Corporate E-learning Market Size (2024 – 2030)

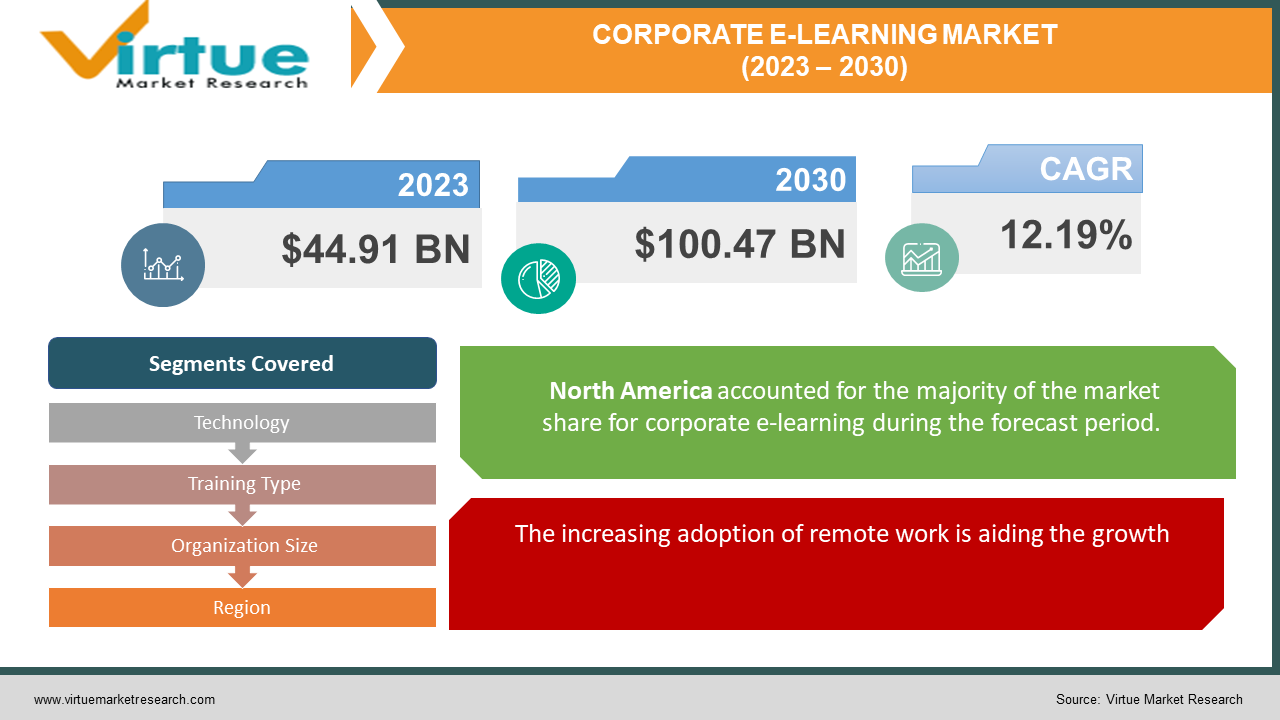

The global corporate e-learning market was valued at USD 44.91 billion and is projected to reach a market size of USD 100.47 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 12.19%.

Online training that assists staff in acquiring the competencies needed to satisfy company demands is known as corporate e-learning. Digital learning is one such approach to business training. It is used in conjunction with in-person learning methods, including mentorship, on-the-job coaching, and instructor-led training. This market had a limited presence in the past. CDs and other videos were the primary platforms used. Presently, this market has seen an upsurge because of various technological advancements, access, and demand. In the future, with a growing focus on innovation, creativity, personalization, and remote work, this market is set to see an accelerated trajectory. During the forecast period, a considerable growth rate is anticipated.

Key Market Insights:

Employees may access eLearning possibilities in 90% of large firms.

By 2026, the corporate e-learning market is projected to be valued at $50 billion.

82% of businesses undertake at least some of their compliance training via eLearning.

Online learning and development initiatives are used by 62% of businesses to fill knowledge gaps among staff members.

According to reports, online course completion rates range from 15% to 20% on average, depending on the sector, course content, and student involvement. To tackle this, companies are working towards having engaging content, personalization, clear objectives, and regular feedback.

Corporate E-learning Market Drivers:

The increasing adoption of remote work is aiding the growth.

The pandemic has played a significant role in making work-from-home a new trend. People prefer to work from the comfort of their homes. Employees prefer programs that can be accessed from anywhere. Various online platforms, like virtual classrooms, mobile apps, and other learning management systems, are being offered. Through this, courses, trainings, live sessions, and other collaboration tools are being implemented. Interactive sessions are being prioritized. According to a Forbes report, in 2023, 12.7% of full-time workers will be working from home, and 28.2% will be using a hybrid approach. Because of this, they can cut down on transportation and gas charges. Additionally, they rely on home-cooked meals rather than junk food, leading to the development of good health. As this option becomes more prevalent, organizations have been incorporating e-learning solutions for better performance and results.

The concept of microlearning has been fueling the expansion.

A collection of condensed online learning courses called microlearning is intended to lessen learner fatigue. The modules, which typically include a single learning aim or topic and are fewer than 20 minutes in length, might be skill-based, professional, instructional, or both. Microlearning, which focuses the brain on learning one item rapidly and then taking a break, has been demonstrated to lower the risk of mental weariness. Learning exercises spaced out across time in a repetitive pattern aid in the retention of new knowledge in both short- and long-term memory. This further boosts the learner’s efficiency. Moreover, these techniques have been found to have a higher level of engagement, thereby making the session more communicative. Furthermore, costs for space facilities are reduced by this method.

Corporate E-learning Market Restraints and Challenges:

Internet connections, data security, lack of interest, and quality deterioration are the main issues that the market is currently experiencing.

Wi-fi is one of the biggest barriers in the market. Remote and underdeveloped areas might face difficulties with access. Secondly, with an increasing number of online platforms, data privacy is a hindrance. There have been cases of data breaches. Sensitive and confidential information is shared through these platforms. Misuse and leakage of this data can result in huge losses for the organization. Thirdly, since everything is done virtually. Therefore, this can result in a lack of engagement. Many times, employees might just log in and do other work. Furthermore, it is essential to ensure that the videos and audio are of good quality and consistency.

Corporate E-learning Market Opportunities:

E-learning helps with global outreach. By having a broader consumer base, companies will have easier access to networking, collaborations, and partnerships. Additionally, personal growth is possible through access to various contacts. Secondly, the skill gap is a very common concern. Through these modules, people can continuously upskill and reskill themselves. Thirdly, through the advent of various AI and ML tools, data-driven insights are obtained. Companies and individuals can gain information regarding their areas of improvement, strengths, and weaknesses. Moreover, personalization has been providing the market with an ample number of options. By catering to individual approaches, people can apply for job positions at which they are skilled.

CORPORATE E-LEARNING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.19% |

|

Segments Covered |

By Technology, Training Type, Organization Size, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cornerstone OnDemand, SAP Litmos, Adobe Captivate Prime, D2L Brightspace, IBM Talent Management Solutions, LinkedIn Learning, Articulate 360, Oracle Learning Cloud, Blackboard, Coursera for Business |

Corporate E-learning Market Segmentation: By Technology

-

Web Based

-

Learning management system

-

Learning content management system

-

Podcast

-

Virtual classroom

Based on technology, the learning management system is the largest segment in this market. LMS is a software for providing staff with online training and educational materials Corporate LMS facilitates the onboarding of new workers and equips them with the information and abilities needed to carry out their jobs, thereby enabling them to progress in their careers more quickly. This saves time and money. Apart from this, this technology is efficient, advanced, personalized, affordable, easy to access, and helps with management. Learning content management systems is the fastest-growing segment. Professionals who oversee online training content and make it accessible to learners create the learning content management system. It makes it possible to tailor specific courses to the needs of each individual. They may edit text, graphics, audio, and video material for e-learning with the help of LCMS. They provide these e-learning materials and enable customization and reuse of the materials for every cooperative individual without interfering with other users' online training experiences.

Corporate E-learning Market Segmentation: By Training Type

-

Instructor-led & text-based

-

Outsourced

Based on training type, instructor-led and text-based training are the largest segments in this market. Training conducted by instructors is especially advantageous for new or complicated topics. A trainee's learning process can be considerably improved by having an instructor available to respond to inquiries and provide concept demonstrations. Text-based audio and videos help with the complete offering of the content. The outsourced category is considered to be the fastest-growing. Contracting out company operations and functions to other organizations is a prevalent practice known as outsourcing. Outsourcing provides several advantages, including an increased competitive edge, cost savings, and efficiency improvements. Besides, technical expertise, creativity, high-quality results, and better networking are facilitated.

Corporate E-learning Market Segmentation: By Organization Size

-

Large-scale enterprises

-

Small and medium-scale enterprises

Based on organization size, large-scale enterprises are the largest segment. This is because of a greater workforce, demand, investments, and work-from-home culture. Small and medium-scale enterprises are the fastest-growing segment. E-learning is flexible, accessible, cost-effective, and standardized, motivating smaller firms to implement this technology. Furthermore, governmental involvement and rising funds have been creating an elevation.

Corporate E-learning Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on region, North America is the largest in this market, holding a rough share of 33%. Reasons like technological advancements, the economy, investments, the presence of key companies, opportunities, a greater workforce, and access to resources are contributing to the success. Asia-Pacific is the fastest-growing region. Countries like China, India, Japan, and Australia are the notable ones. Rising workforce, dual income, urbanization, emerging startups, economic stability, governmental involvement, funds, collaborations, R&D activities, and internet connectivity in remote areas are a few factors helping with the upsurge. This region holds an approximate share of 23% in 2023. Europe is also one of the regions showing significant growth. Countries like the United Kingdom, Germany, and France are at the top. Advancements in artificial intelligence, personalized learning solutions, digital education initiatives, and demand are aiding the progress.

COVID-19 Impact Analysis on the Global Corporate E-learning Market:

The outbreak of the virus had a positive impact on the market. Lockdowns, social isolation, and movement restrictions became the new norm. Remote work was gaining attention because many organizations and manufacturing units were shut down. Companies were unable to conduct in-person meetings due to all these guidelines and protocols. Virtual classrooms, meetings, and seminars were emphasized. Besides, there was a lot of uncertainty and financial restraints, due to which layoffs were happening. Upskilling was very necessary to keep up. These platforms helped people take up courses and find new opportunities. Furthermore, people worldwide were able to access the modules. Training was offered regardless of their geographic location. Post-pandemic, with digitalization becoming the new trend, the market has continued to grow. As per a report by Luisa Zhou, by 2026, corporate eLearning is predicted to increase by more than 250%.

Latest Trends/ Developments:

The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heavily to improve existing creations while maintaining competitive pricing. This has further resulted in increased enlargement.

Virtual reality (VR) has been gaining prominence. With the use of virtual reality (VR) technology, businesses can conduct training sessions in safe, controlled environments that provide participants the chance to improve their abilities and engage with real-world work scenarios without taking any risks. Virtual reality offers a secure place for people to experiment with new abilities, make errors, grow from them, and achieve professional success.

Key Players:

-

Cornerstone OnDemand

-

SAP Litmos

-

Adobe Captivate Prime

-

D2L Brightspace

-

IBM Talent Management Solutions

-

LinkedIn Learning

-

Articulate 360

-

Oracle Learning Cloud

-

Blackboard

-

Coursera for Business

In April 2022, Skillsoft completed the acquisition of Codecademy. The Skillsoft team will assist in scaling work with Codecademy for Business, and Codecademy will continue to support both individual learners and corporations. With over 75% of the Fortune 1000 clients, Skillsoft will assist us in introducing Codecademy to some of the largest corporations in the world and their workforces.

In August 2021, premier online learning and teaching platform Udemy announced that it had purchased online leadership development company CorpU, which offers access to top-notch professionals and cohort-based immersive learning experiences. With CorpU's immersive experiences, the purchase enhances Udemy's learning offerings and provides transformative learning that promotes creativity, leadership, and business agility.

In February 2020, the largest online learning and teaching marketplace in the world, Udemy, said that Benesse Holdings, Inc., a longtime partner in Japan, has committed to investing $50 million in the $2 billion firm. The business intends to make more investments in international markets and will increase its operations in Denver, Colorado; Dublin, Ireland; Gurgaon, India; Sao Paulo, Brazil; and Ankara, Turkey, in addition to its San Francisco headquarters.

Chapter 1. Corporate E-learning Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Corporate E-learning Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Corporate E-learning Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Corporate E-learning Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Corporate E-learning Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Corporate E-learning Market – By Technology

6.1 Introduction/Key Findings

6.2 Web Based

6.3 Learning management system

6.4 Learning content management system

6.5 Podcast

6.6 Virtual classroom

6.7 Y-O-Y Growth trend Analysis By Technology

6.8 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Corporate E-learning Market – By Training Type

7.1 Introduction/Key Findings

7.2 Instructor-led & text-based

7.3 Outsourced

7.4 Y-O-Y Growth trend Analysis By Training Type

7.5 Absolute $ Opportunity Analysis By Training Type, 2024-2030

Chapter 8. Corporate E-learning Market – By Organization Size

8.1 Introduction/Key Findings

8.2 Large-scale enterprises

8.3 Small and medium-scale enterprises

8.4 Y-O-Y Growth trend Analysis By Organization Size

8.5 Absolute $ Opportunity Analysis By Organization Size, 2024-2030

Chapter 9. Corporate E-learning Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Technology

9.1.3 By Training Type

9.1.4 By By Organization Size

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Technology

9.2.3 By Training Type

9.2.4 By Organization Size

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Technology

9.3.3 By Training Type

9.3.4 By Organization Size

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Technology

9.4.3 By Training Type

9.4.4 By Organization Size

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Technology

9.5.3 By Training Type

9.5.4 By Organization Size

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Corporate E-learning Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cornerstone OnDemand

10.2 SAP Litmos

10.3 Adobe Captivate Prime

10.4 D2L Brightspace

10.5 IBM Talent Management Solutions

10.6 LinkedIn Learning

10.7 Articulate 360

10.8 Oracle Learning Cloud

10.9 Blackboard

10.10 Coursera for Business

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Corporate E-learning Market was valued at USD 44.91 billion and is projected to reach a market size of USD 100.47 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12.19%.

Increasing adoption of remote work and the concept of microlearning are the main factors propelling the Global Corporate E-learning Market.

Based on Technology, the Global Corporate E-learning Market is segmented into Web-based, learning management systems, Learning content management systems, Podcasts, and Virtual classrooms.

North America is the most dominant region for the Global Corporate E-learning Market.

Cornerstone OnDemand, SAP Litmos, and Adobe Captivate Prime are the key players operating in the Global Corporate E-learning Market.