Copper Cathode Market Size (2025-2030)

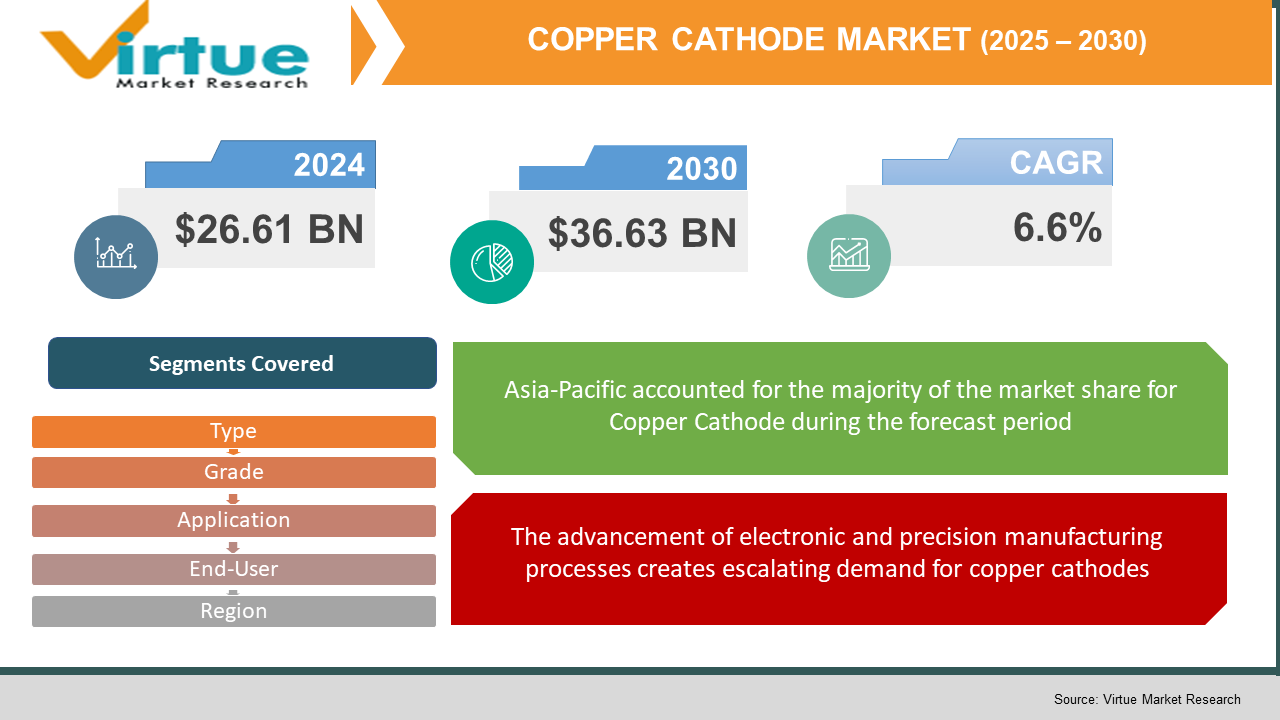

The Copper Cathode Market was valued at USD 26.61 Billion in 2024 and is projected to reach a market size of USD 36.63 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6.6%.

The Copper Cathode Market represents the cornerstone of global metal processing and manufacturing industries, serving as the primary source of high-purity copper for countless applications worldwide. Copper cathodes are refined copper products that undergo electrolytic purification processes to achieve exceptional purity levels, typically ranging from 99.95% to 99.99%. These refined copper products serve as fundamental raw materials for manufacturing electrical conductors, electronic components, construction materials, and various industrial applications that form the backbone of modern infrastructure and technology. The market's current landscape is characterized by sophisticated production facilities utilizing advanced electrorefining technologies, where copper concentrate is processed through complex chemical and electrical processes to remove impurities and produce high-grade cathodes. These facilities operate with stringent quality control measures to ensure consistent purity levels and metal characteristics that meet international standards for electrical conductivity, corrosion resistance, and mechanical properties. The production process involves dissolving copper anodes in electrolytic cells filled with copper sulfate solution, where electrical current facilitates the transfer of pure copper ions to cathode plates, resulting in high-quality copper sheets ready for further processing. The market encompasses a diverse ecosystem of mining companies, smelting operations, refineries, and downstream manufacturers who collectively form an integrated supply chain spanning from ore extraction to finished product delivery. This industry demonstrates remarkable resilience and adaptability, continuously evolving to meet changing technological demands, environmental regulations, and global economic conditions. Modern copper cathode production facilities incorporate sophisticated automation systems, environmental control technologies, and energy-efficient processes that minimize waste generation while maximizing output quality and operational efficiency.

Key Market Insights:

- Global copper cathode production reached approximately 24.8 million metric tons in 2024, with China accounting for 45-48% of total worldwide production capacity through its extensive network of smelting and refining facilities.

- The electrical and electronics sectors consumed over 11.8 million metric tons of copper cathodes in 2024 alone, representing nearly 48% of total global consumption and highlighting the material's critical role in modern electrical infrastructure.

- High-purity copper cathodes (99.99% purity) account for approximately 35% of total market value despite representing only 15% of production volume, commanding premium pricing due to specialized applications in electronics and precision manufacturing.

- Copper cathode prices experienced significant fluctuations in 2024, ranging from USD 8,200 to USD 10,100 per metric ton, with March 2024 recording the highest monthly values exceeding USD 10,000 per metric ton.

- Asia-Pacific region dominates copper cathode production with 65% of global capacity, followed by South America at 18%, North America at 12%, and other regions accounting for the remaining 5% of worldwide production.

- Approximately 78% of major copper cathode producers have implemented automated quality control systems and digital monitoring technologies to enhance production efficiency and maintain consistent product quality standards.

- The industry allocated over USD 2.8 billion in 2024 toward environmental compliance and sustainability initiatives, including waste reduction technologies, energy-efficient processes, and carbon footprint minimization programs.

- Copper cathode supply chains demonstrated improved resilience in 2024, with average delivery times reduced by 12% compared to previous years through enhanced logistics coordination and inventory management optimization.

- The top 15 copper cathode producers globally control approximately 72% of total market capacity, with the leading five companies accounting for 42% of worldwide production, indicating moderate market concentration levels.

Market Drivers:

The unprecedented global shift toward electrification across transportation, energy generation, and industrial applications serves as the primary catalyst driving copper cathode demand to unprecedented levels.

Electric vehicle production alone consumed approximately 1.8 million metric tons of copper cathodes in 2024, representing a 340% increase from 2019 levels. Wind turbine installations require substantial copper cathode quantities, with each megawatt of wind generation capacity utilizing approximately 3.5 tons of refined copper. Solar panel manufacturing and installation infrastructure further amplify demand, as photovoltaic systems incorporate copper cathodes in inverters, wiring systems, and grid connection components. The expansion of electrical grid infrastructure to accommodate renewable energy integration necessitates massive copper cathode consumption for transmission lines, transformers, and distribution networks. Energy storage systems, particularly large-scale battery installations, represent emerging demand drivers requiring high-purity copper cathodes for electrical connections and thermal management systems.

The advancement of electronic and precision manufacturing processes creates escalating demand for copper cathodes.

Semiconductor manufacturing facilities require copper cathodes with purity levels exceeding 99.999% for interconnect applications in advanced microprocessors and memory devices. 5G network infrastructure deployment demands enormous quantities of high-quality copper cathodes for base station equipment, fiber optic cables, and signal transmission components. Internet of Things (IoT) device proliferation generates substantial demand for miniaturized copper components manufactured from premium-grade cathodes. Artificial intelligence hardware, including data centre equipment and specialized processing units, incorporates sophisticated copper-based cooling systems and electrical connections requiring exceptional material quality. The aerospace and defense industries increasingly specify high-performance copper cathodes for critical applications in satellite systems, avionics equipment, and advanced weapon systems.

Market Restraints and Challenges:

The copper cathode market faces significant constraints from volatile raw material costs, environmental regulations, and supply chain vulnerabilities. Stringent environmental compliance requirements impose substantial capital expenditures for pollution control systems and waste management infrastructure. Geopolitical tensions and trade restrictions create supply chain disruptions, particularly affecting international shipments and long-term contract stability. Energy costs for electrolytic refining processes remain substantial, directly impacting production economics and pricing competitiveness across different regional markets.

Market Opportunities:

Emerging opportunities in the copper cathode market center on advanced manufacturing applications, recycling technologies, and specialized product development. The growing emphasis on circular economy principles creates significant potential for copper cathode recovery from electronic waste and industrial scrap materials. High-value niche applications in medical devices, precision instruments, and specialized electronics command premium pricing for ultra-pure copper cathodes. Integration opportunities exist for developing customized alloy products and specialized processing services that add value beyond standard cathode production. Strategic partnerships with technology companies offer pathways for developing innovative copper-based materials for next-generation applications in quantum computing, advanced battery technologies, and high-performance electronics.

COPPER CATHODE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.6% |

|

Segments Covered |

By Type, end user, grade, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Codelco, Freeport-McMoRan, BHP Billiton, Glencore, Southern Copper Corporation, First Quantum Minerals, Jiangxi Copper Company, Tongling Nonferrous Metals, Aurubis AG, KGHM Polska Miedź |

Copper Cathode Market Segmentation:

Copper Cathode Market Segmentation by Type:

- Electrolytic Refined Copper

- Fire-Refined Copper

- High-Purity Copper

- Oxygen-Free Copper

- Tough Pitch Copper

Electrolytic refined copper represents the fastest-growing segment, driven by increasing demand for standardized, high-quality copper products that meet international specifications for electrical conductivity and purity. This segment benefits from continuous technological improvements in electrolytic refining processes and growing adoption across diverse industrial applications.

High-purity copper maintains its position as the most dominant segment by value, commanding premium pricing due to specialized applications in electronics manufacturing, semiconductor production, and precision engineering. This segment's dominance reflects the critical importance of ultra-pure copper in advanced technological applications requiring exceptional electrical and thermal properties.

Copper Cathode Market Segmentation by Grade:

- 99.99% Purity

- 99.95% Purity

- Standard Grade (99.90% Purity)

- Commercial Grade

- Industrial Grade

99.99% purity grade emerges as the fastest-growing segment, fueled by expanding semiconductor manufacturing capacity and increasing demand for high-performance electronic components.

Standard grade (99.90% purity) represents the most dominant segment by volume, serving the majority of construction, electrical, and general industrial applications. This segment's dominance stems from its optimal balance between quality specifications and cost-effectiveness for mainstream copper applications.

Copper Cathode Market Segmentation by Application:

- Electrical & Electronics

- Construction

- Transportation

- Industrial Machinery

- Consumer Goods

Electrical & electronics constitutes the fastest-growing application segment, propelled by digital transformation initiatives, smart device proliferation, and expanding telecommunications infrastructure. The segment benefits from continuous innovation in electronic devices and increasing copper content per unit in advanced technologies.

Construction remains the most dominant application segment by volume, encompassing plumbing systems, electrical wiring, roofing materials, and architectural applications. This segment's dominance reflects copper's fundamental role in building infrastructure and residential construction activities worldwide.

Copper Cathode Market Segmentation by End-User:

- Wire & Cable Manufacturers

- Electronic Device Producers

- Construction Companies

- Automotive Industry

- Aerospace & Defense

Electronic device producers represent the fastest-growing end-user segment, driven by accelerating consumer electronics demand, industrial automation expansion, and emerging technology adoption. This segment benefits from increasing copper content in sophisticated electronic systems and miniaturized components.

Wire & cable manufacturers maintain their position as the most dominant end-user segment, consuming the largest volumes of copper cathodes for producing electrical cables, power transmission lines, and communication cables. This segment's dominance reflects the fundamental importance of copper conductors in electrical infrastructure development.

Copper Cathode Market Segmentation: Regional Analysis:

- Asia-Pacific

- North America

- Europe

- South America

- Middle East & Africa

Asia-Pacific dominates the copper cathode market with a commanding 52% market share, driven by China's massive industrial production capacity, extensive manufacturing infrastructure, and robust domestic demand across electronics, construction, and automotive sectors. The region benefits from integrated supply chains, cost-effective production capabilities, and proximity to major copper mining operations.

Asia-Pacific also demonstrates the highest growth rates, fueled by rapid industrialization in emerging economies, expanding renewable energy installations, and increasing electric vehicle adoption. Government initiatives promoting green energy transition and smart city development create substantial demand for high-quality copper cathodes throughout the region.

COVID-19 Impact Analysis:

The COVID-19 pandemic initially disrupted copper cathode markets through temporary production shutdowns, logistics constraints, and reduced industrial demand during global lockdowns. However, the crisis ultimately accelerated digital transformation initiatives, remote work infrastructure development, and government stimulus programs focused on renewable energy and infrastructure modernization. Recovery phases demonstrated remarkable market resilience, with demand rebounding strongly as economic activities resumed and new technology adoption accelerated. The pandemic highlighted the critical importance of supply chain diversification and local production capabilities, prompting strategic investments in regional refining capacity and inventory management optimization.

Latest Trends and Developments:

Contemporary market trends emphasize sustainability, technological integration, and value-added processing capabilities within copper cathode production and distribution networks. Advanced automation systems incorporating artificial intelligence and machine learning optimize production efficiency while maintaining consistent quality standards. Blockchain technology implementation enhances supply chain transparency and product traceability throughout global distribution networks. Green production initiatives focus on renewable energy utilization, waste heat recovery, and circular economy principles for sustainable manufacturing operations. Digital marketplace platforms facilitate direct producer-consumer connections, reducing intermediary costs and improving price transparency across international markets.

Key Players in the Market:

- Codelco

- Freeport-McMoRan Inc.

- Glencore PLC

- BHP

- Southern Copper Corporation

- Rio Tinto

- Jiangxi Copper Co. Ltd.

- Zijin Mining Group Co., Ltd.

- First Quantum Minerals Ltd.

- Antofagasta PLC

Chapter 1. Copper Cathode Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Copper Cathode Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Copper Cathode Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Copper Cathode Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Copper Cathode Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Copper Cathode Market– By Type

6.1 Introduction/Key Findings

6.2 Electrolytic Refined Copper

6.3 Fire-Refined Copper

6.4 High-Purity Copper

6.5 Oxygen-Free Copper

6.6 Tough Pitch Copper

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. Copper Cathode Market– By Grade

7.1 Introduction/Key Findings

7.2 99.99% Purity

7.3 99.95% Purity

7.4 Standard Grade (99.90% Purity)

7.5 Commercial Grade

7.6 Industrial Grade

7.7 Y-O-Y Growth trend Analysis By Grade

7.8 Absolute $ Opportunity Analysis By Grade , 2025-2030

Chapter 8. Copper Cathode Market– By End-User

8.1 Introduction/Key Findings

8.2 Wire & Cable Manufacturers

8.3 Electronic Device Producers

8.4 Construction Companies

8.5 Automotive Industry

8.6 Aerospace & Defense

8.7 Y-O-Y Growth trend Analysis End-User

8.8 Absolute $ Opportunity Analysis End-User , 2025-2030

Chapter 9. Copper Cathode Market– By Application

9.1 Introduction/Key Findings

9.2 Electrical & Electronics

9.3 Construction

9.4 Transportation

9.5 Industrial Machinery

9.6 Consumer Goods

9.7 Y-O-Y Growth trend Analysis Application

9.8 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 10. Copper Cathode Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Type

10.1.3. By End-User

10.1.4. By Grade

10.1.5. Application

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Type

10.2.3. By End-User

10.2.4. By Grade

10.2.5. Application

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Type

10.3.3. By Application

10.3.4. By Grade

10.3.5. End-User

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Application

10.4.3. By Grade

10.4.4. By Type

10.4.5. End-User

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By End-User

10.5.3. By Application

10.5.4. By Grade

10.5.5. Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. COPPER CATHODE MARKET– Company Profiles – (Overview, Portfolio, Financials, Strategies & Developments)

11.1 Codelco

11.2 Freeport-McMoRan Inc.

11.3 Glencore PLC

11.4 BHP

11.5 Southern Copper Corporation

11.6 Rio Tinto

11.7 Jiangxi Copper Co. Ltd.

11.8 Zijin Mining Group Co., Ltd.

11.9 First Quantum Minerals Ltd.

11.10 Antofagasta PLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The primary growth drivers include accelerating electrification across transportation and energy sectors, expanding renewable energy infrastructure development, increasing demand from electronics and telecommunications industries, and growing adoption of electric vehicles requiring substantial copper content for batteries and charging infrastructure.

Major concerns encompass volatile raw material costs, environmental compliance requirements, energy-intensive production processes, supply chain vulnerabilities from geopolitical tensions, and increasing competition from alternative materials in specific applications.

Leading market participants include Codelco, Freeport-McMoRan, BHP Billiton, Glencore, Southern Copper Corporation, First Quantum Minerals, Jiangxi Copper Company, Tongling Nonferrous Metals, Aurubis AG, KGHM Polska Miedź, and other major mining and refining companies with global operations.

Asia-Pacific region holds the largest market share at approximately 52%, driven by China's dominant production capacity, extensive manufacturing infrastructure, and substantial domestic consumption across electronics, construction, and automotive industries.

Asia-Pacific region demonstrates the fastest growth rates, propelled by rapid industrialization in emerging economies, government initiatives promoting renewable energy adoption, expanding electric vehicle production, and increasing investments in smart city infrastructure development projects.