Global Contactless Payments Market Size (2023-2030)

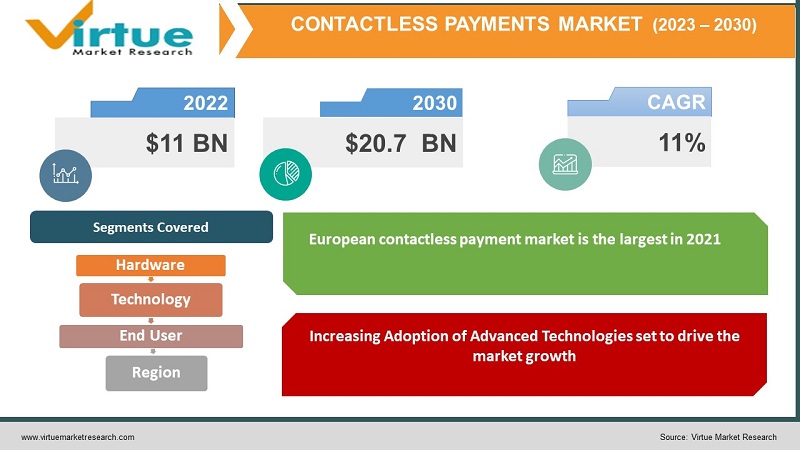

In 2022, the global contactless payment market size is worth $11 billion. The market is projected to reach a value of $ 20.7 billion by 2030, growing at a CAGR of 11% between 2023 and 2030. Contactless payments have increased as a result of the proliferation of affordable mobile devices and the growth of internet connectivity, which has also transformed traditional banking processes completely.

Industry Overview:

In Contactless Payment, consumers can use their debit or credit cards with RFID technology—also known as chip cards—or other payment devices to pay for products and services without having to swipe, enter a personal identification number (PIN), or sign for a transaction. It can be also done using NFC technology. NFC transactions use a specific radio frequency to allow a card or smartphone to connect with a payment scanner when they're close enough. Consumers currently have several transaction choices to select from, compared to a few decades ago: digital wallets, UPI, net banking, QR code scanning, contactless payment cards, and so on are making contactless payments much easier.

COVID-19 impact on the Contactless Payment Market

The COVID-19 pandemic is predicted to have a positive impact on the market. Users and businesses are adjusting their payment habits as a result of the COVID-19 epidemic since the World Health Organization (WHO) has advised customers to avoid handling cash and instead use contactless payments. As a consequence, this is poised to generate growth prospects for the contactless payments market. However, in today's atmosphere, contactless payments have risen to the forefront of all-things-payments.

The Reserve Bank of India's November 2018 directive to replace all magnetic stripe-only cards with EMV chip cards by December 31, 2018, sent the appropriate message to consumers and companies about the banking regulator's intention to protect digital payment modalities. The COVID-19 pandemic has prompted merchants all around the world to resort to technology to help them boost efficiency, plan better, and better serve their consumers. As a result, the retail industry is projected to see increased demand for contactless payment systems.

Market Drivers:

COVID-19 Pandemic is poised to drive the contactless payment demand :

The emergence of the coronavirus (Covid-19) pandemic has increased the demand for contactless payment solutions that need minimal physical interactions, which is also driving market expansion. Contactless payment has made the payment process safe and secure making it the most reliable method of payment, thus boosting its market demand.

Rising Acceptance by Merchants to Boost Market Growth:

Contactless payments have provided an easy, convenient, and safe way to pay for customers and to accept payments for merchants. Retailers are also seeing the advantages of contactless payments, such as faster transactions, more revenue, higher operational efficiency, and lower operating costs which in turn is driving the market growth. Consumers favor merchants who offer digital, contactless payment methods, according to 57% of respondents. Consumers are seeking contactless payments at a higher rate than before, according to six out of ten merchants.

Increasing Adoption of Advanced Technologies set to drive the market growth:

Early adoption of sophisticated technology among end-users and an increase in government initiatives to drive the use of wearable and contactless payment are contributing to the growth of the contactless payment market around the globe.

Market Restraints:

Concerns of Payment Security impeding market growth:

The adoption of contactless payment has been hampered by a lack of trust caused by concerns about security, data theft, and misuse of contactless payment methods by people who aren't authorized.

High deployment Cost is dragging the rise of the Contactless Payments Market:

When a PIN is not used, contactless transactions are considerably more expensive because they are often processed across networks like Visa and MasterCard. Merchants pay the same 2.5 percent cost for contactless transactions as they do for credit card purchases, and the fee rises to 2.8 percent if the card is used online or over the phone.

Market Insights And Developments

- Mobeewave and IDEMIA joined forces in October 2019 to combine secure mobile POS and fare validation.

- Worldline and Ingenico Group merged in 2020. With pro forma revenues of USD 5.3 billion in 2019, Worldline is one of the top European payment service providers.

- Mastercard teamed up with MatchMove, a Singapore-based Banking-as-a-Service provider, and Tappy Technologies, a world-leading wearable payment integrator, in December 2020.

- Apple has added Mobeewave's technology to its portfolio, which transforms a smartphone into a point-of-sale terminal. In October 2019, Samsung approached Mobeewave for a partnership.

CONTACTLESS PAYMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

11% |

|

Segments Covered |

By Hardware, Technology, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ingenico Group, Verifone Systems, Inc., Inside Secure, Proxama PLC., Wirecard AG, Giesecke & Devrient GmbH, Heartland Payment Systems, Inc., Mobeewave , Paycare, Infineon |

Market Segments

This research report on the global cashless payment market has been segmented based on hardware, technology, and end-user.

Cashless Payments Market- By Hardware

- Smart Cards

- Smartphones and Wearables

- Point of Sales Terminals

In 2020, the smartphone and wearable sector dominated the contactless payment market, and this trend is poised to continue throughout the forecast period. The rise in smartphone and wearable device use among the youth of various countries is propelling the market in this category forward. In 2020, 92.3 million Americans aged 14 and above used smartphones for payments at least once in six months, it is estimated to rise to 101.2 million in 2021. Smartphone usage for contactless payment will reach 50% of all smartphone users by 2025.

A point-of-sale (POS) system is a mix of hardware and software that allows you to receive and process various types of digital payments. The software handles the remaining payment methods, processing, and other peripheral value-added services, while the hardware comprises a card acceptance machine.

Cashless Payments Market- By Technology

- RFID (Radio Frequency Identification)

- NFC (Near-field communication)

- IR (Infrared)

- Others

The radio waves from the NFC chip create a connection and exchange encrypted data, allowing for quick and secure transactions. To make a payment or perform a transaction, a card or smartphone equipped with NFC can be held within 10 cm of the scanner. 2 Billion NFC-enabled devices in the world across the major mobile operating system. NFC market is poised to grow 17.9% over the next decade. The NFC market is estimated to be worth $49.5 Billion by 2025.

Radiofrequency identification (RFID) or near-field communication (NFC) technology are used to enable contactless transactions. When you make a purchase, these radio waves provide information to the merchant's payment reader about your bank account, contactless card, or phone app. Near field communication, or NFC is the technology that enables contactless payments. It's an improved version of the existing RFID (Radio Frequency Identification) technology. RFID technology has only lately begun to be used for contactless payments. For it to work, the two components - the scanner or POS terminal and the consumer's payment device - must be nearby.

Cashless Payments Market- By End User

- Transportation and Logistics

- Retail

- Hospitality

- Energy and Utilities

- Healthcare

- Others

Contactless payment systems are becoming increasingly popular in the hospitality industry. They incorporate some of the most cutting-edge technology while giving a more user-friendly experience for your visitors. Contactless payments are expected to grow in popularity rapidly, according to 94 percent of businesses. Touchless retail transactions are becoming increasingly common, with mobile wallets, app payments, and NFC cards among the most popular options.

Cashless Payments Market- By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

North America has been slow to accept contactless payments. In North America, the much-anticipated "death of the wallet" never came to pass. According to research by global management consulting company A.T. Kearney, only 3% of cards in use in the United States were contactless in 2018, compared to roughly 64% in the United Kingdom and up to 96 percent in South Korea.

In terms of market size, the European contactless payment market is the largest in 2021, but it is highly fragmented due to the usage of numerous currencies and languages. The region includes a wide spectrum of countries, from economically and technologically advanced nations like the United Kingdom and Germany too heavily indebted nations like Greece and Austria. The leading countries in the European contactless payment market are the United Kingdom, Poland, Spain, and Germany. In the UK, there were 1.6 billion debit and credit card transactions, according to UK Finance. Contactless cards were used in nearly a third of all card transactions in the UK. There were 642 million contactless card transactions, up from 537 million a year before by 19.5 percent.

Owing to the improved service offered by contactless payments, rising adoption of new emergent systems, technological advancements in digital platforms and mobile devices, and increasing penetration due to the COVID-19 pandemic, the Asia Pacific contactless payment market will grow by xx% annually with a total addressable market cap of $xxxx billion between 2022 and 2027.

In between 2014 and 2019, the number of consumer digital payments transactions in the Middle Eastern countries like the United Arab Emirates (UAE) increased at a rate of more than 9% each year, compared to Europe's average yearly growth rate of 4 to 5%. In between February 2019 and January 2020, Saudi Arabia saw a 70 percent increase in card payments.

Key Players in the Market

- Ingenico Group

- Verifone Systems, Inc.

- Inside Secure

- Proxama PLC.

- Wirecard AG

- Giesecke & Devrient GmbH

- Heartland Payment Systems, Inc.

- Mobeewave

- Paycare

- Infineon

Chapter 1. Cashless Payments Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Cashless Payments Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Cashless Payments Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Cashless Payments Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Cashless Payments Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Cashless Payments Market - By Hardware

6.1 Smart Cards

6.2. Smartphones and Wearables

6.3. Point of Sales Terminals

Chapter 7. Cashless Payments Market - By Technology

7.1. RFID (Radio Frequency Identification)

7.2. NFC (Near-field communication)

7.3. IR (Infrared)

7.4. Others

Chapter 8. Cashless Payments Market - By End User

8.1. Transportation and Logistics

8.2. Retail

8.3. Hospitality

8.4. Energy and Utilities

8.5. Healthcare

8.6. Others

Chapter 9. Cashless Payments Market – By Region

9.1. North America

9.2. Europe

9.3.The Asia Pacific

9.4.Latin America

9.5. Middle-East and Africa

Chapter 10. Cashless Payments Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Ingenico Group

10.2. Verifone Systems, Inc.

10.3. Inside Secure

10.4. Proxama PLC.

10.5. Wirecard AG

10.6. Giesecke & Devrient GmbHa

10.7. Heartland Payment Systems, Inc.

10.8. Mobeewave

10.9. Paycare

10.10. Infineon

Download Sample

Choose License Type

2500

4250

5250

6900