Cooking Oil Market Size (2024-2030)

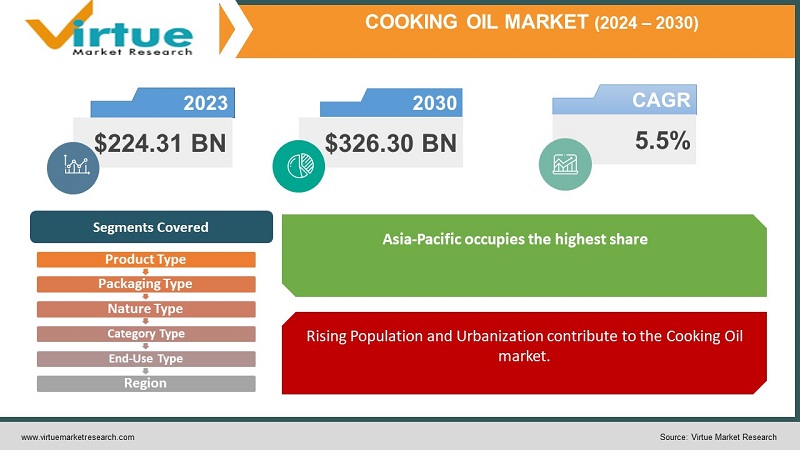

The Global Cooking Oil Market is valued at USD 224.31 billion in 2023 and is projected to reach a market size of USD 326.30 billion by the end of 2030. Over the forecast period 2024-2030, the market is projected to grow at a CAGR of 5.5%.

Cooking oil is a synthetic oil used in frying, baking, food preparation, and seasoning. These oils are made from different oils. Olive oil, canola oil, sunflower oil, soybean oil, avocado oil etc. It has many health benefits and is widely used in food applications. The market is driven by strong demand for healthy and unhealthy foods. The increasing use of avocado oil for its health benefits, the increasing demand for canola oil in snacks due to its cheapness and versatility, and the increasing commercialization of soybean oil by large companies are driving business growth.

The impact of advertising on consumers is an important factor affecting business growth and is also the main reason why consumers switch brands and types of edible oils. Additionally, entrepreneurs and stakeholders are involved in the development of new food packaging, which has a significant impact on short-term business growth. Also, if there is a new variety, consumers will want to buy cooking oil to taste the new taste.

Key Market Insights:

The Asia Pacific region maintains its dominance, consuming around 55% of the market share, with North America and Europe following closely behind. Latin America and the Middle East & Africa bring a touch of flavor to the mix.

There is a noticeable shift in consumer preferences when it comes to fats, as people are moving away from saturated options and embracing healthier alternatives such as olive, canola, and plant-based oils like avocado and walnut.

Additionally, there is a growing interest in functional oils that contain CBD or antioxidants, which are gaining popularity.

The growing concerns surrounding deforestation and the environmental impact of palm oil have sparked a push for alternative oils such as algae and camelina, as well as the promotion of carbon-neutral production and the upcycling of used oil. The desire for convenience and affordability is being met through various means such as direct-to-consumer models, personalized oil subscriptions, and innovative packaging options like mini-packs and resealable formats.

Cooking Oil Market Drivers:

Rising Population and Urbanization contribute to the Cooking Oil market.

There is no denying the fact that increasing population will result in increasing demand for cooking oil as more people will naturally consume more food and hence, the cooking oil. On the other hand, Urbanization further fuels cooking oil demands as people eat out more often and heavily rely on processed food, both of these necessities require large amounts of cooking oil which in turn drives the market. Also, fast-food companies like McDonald’s, KFC, Pizza Hut, Taco Bell, etc. are rapidly growing in developing nations which results in increased processed food demands globally. And so, there is a necessary need for cooking oil in these nations.

Shifting Dietary Preferences of this generation drives the Cooking Oil Market.

Nowadays people are becoming more aware of the growing health concerns which will naturally lead them to shift their diet approach which increases the demand for healthier cooking oils like Olive oil, Avocado Oil, Canola Oil, etc. On the contrary, vegan and vegetarian diets are gaining popularity because of their plant-based oil which contributes towards market growth.

Rising disposable income is fueling market growth globally.

With healthy purchasing power, consumers are willing to invest in higher quality oils such as organic, cold-pressed, or increased varieties. As spending on these premium quality oils increases, it will enhance the market growth. Consumers often like to be stuck with a particular brand because of their unique properties, and health benefits which solidify the position of key players in the market and enable them to produce more of these types of oils which in turn drives the market.

Cooking Oil Market Restraints and Challenges:

Volatility in the prices of oil provides a challenge to the market growth.

The market relies deliberately on raw materials like soybeans, palm oil, etc. whose prices fluctuate due to factors like weather, political instability, and global need. These ups and downs result in hasty price changes for end users, impacting affordability and creating market unstable. Also due to these fluctuations manufacturers and distributors find it hard to manage inventory and production costs.

The cooking oil market raises environmental concerns.

Palm oil manufacturing is often linked to deforestation and leads to the destruction of habitat which raises environmental concerns. This growing concern provides a challenge to adapt to sustainable sourcing practices and ethical production standards. The Governments of the respective nations are implementing stricter regulations in order to control deforestation and encourage industries to adapt to ethical and sustainable practices for the production and manufacture of cooking oil, which poses a challenge to the concerned industries.

Cooking Oil Market Opportunities:

The cooking oil market provides an excellent opportunity for solid market players for growth and innovation. They can capitalize on health trends with oils that are processed with anti-oxidants, vitamins, and omega-3s and targeted marketing. Industries can also benefit by investing in certified sustainable palm oil extraction which attracts eco-conscious consumers. Also, by implementing QR codes on packaging industries can earn the trust of consumers which solidifies their market position and also to aware consumers of information of oil extraction, production practices, and environmental impact.

COOKING OIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product Type, Packaging Type, nature type, category type, end use type,and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company, Ach Food Companies Inc., Beidahuang Group , Fuji Oil Holdings Inc., Wilmar International, Musin Mas Group, Adani Group , Ruchi Soya, Bunge Alimentos Sa, American Vegetable Oils Inc. |

Cooking Oil Market Segmentation:

Cooking Oil Market Segmentation: By Product Type:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Rapeseed Oil

- Olive Oil

- Coconut Oil

- Others

In 2023, based on the product type, the palm oil segment accounted for the largest revenue share growing at a CAGR of 5.2% and has led the market. The consumption of palm oil is increased by the fact that it helps in recovering the patient from arthritis, Alzheimer’s, cancer, etc. Also, the manufacturing of crude palm oil is supported by the ever-increasing population. Moreover, palm oil is in demand because of its properties like it shows oxidation resistance, giving products longer shelf life, and being semi-solid at room temperature.

The soybean oil segment accounted for the second-largest revenue share in the market. Due to its properties to promote heart health, soybean oil is the first runner-up in the market. It also helps in reducing blood clotting and plays a significant part in regulating bone metabolism.

Cooking Oil Market Segmentation: By Packaging Type:

- Pouches

- Jars

- Cans

- Bottles

- Others

In 2023, based on the packaging type, the bottles segment accounted for the largest revenue share growing at a CAGR of 4.2% and has led the market. The bottle segment is in high demand because of its versatility and consumer popularity. Most of the bottles come up with the material of glass, and plastic and are available in various shapes and sizes. Bottles are mostly used for oils that are used in smaller quantities.

The pouches segment accounted for the second-largest revenue share in the market. The pouches are popular because of their lightweight, and flexibility, and after use doesn’t require any storage.

Cooking Oil Market Segmentation: By Nature Type:

- Organic

- Conventional

In 2023, based on the Nature type, the conventional segment accounted for the largest revenue share growing at a CAGR of 5.3% and has led the market. Conventional oil is in more demand because it is cheaper, has wider availability, and consumer familiarity.

Organic oil however struggles with higher costs as production is limited but has shown a CAGR of 9%. The increasing demand for organic oil is because of its purity and enhanced health benefits.

Cooking Oil Market Segmentation: By Category Type:

- Refined

- Semi-Refined

- Unrefined

In 2023, based on the Category type, the refined segment accounted for the largest revenue and has led the market. Refined oil is undoubtedly in high demand because of its neutral flavor and higher smoke point enabling it for high-heat cooking like frying and grilling.

Semi-refined oil is next in the queue with refined oil. It is in very low demand as compared to refined oil. It retains flavors and nutrients after its processing.

Cooking Oil Market Segmentation: By End-Use Type:

- Domestic

- Industrial

- Food Service

In 2023, based on the End-Use type, the domestic segment accounted for the largest revenue and has led the market. The increasing demand for cooking oil in households is because it is a basic amenity for cooking and baking. Oils commonly used in residence are olive oil, soybean oil, palm oil, etc. These types of oil are commonly available in bottles and pouches and can be purchased from online stores, supermarkets, etc.

Cooking Oil Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2023, based on the Regions, the Asia-Pacific segment accounted for the largest revenue share around 55% with a growing CAGR of 6.2%, and has led the market. The main reason could be its high population density, urbanization, and rising purchasing power. India and China are among the top cooking oil-consuming nations. The heavy use of palm oil in countries results in more usage of cooking oil to encourage market growth.

North America is second on the list, and shares around 15% of the market. This American region relies heavily on soybean oil around 60% of the market. Rapid technological advancements attract major players to invest in this region.

The European region is third on the list and shares around 12% of the market. Most Mediterranean countries rely on olive oil for its health benefits and its flavor profile.

Soybean and sunflower oil are dominant in the South American region and share around 10% of the market.

Middle East & Africa region shares around 8% of the market. Palm oil is in huge demand in West Africa and Olive oil is dominant in North Africa.

COVID-19 Impact Analysis on the Global Cooking Oil Market:

With the emergence of the COVID-19 outbreak in 2019, the cooking oil industry resulted in both chaos and opportunities. Initially, there was panic buying and disruptions in the supply chain. Over time certain trends emerged. People became more health conscious. Started preferring olive oil and canola oil. Additionally, there was a surge in e-commerce for purchasing cooking oil and sustainability became a focus.

Although challenges like price volatility and inflation still exist businesses have the chance to capitalize on these circumstances. By innovating packaging and distribution methods targeting niche markets and adopting practices companies can pave their way, to success.

Latest Trends/ Developments:

In August 2022, in a bid to increase the farm incomes, the Indian government announced a new national agriculture programme. The project called the National Mission on Edible Oil Palm Oil (NMEOOP), aims to achieve self-sufficiency in edible oil with an investment of over US$ 1.4706 billion. The aim is to promote palm oil production, reduce dependence on imports, and help farmers benefit from the broad market.

Key Players:

- Archer Daniels Midland Company

- Ach Food Companies Inc.

- Beidahuang Group

- Fuji Oil Holdings Inc.

- Wilmar International

- Musin Mas Group

- Adani Group

- Ruchi Soya

- Bunge Alimentos Sa

- American Vegetable Oils Inc.

- In 2022, Archer-Daniels-Midland announced a new 7.5-year partnership that will see the two companies work closely together on projects to increase the use of agricultural recycling throughout the North American supply chain. The joint venture between the two companies has multiple jurisdictions aimed at reducing carbon emissions and is expected to cover 2 million acres by 2030.

- In March 2022, Alfa Laval acquired Desmet, a leader in the construction and supply of plants and technology for cooking oils and biofuels. Desmet is part of the Desmet Ballestra Group. This acquisition strengthens Alfa Laval's position in renewable energy and helps the company increase cooking oil consumption.

Chapter 1. Global Cooking Oil Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Cooking Oil Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Cooking Oil Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Cooking Oil Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Cooking Oil Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Cooking Oil Market– By Product Type

6.1. Introduction/Key Findings

6.2. Palm Oil

6.3. Soybean Oil

6.4. Sunflower Oil

6.5. Rapeseed Oil

6.6. Olive Oil

6.7. Coconut Oil

6.8. Others

6.9. Y-O-Y Growth trend Analysis By Product Type

6.10. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Global Cooking Oil Market– By Packaging Type

7.1. Introduction/Key Findings

7.2. Pouches

7.3. Jars

7.4. Cans

7.5. Bottles

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Packaging Type

7.8. Absolute $ Opportunity Analysis By Packaging Type, 2024-2030

Chapter 8. Global Cooking Oil Market– By Nature Type

8.1. Introduction/Key Findings

8.2. Organic

8.3. Conventional

8.4. Y-O-Y Growth trend Analysis Nature Type

8.5. Absolute $ Opportunity Analysis Nature Type , 2024-2030

Chapter 9. Global Cooking Oil Market– By Category Type

9.1. Introduction/Key Findings

9.2. Refined

9.3. Semi-Refined

9.4. Unrefined

9.5. Y-O-Y Growth trend Analysis Category Type

9.6. Absolute $ Opportunity Analysis Category Type , 2023-2030

Chapter 10. Global Cooking Oil Market– By End-Use Type

10.1. Introduction/Key Findings

10.2. Domestic

10.3 Industrial

10.4. Food Service

10.5. Y-O-Y Growth trend Analysis End-Use Type

10.6 . Absolute $ Opportunity Analysis End-Use Type , 2023-2030

Chapter 11. Global Cooking Oil Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. North America

11.1.1. By Country

11.1.1.1. U.S.A.

11.1.1.2. Canada

11.1.1.3. Mexico

11.1.2. By Product Type

11.1.3. By Packaging Type

11.1.4. By Category Type

11.1.5. Nature Type

11.1.6. End-Use Type

11.1.7. Countries & Segments - Market Attractiveness Analysis

11.2. Europe

11.2.1. By Country

11.2.1.1. U.K.

11.2.1.2. Germany

11.2.1.3. France

11.2.1.4. Italy

11.2.1.5. Spain

11.2.1.6. Rest of Europe

11.2.2. By Product Type

11.2.3. By Packaging Type

11.2.4. By Category Type

11.2.5. Nature Type

11.2.6. End-Use Type

11.2.7. Countries & Segments - Market Attractiveness Analysis

11.3. Asia Pacific

11.3.2. By Country

11.3.2.2. China

11.3.2.2. Japan

11.3.2.3. South Korea

11.3.2.4. India

11.3.2.5. Australia & New Zealand

11.3.2.6. Rest of Asia-Pacific

11.3.2. By Product Type

11.3.3. By Packaging Type

11.3.4. By Category Type

11.3.5. Nature Type

11.3.6. End-Use Type

11.3.7. Countries & Segments - Market Attractiveness Analysis

11.4. South America

11.4.3. By Country

11.4.3.3. Brazil

11.4.3.2. Argentina

11.4.3.3. Colombia

11.4.3.4. Chile

11.4.3.5. Rest of South America

11.4.2. By Product Type

11.4.3. By Packaging Type

11.4.4. By Category Type

11.4.5. Nature Type

11.4.6. End-Use Type

11.4.7. Countries & Segments - Market Attractiveness Analysis

11.5. Middle East & Africa

11.5.4. By Country

11.5.4.4. United Arab Emirates (UAE)

11.5.4.2. Saudi Arabia

11.5.4.3. Qatar

11.5.4.4. Israel

11.5.4.5. South Africa

11.5.4.6. Nigeria

11.5.4.7. Kenya

11.5.4.11. Egypt

11.5.4.11. Rest of MEA

11.5.2. By Product Type

11.5.3. By Packaging Type

11.5.4. By Category Type

11.6.5. Nature Type

11.5.6. End-Use Type

11.5.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12. Global Cooking Oil Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Archer Daniels Midland Company

12.2. Ach Food Companies Inc.

12.3. Beidahuang Group

12.4. Fuji Oil Holdings Inc.

12.5. Wilmar International

12.6. Musin Mas Group

12.7. Adani Group

12.8. Ruchi Soya

12.9. Bunge Alimentos Sa

12.10. American Vegetable Oils Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Cooking Oil Market is valued at USD 224.31 billion in 2023 and is projected to reach a market size of USD 326.30 billion by the end of 2030. Over the forecast period 2024-2030, the market is projected to grow at a CAGR of 5.5%.

Archer Daniels Midland Company, Ach Food Companies Inc., Beidahuang Group, Fuji Oil Holdings Inc., Wilmar International, Musin Mas Group, Adani Group, Ruchi Soya, Bunge Alimentos Sa, American Vegetable Oils Inc.

Asia-Pacific is the most dominant region for the Global Cooking Oil Market with around 55% of the share in the market.

Based on End-Use, the Global Cooking Oil Market is segmented into three categories: Domestic, Industrial, and Food Service.

Industries face many challenges such as adapting to sustainable practices without change in profit margin and having to deal with price fluctuations of raw materials.