Construction Insulation Coatings Market Size (2024 – 2030)

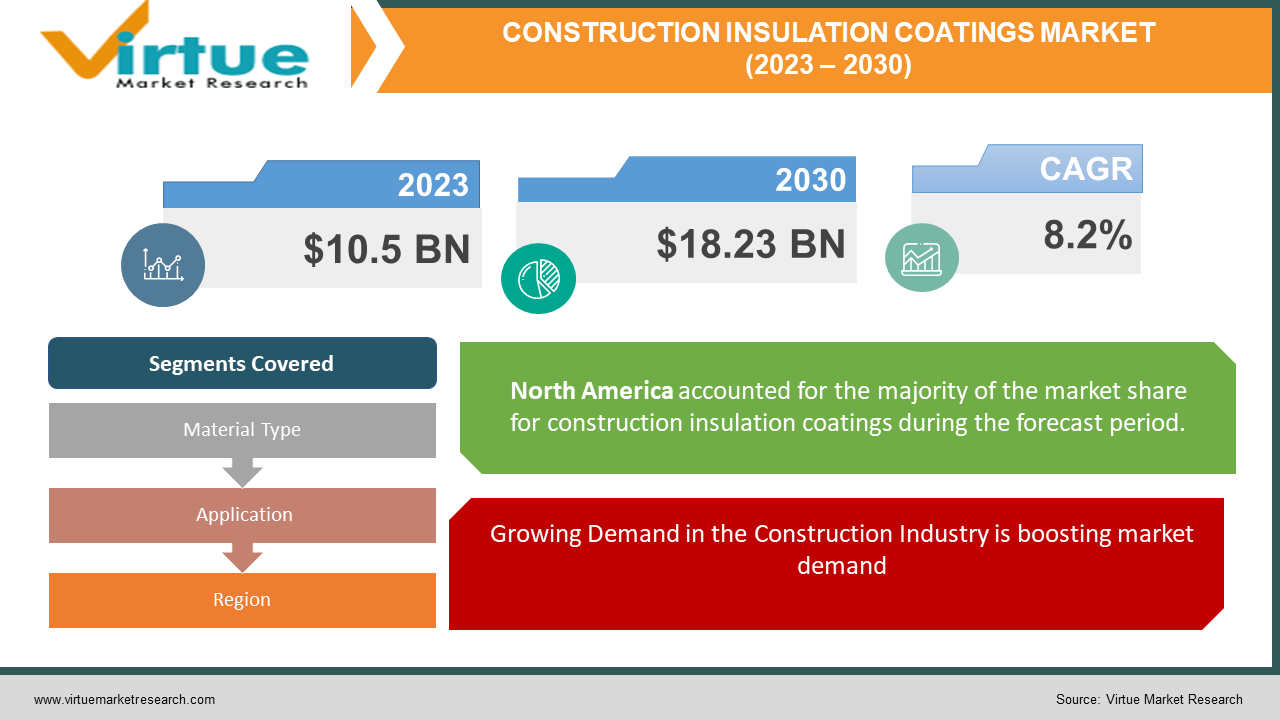

The Global Construction Insulation Coatings Market was valued at USD 10.5 billion in 2023 and is projected to reach a market size of USD 18.23 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.2%.

In this comprehensive report on the Global Construction Insulation Coatings Market, we delve into the dynamic landscape of the construction industry, exploring the pivotal role insulation coatings play in shaping modern building practices. With a keen focus on energy efficiency, sustainability, and innovation, the report provides a detailed analysis of the market drivers propelling the adoption of insulation coatings, including the industry's commitment to green building standards, rising demand in the construction sector, and the imperative for enhanced building performance and safety. Despite facing challenges such as competition from traditional materials and raw material price fluctuations, the market showcases resilience, particularly evident in its response to the COVID-19 pandemic. Through a regional lens, North America's dominance and the rapid growth in the Asia-Pacific region underscore the global trajectory of this market. The report captures key market insights, trends, and developments, shedding light on the transformative journey of construction insulation coatings within the construction landscape.

Key Market Insights:

In the ever-evolving landscape of the construction industry, the demand for insulation coatings has seen a significant upswing, primarily fueled by the sector's growing emphasis on energy efficiency. Buildings and infrastructures designed with energy conservation in mind have become the norm, leading to a surge in the adoption of insulation coatings. These coatings play a crucial role in enhancing thermal efficiency, thereby ensuring comfortable indoor environments while simultaneously reducing heating and cooling expenses. This emphasis on energy-efficient construction practices has positioned insulation coatings as indispensable components in modern building projects. One of the driving factors behind the increased adoption of insulation coatings lies in the construction industry's commitment to sustainable practices. These coatings offer efficient thermal insulation, effectively reducing energy consumption and, by extension, emissions. Regulatory bodies and governments worldwide have championed green building standards, with certifications like LEED serving as industry benchmarks. Insulation coatings that meet these stringent criteria are highly sought after. Compliance with these standards not only promotes eco-friendly construction but also enhances the marketability of buildings. As a result, demand for insulation coatings has surged, aligning with the global shift towards sustainable and environmentally responsible construction.

However, despite the evident advantages and innovative thermal insulation capabilities of these coatings, they face fierce competition from traditional materials such as fiberglass and mineral wool. The challenge lies in convincing consumers and businesses to transition to insulation coatings, especially when these traditional materials are well-established and often perceived as more cost-effective alternatives. Overcoming this perception and ensuring the cost-competitiveness of insulation coatings is a significant hurdle in their market penetration efforts. Another challenge stems from the inherent volatility in raw material prices. The production of insulation coatings relies on a variety of raw materials, the availability and prices of which can fluctuate due to supply-demand dynamics, geopolitical tensions, and economic conditions. These fluctuations disrupt supply chains, impacting pricing strategies and overall affordability. Manufacturers are faced with the task of balancing the need for high-performance coatings with affordability, making the development of cost-effective solutions a critical focal point for sustained market growth.

Global Construction Insulation Coatings Market Drivers:

Growing Demand in the Construction Industry is boosting market demand.

The construction industry's increasing demand for insulation coatings is primarily driven by the need for energy-efficient buildings and infrastructures. Insulation coatings enhance thermal efficiency, making buildings more comfortable while reducing heating and cooling expenses. As energy costs rise and environmental concerns become more prominent, contractors and developers are turning to insulation coatings to meet energy efficiency standards, driving the market's growth. Additionally, the construction sector's constant expansion, especially in emerging economies, further fuels the demand for these coatings.

Focus on Sustainability and Energy Efficiency is contributing to market expansion.

Insulation coatings contribute significantly to sustainable construction practices. They offer efficient thermal insulation, reducing energy consumption and emissions. Governments and regulatory bodies worldwide are emphasizing green building standards, encouraging the use of insulation coatings that meet these criteria. By saving energy, minimizing waste, and extending building lifespan, these coatings align with environmentally friendly construction practices. The emphasis on sustainable, energy-efficient buildings has become a key driver for the adoption of construction insulation coatings.

Compliance with Green Certifications is helping to expand the global market.

Green certifications like LEED have become industry benchmarks for environmentally responsible construction. Insulation coatings that meet these certifications are in high demand. Compliance with these standards not only ensures eco-friendly construction but also enhances the marketability of buildings. Construction projects aiming for green certifications often specify the use of insulation coatings, driving manufacturers to innovate and develop coatings that fulfill these criteria. The demand for green building projects propels the growth of insulation coatings in the construction sector.

Global Construction Insulation Coatings Market Restraints and Challenges:

Competition with Traditional Insulation Materials is slowing down growth in the global market for coatings.

The market for construction insulation coatings faces stiff competition from traditional insulation materials like fiberglass and mineral wool. These traditional materials are well-established, widely accepted, and often perceived as cost-effective alternatives. Manufacturers need to focus on creating cost-competitive products that match the effectiveness of traditional materials to enhance market attractiveness.

Volatility in Raw Material Prices is hindering market growth.

The production of construction insulation coatings relies on various raw materials, including resins, pigments, additives, and solvents. Fluctuations in the availability and prices of these raw materials due to supply-demand changes, geopolitical tensions, and economic conditions can lead to unpredictable costs..

Relatively High Price of Insulation Coatings increasing the competition.

Construction insulation coatings are relatively expensive compared to traditional insulation materials. The costs associated with the application technology, including specialized equipment and skilled labor, contribute to the overall price. This higher price point can deter potential customers, especially in price-sensitive markets. Manufacturers face the challenge of balancing the need for innovative, high-performance coatings with affordability to cater to a wider customer base. Developing cost-effective insulation coatings while maintaining performance standards is a significant challenge for the market.

CONSTRUCTION INSULATION COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.2% |

|

Segments Covered |

By Material Type, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AkzoNobel (Netherland), PPG (US), Sherwin-Williams Company (US), Kansai Paint Co., Ltd. (Japan), Jotun Group (Norway), Nippon Paint, Holdings Co., Ltd. (Japan), Axalta Coating System (US), Hempel (Denmark),Carboline (US) |

Construction Insulation Coatings Market Segmentation: By Material Type

-

Acrylic-Based Construction Insulation Coatings

-

Polyurethane-Based Construction Insulation Coatings

-

Epoxy-Based Construction Insulation Coatings

-

Mullite-Based Construction Insulation Coatings

-

YSZ (Yttria-Stabilized Zirconia)-Based Construction Insulation Coatings

-

Others

Acrylic-Based Construction Insulation Coatings dominate the market with a substantial 45% market share. These coatings are favored for their durability, low maintenance, and effective thermal insulation properties. Additionally, acrylic-based coatings offer cost-effective solutions, making them the preferred choice for a wide range of applications. Their versatility in providing efficient insulation while being relatively affordable contributes significantly to their market dominance.

Polyurethane-Based Construction Insulation Coatings are experiencing a notable uptick, capturing a rising market share of 15%. The increasing adoption of these coatings is attributed to their excellent thermal insulation properties, making them ideal for applications in HVAC systems and industrial equipment. Their ability to prevent heat loss or gain in critical areas, coupled with the growing emphasis on energy-efficient climate control, has fueled their demand. Additionally, advancements in polyurethane technology have led to coatings that offer superior insulation performance, making them increasingly popular in construction projects aiming for enhanced energy efficiency and sustainability.

Construction Insulation Coatings Market Segmentation: By Application

-

Roof Insulation Coatings

-

Wall Insulation Coatings

-

Floor Insulation Coatings

-

HVAC Insulation Coatings

-

Pipeline Insulation Coatings

-

Equipment Insulation Coatings

Roof Insulation Coatings lead the market with a substantial 35% market share. The significant adoption of these coatings is due to their pivotal role in enhancing energy efficiency and reducing cooling costs in both residential and commercial buildings. Roofs are often the primary source of heat absorption, making these coatings essential for maintaining indoor temperatures. The rising awareness about the economic and environmental benefits of roof insulation coatings has further bolstered their market share.

Floor Insulation Coatings have witnessed a steady rise, capturing an increasing market share of 10%. The growing emphasis on creating energy-efficient and comfortable living spaces has propelled the demand for floor insulation coatings. These coatings provide thermal insulation, ensuring that indoor temperatures are maintained, especially in regions with varying climates. Additionally, advancements in technology have led to the development of innovative floor insulation solutions, further driving their adoption in construction projects.

Construction Insulation Coatings Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America holds the majority market share of 35% in the Global Construction Insulation Coatings Market. The region's dominance can be attributed to the widespread adoption of energy-efficient construction practices and the stringent regulations promoting sustainable building solutions. Additionally, the growing demand for renovation and retrofitting projects in existing buildings further fuels the market in North America. The mature construction industry in the region, coupled with awareness about the long-term benefits of insulation coatings, contributes significantly to its market share.

The Asia-Pacific region is the rising star in the Construction Insulation Coatings Market, capturing a growing market share of 25%. Countries like China and India are witnessing rapid urbanization, industrialization, and infrastructural development, leading to an increased demand for energy-efficient and environmentally friendly construction solutions. Rising disposable incomes, coupled with government initiatives promoting sustainable construction, have fueled the adoption of insulation coatings in the region. The construction boom in emerging economies, combined with a growing awareness of the importance of insulation coatings for energy conservation, drives the market's growth in Asia-Pacific.

COVID-19 Impact Analysis on the Global Construction Insulation Coatings Market:

The COVID-19 pandemic significantly impacted the Global Construction Insulation Coatings Market, leading to shifts in demand patterns and supply chain disruptions. During the initial phases of the pandemic, construction activities faced slowdowns due to lockdowns, labor shortages, and economic uncertainties, causing a temporary dip in market growth. The pandemic highlighted the importance of energy-efficient buildings and infrastructure, driving the demand for insulation coatings in projects focused on improving indoor air quality and reducing energy consumption. Remote working trends also influenced construction priorities, leading to renovations and upgrades in residential spaces. Additionally, heightened awareness of health and safety concerns prompted the adoption of coatings with antimicrobial properties. While challenges persisted, the industry's adaptability and the growing emphasis on sustainable, energy-efficient construction practices ultimately drove the market's resilience and recovery in the post-pandemic landscape.

Latest Trends/ Developments:

The Global Construction Insulation Coatings Market has been witnessing several noteworthy trends and developments, shaping the industry landscape. One of the key trends is the increasing focus on sustainable and eco-friendly insulation coatings. With growing environmental concerns, manufacturers are developing coatings made from recycled materials and incorporating biodegradable elements, aligning with global sustainability goals. Another prominent trend is the integration of smart technologies in insulation coatings. Innovations such as coatings embedded with sensors for real-time monitoring of temperature and energy efficiency are gaining traction, enabling data-driven decision-making in construction projects. Additionally, there is a rising demand for high-performance insulation coatings that offer multifunctional benefits, including thermal insulation, fire resistance, and soundproofing. These coatings cater to diverse applications in residential, commercial, and industrial sectors. The market is also witnessing advancements in nanotechnology, leading to the development of nanocoatings that provide enhanced thermal insulation properties and improved durability.

Key Players:

-

AkzoNobel (Netherland)

-

PPG (US)

-

Sherwin-Williams Company (US)

-

Kansai Paint Co., Ltd. (Japan)

-

Jotun Group (Norway)

-

Nippon Paint

-

Holdings Co., Ltd. (Japan)

-

Axalta Coating System (US)

-

Hempel (Denmark)

-

Carboline (US)

-

PPG and Satys form a partnership to offer electrocoating services for OEM aircraft components.

-

Sherwin-Williams launches SofTop Comfort flooring systems, combining comfort, aesthetics, and sustainability in resinous flooring.

Chapter 1. Construction Insulation Coatings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Construction Insulation Coatings Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Construction Insulation Coatings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Construction Insulation Coatings Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Construction Insulation Coatings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Construction Insulation Coatings Market – By Material Type

6.1 Introduction/Key Findings

6.2 Acrylic-Based Construction Insulation Coatings

6.3 Polyurethane-Based Construction Insulation Coatings

6.4 Epoxy-Based Construction Insulation Coatings

6.5 Mullite-Based Construction Insulation Coatings

6.6 YSZ (Yttria-Stabilized Zirconia)-Based Construction Insulation Coatings

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Material Type

6.9 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 7. Construction Insulation Coatings Market – By Application

7.1 Introduction/Key Findings

7.2 Roof Insulation Coatings

7.3 Wall Insulation Coatings

7.4 Floor Insulation Coatings

7.5 HVAC Insulation Coatings

7.6 Pipeline Insulation Coatings

7.7 Equipment Insulation Coatings

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Construction Insulation Coatings Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Material Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Material Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Material Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Material Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Material Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Construction Insulation Coatings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 AkzoNobel (Netherland)

9.2 PPG (US)

9.3 Sherwin-Williams Company (US)

9.4 Kansai Paint Co., Ltd. (Japan)

9.5 Jotun Group (Norway)

9.6 Nippon Paint

9.7 Holdings Co., Ltd. (Japan)

9.8 Axalta Coating System (US)

9.9 Hempel (Denmark)

9.10 Carboline (US)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Construction Insulation Coatings Market was valued at USD 10.5 billion in 2023 and is projected to reach a market size of USD 18.23 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.2%.

The Global Construction Insulation Coatings Market drivers include the growing demand in the construction industry, focus on sustainability and energy efficiency, compliance with green certifications, and enhanced building performance and safety.

The segments under the Global Construction Insulation Coatings Market by Application Area include Roof Insulation Coatings, Wall Insulation Coatings, Floor Insulation Coatings, HVAC Insulation Coatings, Pipeline Insulation Coatings, and Equipment Insulation Coatings.

North America is the most dominant region for the Global Construction Insulation Coatings Market.

The leading players in the Global Construction Insulation Coatings Market include AkzoNobel, PPG, Sherwin-Williams Company, Kansai Paint Co., Ltd., Jotun Group, Nippon Paint Holdings Co., Ltd., Axalta Coating System, Hempel, and Carboline.