe is expected to experience high growth with a CAGR of 17.4%, driven by high R&D spending and well-developed healthcare infrastructure. Asia-Pacific is anticipated to see the most significant growth rate on account of growing disposable income, medical tourism, and rising consciousness of cosmetic treatments.

COVID-19 Impact Analysis on the Cosmetic Lasers Market:

The COVID-19 pandemic heavily impacted the cosmetic laser market, mainly because of the temporary shutdown of aesthetic centers and dermatology clinics, which caused a steep decline in procedures. Elective procedures were rescheduled, and consumer expenditures on non-essential services dropped, further affecting the market. Nevertheless, with the opening of restrictions and rising vaccination rates, the market is rebounding robustly. Bottled-up demand from delayed treatments, combined with a new focus on personal looks as people get back to socializing, is fueling growth. Clinics have responded by introducing more stringent safety measures and virtual consultations to address the changing needs of consumers in the post-pandemic environment.

Recent Trends/Developments:

The market for cosmetic lasers is growing at a high rate due to technological development and increasing demand for non-invasive cosmetic procedures. Emerging technologies like the creation of advanced multi-application laser platforms and the convergence of artificial intelligence and robotics are improving the accuracy of treatment and creating new conditions that can be treated. Cosmetic lasers are now being used for medical dermatology treatments, such as scar reduction, pigmentation disorders, and vascular lesions. Manufacturers are focusing on developing sustainable and energy-efficient laser devices to reduce environmental impact and operational costs.

Key Players in the Cosmetic Lasers Market:

- Alma Lasers (Israel)

- Candela Corporation (US)

- Cutera, Inc. (US)

- Cynosure, Inc. (US)

- El.En. S.p.A. (Italy)

- Lumenis Ltd. (Israel)

- Sciton, Inc. (US)

- Solta Medical (US)

- Syneron Medical Ltd. (Israel)

- Aerolase Corporation (US)

Chapter 1. Cosmetic Lasers Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Cosmetic Lasers Market– Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Cosmetic Lasers Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Cosmetic Lasers Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Cosmetic Lasers Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Cosmetic Lasers Market– By Product Type

6.1 Introduction/Key Findings

6.2 Ablative Lasers

6.3 Non-Ablative Lasers

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Global Cosmetic Lasers Market– By Application

7.1 Introduction/Key Findings

7.2 Hair Removal

7.3 Skin Resurfacing

7.4 Vascular Lesions

7.5 Scar and Acne Removal

7.6 Body Contouring

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. Global Cosmetic Lasers Market– By Modality

8.1 Introduction/Key Findings

8.2 Pulsed Dye Laser (PDL)

8.3 YAG Laser

8.4 Carbon Dioxide (CO₂) Laser

8.5 Erbium Laser

8.6 Intense Pulsed Light (IPL)

8.7 Radiofrequency and Infrared

8.8 Y-O-Y Growth trend Analysis Modality

8.9 Absolute $ Opportunity Analysis Modality , 2023-2030

Chapter 9. Global Cosmetic Lasers Market– By End-User

9.1 Introduction/Key Findings

9.2 Hospitals

9.3 Skin Care Clinics

9.4 Cosmetic Surgery Centers

9.5 Medical Spas

9.6 Y-O-Y Growth trend Analysis End-User

9.7 Absolute $ Opportunity Analysis End-User , 2023-2030

Chapter 10. Cosmetic Lasers Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Product Type

10.1.3. By Application

10.1.4. By Modality

10.1.5. End-User

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Product Type

10.2.3. By Application

10.2.4. By Modality

10.2.5. End-User

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Product Type

10.3.3. By Application

10.3.4. By Modality

10.3.5. End-User

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By End-User

10.4.3. By Modality

10.4.4. By Application

10.4.5. Product Type

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Application

10.5.3. By Modality

10.5.4. By Product Type

10.5.5. End-User

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Cosmetic Lasers Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Alma Lasers (Israel)

11.2 Candela Corporation (US)

11.3 Cutera, Inc. (US)

11.4 Cynosure, Inc. (US)

11.5 El.En. S.p.A. (Italy)

11.6 Lumenis Ltd. (Israel)

11.7 Sciton, Inc. (US)

11.8 Solta Medical (US)

11.9 Syneron Medical Ltd. (Israel)

11.10 Aerolase Corporation (US)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

As of 2024, the global cosmetic lasers market was valued at approximately USD 3.99 billion. It is projected to reach around USD 14.75 billion by 2030, growing at a compound annual growth rate (CAGR) of 29.9% during the forecast period from 2024 to 2030.

The market's expansion is primarily driven by the increasing demand for non-invasive aesthetic procedures, technological advancements in laser treatments, a growing aging population seeking anti-aging solutions, and rising consumer awareness about cosmetic laser benefits.

Hair removal and skin resurfacing are among the leading applications in the cosmetic lasers market. The versatility and effectiveness of laser treatments in addressing various skin concerns have made these applications particularly popular

Major companies operating in the cosmetic lasers market include Lumenis Ltd., Candela Corporation, Cynosure, Inc., Alma Lasers, Ltd., Sciton, Inc., Solta Medical, Syneron Medical Ltd., Cutera, Inc., and El.En. S.p.A., and Aerolase Corporation.

Challenges in the market include the high cost of laser treatments, potential side effects such as redness and swelling, limited insurance coverage for cosmetic procedures, and the necessity for skilled practitioners to perform laser treatments safely and effectively.