Consent Management Market Size (2025-2030)

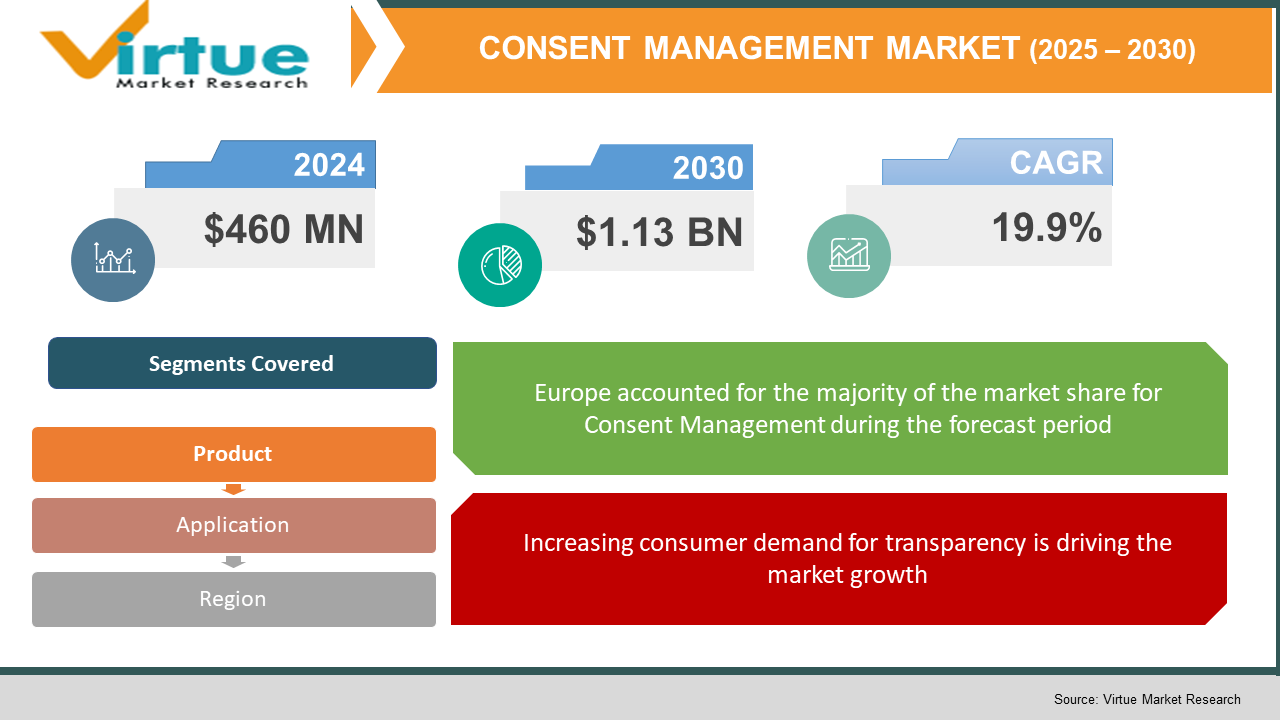

The global Consent Management Market was valued at USD 460 million in 2024 and is projected to grow at a CAGR of approximately 19.9% from 2025 to 2030, reaching around USD 1.13 billion by 2030.

Consent management refers to platforms and services that enable companies to collect, store, and manage user consent for data usage, ensuring compliance with data privacy regulations such as GDPR, CCPA, and emerging laws in India and China. The market’s strong growth is driven by rising consumer awareness, intensifying regulatory environments, and increased digital transformation, pushing organizations to implement robust consent solutions that offer transparency, user control, and auditability.

Key market insights:

Europe holds the largest market share due to its stringent GDPR framework, with North America closely following, while Asia-Pacific emerges rapidly amid increasing data regulation initiatives in India, China, and Southeast Asia.

The cloud-deployment segment dominates, offering scalability and cost-efficiency over on-premises solutions.

Software components, including CMPs and preference management tools, account for the majority of market revenue, surpassing services.

The market is undergoing investment and consolidation, highlighted by OneTrust securing USD 150 million funding and Piwik PRO raising USD 5 million in 2023.

Global Consent Management Market Drivers

Growing regulatory pressure for compliance is driving the market growth

Increased data privacy laws worldwide—such as GDPR in Europe, CCPA in California, DPDP in India, and PIPL in China—mandate explicit user consent and robust data handling processes. Non-compliance entails heavy penalties and reputational risk. Organizations seek CMPs to centralize consent capture, automate preference tracking, and demonstrate compliance during audits. AI-powered platforms further enhance compliance through real-time monitoring, granular consent logs, and built-in policy updates. As regulations evolve, demand for agile CMP solutions intensifies, ensuring businesses align with shifting legal frameworks and maintain trust with stakeholders.

Increasing consumer demand for transparency is driving the market growth

As data breaches and surveillance practices proliferate, consumers are more aware of their privacy rights. Surveys show that over 70% of users expect control over how their data is used. Traditional “I agree” banners no longer suffice; users seek granular preferences, simple interfaces, and the ability to revoke consent anytime. CMPs have responded with intuitive dashboards, preference centers, and enhanced interoperability with marketing and compliance systems. Businesses adopt these solutions to build brand loyalty, offering personalized interactions while maintaining transparency. Enhanced user trust translates into reduced churn and higher conversion rates, placing CMPs at the heart of modern digital strategy.

Digital transformation and cybersecurity concerns is driving the market growth

Organizations across industries are embracing digital channels for customer engagement, creating vast data footprints that are susceptible to cyber threats. Consent management solutions help secure this data by ensuring explicit user authorization and detailed audit logs. CMPs also assist in meeting security regulations by maintaining immutable consent records and periodic compliance checks. AI integration enables proactive detection of consent policy violations and automated remediation. Digital-first enterprises prioritize CMPs not just for legal compliance, but as essential security infrastructure, mitigating risk and fostering secure, privacy-first digital ecosystems.

Global Consent Management Market Challenges and Restraints

Navigating fragmented regulations is restricting the market growth

The global consent management market must contend with complex and often inconsistent regulation. In the US, more than 20 states have varying consent standards—including both opt-in and opt-out models—forcing businesses to tailor their systems per jurisdiction. These divergent requirements also vary for sensitive data and profiling activities. Internationally, businesses must adapt to GDPR, CCPA, DPDP, PIPL, LGPD in Brazil, and others, each with unique consent definitions. Implementing systems to manage multiple consent frameworks across geographies increases technical and legal complexity, increases implementation costs, and challenges interoperability. This landscape hinders seamless scaling of CMPs and makes compliance management a continual challenge for multinational organizations, especially SMBs.

Balancing user experience and compliance is restricting the market growth

CMPs often struggle to balance compliance with user experience. Overly granular consent interfaces can overwhelm users, leading to consent fatigue or mass rejections. Conversely, simplified pop-ups may breach regulations or be manipulated via dark patterns. Research shows only 11% of CMP designs meet minimal legal standards while suboptimal designs yield significantly higher consent acceptance rates. Striking a balance between transparency, usability, and compliance requires careful interface design, constant testing, and user feedback loops. Designing flexible yet legally robust solutions incurs higher development costs and requires multidisciplinary expertise, hampering adoption among cost-conscious organizations.

Market opportunities

As global data privacy awareness intensifies and regulations proliferate, the consent management market is poised for significant expansion. Advanced CMPs that integrate AI-driven analytics, real-time updating, multi-channel synchronization, and preference portability across ecosystems can capitalize on demand from enterprises seeking adaptability and user trust. The push toward data localization and sovereign cloud infrastructure in regions like India, China, and parts of Europe creates niche opportunities for localized CMP solutions. A growing number of verticals—such as healthcare, finance, telecom, government, and retail—are seeking sector-specific profiles embedded with domain compliance capabilities like HIPAA tracking and financial data encryption. In emerging markets across APAC, Middle East, and Latin America, heightened digital adoption combined with nascent privacy regulations presents a fertile market for early movers. Security-conscious industries, including cybersecurity platforms and identity management providers, can leverage CMP extensions as integrated trust services. Moreover, the increasing interconnection of IoT ecosystems, smart devices, and edge computing opens new fronts for consent management beyond web and mobile, extending to connected cars, industrial systems, and healthcare devices. Blockchain-based audit logs, consent trust protocols, and decentralized identity frameworks represent further innovation zones. Strategic partnerships among CMP providers, CRM, marketing automation, and privacy compliance tool vendors will also enable integrated privacy stacks. As organizations seek to minimize data risk and preserve customer loyalty, the ability to offer transparent, scalable, and technologically advanced consent management solutions will define market winners.

CONSENT MANAGEMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

19.9% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

OneTrust, TrustArc, Cookiebot, Quantcast, Piwik PRO, BigID, Sourcepoint, SAP SE, and Crownpeak. |

Consent Management Market segmentation

Consent Management Market segmentation By Product:

- Consent management platforms

- Preference management solutions

- Consent analytics tools

- Deployment services

Consent management platforms are currently the dominant product segment. They represent the largest share of revenue as they encompass the core functionality needed for consent capture, preference tracking, documentation, and reporting. CMPs serve as foundational tools enabling companies to integrate consent flows into various channels—websites, mobile apps, and enterprise systems—while maintaining audit trails. Their versatility and regulatory compliance capacity make them the go-to option for organizations needing turnkey solutions. As data compliance demands intensify, businesses increasingly invest in CMPs that bundle user interfaces, backend analytics, and integration modules, reinforcing their dominance in the consent management product landscape.

Consent Management Market segmentation By Application:

- Web applications

- Mobile applications

- IoT/edge devices

- Enterprise systems

Web applications represent the most dominant application segment within the consent management market. Most consent interactions occur in browsers through cookie banners, privacy pop-ups, and embedded preferences. Regulatory frameworks like GDPR and CCPA focus heavily on web-based data collection, reinforcing CMP deployment in that environment. Although mobile apps and IoT devices are gaining attention, the web remains the primary interface through which users consent to cookies, tracking, and analytics. As such, CMP providers prioritize robust web compatibility, granular browser controls, and banner customization. Given that nearly every consumer engagement starts on web platforms, this application segment continues to generate the largest market share.

Consent Management Market Regional Segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Europe is the most dominant region in the global consent management market currently in 2024. The implementation of GDPR in 2018 transformed consent management into a legal imperative. GDPR introduced strict requirements for explicit, informed, revocable consent, transparency, and data subject rights across all EU member states. The uniform application of GDPR across diverse countries created a unified demand for CMPs. Enterprises in the region invested heavily in systems capable of granular consent, cross-border data transfer management, and audit readiness. Europe also led the development of vendor ecosystems offering advanced CMPs, localized compliance services, and regulatory support. The requirement for Cookie banners, preference centres, and documentation capabilities became entrenched across all web properties of European organizations. This regulatory-first environment triggered vendor innovation in AI-driven consent analytics, automated compliance updates, and multi-jurisdictional support. While North America follows closely—especially with CCPA and emerging state laws—the fragmented landscape requires more tailored solutions. Asia-Pacific is growing, but still lags behind in regulatory enforcement. Europe’s early regulatory leadership, homogeneous legal setting, and demand for privacy-first digital infrastructure firmly place it as the dominant region in consent management.

COVID‑19 Impact Analysis on the Consent Management Market

The COVID‑19 pandemic acted as a digital accelerant, forcing enterprises to shift rapidly to online channels amid lockdowns and remote operations. This surge in digital engagement led to exponentially more data collection points: remote collaboration tools, online services, telehealth platforms, e-commerce, and contact tracing apps. With online footprints expanding overnight, organizations faced increased regulatory scrutiny and public attention on how personal data was being collected and used. Businesses that had previously treated consent management as an afterthought found themselves at legal and reputational risk. As a result, CMP adoption surged post‑2020. According to Allied Market Research, the global market, valued at USD 318 million in 2020, experienced slowed growth in 2021–22 but rebounded aggressively through compliance-driven investments, reaching USD 382 million by 2021 and rising steadily toward USD 2.27 billion by 2030. COVID also heightened public awareness of data privacy, particularly around health data and digital tracking. Contact tracing apps triggered debates over consent, data retention, and transparency, which underscored the importance of strong CMP frameworks. Regulators in Europe and the US issued guidelines for app-based consent, emphasizing user control in mobile environments. This further broadened the scope of consent management beyond cookie banners into mobile and IoT ecosystems. Post‑pandemic, investments in CMP technologies intensified. Enterprises sought platforms that offered multi-channel synchronization, preference revocation workflows, real‑time tracking, and integration with customer data platforms. The pandemic expedited regulatory timelines—several countries prioritized data protection frameworks amid emergency legislation—and CMP providers responded by accelerating product roadmaps. New features such as dynamic consent flows, biometric verification, and COVID-specific data tagging were introduced to meet evolving requirements. Overall, COVID‑19 transformed consent management from a compliance tool to a critical component of user trust strategy. The pandemic’s digital shift not only spurred market growth, but also redefined best practices: embedding consent into digital-first service design, offering transparent preference management, and positioning consent as a differentiator in privacy-aware consumer markets.

Latest trends/Developments

The consent management market is rapidly evolving, driven by technological innovation, regulatory changes, and shifting consumer expectations. One notable trend is the integration of artificial intelligence and automation. CMPs now leverage AI to analyze user behavior, predict consent preferences, and dynamically adjust interfaces, enabling personalized but compliant experiences in real time. AI-driven dashboards can flag consent anomalies, detect opt-out violations, and prompt automated remediation. Interoperability is another major development. CMP platforms increasingly integrate with marketing automation systems, customer data platforms, analytics tools, and CRM systems to ensure that consent preferences flow consistently across the enterprise. This connectivity ensures that downstream systems enforce consent in all user interactions, reducing compliance gaps.

User experience is also being redesigned. Modern CMPs feature intuitive dashboards, granular preference centers, and mobile-first designs. One-click opt-out and preference revocation have become standard, aligning with consumer demand for trust and transparency. Research shows that simple reject‑all choices significantly alter consent rates, prompting CMPs to uphold clearer interface standards. On the regulatory front, emerging laws in India (DPDP), China (PIPL), Brazil (LGPD), and multiple US states have expanded CMP use cases. Platforms now offer multi-jurisdictional compliance modules, region‑specific clauses, and consent rule engines to adapt to varying legal requirements. Blockchain and decentralized identity technologies are being piloted to create immutable consent logs and cross-domain portability. Some platforms offer public ledger-backed audit trails, enabling verifiable, tamper-proof proof of consent. Preference portability standards are being explored to let users transfer consent decisions between services.

IoT and edge systems are entering the landscape. CMPs are being extended into connected cars, smart devices, and industrial ecosystems, where user consent may live on edge nodes rather than centralized servers. Finally, market consolidation is underway. Large CMP vendors—including OneTrust, TrustArc, Piwik PRO—are acquiring smaller niche providers to enhance AI capabilities, regional coverage, or vertical specialization. Investment dollars are fueling R&D in privacy engineering, usability metrics, and compliance analytics. In sum, the consent management market is rapidly maturing into a sophisticated ecosystem. AI, interoperability, UX-driven design, emerging legal regimes, new deployment environments, and blockchain-assisted auditability are reshaping how consent is captured, managed, and respected in the modern digital economy.

Key Players:

- OneTrust

- TrustArc

- Cookiebot

- Quantcast

- Iubenda

- Trunomi

- Piwik PRO

- BigID

- SAP SE

- Sourcepoint

- Crownpeak

- Didomi

Chapter 1. Consent Management Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Type s

1.5. Secondary Type s

Chapter 2. CONSENT MANAGEMENT MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. CONSENT MANAGEMENT MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. CONSENT MANAGEMENT MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. CONSENT MANAGEMENT MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. CONSENT MANAGEMENT MARKET – By Product

6.1 Introduction/Key Findings

6.2 Consent management platforms

6.3 Preference management solutions

6.4 Consent analytics tools

6.5 Deployment services

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. CONSENT MANAGEMENT MARKET – By Application

7.1 Introduction/Key Findings

7.2 Web applications

7.3 Mobile applications

7.4 IoT/edge devices

7.5 Enterprise systems

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. CONSENT MANAGEMENT MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. CONSENT MANAGEMENT MARKET – Company Profiles – (Overview, Product, Portfolio, Financials, Strategies & Developments)

9.1 OneTrust

9.2 TrustArc

9.3 Cookiebot

9.4 Quantcast

9.5 Iubenda

9.6 Trunomi

9.7 Piwik PRO

9.8 BigID

9.9 SAP SE

9.10 Sourcepoint

9.11 Crownpeak

9.12 Didomi

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global Consent Management Market was valued at USD 460 million in 2024 and is projected to grow at a CAGR of approximately 19.9% from 2025 to 2030, reaching around USD 1.13 billion by 2030.

Key drivers include tighter privacy regulations, rising consumer demand for transparency, and increased digitalization and cyber risk.

By product: CMP platforms, preference analytics, consent services. By application: web apps, mobile, IoT, enterprise systems

Europe leads, driven by GDPR and uniform regulatory enforcement across the region.

Leading vendors include OneTrust, TrustArc, Cookiebot, Quantcast, Piwik PRO, BigID, Sourcepoint, SAP SE, and Crownpeak