Corrosion Inhibitors Market Size (2024 – 2030)

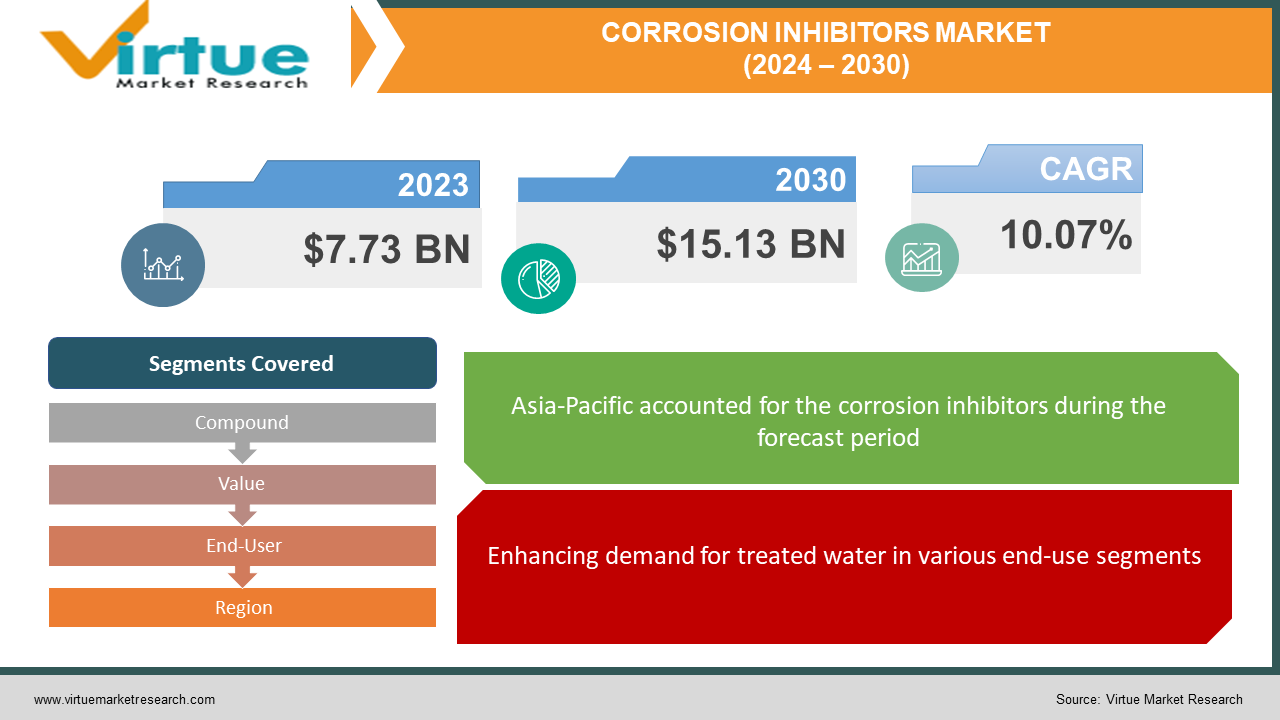

The Corrosion Inhibitors Market was approximately valued at USD 7.73 billion in 2023 and is projected to reach a market size of USD 15.13 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 10.07%.

Chemicals called corrosion inhibitors are utilized in fluids or gases to cease or slow down corrosion. Enhancing the requirement to safeguard metal structures and devices from corrosion, which can lead to major financial losses and security risks, is generating a high demand for corrosion inhibitors. Corrosion can lead to costly repairs, lost productivity, and legal consequences by causing environmental harm, product contamination, and equipment failure. Additionally, the growing use of eco-friendly and sustainable technologies is estimated to drive revenue growth of the corrosion inhibitor market during the expected year. With strict government rules addressing environmental deterioration, there is a rising demand for environmentally friendly corrosion inhibitors. However, several restrictions, including the availability of substitutes and fluctuating raw material costs, are restricting revenue development of the corrosion inhibitor market.

Key Market Insights:

-

The major applying end users of corrosion inhibitors is the chemical processing industry. The requirement to prevent corrosion in pipelines, vessels, and other equipment is generating a high demand for corrosion inhibitors in the chemical processing sector. The corrosion inhibitor market revenue enhancement is anticipated to be influenced throughout the estimated period owing to the rising demand for specialty chemicals.

-

It is expected that both the organic and inorganic corrosion inhibitor markets will strengthen steadily over the upcoming years, driven by a rise in the demand for high-performance, sustainable products across several industries. Producers are therefore estimated to make investments in R&D operations to generate cutting-edge goods that fulfill the changing demands of the market and offer greater performance and sustainability.

-

Moreover, the rising use of eco-friendly and sustainable technologies is estimated to propel revenue growth of the corrosion inhibitor market during the future years. With stringent government rules addressing environmental deterioration, there is an enhancing demand for environmentally friendly corrosion inhibitors.

Corrosion Inhibitors Market Drivers:

Enhancing demand for treated water in various end-use segments

Freshwater resources make up only 2.5% of the total water resources globally, which makes the supply of water for industrial and domestic consumption a hard challenge. The widening vacuum between the demand and supply of water makes it needed to efficiently recycle it, which can be undertaken by purifying it. The corrosion inhibitor market is faster growing in water treatment sectors across the world. Industrial manufacturers are the biggest customers for corrosion inhibitors and demand more effective inhibitors that will lower downtime for equipment repair. A growth in the demand for corrosion inhibitors in numerous industries like oil & gas, power generation, chemical and metals processing to safeguard from corrosion has led to greater demand from emerging nations, in particular. Cooling water is the dominant segment for corrosion inhibitors in the water treatment technique to safeguard the metal machinery from the water flow.

Escalating demand arriving from the Power Generation and Oil & Gas Sector

Taking into consideration just the US, the yearly expenditure of corrosion to the oil & gas industry is expected to reach USD 27 billion, as per the NACE International (National Association of Corrosion Engineers). Using corrosion-resistant materials more extensively and applying corrosion-related methods can lower costs. Metal corrosion can be decreased or suppressed with corrosion inhibitors. Metals and alloys are secured by insulating them or by retarding corrosion resulting from cathodic and anodic processes. The utilisation of corrosion inhibitors in diverse industries decreases maintenance and repair charges, widens the shelf life of equipment, and minimises production loss from corrosion. Corrosion inhibitors are therefore a required component to lower corrosion costs.

Corrosion Inhibitors Market Restraints and Challenges:

Requirement for eco-friendly formulations

Strict environmental legislation is one of the key factors influencing the development of the corrosion inhibitor market. The growing issue of chemicals affecting the environment and health has resulted in stringent regulatory constraints for corrosion inhibitor manufacturers. This persuades the manufacturers to choose non-toxic alternatives. The feature of the non-toxic corrosion inhibitors formulations to operate under severe conditions makes it difficult for the producers to provide a replacement for standard formulations. For example, an alternative in the oil & gas industry has been zinc phosphate. Although effective, this inhibitor does not level up the performance of chromate complexes like hexavalent chromium. This chemical is called for causing cancer in humans and animals, according to the United States Department of Labor.

Corrosion Inhibitors Market Opportunities:

Increasing industrialization in developing nations

Infrastructural development in countries such as China, India, Brazil, and South Korea, are estimated to undergo infrastructural growth and boost industrial activities for the development of their countries. Infrastructural development associated with the electricity requirement, pure water demand, fuel demand, transportation necessity, and construction requirement are expected to push the market for corrosion inhibitors in the future years. The global expenditure on infrastructure is estimated to reach USD 94 trillion by 2040, and an additional USD 3.4 trillion would be needed to attain the United Nations’ Sustainable Development Goals for electricity and water, as per Oxford Economics. Nations in Asia Pacific, China, India, Indonesia, Malaysia, the Philippines, Thailand, and Vietnam, will be among the rapidly-growing infrastructure spending countries, according to an Oxford Economics study. This has resulted in the increasing consumption of industrial water in upcoming economies. This generates an opportunity for manufacturers to provide a wide range of corrosion inhibitors to several specific applications to safeguard them from corrosion.

CORROSION INHIBITORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.07% |

|

Segments Covered |

By Compound, Value, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Nouryon Holding B.V., Dow Chemical Company, Cortec Corporation, Baker Hughes Ltd., Ecolab Inc., Lubrizol Ltd., DuPont de Nemours Inc., Eastman Chemical Company, NALCO India |

Corrosion Inhibitors Market Segmentation: By Compound

-

Organic Corrosion inhibitors

-

Inorganic Corrosion inhibitors

Based on the compound, the Organic inhibitor market showcases the highest CAGR during the estimated period. They are effective at a stretch of temperature, have good solubility with water, are low cost, and are suitable with protected materials. Oxygen, nitrogen, or sulfur atoms as double bonds exist in this compound. The absorption process is ensured by the lone pair electrons of atoms. This technique is neither physical nor purely chemical adsorption. The organic inhibitor’s chemical structure, nature & surface expense, distribution of charge in the molecule, and type of aggressive media propels the adsorption process.

Corrosion Inhibitors Market Segmentation: By Value

-

Water-based Corrosion Inhibitors

-

Oil-based Corrosion Inhibitors

-

Volatile Corrosion Inhibitors

In terms of value, the Water-based segment is estimated to account for the biggest share of the corrosion inhibitor market. Water-based corrosion inhibitors modify the properties of the metal surfaces by lowering their susceptibility to oxidation and corrosion formation. Water-based inhibitors are particularly sold as a concentrate and diluted with water for usage, to make their price less than most oil/solvent-based products. Application techniques for these inhibitors involve spray, brush, or immersion. They are cleaner to use and minus issues of solvent fumes. Water-based inhibitors can be highly beneficial in curbing corrosion for a widened period under reasonable plant storage and secured shipping situations.

Corrosion Inhibitors Market Segmentation: By End-User

-

Oil & gas

-

Power generation

-

Chemicals

-

Metals processing

-

Pulp & paper

-

Others

Based on End-User, Oil & Gas and Refinery industry is estimated to develop at a CAGR of 5.6%, in terms of value during the estimated period. The oil & gas industry has a major impact on a country’s GDP due to its economic significance and size. The industry also uses corrosion inhibitors on a huge scale. Equipment utilized in this industry, such as pipelines, vessels, and subsea equipment, for routine operations, need corrosion inhibitors for efficient functioning.

Corrosion Inhibitors Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The APAC region dominates the water treatment chemicals market in terms of market value. Forces such as high population, growing industrial growth, and increasing concern for the environment are influencing the demand for water treatment chemicals in the region and are directly persuading the market of corrosion inhibitors. The growth in several end-use industries in the region is also resulting in innovations and developments in the field of corrosion inhibitors, thereby propelling the growth of the Asia Pacific corrosion inhibitors market.

COVID-19 Impact Analysis on the Corrosion Inhibitors Market:

Corrosion inhibitors are utilized in applications, such as water treatment, process & product additives, and oil & gas production in several end-use industries, involving power generation, oil& gas and refinery, metal & mining, pharmaceutical, and utilities, among others. Corrosion inhibitors are utilized for purifying harmful water, saving the life of metals & alloys in the above-mentioned end-use industries. They manage the process of corrosion by slowing it in different segments of the industries and treating toxic water. Owing to the COVID-19 pandemic, the chemical industry has been majorly impacted throughout the world. Disruption in the supply chain, decrement in workforce, limitations in movement, and decline in demand due to global uncertainty hindered the development of the chemical industry.

The oil & gas industry also saw a decline in demand due to the pandemic. Lowered output hindering revenue realization put a stop to the progress of many nations in these sectors. COVID-19 caused widespread concern and economic hardship for consumers, businesses, and communities across the world. The lockdown, due to the pandemic in various nations, affected the transportation fuel demand. Travel bans, coupled with the grounding of international flights, have led to a heavy decrement in the consumption of Aviation Turbine Fuel (ATF) across the globe. However, the corrosion inhibitor market hasn’t been affected much and their demand remains in sectors like oil & gas, pharmaceutical, etc

Latest Trends:

Usage of corrosion-resistant materials

Industries in the established market are showcasing a high degree of maturity. The substitution of steel with plastics, ceramics, composite materials, and corrosion-resistant alloys in these industries is an instance of this. The metals and alloys that can resist corrosion to some degree are called Corrosion-Resistant alloys (CRA). The corrosion inhibitors market is slowly transforming towards more sustainable options due to rising environmental issues and regulatory pressures. The usage of Duplex Stainless Steel (DSS), Super Duplex Stainless Steel (SDSS), and other exotic products is becoming famous in the oil & gas industry. These are applied for managing highly corrosive fluids as the oil & gas industry has high stakes of shutdown owing to material failure. These exotic metals also have amazing strength, durability, and capacity to withstand extreme pressure & temperature, among other characteristics. Due to this feature, these metals are being used in demanding industries like automobile, aerospace, oil & gas industry, and power generation, among other sectors.

Key Players:

-

BASF SE

-

Nouryon Holding B.V.

-

Dow Chemical Company

-

Cortec Corporation

-

Baker Hughes Ltd.

-

Ecolab Inc.

-

Lubrizol Ltd.

-

DuPont de Nemours Inc.

-

Eastman Chemical Company

-

NALCO India

Recent Developments

-

A new product ‘Gardobond X4802/2 RFU’ was launched by Chemetall, which is an efficiently performing and non-chrome pretreatment technology for pre-painted coils. The latest product is acidic in nature, based on water, no-rinse, & multi-metal pretreatment technology that is perfect with substrates like hot dip galvanizing (HDG) and zinc magnesium (ZM). ‘Gardobond X4802/2 RFU’ aids in lowering the emission of volatile organic compounds & thus, meets the greatest market standards for pre-painted coils which are applied in home appliance and construction industries.

-

Nalco Water an Ecolab company has come up with new phosphorus-free & low phosphorus programs for scaling inhibition and handling mild-steel corrosion in industries. The newly introduced program provides superior performance in varying water conditions with minimal dosage. This program takes off the aquatic nutrients for bacteria by removing added phosphate and letting operation at a higher pH.

-

LANXESS was bound by an agreement to purchase 100 percent shares in Emerald Kalama Chemical in 2021. The US-based company is a leading manufacturer of specialty chemicals in the world, especially for the consumer segment, and is majority-owned by affiliates of the US private equity firm, American Securities LLC.

Chapter 1. Corrosion Inhibitors Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Corrosion Inhibitors Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Corrosion Inhibitors Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Corrosion Inhibitors Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Corrosion Inhibitors Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Corrosion Inhibitors Market – By Compound

6.1 Introduction/Key Findings

6.2 Organic Corrosion inhibitors

6.3 Inorganic Corrosion inhibitors

6.4 Y-O-Y Growth trend Analysis By Compound

6.5 Absolute $ Opportunity Analysis By Compound, 2024-2030

Chapter 7. Corrosion Inhibitors Market – By Value

7.1 Introduction/Key Findings

7.2 Water-based Corrosion Inhibitors

7.3 Oil-based Corrosion Inhibitors

7.4 Volatile Corrosion Inhibitors

7.5 Y-O-Y Growth trend Analysis By Value

7.6 Absolute $ Opportunity Analysis By Value, 2024-2030

Chapter 8. Corrosion Inhibitors Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Oil & gas

8.3 Power generation

8.4 Chemicals

8.5 Metals processing

8.6 Pulp & paper

8.7 Others

8.8 Y-O-Y Growth trend Analysis By End-Use Industry

8.9 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 9. Corrosion Inhibitors Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Compound

9.1.3 By Value

9.1.4 By By End-Use Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Compound

9.2.3 By Value

9.2.4 By End-Use Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Compound

9.3.3 By Value

9.3.4 By End-Use Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Compound

9.4.3 By Value

9.4.4 By End-Use Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Compound

9.5.3 By Value

9.5.4 By End-Use Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Corrosion Inhibitors Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BASF SE

10.2 Nouryon Holding B.V.

10.3 Dow Chemical Company

10.4 Cortec Corporation

10.5 Baker Hughes Ltd.

10.6 Ecolab Inc.

10.7 Lubrizol Ltd.

10.8 DuPont de Nemours Inc.

10.9 Eastman Chemical Company

10.10 NALCO India

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Corrosion Inhibitors Market was approximately valued at USD 7.73 billion in 2023 and is projected to reach a market size of USD 15.13 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 10.07%.

The demand for treated water and the oil and gas industry is propelling the Corrosion Inhibitors Market.

Corrosion Inhibitors Market is segmented based on Compound, Value, End User, and Region.

Asia-Pacific is the most dominant region for the Corrosion Inhibitors Market.

Ecolab Inc., Lubrizol Ltd., DuPont de Nemours Inc., Eastman Chemical Company, and NALCO India are a few of the key players operating in the Corrosion Inhibitors Market.