Contract Research Organization (CRO) Services Market Size (2024 – 2030)

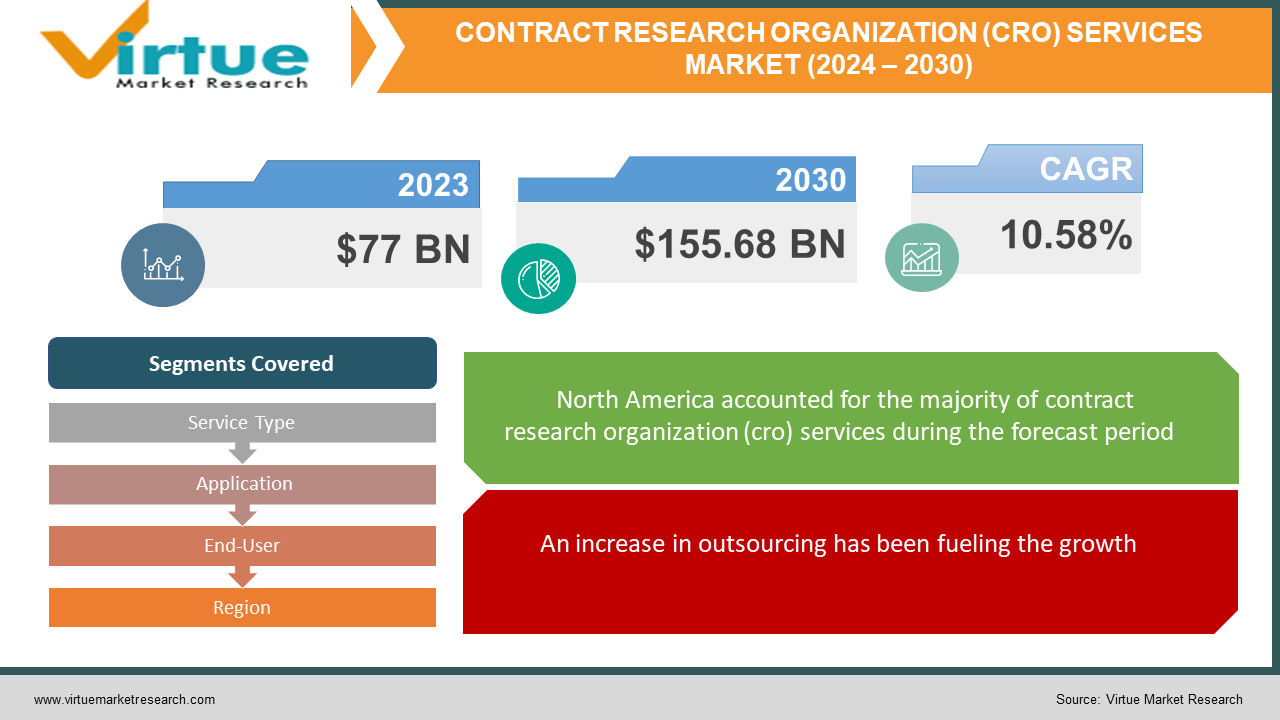

The global contract research organization (CRO) services market was valued at USD 77 Billion and is projected to reach a market size of USD 155.68 Billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 10.58%.

A contract research organization is a company that provides specific services to various end-user industries. Pharmaceutical, biotechnology, and medical device businesses get research support services from contract research organizations (CROs). Foundations, governmental agencies, and colleges can also receive assistance from CROs. This market has had a good presence in the past. Even though there were fewer in number, many companies allotted contracts and outsourced to these firms. Presently, with good economic development, this industry has experienced notable progress. Additionally, flexible service models have been aiding the expansion. In the future, with a greater focus on increasing the number of R&D activities, globalization, and advanced technologies being commercialized, this market is anticipated to have considerable growth.

Key Market Insights:

It was projected that the clinical segment of the global pharmaceutical CRO market will reach a valuation of 56.5 billion US dollars by 2023.

With an 8% CAGR, the US market for CRO services is projected to reach $31.81 billion by 2032.

The CRO market is expected to rise, with North America accounting for $24.4 billion of the total.

With a valuation of around 21 billion dollars as of May 2023, Thermo Fisher's acquisition of PPD stands as the largest merger and acquisition (M&A) deal involving contract research organizations.

Roughly 80–85% of clinical studies encounter delays at different phases on average. To tackle this, companies in this industry have been designing optimized protocols, improving patient recruitment strategies, and enhancing their communication abilities.

Contract Research Organization (CRO) Services Market Drivers:

An increase in outsourcing has been fueling the growth.

Over the years, there have been significant improvements in the healthcare sector. This is because of a well-developed economy. There have been numerous companies that have been prevalent in the market. As such, the number of pharmaceutical activities has also drastically increased. To support this, there have been tremendous investments from governmental bodies and other multinational companies. Various emerging startups and firms have come up with unique and innovative approaches to performing trials. These startups usually concentrate on one type of disease. Therefore, this creates specialized expertise in a particular therapeutic area. Pharmaceutical and biotechnology companies have been outsourcing many of their activities to get better insights, enhance efficiency, and obtain advanced therapeutics. This allows the companies to concentrate on other important tasks involved in the drug development process. Moreover, the costs involved are also reduced, as there are no expenses for purchasing equipment, getting a workspace, or hiring people. To keep up with this, there has been an increase in the number of CROs with advanced functionalities.

The rising number of chronic diseases has been contributing to the expansion.

Changes in lifestyle activities and the environment have created an upsurge in the number of people being diagnosed with various sorts of illnesses. People are being diagnosed with disorders at a young age. Few of them have a high probability of relapse since there isn't a vaccine or medicine that is known to completely eradicate certain diseases. As such, vaccine development is being prioritized for a few diseases, like diabetes and cancer. Researchers are constantly working on different therapeutics by using many approaches. CROs conduct essential activities like medical writing, preclinical research, post-marketing surveillance, clinical trials, data management, etc. All these processes are important for manufacturing, commercializing, and analyzing the performance of a drug. CROs are skilled at navigating intricate trial procedures, adhering to regulatory regulations, and implementing technologies to simplify trial operations, causing an elevation in demand for their services.

Contract Research Organization (CRO) Services Market Restraints and Challenges:

Regulatory guidelines, data security, misaligned incentives, and IP concerns are the main issues that the market is currently facing.

CROs need to adhere to strict rules and regulations. Negligence in any manner can affect the quality of the product, resulting in false results. Additionally, for a CRO to be eligible to provide services, they need to meet a large number of requirements that involve complex procedures, qualifications, and other paperwork. Secondly, there have been a few cases of data breaches and misuse. It is very essential to navigate the complexities associated with the protection of information. Handling this data can pose a lot of questions in people's minds, causing damage to the market. Thirdly, few of them concentrate on increasing their revenue. This can create low-quality designs, trials, and data analysis, affecting the research work. Additionally, they have less familiarity with and knowledge about the project, which can create faulty outcomes. Furthermore, not having good knowledge about intellectual property rights (IPR) can be a potential hindrance. If proper communication and documentation regarding ownership are not carried out, it can create misuse and fraud for both companies.

Contract Research Organization (CRO) Services Market Opportunities:

The concept of precision medicine has provided an ample number of possibilities for the industry. This involves tailoring the medicine to the genetic makeup of individuals. For this purpose, many elements are being designed that monitor the activity in cells and prepare medicine accordingly. CROs have been providing services related to this field to develop biomarkers, genomic tools, and other targeted therapies. Fields like artificial intelligence, machine learning, and data analytics have been helpful. By using these technologies, the data gathered can be enhanced, and meaningful insights can be gained. Apart from this, processes like gene and cell therapies have gained prominence. These techniques use cells and genes to prevent or cure a medical disorder. Gaining expertise in these fields can be beneficial to these organizations, helping to increase turnover.

CONTRACT RESEARCH ORGANIZATION (CRO) SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.58% |

|

Segments Covered |

By Service Type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

IQVIA Holdings, Inc., Laboratory Corporation of America Holdings (LabCorp), ICON plc, PPD, Inc. (Thermo Fisher Scientific), Charles River Laboratories International, Inc. (Bauch & Lomb), Syneos Health, Inc., Eurofins Scientific, WuXi AppTec, Medpace Holdings, Inc., Parexel International Corporation (a division of IQVIA) |

Contract Research Organization (CRO) Services Market Segmentation: By Service Type

-

Clinical Research Services

-

Phase 1

-

Phase 2

-

Phase 3

-

Phase 4

-

-

Early Phase Development Services

-

Pre-Clinical Services

-

Discovery Services

-

Chemistry, Manufacturing, and Control Services

-

Others

-

-

Laboratory Services

-

Consulting Services

-

Data Management Services

In 2023, based on service type, clinical research services are the largest category in this market. Improving patient outcomes and expanding medical knowledge both depend heavily on clinical research. It involves human participants and aids in the conversion of fundamental research into novel therapies and patient-beneficial knowledge. Developing information that enhances human health or broadens the understanding of human knowledge is the aim of clinical research. Early-phase developmental services are the fastest-growing category. Early-phase development services are critical for evaluating a drug's safety, effects, and possible indications of effectiveness. It is also necessary to comprehend the characteristics, safety, and POC of a novel medication.

Contract Research Organization (CRO) Services Market Segmentation: By Application

-

Oncology

-

CNS Disorder

-

Cardiology

-

Infectious Disease

-

Metabolic Disorder

-

Renal/Nephrology

-

Others

Based on application, in 2023, the oncology segment held the largest market share. The need for oncology drugs is on the rise because of the increasing incidence of heart diseases. A lot of companies in this market have been working on clinical trials for different oncology medications. This augments the need for CROs to carry out important activities that can be related to clinical trials, research, data analysis, etc. The CNS disorder category is one of the fastest-growing applications. This comprises diseases like Alzheimer's, Parkinson's, and dementia. Finding relevant medications for these conditions is pivotal to increasing the longevity rate. Many companies are investing heavily in R&D activities for this application, consequently raising the need for CROs in this area.

Contract Research Organization (CRO) Services Market Segmentation: By End-User

-

Pharmaceutical and Biotechnology Companies

-

Academic and Research Institutions

-

Medical Device Companies

-

Others

Based on end-users, pharmaceutical and biotechnology companies are the largest growers, with a share of over 49%. These organizations are involved in a lot of manufacturing activities. They even have funds to carry out many R&D activities. As such, they are involved in many clinical trials and collaborate with many CROs. There is an ongoing trend for outsourcing activities, especially in the pre-clinical phase of drug development and regulatory affairs. This again benefits these organizations. By employing these services for CROs, these companies can focus on bigger tasks and can also promote cost-efficient techniques. The category for medical device companies is growing at the fastest rate. CROs facilitate easier management, monitoring, and quality assurance of various medical devices. They also play a role in evaluating the economic value of the product by conducting assessments and cost-effectiveness studies.

Contract Research Organization (CRO) Services Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on region, in 2023, North America holds the highest market share with a rough share of 35%. Countries like the United States and Canada are at the top. This is mainly because of the key players that have a significant presence in the region. These companies have headquarters in North American countries, subsidiaries, and a strong global presence. A few of them include IQVIA Holdings Inc., Laboratory Corporation of America Holdings (LabCorp), ICON plc, and PPD, Inc. They have a well-established name in the industry, and people will trust their services. Hence, collaborations and partnerships become simpler. Besides, companies in this region invest in huge amounts due to the good stability of the economy. As such, R&D activities are carried out easily with the easy availability of infrastructure and other necessary resources. Asia-Pacific is the fastest-growing region, with countries like China, India, and South Korea at the forefront. This region holds an approximate share of 23%. The healthcare sector in Asian countries has witnessed numerous changes. Over the years, there has been a lot of development in improving access to these facilities due to progress in the economy. Companies like WuXi AppTec, QuintilesIMS, and Charles River Laboratories International, Inc. have had a notable presence in these areas. Outsourcing has increased drastically due to better funding and investments. Furthermore, the education of the technicians and other laborers is highly emphasized. This area has renowned expertise in these fields, contributing to a greater presence.

COVID-19 Impact Analysis on the Global Contract Research Organization (CRO) Services Market:

The outbreak of the virus had a positive impact on the market. There was an immediate need to develop a vaccine for the coronavirus to stop its prevention. Besides, healthcare necessities like PPE kits, drugs, masks, etc. were very vital. Pharmaceutical companies invest a lot in research and development activities. Governmental agencies and other business tycoons allotted many funds for the betterment of society. This led to many collaborations and partnerships with various CROs to develop the essentials. Services regarding regulatory affairs, clinical research, biostatistics, regulatory submission, pharmacovigilance, and many more were prioritized as they were crucial for vaccine development. This led to increased demand and, subsequently, greater income generation for this market. According to a report by outsourcingpharma.com, the budget for clinical development has increased continuously since the pandemic. Post-pandemic, the market has continued to grow owing to demand and technological advancements.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money improving their present technology to retain competitive pricing. Even more growth has resulted from this.

Digital technologies have accelerated the development of decentralized and hybrid clinical trial models, making it possible to collect electronic data, conduct virtual visits, and follow patients remotely. This pattern enhances the study procedures and increases patient involvement.

Key Players:

-

IQVIA Holdings, Inc.

-

Laboratory Corporation of America Holdings (LabCorp)

-

ICON plc

-

PPD, Inc. (Thermo Fisher Scientific)

-

Charles River Laboratories International, Inc. (Bauch & Lomb)

-

Syneos Health, Inc.

-

Eurofins Scientific

-

WuXi AppTec

-

Medpace Holdings, Inc.

-

Parexel International Corporation (a division of IQVIA)

In July 2023, as the first life sciences technology provider of Salesforce-based solutions in China, IQVIA teamed up with Alibaba Cloud. Through the cooperation, IQVIA aimed to provide goods that adhered to China's requirements regarding data protection and residency.

In May 2023, leading international life sciences business Labcorp established a strategic partnership with Jefferson Health (Jefferson), the biggest health system in the Southern New Jersey and Greater Philadelphia regions. Through the new strategic partnership, Labcorp's broad network of patient service centers, sophisticated data and digital technologies, and premier clinical laboratory services will provide efficient and complete laboratory components of healthcare to the communities serviced by Jefferson.

In March 2023, global leader in medical dermatology LEO Pharma and ICON plc announced a strategic alliance that will help LEO Pharma achieve its goal of becoming one of the industry's most successful and efficient clinical portfolio execution organizations by enabling patient-centric, cost-effective clinical trial execution at scale. The partnership's goal is to make dermatology patients' lives better by providing them with access to cutting-edge clinical trials and the introduction of new medications.

Chapter 1. Contract Research Organization (CRO) Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Contract Research Organization (CRO) Services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Contract Research Organization (CRO) Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Contract Research Organization (CRO) Services Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Contract Research Organization (CRO) Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Contract Research Organization (CRO) Services Market – By Service Type

6.1 Introduction/Key Findings

6.2 Clinical Research Services

6.3 Phase 1

6.4 Phase 2

6.5 Phase 3

6.6 Phase 4

6.7 Early Phase Development Services

6.8 Pre-Clinical Services

6.9 Discovery Services

6.10 Chemistry, Manufacturing, and Control Services

6.11 Others

6.12 Laboratory Services

6.13 Consulting Services

6.14 Data Management Services

6.15 Y-O-Y Growth trend Analysis By Service Type

6.16 Absolute $ Opportunity Analysis By Service Type, 2024-2030

Chapter 7. Contract Research Organization (CRO) Services Market – By Application

7.1 Introduction/Key Findings

7.2 Oncology

7.3 CNS Disorder

7.4 Cardiology

7.5 Infectious Disease

7.6 Metabolic Disorder

7.7 Renal/Nephrology

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Contract Research Organization (CRO) Services Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Pharmaceutical and Biotechnology Companies

8.3 Academic and Research Institutions

8.4 Medical Device Companies

8.5 Others

8.6 Y-O-Y Growth trend Analysis By End-Use Industry

8.7 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 9. Contract Research Organization (CRO) Services Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Service Type

9.1.3 By Application

9.1.4 By End-Use Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Service Type

9.2.3 By Application

9.2.4 By End-Use Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Service Type

9.3.3 By Application

9.3.4 By End-Use Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Service Type

9.4.3 By Application

9.4.4 By End-Use Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Service Type

9.5.3 By Application

9.5.4 By End-Use Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Contract Research Organization (CRO) Services Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

10.1 IQVIA Holdings, Inc.

10.2 Laboratory Corporation of America Holdings (LabCorp)

10.3 ICON plc

10.4 PPD, Inc. (Thermo Fisher Scientific)

10.5 Charles River Laboratories International, Inc. (Bauch & Lomb)

10.6 Syneos Health, Inc.

10.7 Eurofins Scientific

10.8 WuXi AppTec

10.9 Medpace Holdings, Inc.

10.10 Parexel International Corporation (a division of IQVIA)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Contract Research Organization (CRO) Services Market was valued at USD 77 billion and is projected to reach a market size of USD 155.68 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 10.58%.

An increase in outsourcing and a rising number of chronic diseases are the main factors propelling the Global Contract Research Organization (CRO) Services Market.

Based on Application, the Global Contract Research Organization (CRO) Services Market is segmented into Oncology, CNS Disorder, Cardiology, Infectious Disease, Metabolic Disorder, Renal/Nephrology, and Others.

North America is the most dominant region for the Global Contract Research Organization (CRO) Services Market.

IQVIA Holdings Inc., Laboratory Corporation of America Holdings (LabCorp), and ICON plc are the key players operating in the Global Contract Research Organization (CRO) Services Market.