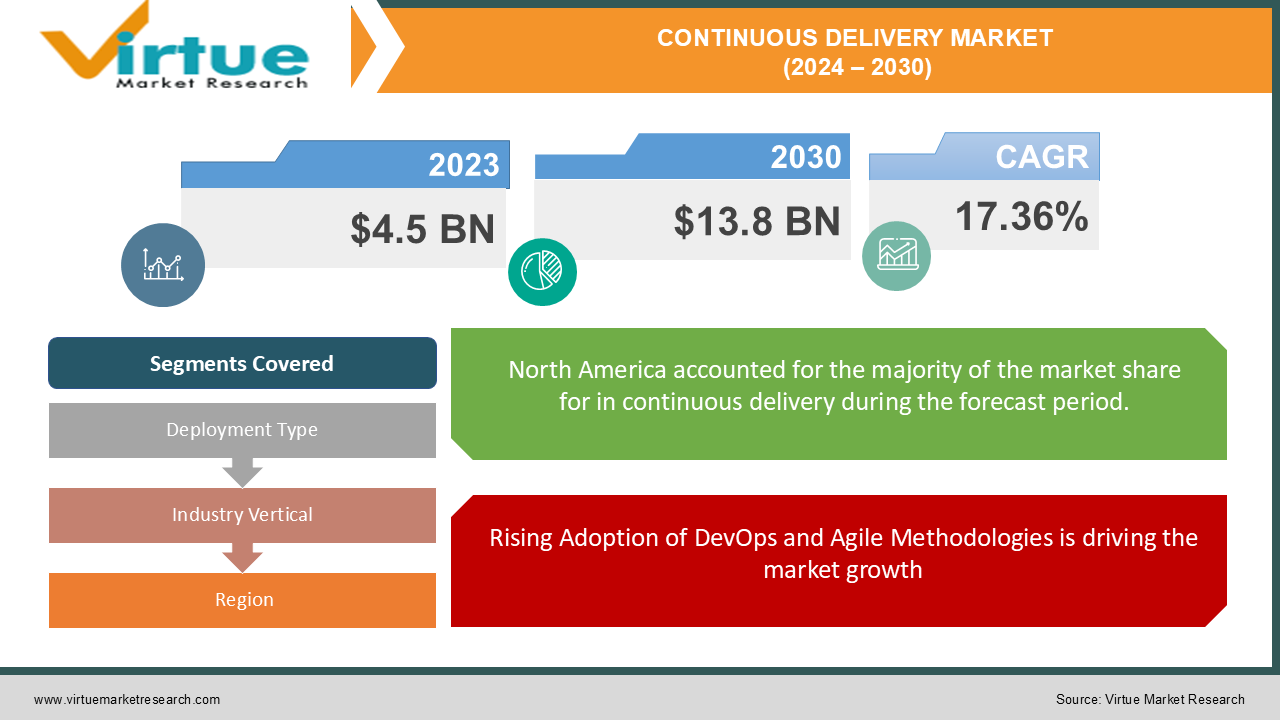

Continuous Delivery Market Size (2024–2030)

The Global Continuous Delivery Market was valued at USD 4.5 billion in 2023 and is projected to grow at a CAGR of 17.36% from 2024 to 2030, reaching a market value of USD 13.8 billion by 2030.

Continuous delivery (CD) is a software development practice where code changes are automatically built, tested, and prepared for a production release. This approach significantly accelerates the software delivery process while ensuring the release of high-quality software. As organizations continue to embrace DevOps and agile methodologies, the demand for continuous delivery solutions is increasing across various sectors. The BFSI, IT & Telecom, Retail, and Healthcare sectors are among the leading adopters of CD practices to enhance productivity, improve software quality, and accelerate time-to-market. With growing digital transformation initiatives, organizations worldwide are leveraging continuous delivery to stay competitive, respond to market demands, and enhance customer experiences.

Key Market Insights:

The cloud deployment model dominates the global continuous delivery market, accounting for 65% of the market share in 2023. The flexibility, scalability, and cost-effectiveness of cloud-based solutions are driving their adoption across various industries.

BFSI is the leading industry vertical, contributing 30% of the total market revenue in 2023. Financial institutions are increasingly adopting continuous delivery to automate software development pipelines, enhance security, and ensure faster deployment of applications.

The retail sector is expected to witness the highest growth, with a projected CAGR of 20% from 2024 to 2030. Retailers are leveraging continuous delivery to accelerate the development and deployment of e-commerce platforms, mobile apps, and customer-centric software solutions.

North America holds the largest market share, accounting for over 40% of the global continuous delivery market in 2023, driven by the early adoption of DevOps practices and advanced software development technologies in the region.

The increasing adoption of microservices architecture and containerization is enabling continuous delivery solutions to integrate seamlessly with development environments, promoting faster and more efficient software releases.

Global Continuous Delivery Market Drivers:

Rising Adoption of DevOps and Agile Methodologies is driving the market growth The increasing adoption of DevOps and agile development practices is a key driver of the global continuous delivery market. DevOps aims to automate and integrate the processes of software development (Dev) and IT operations (Ops), enabling organizations to shorten development cycles, improve collaboration, and deliver high-quality software at a faster pace. Continuous delivery is a fundamental aspect of DevOps, allowing developers to automatically build, test, and deploy code changes more frequently and reliably. By automating the entire software release process, continuous delivery enables development teams to deliver new features, updates, and bug fixes to users more frequently, without the delays and manual intervention traditionally associated with software releases. This capability is particularly important in industries like BFSI, healthcare, and retail, where the ability to rapidly respond to market changes and customer needs is critical for maintaining a competitive edge.

Demand for Faster Time-to-Market and Improved Software Quality is driving the market growth The demand for faster time-to-market is another significant factor driving the growth of the continuous delivery market. In today’s highly competitive business environment, organizations must constantly innovate and deliver new features, products, and services to stay ahead of the competition. Continuous delivery enables organizations to automate the software release process, reducing the time it takes to deliver new updates and features to users. By integrating continuous delivery into their software development pipelines, companies can accelerate the delivery of software while ensuring high levels of quality and security. Automated testing, which is a key component of continuous delivery, ensures that code changes are thoroughly tested before being deployed to production, reducing the likelihood of errors and downtime. This is particularly important in industries like healthcare, BFSI, and IT & telecom, where software reliability is critical for operations and customer satisfaction.

Digital Transformation and Cloud Adoption are driving the market growth: The increasing focus on digital transformation across industries is a major driver of the continuous delivery market. Organizations are investing heavily in digital technologies to modernize their operations, improve customer experiences, and stay competitive in the digital economy. Continuous delivery plays a crucial role in these digital transformation initiatives by enabling organizations to automate and streamline their software development processes. The widespread adoption of cloud computing is also fueling the growth of the continuous delivery market. Cloud platforms provide the infrastructure and tools necessary to implement continuous delivery at scale, allowing organizations to build, test, and deploy software in a more agile and efficient manner. Cloud-based continuous delivery solutions offer several advantages, including the ability to scale resources up or down based on demand, reduce infrastructure costs, and improve collaboration between distributed development teams.

Global Continuous Delivery Market Challenges and Restraints:

Complexity of Implementation and Integration is restricting the market growth One of the primary challenges facing the global continuous delivery market is the complexity of implementing and integrating continuous delivery solutions within existing software development processes. While continuous delivery offers significant benefits in terms of automation and efficiency, many organizations struggle to adopt these practices due to the technical complexity involved. Implementing continuous delivery requires significant changes to an organization’s software development lifecycle (SDLC), including the automation of build, test, and deployment processes. This often involves the integration of various tools and technologies, such as version control systems, automated testing frameworks, containerization platforms, and continuous integration (CI) pipelines. For organizations with legacy systems or monolithic architectures, transitioning to continuous delivery can be a time-consuming and resource-intensive process.

Security and Compliance Concerns are restricting the market growth: Security and compliance are critical considerations for organizations adopting continuous delivery, particularly in highly regulated industries such as BFSI, healthcare, and government. Continuous delivery pipelines introduce new security challenges, as automated processes may inadvertently expose vulnerabilities in the code or infrastructure. Continuous delivery relies on the automation of code deployment, which can increase the risk of security breaches if not properly secured. For example, automated deployment pipelines may inadvertently deploy code that contains security vulnerabilities, leading to data breaches or service disruptions. Additionally, the use of third-party tools and cloud-based platforms in continuous delivery pipelines introduces potential security risks, as these tools may have vulnerabilities that could be exploited by malicious actors.

Market Opportunities:

The global continuous delivery market is expected to experience significant growth opportunities due to the increasing demand for automation and digital transformation across various industries. One of the key opportunities lies in the growing adoption of DevOps and agile methodologies. As organizations strive to accelerate their software development processes and improve collaboration between development and operations teams, the adoption of continuous delivery is becoming more widespread. Continuous delivery enables organizations to automate their software release processes, allowing for faster and more frequent deployments of high-quality software. The increasing adoption of cloud computing and microservices architecture also presents a major growth opportunity for the continuous delivery market. Cloud platforms provide the necessary infrastructure to implement continuous delivery at scale, allowing organizations to build, test, and deploy software more efficiently. The shift towards microservices, where applications are developed as loosely coupled services, further enhances the need for continuous delivery solutions to manage and deploy these services independently. Another significant opportunity lies in the healthcare and BFSI sectors, where continuous delivery is being used to enhance the security and efficiency of software development pipelines. In the healthcare industry, for example, continuous delivery enables organizations to automate the testing and deployment of healthcare applications, reducing the risk of errors and ensuring compliance with regulatory standards. In the BFSI sector, continuous delivery helps financial institutions to deploy updates more frequently and securely, improving the customer experience while maintaining compliance with stringent security regulations.

CONTINUOUS DELIVERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.36% |

|

Segments Covered |

By Deployment Type, Industry Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Microsoft Corporation, IBM Corporation, Amazon Web Services, Inc., Atlassian Corporation Plc, Red Hat, Inc., GitLab Inc., CircleCI, Jenkins, Puppet Labs, Inc., CloudBees, Inc. |

Continuous Delivery Market Segmentation: By Deployment Type

-

On-Premises

-

Cloud

The cloud deployment model dominates the global continuous delivery market, accounting for 65% of the market share in 2023. Cloud-based continuous delivery solutions offer greater flexibility, scalability, and cost-efficiency, making them the preferred choice for organizations looking to streamline their software development processes.

Continuous Delivery Market Segmentation: By Industry Vertical

-

BFSI

-

IT & Telecom

-

Retail

-

Healthcare

-

Manufacturing

-

Others

The BFSI sector is the largest adopter of continuous delivery solutions, contributing 30% of the total market revenue in 2023. Financial institutions are increasingly leveraging continuous delivery to automate their software development pipelines, enhance security, and ensure the rapid deployment of applications and updates.

Continuous Delivery Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America holds the largest market share, accounting for over 40% of the global continuous delivery market in 2023. The region’s dominance is driven by the early adoption of DevOps practices, advanced software development tools, and a strong focus on automation in industries such as BFSI, IT & Telecom, and retail. The presence of key market players, coupled with a robust IT infrastructure, has further solidified North America’s leadership position in the continuous delivery market.

COVID-19 Impact Analysis:

The COVID-19 pandemic significantly accelerated the adoption of continuous delivery solutions across various industries. With the sudden shift to remote work, organizations faced the challenge of maintaining efficient software development processes while ensuring seamless collaboration between distributed teams. Continuous delivery, which enables the automation of software release pipelines, played a crucial role in helping organizations overcome these challenges. During the pandemic, industries such as IT & Telecom, healthcare, and retail witnessed a surge in the demand for digital services and applications. Continuous delivery allows organizations to rapidly deploy new features and updates to meet the evolving needs of their customers. For example, healthcare providers leveraged continuous delivery to deploy telehealth platforms and patient management systems, while retailers used it to enhance their e-commerce platforms and mobile applications. Moreover, the pandemic highlighted the importance of agile development practices and DevOps in maintaining business continuity. As organizations sought to accelerate their digital transformation efforts, continuous delivery became a key enabler of faster and more reliable software releases. In the post-pandemic era, the adoption of continuous delivery is expected to continue growing as organizations prioritize automation and digital innovation to remain competitive in the market.

Latest Trends/Developments:

Several key trends are shaping the future of the global continuous delivery market. One of the most notable trends is the increasing adoption of cloud-native technologies, such as Kubernetes and Docker, which are enabling organizations to implement continuous delivery pipelines more efficiently. Cloud-native architectures allow for greater flexibility and scalability, making it easier for organizations to manage and deploy software in distributed environments. Another important trend is the growing focus on security and compliance in continuous delivery pipelines. As organizations automate their software development processes, ensuring the security of the code and infrastructure becomes paramount. Continuous delivery solutions are being enhanced with security features, such as automated vulnerability scanning and secure code deployment, to address the growing concerns around cybersecurity and regulatory compliance. The integration of AI and machine learning into continuous delivery pipelines is also gaining traction. AI-driven tools are being used to automate testing, identify potential issues in the code, and optimize deployment processes. This trend is expected to further enhance the efficiency and reliability of continuous delivery solutions, enabling organizations to deliver high-quality software at a faster pace. Additionally, the rise of DevSecOps, which integrates security practices into the DevOps pipeline, is becoming a critical focus for organizations. Continuous delivery solutions are evolving to incorporate security checks and compliance measures at every stage of the software development lifecycle, ensuring that security is not compromised in the pursuit of faster software releases.

Key Players:

-

Microsoft Corporation

-

IBM Corporation

-

Amazon Web Services, Inc.

-

Atlassian Corporation Plc

-

Red Hat, Inc.

-

GitLab Inc.

-

CircleCI

-

Jenkins

-

Puppet Labs, Inc.

-

CloudBees, Inc.

Chapter 1. Continuous Delivery Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Continuous Delivery Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Continuous Delivery Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Continuous Delivery Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Continuous Delivery Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Continuous Delivery Market – By Deployment Type

6.1 Introduction/Key Findings

6.2 On-Premises

6.3 Cloud

6.4 Y-O-Y Growth trend Analysis By Deployment Type

6.5 Absolute $ Opportunity Analysis By Deployment Type, 2024-2030

Chapter 7. Continuous Delivery Market – By Industry Vertical

7.1 Introduction/Key Findings

7.2 BFSI

7.3 IT & Telecom

7.4 Retail

7.5 Healthcare

7.6 Manufacturing

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Industry Vertical

7.9 Absolute $ Opportunity Analysis By Industry Vertical, 2024-2030

Chapter 8. Continuous Delivery Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Deployment Type

8.1.3 By Industry Vertical

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Deployment Type

8.2.3 By Industry Vertical

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Deployment Type

8.3.3 By Industry Vertical

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Deployment Type

8.4.3 By Industry Vertical

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Deployment Type

8.5.3 By Industry Vertical

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Continuous Delivery Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Microsoft Corporation

9.2 IBM Corporation

9.3 Amazon Web Services, Inc.

9.4 Atlassian Corporation Plc

9.5 Red Hat, Inc.

9.6 GitLab Inc.

9.7 CircleCI

9.8 Jenkins

9.9 Puppet Labs, Inc.

9.10 CloudBees, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Continuous Delivery Market was valued at USD 4.5 billion in 2023 and is projected to reach USD 13.8 billion by 2030, growing at a CAGR of 17.36%.

The key drivers include the adoption of DevOps and agile methodologies, the demand for faster time-to-market, and the increasing focus on digital transformation and cloud adoption.

The market is segmented by deployment type (on-premises, cloud) and industry vertical (BFSI, IT & Telecom, retail, healthcare, manufacturing, and others).

North America is the dominant region, holding over 40% of the market share in 2023, driven by early adoption of DevOps practices and cloud-based solutions.

Leading players include Microsoft Corporation, IBM Corporation, Amazon Web Services, Atlassian Corporation Plc, Red Hat, GitLab, and CircleCI.