Global Confidential Computing Market Research Size (2024 – 2030)

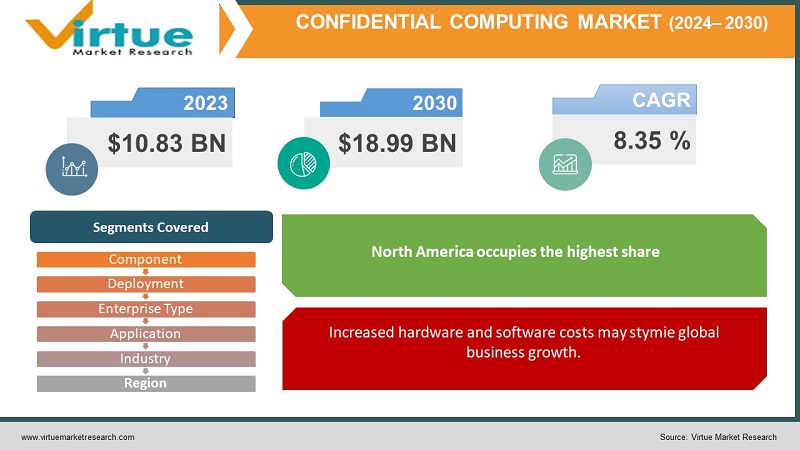

The Confidential Computing Market had a valuation of USD 10.83 billion, in 2023. Is expected to reach a market size of USD 18.99 billion by the end of 2030. During the forecast period spanning from 2024 to 2030, the market is estimated to grow at a compound growth rate (CAGR) of 8.35%.

Confidential computing is a technique that provides data encryption and storage solutions for both businesses and individuals ensuring the protection of data. It has gained support from hardware, software, and cloud providers. Moreover, confidential computing ensures data confidentiality and security across computing environments enabling enterprises to process private data comply with regulations, and positively impact cloud computing operations. Furthermore, confidential computing instills confidence by empowering data owners to maintain control over their information when it is being handled by servers. The methodology employed in computing assists in safeguarding information through data encryption and secure storage options for both corporate entities as well as individuals. Additionally, it has garnered endorsement from hardware manufacturers, software developers, and cloud service providers. This approach guarantees the confidentiality and security of data, across settings—enabling companies to securely handle private information while adhering to regulatory requirements—and significantly influencing activities within the realm of cloud computing. Moreover with computing data owners can maintain control over their data even when it is being processed by distant servers.

Key Market Insights:

In the year 2021, around 72% of the market in computing belonged to software. On the other hand, hardware accounted for 23% of this market. Looking ahead, to 2026 it is predicted that software will continue to dominate with a market share of around 64% while hardware is expected to make up 30 percent of the market. The estimated value of the computing industry, in terms of revenue, was around $10 billion in 2022 and it is projected to reach $19 billion by 2030. The computing market is expected to grow in the coming years driven by the growing significance of adhering to government regulations, like the General Data Protection Regulation and the California Consumer Privacy Act. In October 2022 Google Cloud introduced an isolated environment called a confidential environment that enables organizations to collaborate on work.

Confidential Computing Market Drivers:

A significant necessity to comply with data compliance rules enforced by the government to improve global market growth.

Compliance with government rules such as the General Data Protection Regulation and the California Consumer Privacy Act will drive worldwide confidential computing industry developments. Aside from that, confidential computing provides a secure environment and protects end-user sensitive information, which can assist enterprises as well as end-users in securing data privacy and complying with government rules. Private computing is said to have an impact, on the growth of the market. It aids businesses in meeting HIPAA regulations by providing a space for information. The demand for strict compliance standards across multiple industries like healthcare, government, and finance is expected to drive the growth of the global market in the coming years. The launch of new products has been beneficial for every firm, including the confidential computer business. Microsoft Corporation, for instance, has recently expanded its classified VM family by introducing the ECesv5-series and DCesv5-series in the first half of 2023. These initiatives are anticipated to have an impact, on the growth of the market.

Increased hardware and software costs may stymie global business growth.

The rising costs of cloud computing implementation and integration will stymie the growth of the global secret computing industry Furthermore, rising software and technology prices may hinder business growth around the world. In addition to significant increases in staff and software costs, maintenance fees will impede the expansion of the global industry.

Confidential Computing Market Restraints and Challenges:

The complexity challenge is connected with secure computer technologies.

Confidential computing can pose a challenge, for enterprises and organizations ones with limited IT resources. The reason behind this is that the technology behind it is still relatively new and continuously evolving. It requires expertise in areas such as encryption, secure enclaves, and trusted execution environments which may not be readily available in organizations. Additionally integrating computing solutions with existing IT infrastructure can be quite complex. Thorough testing and debugging are essential to ensure that the solution functions correctly, without introducing any vulnerabilities or compatibility issues. The complexity of confidential computing can also pose deployment and administration issues.

Confidential Computing Market Opportunities:

There is an opportunity for growing demand for confidential Al solutions.

As the utilization of Artificial Intelligence (AI) keeps expanding there is an increasing demand, for solutions that can ensure the protection and security of AI models and data. To safeguard AI data confidentiality AI solutions employ secure enclaves and homomorphic encryption algorithms. Confidential AI encompasses a range of technologies and practices employed in AI applications to preserve the confidentiality and privacy of data. Typically large datasets containing business data or identifiable information (PII) are utilized to train AI models. This thing can then make forecast decisions by the data. However incorporating data into AI applications can give rise, to privacy and security concerns.

CONFIDENTIAL COMPUTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.35% |

|

Segments Covered |

By Component, Deployment, Enterprise Type, Application, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amazon Web Services Inc., Google LLC., Alibaba Cloud, Ovh SAS, Fortanix, Microsoft Corporation, Intel Corporation, Cyxtera Technologies Inc., International Business Machines Corporation, Advanced Micro Devices Inc. |

Confidential Computing Market Segmentation: By Component

-

Software

-

Hardware

-

Services

In 2022, based on market segmentation by component, software occupies the highest share of about 25% in the market. Examples of software solutions, in the field of computing include tools for encrypting and decrypting data, managing enclaves, and designing and deploying secure applications. The services segment is experiencing growth in the computing market with a projected compound annual growth rate (CAGR) of 25% from 2023 to 2030. Services such as consulting, implementation, and support play a role in the realm of computing.

The dominance of software solutions in the computing industry can be attributed to their maturity and wide availability. There is a range of software options for confidential computing including both open source initiatives and commercial offerings. The growing need for expert assistance in deploying and managing secure systems is driving the expansion of services, within this domain.

Confidential Computing Market Segmentation: By Deployment

-

Cloud

-

On-premise

In 2022, based on market segmentation by deployment, Cloud occupies the highest share of about 25% in the market. On-premise deployment is experiencing the growth rate among all deployment types with a Compound Annual Growth Rate (CAGR) of 20%, for the projected period. The popularity of cloud computing can be attributed to its advantages in terms of scalability, flexibility, and cost-effectiveness. The increasing demand in industries that prioritize data security and compliance along with the growing awareness of security breaches in cloud computing has led to a rise in the adoption of, on-premise confidential computing solutions that are cost-effective and easy to implement.

Confidential Computing Market Segmentation: By Enterprise Type

-

SMEs

-

Large Enterprises

In 2022, based on market segmentation by type, large enterprises occupy the highest share of about 85% in the market. With a CAGR of 25% during the predicted period, SMEs are the fastest-expanding firm type. Large organizations dominate due to bigger spending for IT security and compliance, as well as more sophisticated IT environments. The growing awareness of the risks of data breaches and security vulnerabilities, regulatory compliance requirements, and the availability of more affordable and easy-to-deploy confidential computing solutions are driving the rapid expansion of the confidential computing market in SMEs.

Confidential Computing Market Segmentation: By Application

-

Privacy & Security

-

IoT & Edge

-

Personal Computing Devices

-

Blockchain

-

Multi-party Computing

In 2022, based on market segmentation by application, Privacy, and security occupy the highest share of about 60% in the market. The IoT & edge application is experiencing a growth rate projected at 40% CAGR. The significance of privacy and security, in this domain stems from its role in computing. The rapid expansion of the computing market in IoT & and edge is propelled by the rising adoption of IoT and edge computing devices, the increasing demand for safeguarding data collected and processed at the edge, and the availability of specialized confidential computing solutions, for IoT and edge environments.

Confidential Computing Market Segmentation: By Industry

-

Manufacturing

-

Retail & Consumer Goods

-

BFSI

-

Healthcare & Life Science

-

Utility

-

Government & Public Sector

-

IT & Telecom

-

Education

In 2022, based on market segmentation by industry, BFSI occupies the highest share of about 30% in the market. Healthcare and life sciences are experiencing growth with a projected compound growth rate (CAGR) of 35%. The BFSI sector holds a position, due to its regulation globally. On the other hand, the healthcare and life science industry is witnessing expansion in the confidential computing market. This growth can be attributed to the increasing adoption of health records (EHRs) and other digital healthcare technologies. Protecting patient data from cyberattacks and data breaches has become a concern driving the demand for more secure confidential computing solutions, in this sector.

Confidential Computing Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, based on market segmentation by region, North America occupies the highest share of about 40% of the market. Asia Pacific is experiencing the fastest growth, among all regions with a projected compound growth rate (CAGR) of 15%. North America on the other hand holds its dominance due to being the mature market when it comes to confidential computing. The rapid expansion of the Asia Pacific computing market can be attributed to factors. These include the region's increasing adoption of cloud computing and other digital technologies growing awareness about data breaches and security vulnerabilities rising demand for computing solutions in sectors like healthcare, finance, and government as well as the availability of more affordable and user-friendly options, for implementing such solutions.

COVID-19 Impact Analysis on the Global Confidential Computing Market:

The global outbreak of COVID-19 had an impact, on supply chains around the world resulting in disruptions to the production and delivery of hardware components for computing systems. Consequently, organizations were forced to reevaluate their timelines for implementing computing technologies leading to delays. However, this situation also prompted a shift in direction and necessitated adjustments, across sectors. In response to the evolving business landscape organizations quickly embraced cloud computing solutions, online platforms, and digital services. This increased reliance on infrastructure has further emphasized the need, for measures to ensure secure and confidential data processing. Organizations are now actively seeking safeguards that can protect data while enabling remote access and collaboration. Consequently, this is expected to drive the adoption of computing technology.

Latest Trends/ Developments:

Edge computing involves processing data in proximity, to its source or the edge of a network, which helps minimize delays and enables decision-making. A new trend is emerging where confidential computing capabilities are combined with edge computing infrastructure. This combination allows for secure and private data processing at the edge reducing reliance on transmitting information to cloud environments. Confidential computing at the edge is particularly crucial for applications that demand data security and privacy such, as devices, autonomous vehicles, and smart cities.

In May 2023 Intel announced Project Amber. This project introduces a security-as-a-service solution that acts as a trust authority. Its purpose is to verify the reliability of an asset whether it's in the cloud, network edge, or on-premises environment. Microsoft also had some news to share in April 2023. They introduced the DCesv5 series and ECesv5 series as part of their VM family now available in preview mode. These VMs are powered by the 4th Generation Intel Xeon Scalable processors. Come with a brand new hardware-based Trusted Execution Environment known as Intel Trust Domain Extensions (TDX). With these advancements, organizations can easily migrate their workflows to the cloud without making any changes, to their applications.

Key Players:

-

Amazon Web Services Inc.

-

Google LLC.

-

Alibaba Cloud

-

Ovh SAS

-

Fortanix

-

Microsoft Corporation

-

Intel Corporation

-

Cyxtera Technologies Inc.

-

International Business Machines Corporation

-

Advanced Micro Devices Inc.

Chapter 1. Confidential Computing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Confidential Computing Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Confidential Computing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Confidential Computing Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Confidential Computing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Confidential Computing Market – By Component

6.1 Introduction/Key Findings

6.2 Software

6.3 Hardware

6.4 Services

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Confidential Computing Market – By Deployment

7.1 Introduction/Key Findings

7.2 SMEs

7.3 Large Enterprises

7.4 Y-O-Y Growth trend Analysis By Deployment

7.5 Absolute $ Opportunity Analysis By Deployment, 2024-2030

Chapter 8. Confidential Computing Market – By Application

8.1 Introduction/Key Findings

8.2 Privacy & Security

8.3 IoT & Edge

8.4 Personal Computing Devices

8.5 Blockchain

8.6 Multi-party Computing

8.7 Y-O-Y Growth trend Analysis By Application

8.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Confidential Computing Market – By Industry

9.1 Introduction/Key Findings

9.2 Manufacturing

9.3 Retail & Consumer Goods

9.4 BFSI

9.5 Healthcare & Life Science

9.6 Utility

9.7 Government & Public Sector

9.8 IT & Telecom

9.9 Education

9.10 Y-O-Y Growth trend Analysis By Industry

9.11 Absolute $ Opportunity Analysis By Industry , 2024-2030

Chapter 10. Confidential Computing Market – By Scale of Logistics Operation

10.1 Introduction/Key Findings

10.2 Small Scale Operations

10.3 Medium Scale Operations

10.4 Large Scale Operations

10.5 Y-O-Y Growth trend Analysis By Scale of Logistics Operation

10.6 Absolute $ Opportunity Analysis By Scale of Logistics Operation, 2023-2030

Chapter 11. Confidential Computing Market , By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Component

11.1.3 By Deployment

11.1.4 By Application

11.1.5 By Industry

11.1.6 By Industry Vertical

11.1.7 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Component

11.2.3 By Deployment

11.2.4 By Application

11.2.5 By Industry

11.2.6 By Scale of Logistics Operation

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Component

11.3.3 By Deployment

11.3.4 By Application

11.3.5 By Industry

11.3.6 By Scale of Logistics Operation

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Component

11.4.3 By Deployment

11.4.4 By Application

11.4.5 By Industry

11.4.6 By Scale of Logistics Operation

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Component

11.5.3 By Deployment

11.5.4 By Application

11.5.5 By Industry

11.5.6 By Scale of Logistics Operation

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Confidential Computing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Amazon Web Services Inc.

12.2 Google LLC.

12.3 Alibaba Cloud

12.4 Ovh SAS

12.5 Fortanix

12.6 Microsoft Corporation

12.7 Intel Corporation

12.8 Cyxtera Technologies Inc.

12.9 International Business Machines Corporation

12.10 Advanced Micro Devices Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Confidential Computing Market had a valuation of USD 10.83 billion, in 2023. Is expected to reach a market size of USD 18.99 billion by the end of 2030. During the forecast period spanning from 2024 to 2030, the market is estimated to grow at a compound growth rate (CAGR) of 8.35%.

There is a significant necessity to comply with data compliance rules enforced by the government to improve global market growth, increased hardware and software costs may stymie global business growth, there is an opportunity for growing demand for confidential Al solutions, the complexity challenge connected with secure computer technologies are the market drivers of the Global Confidential Computing Market.

Hardware, Software, and Services are the segments under the Global Confidential Computing Market by component.

North America is the most dominant region for Global Confidential Computing Market by component.

Asia-Pacific is the fastest-growing region in the Global Confidential Computing Market,