Cosmeceuticals Market Size (2025 – 2030)

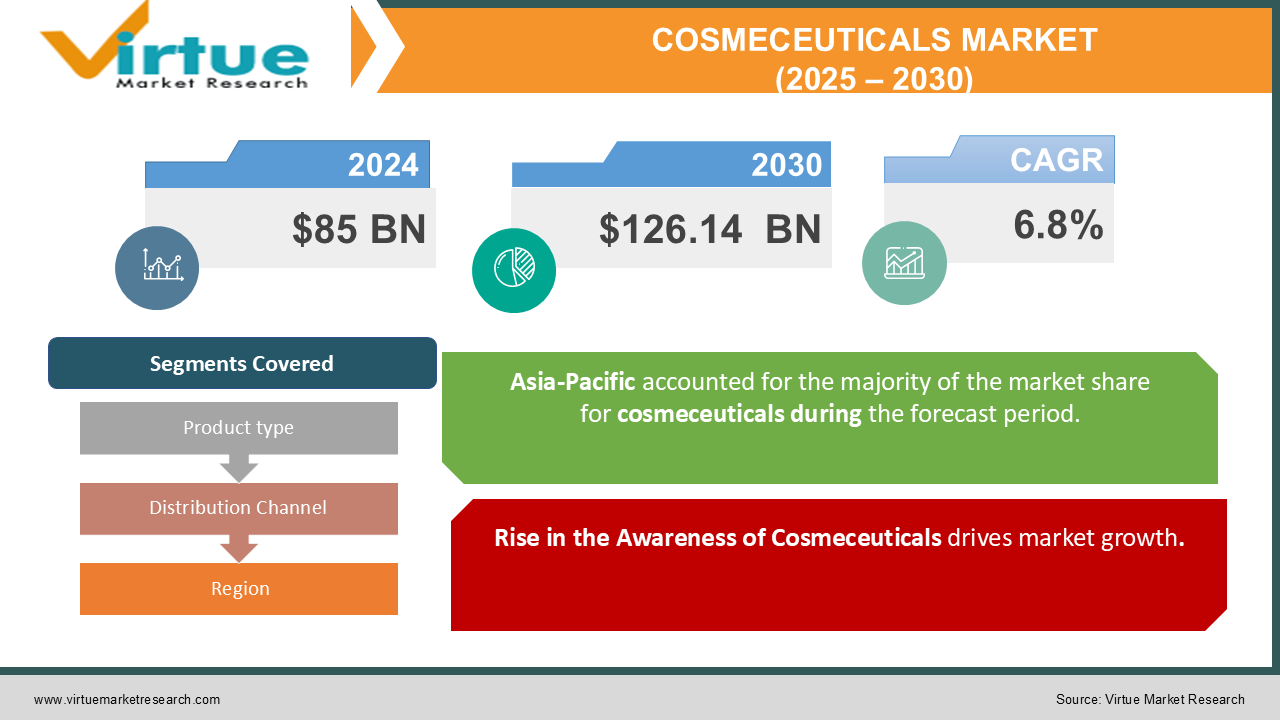

The Cosmeceuticals Market was valued at USD 85 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 126.14 billion by 2030, growing at a CAGR of 6.8%.

Cosmeceuticals refer to cosmetic products that incorporate bioactive ingredients recognized for their therapeutic properties. The growing incidence of skin conditions globally, coupled with dermatologists' preference for recommending these products as an alternative to traditional treatments, is driving their increasing demand. Additionally, the efforts of major market participants in establishing e-commerce platforms to meet the rising demand for these products are expected to contribute to the continued expansion of the cosmeceuticals market.

Key Market Insights:

Cosmeceuticals designed for general skincare, such as sunscreens, moisturizers, and acne treatments, are typically available for over-the-counter purchase without the need for a prescription. On the other hand, specialized products, including moisturizers for conditions like eczema and diabetes, generally require a prescription from a healthcare provider. The legal status of cosmeceuticals remains unclear, as the U.S. FDA has yet to officially recognize this category. In the European Union, cosmetic regulations permit products to offer secondary preventative benefits but prohibit claims of curative effects. Any skincare product marketed as a medicinal treatment would need to undergo extensive testing and obtain regulatory approval before being sold internationally.

Cosmeceuticals Market Drivers:

Rise in the Awareness of Cosmeceuticals drives market growth.

The expansion of initiatives by government bodies and major companies aimed at raising awareness about skin and hair health has significantly contributed to the growing global use of cosmeceuticals. In addition, the continuous efforts by industry leaders to develop active ingredients have played a crucial role in promoting the widespread adoption of these products across both emerging and developed markets.

The rising incidence of skin conditions among both adults and children is a primary factor fueling the high demand for skincare products. Furthermore, consumer awareness of the benefits of natural and organic cosmetics is increasing, alongside the growing availability of these products in major retail outlets. For many consumers, ensuring that beauty products have minimal environmental impact is a key consideration in their purchasing decisions. Additionally, the increasing preference for natural and organic cosmetics is driving greater demand for sustainably sourced ingredients in skincare and cosmetic products.

These trends, coupled with the global shift toward organic product adoption, have prompted numerous market participants to innovate by creating new formulations with a focus on active ingredients, including plant-based alternatives. This rise in product innovation and the surge in key product launches are key drivers of market growth.

Cosmeceuticals Market Restraints and Challenges:

High Cost and Lack of Stringent Regulations hinder Market Growth.

The global demand for cosmeceutical products is increasing due to the rising incidence of skin and hair disorders, a growing elderly population, and heightened awareness of dermatological treatments. However, the high cost of branded cosmeceuticals from major market players is expected to limit the market's growth. Factors contributing to the high cost include the positioning of many companies as luxury brands, significant investments in research and development for novel products, and extensive brand marketing campaigns.

For example, in February 2022, L'Oréal Professional Products launched its "Hair the Love 2022" campaign, which aimed to promote its premium hair care line by targeting hairdressers and enhancing product distribution through leading salon chains.

Moreover, many cosmeceutical companies cite the high cost of ingredients, complex manufacturing processes, and substantial research and development expenses as key contributors to the elevated prices of their products. Additionally, the costs associated with marketing these products—emphasizing the science and technology behind them—further drive up their retail price.

The availability of low-quality alternatives, due to insufficient regulation, is a significant obstacle to market growth. Additionally, the lack of insurance coverage for cosmeceuticals in developing regions is expected to hinder their adoption, particularly during the forecast period.

Cosmeceuticals Market Opportunities:

Rise in skin diseases and lifestyle preferences create opportunities for cosmeceutical market growth.

The cosmeceutical market is expected to experience significant growth due to the rising prevalence of skin diseases worldwide. In the United States, acne affects up to 50 million people, while approximately 80 million individuals suffer from hair loss. Additionally, the incidence of melanoma, a type of skin cancer, continues to rise as the global population grows. This increasing awareness and concern about skin and hair health is driving greater consumer demand for beauty and personal care products, including cosmeceuticals. Consumers are increasingly opting for customized solutions tailored to their specific skin concerns, contributing to the rising popularity of cosmeceutical products. There is also a shift

from traditional cosmetics to cosmeceuticals, primarily due to the presence of natural ingredients that are perceived as more beneficial for skin health. This trend is further bolstering the growth of the cosmeceutical industry. These products typically contain a variety of active ingredients, such as antioxidants and benzoyl peroxide, with glycolic acid being a prominent example. Known for its anti-aging properties, glycolic acid helps prevent skin damage from sun exposure, making it a key component in many cosmeceutical formulations.

COSMECEUTICALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.8% |

|

Segments Covered |

By Product type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

L’Oréal Beiersdorf, Procter and Gamble, Estée Lauder Companies Inc., Shiseido Company Limited, Avon, Unilever, Croda International Plc Allergan,Johnson & Johnson Services, Inc. |

Cosmeceuticals Market Segmentation: By Product Type

-

Skin Care

-

Anti-Ageing

-

Skin Whitening

-

Sun Protection

-

Professional Skin Care

-

Anti-Acne

-

Others

-

-

Hair Care

-

Hair Growth

-

Anti-Dandruff

-

Others

-

-

Injectable

-

Botulinum Toxins

-

Dermal Fillers

-

Others

-

-

Others

-

Lip Care

-

Tooth Whitening

-

Oral Care

-

The skincare segment is dominating the cosmeceutical market, driven by the growing adoption of personal care products and increasing awareness of skin diseases among the general population. Within the skincare category, the anti-aging segment holds the largest market share due to the rising aging population and heightened awareness of anti-aging products designed to effectively address wrinkles and other signs of aging.

The injectable segment is expected to experience the fastest compound annual growth rate (CAGR) during the forecast period, driven by the expanding use of injectable cosmeceuticals in medical and aesthetic procedures. This segment is further subdivided into botulinum toxin, dermal fillers, and other injectable products. Among these, the botulinum toxin segment leads the market share, driven by its growing applications in both cosmeceutical and aesthetic treatments, along with the entry of key market players introducing innovative products to the injectable segment.

Cosmeceuticals Market Segmentation: By Distribution Channel

-

Hypermarkets

-

Convenience stores

-

Pharmacy/Drug Stores

-

Specialty stores

-

Online Stores

-

Others

The pharmacy and drug stores segment holds the largest market share, primarily due to the availability of advanced cosmeceutical products at competitive prices and the discounts offered by these stores. Additionally, the significant expansion of this segment in the global market can be attributed to the widespread presence of pharmacy and drug stores in developed regions and the growing market penetration of leading retail chains.

The online stores segment, however, is expected to register the highest compound annual growth rate (CAGR) compared to other segments. This growth is driven by the increasing investments of major companies in e-commerce and digital platforms, which allow them to engage with consumers in real time. Furthermore, the COVID-19 pandemic has accelerated the shift in consumer preferences towards online shopping, contributing to the growth of this segment.

Cosmeceuticals Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia Pacific region leads the global cosmeceutical market, driven by strategic partnerships, a strong focus on product launches, and increasing investments in digital infrastructure to enhance product appeal and distribution. The growing population and rising awareness of these products among the public are also key factors fueling market growth in the region.

For example, in January 2021, L'Oréal acquired Takami Co., a Japanese skincare brand developer, which included Takami's dermatology clinics under a long-term brand licensing agreement. This acquisition not only provided L'Oréal with better access to regional markets but also strengthened both companies' market positions.

Moreover, the number of cosmeceutical consumers in Asia Pacific is expected to rise steadily, driven by increased awareness of the benefits of enhancing facial aesthetics, skin, and hair health. The growing prevalence of dermatological conditions is further boosting demand for these products in the region.

North America holds the second-largest share of the global market, largely due to a large patient population suffering from dermatological disorders such as melanoma and eczema, as well as the growing adoption of advanced dermatological products. Additionally, the increasing number of non-surgical cosmetic procedures is expected to drive further demand for cosmeceuticals, supporting the region's market growth.

COVID-19 Pandemic: Impact Analysis

The demand for cosmeceuticals globally was significantly impacted by the COVID-19 pandemic. A major decline in patient visits to dermatologists and the closure of stores that distribute these products during lockdown periods were among the primary factors negatively affecting the market. Additionally, the cancellation of elective procedures, including medical aesthetic treatments, to prevent the spread of COVID-19 led to reduced patient visits to specialty clinics offering aesthetic therapies. This decline in procedures resulted in fewer prescriptions for cosmeceuticals, which adversely influenced the market outlook.

Latest Trends/ Developments:

In January 2023, Oriflame launched its inaugural range of cosmeceutical products, NovAge Proceuticals, in the Indian market. These products are formulated to address specific skin concerns, offering concentrated treatments for visible, proven results. Oriflame operates through a social selling model and has gained significant recognition in the cosmetics industry. The company is now focused on expanding its skincare offerings to meet the growing demand for branded skincare in India, a trend accelerated by the COVID-19 pandemic.

In October 2022, Obagi Cosmeceuticals moved its corporate headquarters to The Woodlands, Texas, as part of a broader expansion that has seen 32 businesses relocate or expand in the area. The company leased 16,470 square feet of office space at The Woodlands Towers at The Waterway, contributing to a total of 522,028 square feet of new office space and 2,000 new residents since 2020. Known for its business-friendly environment, The Woodlands offers skilled employees and a high quality of life.

In July 2022, Ankurit Capital acquired a 7.71% stake in Deccan Healthcare Ltd., a company specializing in nutraceutical and cosmeceutical products. The fund purchased 13.3 lakh equity shares at Rs 37.6 per share. Deccan Healthcare plans to utilize the capital for digital transformation, enhancing its online presence, and expanding into international markets. The company is focused on addressing nutrient deficiency diseases and aims to tap into the global market for anti-aging solutions, estimated to be worth over $270 billion.

Key Players:

These are top 10 players in the Cosmeceuticals Market :-

-

L’Oréal

-

Beiersdorf

-

Procter and Gamble

-

Estée Lauder Companies Inc.

-

Shiseido Company Limited

-

Avon

-

Unilever

-

Croda International Plc

-

Allergan

-

Johnson & Johnson Services, Inc.

Chapter 1. Cosmeceuticals Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cosmeceuticals Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cosmeceuticals Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cosmeceuticals Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cosmeceuticals Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cosmeceuticals Market – By Product

6.1 Introduction/Key Findings

6.2 Skin Care

6.3 Anti-Ageing

6.4 Skin Whitening

6.5 Sun Protection

6.6 Professional Skin Care

6.7 Anti-Acne

6.8 Others

6.9 Hair Care

6.10 Hair Growth

6.11 Anti-Dandruff

6.12 Others

6.13 Injectable

6.14 Botulinum Toxins

6.15 Dermal Fillers

6.16 Others

6.17 Others

6.18 Lip Care

6.19 Tooth Whitening

6.20 Oral Care

6.21 Y-O-Y Growth trend Analysis By Product

6.22 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Cosmeceuticals Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Hypermarkets,

7.3 Convenience stores,

7.4 Pharmacy/Drug Stores

7.5 Specialty stores

7.6 Online Stores

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Distribution Channel

7.9 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Cosmeceuticals Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Cosmeceuticals Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 L’Oréal

9.2 Beiersdorf

9.3 Procter and Gamble

9.4 Estée Lauder Companies Inc.

9.5 Shiseido Company Limited

9.6 Avon

9.7 Unilever

9.8 Croda International Plc

9.9 Allergan

9.10 Johnson & Johnson Services, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growing incidence of skin conditions globally, coupled with dermatologists' preference for recommending these products as an alternative to traditional treatments, is driving their increasing demand.

The top players operating in the Cosmeceuticals Market are - L’Oréal, Beiersdorf, Procter and Gamble, Estée Lauder Companies Inc., Shiseido Company Limited, Avon and Unilever.

The demand for cosmeceuticals globally was significantly impacted by the COVID-19 pandemic. A major decline in patient visits to dermatologists and the closure of stores that distribute these products during lockdown periods were among the primary factors negatively affecting the market.

In January 2023, Oriflame launched its inaugural range of cosmeceutical products, NovAge Proceuticals, in the Indian market. These products are formulated to address specific skin concerns, offering concentrated treatments for visible, proven results.

North America is the fastest-growing region in the Cosmeceuticals Market.