Continuous Integration Tools Market Size (2025 – 2030)

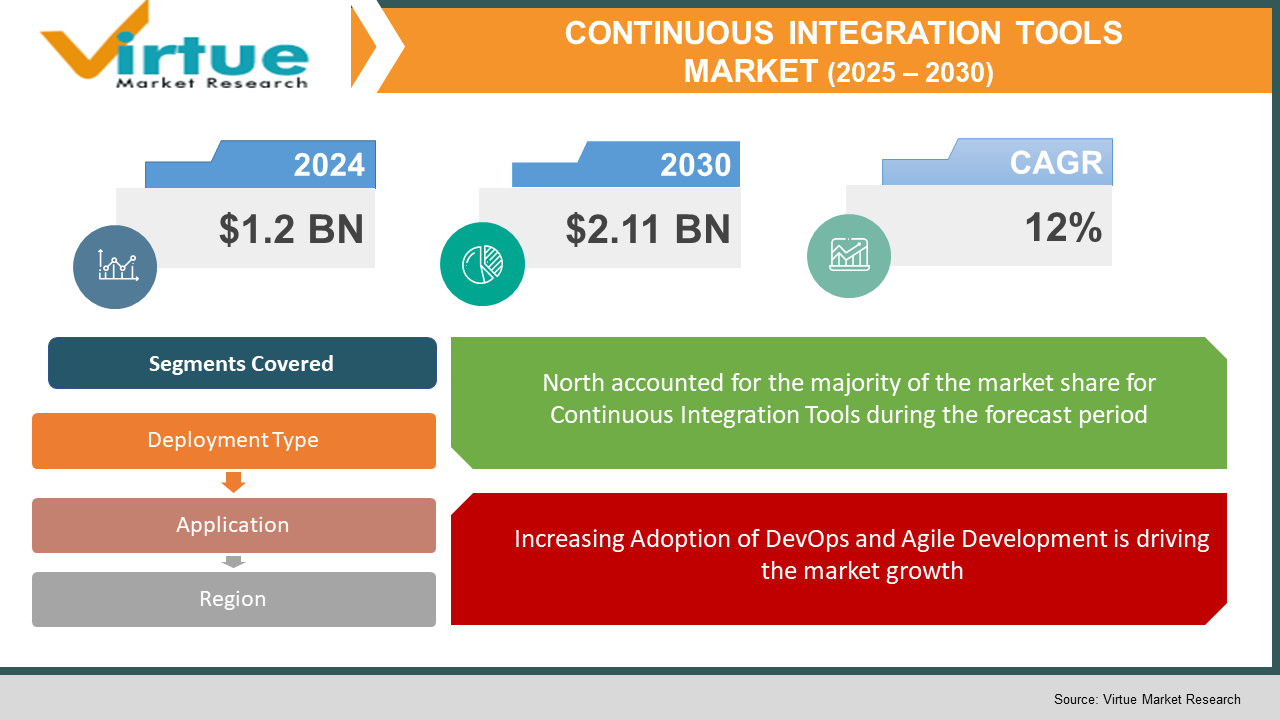

The Global Continuous Integration Tools Market was valued at USD 1.2 billion in 2024 and will grow at a CAGR of 12% from 2025 to 2030. The market is expected to reach USD 2.11 billion by 2030.

The Continuous Integration Tools Market focuses on software development tools that automate the integration process of code changes into a shared repository. These tools help developers identify bugs early, streamline software delivery, and enhance collaboration among development teams. The growing adoption of DevOps practices, increasing demand for automation in software development, and rising emphasis on faster release cycles are key factors driving market growth. Cloud-based solutions are expected to gain significant traction due to their scalability and flexibility.

Key Market Insights:

- The rising adoption of DevOps and Agile methodologies in software development is a major driver, with over 70% of IT companies implementing these practices.

- Cloud-based continuous integration tools are expected to grow at a CAGR of 14% due to the increasing preference for remote development and deployment solutions.

- North America dominates the market, accounting for over 40% of the global revenue, driven by the presence of major software enterprises and advanced IT infrastructure.

- The on-premises segment holds a steady market share of around 35%, particularly among large enterprises with strict data security requirements.

- The demand for AI-driven automation in software testing and integration is increasing, with AI-based continuous integration solutions expected to grow by 15% annually.

- Open-source continuous integration tools like Jenkins and GitLab CI/CD are widely adopted, with Jenkins holding over 40% of the market share.

- The software development industry is projected to spend over USD 5 billion on DevOps tools by 2030, further boosting the market growth of continuous integration tools.

- Emerging markets in Asia-Pacific are witnessing rapid growth, with China and India showing a CAGR of over 13% due to expanding IT industries.

Global Continuous Integration Tools Market Drivers:

Increasing Adoption of DevOps and Agile Development is driving the market growth

The widespread adoption of DevOps and Agile methodologies in software development is one of the primary drivers of the continuous integration tools market. Organizations are shifting from traditional waterfall models to Agile workflows, requiring automated integration tools to manage frequent code changes. DevOps enables faster software deployment, reducing time-to-market and enhancing collaboration between development and operations teams. Continuous integration tools play a crucial role in maintaining code quality and detecting issues early in the development lifecycle. Companies investing in DevOps see a 60% reduction in deployment failures and a 40% increase in overall productivity. With over 85% of IT enterprises adopting DevOps by 2030, the demand for robust continuous integration solutions is set to grow significantly.

Growth in Cloud-Based Development and Deployment is driving the market growth

Cloud-based continuous integration tools are becoming increasingly popular as businesses transition to cloud computing environments. Cloud-based solutions provide scalability, accessibility, and reduced infrastructure costs compared to on-premises alternatives. As companies shift towards microservices architectures and containerized applications, cloud-based CI/CD tools ensure seamless deployment and integration. The global cloud computing market is projected to reach USD 1 trillion by 2030, with continuous integration tools playing a critical role in cloud-native development. The growing adoption of cloud services by small and medium enterprises (SMEs) further fuels market growth, as they prefer cost-effective, flexible, and automated development solutions.

Rising Demand for Automation in Software Development is driving the market growth

Automation is a key factor driving the growth of the continuous integration tools market, as businesses seek to streamline software development and deployment processes. Automated integration reduces human errors, improves code quality, and accelerates release cycles. AI and machine learning are increasingly being integrated into CI/CD pipelines, enabling predictive analytics, automated testing, and intelligent error detection. By 2030, AI-powered DevOps tools are expected to account for 20% of the market, significantly enhancing efficiency in software development. Companies adopting automation see a 35% improvement in developer productivity and a 50% reduction in software release failures.

Global Continuous Integration Tools Market Challenges and Restraints:

Security Concerns in CI/CD Pipelines is restricting the market growth

One of the biggest challenges in the continuous integration tools market is security. As CI/CD pipelines automate code deployment, they become attractive targets for cyberattacks. Weak security practices can expose sensitive data, introduce vulnerabilities into production environments, and compromise software integrity. Open-source CI/CD tools are particularly vulnerable to supply chain attacks, where malicious code is injected into third-party dependencies. In 2023, over 30% of DevOps teams reported security breaches due to misconfigured pipelines. Organizations must implement robust security measures, including automated vulnerability scanning, role-based access control, and continuous monitoring, to mitigate these risks.

Complex Implementation and Integration Issues is restricting the market growth

Despite the advantages of continuous integration tools, their implementation can be complex, especially for enterprises with legacy systems. Organizations often face challenges in integrating CI/CD tools with existing development workflows, databases, and third-party applications. Customization requirements, compatibility issues, and a lack of skilled professionals further complicate adoption. Many companies struggle with configuring CI/CD pipelines, leading to inefficiencies and increased deployment failures. Addressing these challenges requires proper training, strategic planning, and investment in user-friendly solutions that simplify integration processes.

Market Opportunities:

The continuous integration tools market presents significant growth opportunities due to the increasing demand for DevOps automation, cloud-native development, and AI-powered integration solutions. The expansion of IT infrastructure in emerging markets such as Asia-Pacific and Latin America opens new revenue streams for CI/CD tool providers. The rise of containerization and Kubernetes-based deployments is driving the need for CI/CD tools that support seamless orchestration and management. Additionally, industries beyond traditional software development, including fintech, healthcare, and telecommunications, are adopting CI/CD practices to enhance digital transformation. As businesses prioritize faster software releases and improved code quality, investment in advanced continuous integration tools is expected to grow substantially over the forecast period.

CONTINUOUS INTEGRATION TOOLS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

12% |

|

Segments Covered |

By deployment Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Jenkins, GitLab, Atlassian, CircleCI, Travis CI, and AWS CodePipeline. |

Continuous Integration Tools Market Segmentation:

Continuous Integration Tools Market Segmentation By Deployment Type:

- Cloud-based

- On-premises

The cloud-based segment dominates the market due to its flexibility, cost-effectiveness, and scalability. Cloud-based continuous integration tools are widely adopted by enterprises embracing remote development and microservices architectures. With increasing investments in cloud computing, this segment is expected to maintain its lead with a CAGR of 14%.

Continuous Integration Tools Market Segmentation By Application:

- Large Enterprises

- SMEs

Large enterprises dominate the market due to their extensive DevOps implementation and need for robust CI/CD pipelines. With a focus on automation, security, and high-performance software development, large organizations account for over 60% of the market share. However, SMEs are witnessing rapid adoption due to cost-effective cloud-based solutions.

Continuous Integration Tools Market Regional Segmentation:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is the dominant region in the continuous integration tools market, accounting for over 40% of global revenue. The region's leadership is driven by advanced IT infrastructure, high adoption of DevOps practices, and the presence of major CI/CD tool providers like GitLab, Atlassian, and CircleCI. The U.S. leads the market with a strong emphasis on cloud-based software development and enterprise automation. Investments in AI-driven DevOps solutions further boost regional growth.

COVID-19 Impact Analysis on the Continuous Integration Tools Market:

The COVID-19 pandemic acted as a catalyst for unprecedented digital transformation, profoundly impacting the adoption and evolution of DevOps practices and continuous integration (CI) tools. The abrupt shift to remote work environments necessitated a rapid transition to cloud-based development, significantly amplifying the demand for automation and collaboration tools that facilitated seamless remote workflows. This surge in remote work highlighted the critical need for robust software security, scalability, and resilience, as companies scrambled to support distributed teams and maintain operational continuity. In response, organizations prioritized investments in CI/CD solutions to enhance software quality and accelerate deployment cycles, recognizing the pivotal role of agile development practices in navigating the dynamic and unpredictable landscape. The pandemic underscored the importance of rapid iteration and adaptability, prompting companies to embrace CI/CD pipelines to streamline the software delivery process and respond swiftly to evolving market demands. While initial disruptions caused temporary fluctuations in IT budgets, the long-term trajectory of CI/CD adoption remained strong, fueled by the accelerating shift toward cloud-native applications and digital-first business strategies. The necessity for business continuity and digital customer engagement during lockdowns and social distancing measures forced companies to accelerate their digital transformation roadmaps, solidifying CI/CD as a crucial component of their technology infrastructure. Furthermore, the increased reliance on digital services and online platforms during the pandemic underscored the importance of software reliability and performance, driving companies to invest in CI/CD solutions that ensured continuous delivery and minimized downtime. The pandemic effectively accelerated the digital maturity of businesses across various industries, cementing the importance of CI/CD tools in enabling agility, resilience, and rapid innovation in the face of unprecedented challenges.

Latest Trends/Developments:

The continuous integration (CI) tools market is undergoing a significant transformation driven by a confluence of emerging technologies and evolving software development practices. A prominent trend is the integration of artificial intelligence (AI) to automate CI/CD pipelines, leveraging machine learning to predict build failures, optimize test suites, and enhance deployment efficiency. This AI-driven automation significantly reduces manual intervention, accelerating software delivery cycles and improving overall reliability. Simultaneously, the increased adoption of serverless computing architectures is reshaping CI/CD workflows, enabling developers to build and deploy applications without managing underlying infrastructure. Serverless CI/CD solutions are gaining traction due to their scalability, cost-effectiveness, and ability to handle dynamic workloads. Furthermore, GitOps-based deployment strategies, which utilize Git as the single source of truth for infrastructure and application configurations, are becoming increasingly popular for their declarative approach to managing deployments and enhancing consistency. The rise of low-code/no-code development platforms is also impacting the CI/CD landscape, as these platforms are integrating CI/CD pipelines to simplify software delivery for citizen developers and accelerate the time-to-market for applications. In containerized environments, Kubernetes-native CI/CD solutions are gaining popularity, providing seamless integration with container orchestration platforms and enabling efficient management of containerized applications. Security is paramount in modern software development, leading to the integration of DevSecOps practices into CI/CD workflows. This involves incorporating security testing and vulnerability detection tools into the pipeline to ensure compliance and mitigate risks throughout the software development lifecycle. Looking ahead, emerging technologies like blockchain are being explored for software integrity verification, providing a secure and transparent way to track changes and ensure the authenticity of software artifacts. Additionally, the proliferation of edge computing is driving the development of real-time CI/CD implementations, enabling faster deployments and updates in distributed environments. These trends collectively indicate a dynamic and rapidly evolving CI tools market, characterized by automation, security, and the integration of cutting-edge technologies to streamline software delivery and enhance overall development efficiency.

Key Players:

- Jenkins

- GitLab

- Atlassian (Bitbucket Pipelines)

- CircleCI

- Travis CI

- TeamCity

- Bamboo

- Azure DevOps

- AWS CodePipeline

- Google Cloud Build

Chapter 1. CONTINUOUS INTEGRATION TOOLS MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. CONTINUOUS INTEGRATION TOOLS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. CONTINUOUS INTEGRATION TOOLS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. CONTINUOUS INTEGRATION TOOLS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. CONTINUOUS INTEGRATION TOOLS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. CONTINUOUS INTEGRATION TOOLS MARKET – By Deployment Type

6.1 Introduction/Key Findings

6.2 Cloud-based

6.3 On-premises

6.4 Y-O-Y Growth trend Analysis By Deployment Type

6.5 Absolute $ Opportunity Analysis By Deployment Type , 2025-2030

Chapter 7. CONTINUOUS INTEGRATION TOOLS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Large Enterprises

7.3 SMEs

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. CONTINUOUS INTEGRATION TOOLS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Deployment Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Deployment Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Deployment Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Deployment Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Deployment Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. CONTINUOUS INTEGRATION TOOLS MARKET – Company Profiles – (Overview, Packaging Product Portfolio, Financials, Strategies & Developments)

9.1 Jenkins

9.2 GitLab

9.3 Atlassian (Bitbucket Pipelines)

9.4 CircleCI

9.5 Travis CI

9.6 TeamCity

9.7 Bamboo

9.8 Azure DevOps

9.9 AWS CodePipeline

9.10 Google Cloud Build

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 1.2 billion in 2024 and is expected to reach USD 2.11 billion by 2030, growing at a CAGR of 12%.

Key drivers include the adoption of DevOps and Agile methodologies, growth in cloud-based development, and increasing demand for automation in software development.

The market is segmented by product (Cloud-based, On-premises) and application (Large Enterprises, SMEs).

North America is the dominant region, accounting for over 40% of global revenue due to advanced IT infrastructure and widespread DevOps adoption.

Key players include Jenkins, GitLab, Atlassian, CircleCI, Travis CI, and AWS CodePipeline.