Corrosion Monitoring Market Size (2024-2030)

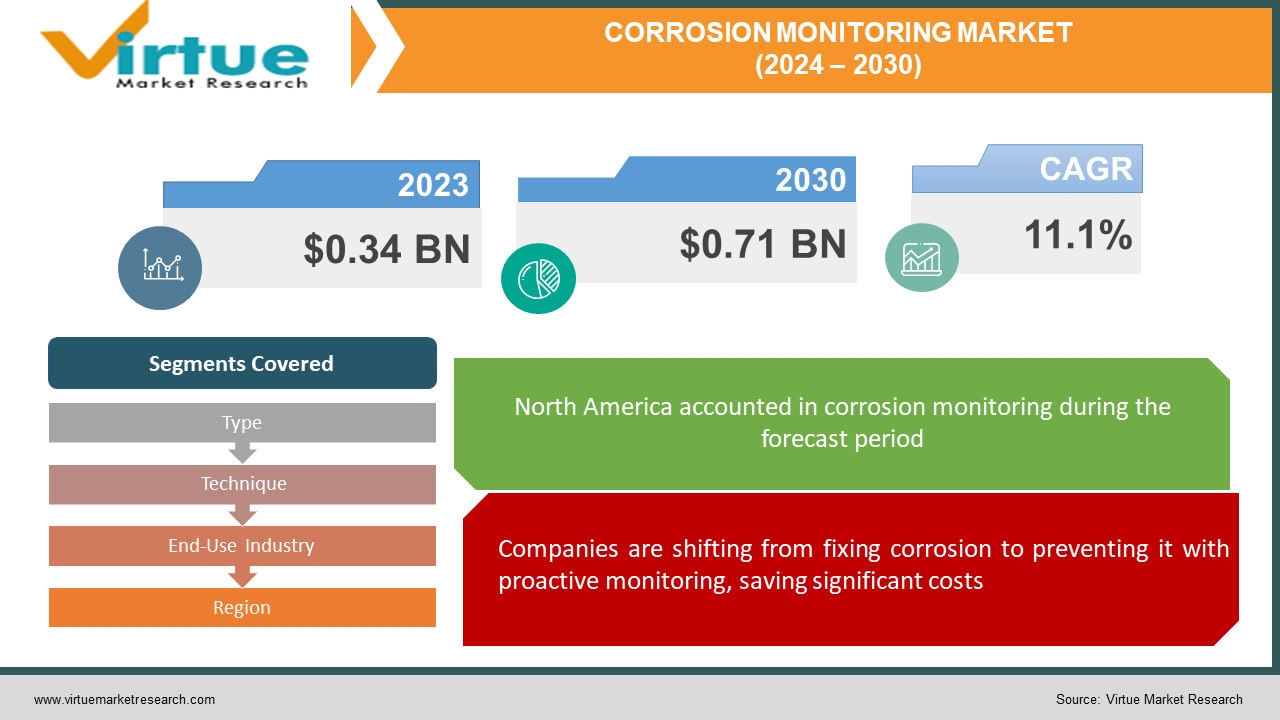

The Corrosion Monitoring Market was valued at USD 0.34 billion in 2023 and is projected to reach a market size of USD 0.71 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 11.1%.

The corrosion monitoring market is on a positive trajectory, driven by several key forces. Companies are increasingly aware of the financial benefits of preventing corrosion damage through early detection. New and improved monitoring techniques are emerging, offering greater accuracy and cost-effectiveness, making them more attractive to a wider range of industries. Additionally, stricter environmental regulations are driving demand for solutions that ensure compliance with pipeline integrity, storage tank safety, and wastewater treatment. This confluence of factors suggests continued growth for the corrosion monitoring market in the coming years.

Key Market Insights:

Technology is a key driver in this market transformation. Advancements in techniques like ultrasonic thickness gauging and remote monitoring systems are making corrosion detection not only more accurate but also highly efficient. These advancements make corrosion monitoring more accessible and attractive to a wider range of industries, leading to broader adoption.

The future of the corrosion monitoring market looks bright. Stringent environmental regulations are acting as a catalyst, pushing industries to adopt robust monitoring solutions. This ensures compliance with pipeline safety, storage tank integrity, and wastewater treatment standards. While the oil and gas sector remains the dominant user due to their critical infrastructure, other industries like water and power generation are taking notice and investing in corrosion monitoring as their infrastructure needs grow and environmental concerns become more prominent.

The Corrosion Monitoring Market Drivers:

Companies are shifting from fixing corrosion to preventing it with proactive monitoring, saving significant costs.

Industries are increasingly adopting proactive strategies, utilizing corrosion monitoring to detect and address issues early. This shift is driven by the substantial cost savings associated with preventing major corrosion damage. Early detection allows for timely repairs, minimizing downtime, and avoiding expensive replacements.

Advancements like ultrasonic gauging and remote systems improve the accuracy and efficiency of corrosion detection.

New and improved monitoring techniques are constantly emerging. Advancements in technologies like ultrasonic thickness gauging, remote monitoring systems, and even sensor integration with AI for real-time analysis are making corrosion detection more accurate, reliable, and efficient. These advancements not only improve effectiveness but also make the process more cost-effective, attracting a wider range of industries.

Stricter environmental regulations require robust monitoring solutions for pipeline safety and wastewater treatment.

Stringent environmental regulations are a major driver. These regulations mandate compliance with pipeline safety, storage tank integrity, and wastewater treatment standards. Corrosion monitoring solutions play a crucial role in ensuring compliance, prompting industries to invest in these technologies.

As infrastructure ages in oil & gas, water, and power, robust monitoring becomes crucial to ensure safe operation.

A significant portion of global infrastructure, especially in oil & gas, water & wastewater, and power generation, is reaching the end of its lifespan. These aging assets are more susceptible to corrosion, increasing the demand for robust monitoring solutions to ensure their continued safe operation and prevent catastrophic failures.

Growing environmental concerns push industries to adopt monitoring solutions to minimize leaks and spills.

Environmental awareness is on the rise, leading to stricter regulations and a growing focus on sustainability. Corrosion monitoring helps industries minimize leaks and spills of hazardous materials, contributing to environmental protection. This focus on environmental impact adds another layer of incentive for industries to adopt corrosion monitoring solutions.

The Corrosion Monitoring Market Restraints and Challenges:

The corrosion monitoring market's growth isn't without hurdles. Despite its potential, several factors can act as brakes on its progress. A significant challenge lies in the initial investment. Installing and maintaining these systems can be expensive, encompassing the monitoring equipment itself, installation, personnel training, and ongoing data analysis. This can be especially discouraging for smaller companies with limited budgets. Furthermore, even with the systems in place, a skilled workforce is needed to operate them effectively. Interpreting the complex data these systems generate requires a deep understanding of the technology, and a lack of qualified personnel in some regions can hinder implementation and maintenance. The battle extends to the physical environment itself. Monitoring corrosion in intricate or hard-to-reach areas can be difficult. Traditional techniques might not be suitable, and newer technologies may be too expensive or underdeveloped for widespread use. Adding to this is a potential lack of awareness, particularly in developing regions. Companies there might not fully grasp the cost-saving benefits that corrosion monitoring offers, limiting its adoption. Finally, even with successful implementation, a new challenge emerges: data overload. Advanced systems can generate massive amounts of data, and effectively managing, analyzing, and interpreting it requires investment in data management solutions and personnel with specialized data analysis skills. Addressing these challenges will be crucial for the corrosion monitoring market to reach its full potential.

The Corrosion Monitoring Market Opportunities:

The future of the corrosion monitoring market is brimming with exciting possibilities. Advancements in technologies like wireless sensors, the Internet of Things (IoT), and AI-powered data analysis are on the horizon. These innovations have the potential to revolutionize corrosion monitoring by creating more efficient, affordable, and user-friendly solutions, ultimately leading to broader adoption across various industries. The demand for remote monitoring solutions is also growing rapidly, presenting a significant opportunity. These solutions allow for real-time data collection and analysis from hard-to-reach locations, enhancing safety and reducing the need for manual inspections. As developing economies invest heavily in infrastructure projects like pipelines, bridges, and power plants, the market for robust corrosion monitoring solutions is poised for significant expansion. Subscription-based service models are another potential game-changer. This approach eliminates the need for large upfront investments, making the latest technologies more accessible to smaller players in the market. Finally, the growing focus on environmental sustainability presents a unique opportunity for corrosion monitoring solutions that minimize leaks and spills. By preventing environmental damage, these solutions can become a key ally for companies prioritizing sustainable practices. Addressing these opportunities will be crucial for the corrosion monitoring market to solidify its position as a vital tool for asset protection and environmental well-being.

CORROSION MONITORING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.1% |

|

Segments Covered |

By Type, Technique, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Emerson Electric Co., GE Measurement & Control Solutions, Honeywell International Inc., Schlumberger Limited, Cosasco, Sensorlink AS, Corrpro Companies, Inc., Permasense Ltd. |

Corrosion Monitoring Market Segmentation: By Type

-

Intrusive Techniques

-

Non-Intrusive Techniques

The non-intrusive segment reigns supreme in the corrosion monitoring market by type, favored for its ease of use and avoidance of direct contact with the asset being monitored. On the other hand, the fastest growth is projected in the non-existent category among "by Type" sectors. This is because this segmentation refers to the physical interaction with the asset (intrusive or non-intrusive), not the growth rate of different monitoring techniques.

Corrosion Monitoring Market Segmentation: By Technique

-

Ultrasonic Thickness Gauging

-

Electrical Resistance Techniques

-

Linear Polarization Resistance (LPR)

-

Galvanic Monitoring

The most dominant technique in the corrosion monitoring market by sector is Ultrasonic Thickness Gauging, which utilizes sound waves to measure remaining material thickness. This method is widely used across various industries. On the other hand, the fastest-growing segment is Electrical Resistance (ER) techniques, which measure changes in electrical properties to assess corrosion. The growing adoption of ER probes for pipelines, tanks, and other assets in oil and gas, chemical, and water treatment industries is fuelling this segment's rapid expansion.

Corrosion Monitoring Market Segmentation: By End-Use Industry

-

Oil & Gas

-

Water & Wastewater

-

Power Generation

-

Chemical Processing

-

Other Industries

The corrosion monitoring market caters to various industries with specific needs. The dominant segment is currently Oil & Gas, driven by the critical nature of their pipelines and storage tanks. However, the torch is being passed to the Asia Pacific region as the fastest-growing segment. This rapid growth is fuelled by their booming infrastructure development and expanding economies. As these countries invest heavily in new assets, the demand for robust corrosion monitoring solutions to ensure their longevity will rise significantly.

Corrosion Monitoring Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America market is a mature player, boasting a well-established infrastructure and a history of early adoption of new technologies. Stringent environmental regulations and the ongoing challenge of maintaining aging infrastructure will continue to be key drivers of demand in North America. Companies in this region can expect a steady and reliable market fueled by these factors.

Europe represents a significant market with a strong focus on regulatory compliance, particularly concerning pipeline safety and wastewater treatment. Strict environmental regulations are pushing European industries to invest in robust monitoring solutions. Additionally, ongoing investments in infrastructure maintenance and modernization will provide further growth opportunities for corrosion monitoring companies in this region.

Asia Pacific region boasts the fastest growth rate within the corrosion monitoring market. This rapid expansion is fueled by the booming infrastructure development taking place in countries like China and India. Growing economies and rising awareness of the cost-saving benefits of corrosion monitoring are further propelling the market forward in the Asia Pacific. Companies looking to tap into a rapidly expanding market should prioritize targeting this region.

COVID-19 Impact Analysis on the Corrosion Monitoring Market:

The COVID-19 pandemic's impact on the corrosion monitoring market has been a double-edged sword. In the short term, the market faced challenges due to project delays and supply chain disruptions caused by lockdowns. Travel restrictions hampered the delivery of equipment and hindered the implementation of new corrosion monitoring projects. Additionally, reduced industrial activity, particularly in oil & gas, led to a decrease in demand for these solutions. Budgetary constraints due to the economic downturn forced companies to tighten their spending, leading to delays or cancellations of non-essential projects, including some corrosion monitoring initiatives.

However, there are reasons for optimism in the long term. As companies recover and focus on optimizing asset lifecycles and improving operational efficiency, corrosion monitoring can play a key role. This could lead to increased demand for these solutions in the long run. Furthermore, the pandemic highlighted the importance of remote monitoring solutions, allowing for data collection and analysis from difficult-to-reach locations while minimizing the need for manual inspections and enhancing worker safety. This trend is expected to continue driving demand for these technologies. Finally, potential government stimulus packages aimed at boosting economies might be directed toward infrastructure development, creating new opportunities for the corrosion monitoring market. Overall, while the pandemic caused initial setbacks, the long-term outlook for the corrosion monitoring market remains positive due to factors like increased focus on asset management, the rise of remote monitoring, and potential infrastructure investments.

Latest Trends/ Developments:

The fight against corrosion is getting a high-tech upgrade. The corrosion monitoring market is buzzing with exciting developments. Artificial intelligence (AI) is on the front lines, analyzing mountains of sensor data to predict corrosion risks, identify weaknesses, and recommend preventive actions. This allows for a more proactive approach to corrosion management, saving time and money in the long run. Furthermore, the rise of digitalization and the Internet of Things (IoT) is leading to the development of smarter, interconnected monitoring systems. These systems can gather real-time data from multiple sensors wirelessly, enabling remote monitoring, improved data access, and faster decision-making. Advanced non-destructive testing (NDT) techniques are also being developed to provide a clearer picture of corrosion, particularly in hard-to-reach areas. These advancements encompass improvements in ultrasonic testing, eddy current testing, and guided wave testing. The trend towards miniaturized and wireless sensors is making corrosion monitoring more versatile and cost-effective. These compact, energy-efficient sensors can be easily deployed in difficult locations and require minimal maintenance, opening doors for a wider range of applications. Finally, subscription-based service models are gaining popularity, allowing companies to access advanced monitoring solutions without a large upfront investment. This approach makes the technology more accessible to smaller players and fosters wider market adoption. With these advancements at the forefront, the corrosion monitoring market is poised for significant growth and innovation in the years to come.

Key Players:

-

Emerson Electric Co.

-

GE Measurement & Control Solutions

-

Honeywell International Inc.

-

Schlumberger Limited

-

Cosasco

-

Sensorlink AS

-

Corrpro Companies, Inc.

-

Permasense Ltd.

Chapter 1. Corrosion Monitoring Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Corrosion Monitoring Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Corrosion Monitoring Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Corrosion Monitoring Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Corrosion Monitoring Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Corrosion Monitoring Market – By Type

6.1 Introduction/Key Findings

6.2 Intrusive Techniques

6.3 Non-Intrusive Techniques

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Corrosion Monitoring Market – By Technique

7.1 Introduction/Key Findings

7.2 Ultrasonic Thickness Gauging

7.3 Electrical Resistance Techniques

7.4 Linear Polarization Resistance (LPR)

7.5 Galvanic Monitoring

7.6 Y-O-Y Growth trend Analysis By Technique

7.7 Absolute $ Opportunity Analysis By Technique, 2024-2030

Chapter 8. Corrosion Monitoring Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Oil & Gas

8.3 Water & Wastewater

8.4 Power Generation

8.5 Chemical Processing

8.6 Other Industries

8.7 Y-O-Y Growth trend Analysis By End-Use Industry

8.8 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 9. Corrosion Monitoring Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Technique

9.1.4 By End-Use Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Technique

9.2.4 By End-Use Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Technique

9.3.4 By End-Use Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Technique

9.4.4 By End-Use Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Technique

9.5.4 By End-Use Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Corrosion Monitoring Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Emerson Electric Co.

10.2 GE Measurement & Control Solutions

10.3 Honeywell International Inc.

10.4 Schlumberger Limited

10.5 Cosasco

10.6 Sensorlink AS

10.7 Corrpro Companies, Inc.

10.8 Permasense Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Corrosion Monitoring Market was valued at USD 0.34 billion in 2023 and is projected to reach a market size of USD 0.71 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 11.1%.

Shift towards Proactive Maintenance, Technological Advancements, Regulatory Landscape, Aging Infrastructure, Growing Environmental Concerns.

Oil & Gas, Water & Wastewater, Power Generation, Chemical Processing, Other Industries.

The most dominant region for the Corrosion Monitoring Market is currently Asia Pacific, driven by booming infrastructure development and expanding economies.

Emerson Electric Co., GE Measurement & Control Solutions, Honeywell International Inc., Schlumberger Limited, Cosasco, Sensorlink AS, Corrpro Companies, Inc., Permasense Ltd.