Corn Glucose Market Size (2025-2030)

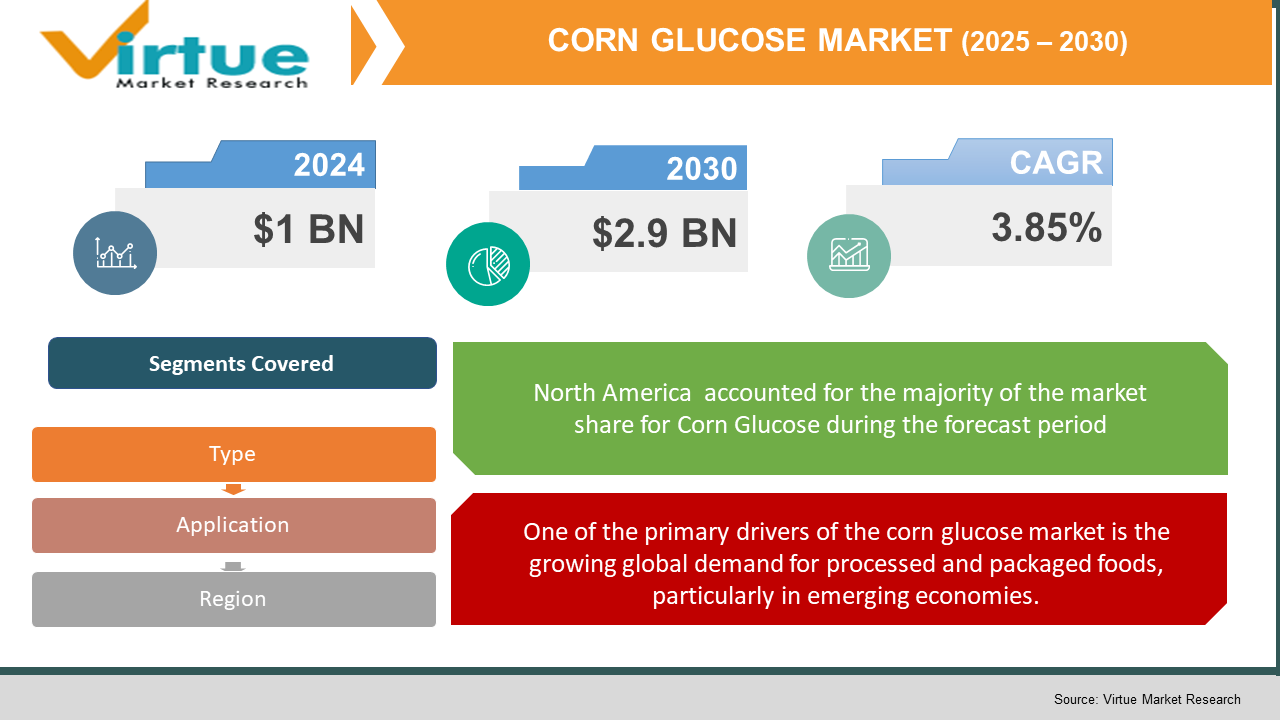

The Corn Glucose Market was valued at USD l billion in 2024 and is projected to reach a market size of USD 2.9 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 3.85%.

The Corn Glucose Market plays a vital part in the global food and beverage space due to its wide applications and cheap sweetening effects. Corn glucose (or glucose syrup) is one of the products resulting from the enzymatic hydrolysis of corn starch, and it finds use in confectionery, bakery, dairy, beverages, and even in pharmaceutical and personal care products. Manufacturers prefer it because it can improve texture, retain moisture, and prolong shelf life, thus adding to the consistency and quality of their products. Increased demand for processed and packaged foods, especially in emerging economies, keeps boosting the corn glucose market. Other factors are innovations in food formulation and a growing trend toward replacing sugar with non-sugar sweeteners. While industries explore cleaner labels and healthier alternatives, corn glucose lies at the crossroads of performance, affordability, and functional versatility.

Key Market Insights:

Over 70% of global corn glucose production is consumed by the confectionery industry. Its superior moisture retention and anti-crystallisation properties make it ideal for candies, jellies, and gums, fueling consistent growth in this segment.

Corn glucose is used in over 80% of carbonated beverages and packaged bakery products. Its ability to improve sweetness and shelf-life without altering taste profiles is a key factor driving its popularity among large-scale beverage and bakery producers.

Corn Glucose Market Drivers:

One of the primary drivers of the corn glucose market is the growing global demand for processed and packaged foods, particularly in emerging economies.

Emerging economies are fast becoming a large consumer base for processed and packaged foods, and therein lies one of the primary factors driving the corn glucose market. Consumers have gradually begun choosing easier access to a variety of ready-made meals, snacks, and beverages with an increase in urbanisation, changing lifestyles, and disposable income growth. Packaged foods rely on corn glucose as one of the economical sweeteners, humectants, and preservatives. It helps to impart texture, enhance taste, and prolong shelf life, key issues in packaged foods. The expanding middle-class population and increasing youth numbers now also add to the growing consumption of confectionery, bakery, and dairy products, widely using corn glucose. Furthermore, the globalisation of food chains and a rising influence of Western eating habits in Asia-Pacific and Latin America only serve to accelerate this trend. Food companies keep innovating with their flavour profiles and textures, and corn glucose remains key as a functional ingredient, keeping the market on track for continuous growth.

Another major growth driver is the cost-effectiveness and high yield associated with corn glucose production, especially in countries with abundant corn supply like the U.S., China, and India.

Another important growth factor of corn glucose is in terms of cost-effectiveness and high yield, especially in countries that could produce massive amounts of corn, such as the U.S., China, and India. Compared to traditional cane sugar, corn glucose offers a more stable pricing structure and consistent quality, so it appeals to giant food and beverage companies. It provides 30-40% savings in cost without compromising taste or performance, perfect for the budget-sensitive production lines. In addition, the corn starch conversion technologies have also moderately progressed to increase the efficiency of the production and significantly lessen environmental waste. Governments in most areas support corn farming in the form of subsidies, making it even more desirable as a raw material. Such economic benefit makes corn glucose the material of choice in competitive food markets and drives increasing its usage in developing countries, which are highly cost-conscious. In a world of a volatile economy, cheap yet functional further strengthens its position in the market.

Corn Glucose Market Restraints and Challenges:

A major restraint in the corn glucose market is the high dependency on corn as a raw material, which subjects the industry to price volatility and supply chain disruptions.

One of the biggest restraints in the corn glucose market is the heavy dependence on corn as a raw material, thus exposing the sector to price volatility and supply chain disruption. Demand fluctuations from animal feed, biofuels, and other industrial applications can avail or deny the industry of its raw materials. Weather conditions affecting corn supply can be aggravated by crop diseases, politically charged events like export bans or trade restrictions, and other such factors. In all these instances, supply disruption would engender increased production costs for corn glucose manufacturers as it becomes difficult to maintain a steady price. Import dependency serves to aggravate this situation among regions having limited corn self-sufficiency. Increasing scrutiny regarding the environmental ramifications of large-scale corn farming, such as soil degradation and pesticides, has also become a potential regulatory threat. The corn glucose market will soon start feeling the heat to diversify raw materials or demonstrate higher sourcing transparency, as global emphasis pivots to sustainable sourcing and climate resilience.

Corn Glucose Market Opportunities:

The Corn Glucose Market has become an opportunity for natural and clean-label ingredients growth in food, beverage, and pharmaceutical markets. Health-conscious consumers are increasingly seeking substitutes to artificial sweeteners, which provides room for corn glucose to be positioned as a naturally derived value-added ingredient. Given its energy-giving and stabilising properties, it provides enormous potential within the rising functional food and nutraceutical sectors. Emerging markets, such as Asia-Pacific, Latin America, and Africa, also show increasing urbanisation and processed food adoption for market advancement. Advancements in food science include enzymatic processing and sustainable starch extraction, which will further help increase the quality and application of corn glucose. Due to innovations in products like sports drinks, protein bars, and low-sugar confectioneries, new demand is likely to emerge. All these factors combine to create opportunities for manufacturers to diversify their portfolios and strengthen their global presence.

CORN GLUCOSE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

3.85% |

|

Segments Covered |

By Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Archer Daniels Midland Company (ADM), Tate & Lyle, Ingredion, Roquette, Global Sweeteners Holdings, Tereos Group, AGRANA, Foodchem International, and Gulshan Polyols |

Corn Glucose Market Segmentation:

Corn Glucose Market Segmentation: By Type

- Liquid Glucose

- Solid Glucose

The corn glucose market can be segmented mainly by type, namely liquid glucose and solid glucose. The predominance in market share of liquid glucose is due to its use in food and beverage applications, especially in confectionery, dairy, and bakery products. Liquid glucose acts as a humectant, thickener, and preservative, improving products' texture and prolonging their shelf life. Furthermore, its easy solubility as well as blendability make liquid glucose highly preferred among manufacturers. In comparison, solid glucose, typically in crystalline form, is gaining popularity in pharmaceuticals and dry food products, wherein stable storage, long shelf life, and measured dosages take precedence. Solid glucose also scores over liquid glucose when it comes to transportability and storage in bulk, thereby lending itself more suitably for large-scale industrial applications. Both types serve a specific need, while demand for either type is influenced by parameters such as end-use industry, regional preferences, and packaging requirements.

Corn Glucose Market Segmentation: By Application

- Food & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Industrial Applications

The largest share of corn glucose is consumed in the food and beverage industry and accounts for the major chunk of global demand. The number of products in which it is contained can be counted: soft drinks, jams, dairy, ice creams, sauces, bakery items, etc. Cleomolecule uses corn glucose as a base for making syrup and energy supplements, besides being used as a binder in tablets. Because of that property, corn glucose is useful in digestible and slightly sweet formulations, with an emphasis on oral rehydration solutions and pediatric formulations." The cosmetic and personal care industry utilises corn glucose as a humectant for skin conditioning agents in moisturisers, shampoos, and lotions, supporting clean-label trends as well." In addition to this, it is widely applied at the industrial level in adhesives, fermentations, and paper manufacturing because they are biodegradable and nontoxic. Thus, the base of such strong applications should reinforce corn glucose as a versatile and essential ingredient across many industries.

Corn Glucose Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The corn glucose market is highly regionalised around the globe, with North America being the leading region in 2024 due to presumed corn production, well-advanced food processing industries, and the consumption level of processed foods and beverages. The presence of major players and well-established distribution channels serves the region as an added advantage. Demand for clean-label and natural sweeteners in health-oriented food and pharmaceutical applications would be identified as further drivers for the next in line: Europe. Meanwhile, growth in the Asia-Pacific region is rapid, supported by urbanisation, changing dietary needs, and a developing middle class. China and India are thus becoming big consumers and producers, with favourable agricultural conditions and growing food industries bolstering their growth. South America would also continue to grow at a slow pace, buttressed by industrialisation and increasing investments into food and beverage inputs. Finally, the market of corn glucose in the Middle East and Africa is growing at a nascent stage, but the adoption is gradually increasing least in the bakery and pharmaceutical segments. The future may promise accelerated growth due to food security initiatives and urbanisation.

COVID-19 Impact Analysis on the Corn Glucose Market:

That pandemic for COVID-19 pandemic had both positive and negative influences on the Corn Glucose Market. The disruption in the global supply chains and logistics posed a temporary shortage of raw materials such as corn, thus delaying the processing of corn glucose and increasing its price. Many manufacturing units started operating below normal capacity due to lockdowns and the unavailability of labour. On the contrary, an increase in demand for packaged and shelf-stable foods during the pandemic has led to more applications for corn glucose in bakery products, confectionery, and C-ready meal applications. Furthermore, in the pharmaceutical industry, the consumption of corn glucose soared in syrups, oral rehydration therapy, and energy supplements, assisting with hydration and immunity needs. The trend toward healthier food products caused manufacturers to search for corn-derived sweeteners as alternatives to artificial sweeteners. Even though the market had a few short-term challenges, its long-term outlook remains positive, with digitalisation and restructuring of supply chains helping companies recover and readjust to the post-pandemic demands.

Latest Trends/ Developments:

The corn glucose market is witnessing a new wave of innovations and strategic shifts in light of changing consumers and their demands across industries. Developments in clean-label and non-GMO glucose syrups present one of the most influential trends, especially in the developed markets where the health-conscious consumer scrutinises the ingredients list. Adoption of cleaner practices in production, such as using renewable energy sources and environmentally friendly packaging, continues to be a growing trend to meet environmental and regulatory standards. Apart from this, product diversification using flavoured, vegan and low glycemic variants such as speciality diets and functional food products is underway in the market. Technological innovations such as AI-enabled supply chain optimisation and real-time quality monitoring for production efficiency and cost reduction are bringing about changes within the market. Growth in new markets, particularly in the APAC region, further fosters opportunity for expansion as demand for processed food and beverages rapidly increases. Corn glucose has also entered non-food industries such as cosmetics, personal care, and industrial adhesives, thereby broadening its application spectrum and strongly positioning the ingredient as versatile and future-ready.

Key Players:

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Tate & Lyle PLC

- Ingredion Incorporated

- Roquette Frères

- Global Sweeteners Holdings Ltd.

- Tereos Group

- AGRANA Beteiligungs-AG

- Foodchem International Corporation

- Gulshan Polyols Ltd.

Chapter 1. Corn Glucose Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary source

1.5. Secondary source

Chapter 2. CORN GLUCOSE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. CORN GLUCOSE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. CORN GLUCOSE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. CORN GLUCOSE MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. CORN GLUCOSE MARKET – By Type

6.1 Introduction/Key Findings

6.2 Liquid Glucose

6.3 Solid Glucose

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. CORN GLUCOSE MARKET – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverages

7.3 Pharmaceuticals

7.4 Cosmetics & Personal Care

7.5 Industrial Applications

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. CORN GLUCOSE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. CORN GLUCOSE MARKET – Company Profiles – (Overview, Type Type , Portfolio, Financials, Strategies & Developments)

9.1 Cargill, Incorporated

9.2 Archer Daniels Midland Company (ADM)

9.3 Tate & Lyle PLC

9.4 Ingredion Incorporated

9.5 Roquette Frères

9.6 Global Sweeteners Holdings Ltd.

9.7 Tereos Group

9.8 AGRANA Beteiligungs-AG

9.9 Foodchem International Corporation

9.10 Gulshan Polyols Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Corn Glucose Market was valued at USD l billion in 2024 and is projected to reach a market size of USD 2.9 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 3.85%.

The Corn Glucose Market is driven by the rising demand for processed and packaged foods globally. Additionally, its cost-effectiveness and versatile applications across food, pharma, and industrial sectors further fuel market growth.

Based on Service Provider, the Corn Glucose Market is segmented into material manufacturers, Raw Material Suppliers, Lab information management systems, Distributors & Wholesalers, End-to-End Solution Providers.

North America is the most dominant region for the Corn Glucose Market.

Cargill, Archer Daniels Midland Company (ADM), Tate & Lyle, Ingredion, Roquette, Global Sweeteners Holdings, Tereos Group, AGRANA, Foodchem International, and Gulshan Polyols are the key players in the Corn Glucose Market.