Condensed Whey Market Size (2025 – 2030)

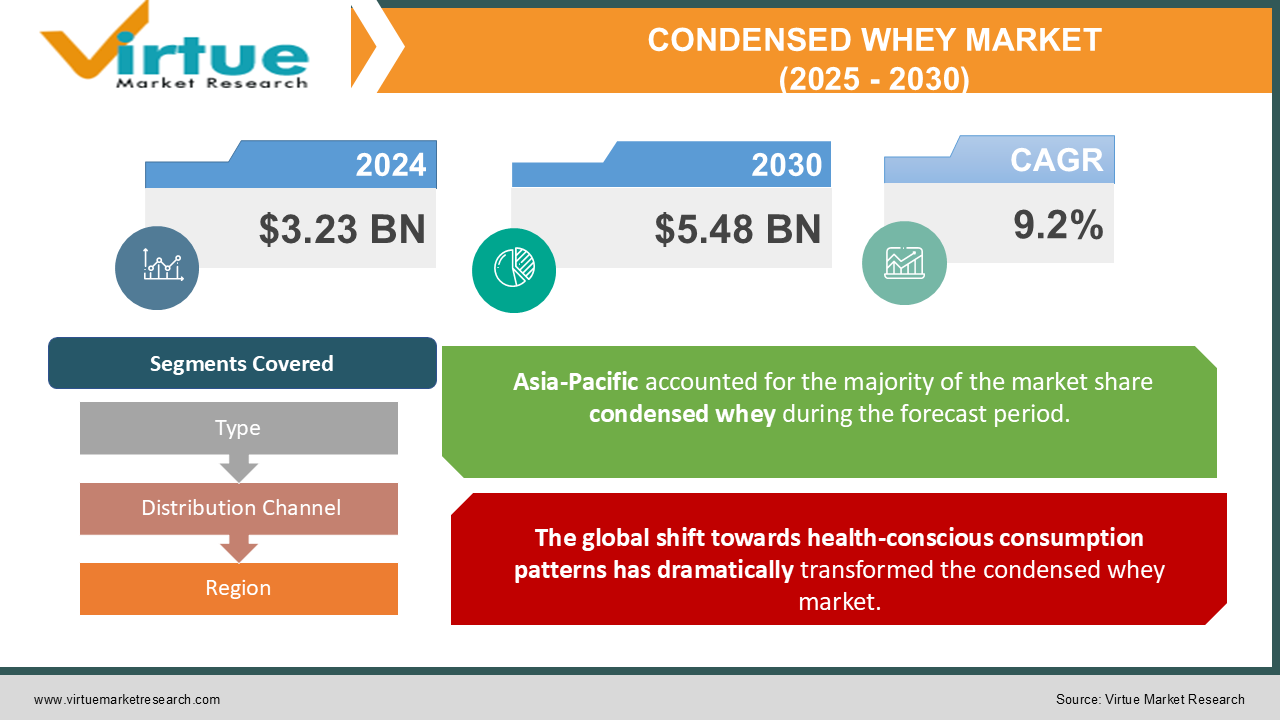

The Condensed Whey Market was valued at USD 3.23 Billion in 2024 and is projected to reach a market size of USD 5.48 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.2%.

The condensed whey market has emerged as a dynamic segment of the global dairy industry, driven by its multifunctionality and diverse applications in food, beverages, animal feed, and nutraceuticals. Condensed whey, a concentrated liquid derived from the cheese-making process, boasts high nutritional value due to its rich protein and lactose content. Its growing popularity stems from its use in enhancing flavor, texture, and nutritional profiles of products, as well as its cost-effectiveness as an ingredient. The food and beverage sector are the largest consumer of condensed whey, with applications ranging from bakery goods and confectioneries to sports nutrition products.

Key Market Insights:

-

Condensed whey accounted for 15% of total whey product consumption globally in 2023.

-

The food and beverage industry utilized 60% of the condensed whey supply in 2023.

-

Over 20% of bakery products globally incorporated condensed whey as an ingredient in 2023.

-

The sports nutrition segment grew by 18%, driven by demand for whey-based supplements.

-

Approximately 35% of condensed whey was used in the animal feed industry in 2023.

-

Swine feed accounted for 45% of animal feed applications for condensed whey.

-

The global lactose-free product segment saw a 25% increase in demand for condensed whey.

-

70% of large-scale dairy processors produced condensed whey as part of their product line.

-

Over 30% of packaged condensed whey was exported in 2023.

-

The confectionery industry utilized 10% of condensed whey, mainly in chocolate production.

Condensed Whey Market Drivers:

The global shift towards health-conscious consumption patterns has dramatically transformed the condensed whey market.

Consumers increasingly seek nutritionally dense, protein-rich ingredients that support wellness, fitness, and dietary requirements. Condensed whey emerges as a quintessential solution, offering a comprehensive nutritional profile that resonates with diverse demographic segments. Sports nutrition represents a critical driver, with athletes and fitness enthusiasts demanding high-quality protein supplements. Condensed whey's rapid absorption, complete amino acid profile, and minimal processing make it an ideal ingredient for muscle recovery, performance enhancement, and metabolic support. Manufacturers are developing specialized whey protein concentrates targeting specific fitness goals, from muscle building to weight management. The rising prevalence of chronic diseases and metabolic disorders has further accelerated market growth. Healthcare professionals increasingly recommend protein-rich supplements to manage conditions like obesity, diabetes, and cardiovascular complications. Condensed whey's bioactive peptides demonstrate potential in reducing inflammation, supporting immune function, and promoting metabolic health.

Technological innovations have revolutionized condensed whey production, transforming traditional dairy waste streams into sophisticated, high-value ingredients.

Advanced membrane filtration techniques, precision fractionation, and molecular separation technologies enable manufacturers to extract and concentrate specific whey components with unprecedented efficiency. Biotechnological breakthroughs have expanded condensed whey's applications beyond conventional domains. Researchers are developing enzymatic processes to modify whey proteins, creating specialized ingredients with enhanced functional properties. These innovations enable customized solutions for food manufacturers, pharmaceutical companies, and nutritional supplement developers. Sustainability-driven processing technologies represent another critical driver. Manufacturers are implementing circular economy principles, converting waste streams into valuable products and reducing environmental footprint. Innovative extraction methods minimize water consumption, energy utilization, and waste generation, making condensed whey production increasingly eco-friendly.

Condensed Whey Market Restraints and Challenges:

Condensed whey market participants confront multifaceted challenges that demand strategic navigation. Volatile dairy commodity prices create significant economic uncertainty, compelling manufacturers to develop robust risk management strategies. Fluctuating milk production, geopolitical tensions, and climate change impact raw material availability and pricing mechanisms. Regulatory compliance represents another substantial challenge. Stringent food safety standards, quality control requirements, and international trade regulations necessitate substantial investments in testing, certification, and traceability systems. Manufacturers must continuously adapt to evolving global standards, requiring ongoing technological upgrades and quality assurance protocols. Technological barriers and high initial capital investments pose significant market entry obstacles. Advanced processing equipment, research infrastructure, and skilled workforce development demand considerable financial resources. Small and medium-sized enterprises struggle to compete with established market players, potentially limiting market diversification.

Condensed Whey Market Opportunities:

The condensed whey market presents extraordinary opportunities across multiple domains. Emerging economies represent untapped potential, with increasing urbanization, rising disposable incomes, and growing awareness of nutritional supplements driving market expansion. Developing nations demonstrate escalating demand for functional food ingredients and protein-enriched products. Personalized nutrition emerges as a transformative opportunity. Advanced genetic testing and metabolic profiling enable customized whey protein formulations tailored to individual physiological requirements. Manufacturers can develop targeted solutions addressing specific health goals, genetic predispositions, and lifestyle needs. Pharmaceutical and nutraceutical sectors offer promising growth trajectories. Researchers are exploring whey's potential in developing innovative drug delivery systems, therapeutic proteins, and specialized medical nutrition. Bioactive peptides derived from condensed whey demonstrate promising applications in managing chronic diseases, supporting immune function, and promoting cellular health.

CONDENSED WHEY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.2% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Arla Foods, Fonterra Co-operative Group, Glanbia PLC, Saputo Inc., Lactalis Ingredients,Friesland Campina, Dairy Farmers of America, Agropur Cooperative, Hilmar Cheese Company, Carbery Group |

Condensed Whey Market Segmentation: By Type

-

Liquid Condensed Whey

-

Powdered Condensed Whey

Liquid condensed whey remains the dominant segment, holding a 55% market share in 2024 due to its wide-ranging applications in industrial and retail sectors. Powdered condensed whey is witnessing rapid growth, driven by its convenience, longer shelf life, and versatility in export markets.

Condensed Whey Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Online Retail

-

Direct Sales

Supermarkets and hypermarkets dominate, accounting for 40% of sales in 2024 due to the availability of diverse product ranges and consumer accessibility.

Online retail is the fastest-growing channel, reflecting a 25% increase in sales in 2024 as consumers increasingly prefer digital shopping platforms.

Condensed Whey Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

Asia-Pacific leads the condensed whey market, driven by its burgeoning population, rapid urbanization, and rising disposable incomes. The region's dominance is rooted in its expansive food processing industry, growing health awareness, and the increasing adoption of protein-enriched diets. Nations like China, India, Japan, and South Korea play pivotal roles in this region's success.

The Middle East and Africa (MEA) is the fastest-growing region for condensed whey, driven by rising imports, growing health awareness, and the adoption of whey in food processing and animal feed. Countries in the Middle East, such as the UAE and Saudi Arabia, heavily import condensed whey for use in infant formula and sports nutrition. Urbanization and awareness campaigns have led to higher adoption of protein-enriched products in MEA markets.

COVID-19 Impact Analysis on Condensed Whey Market:

One of the most significant impacts of the COVID-19 pandemic on the condensed whey market was the disruption of supply chains. During the height of the pandemic, dairy production faced delays, bottlenecks, and interruptions due to labour shortages, transport restrictions, and plant shutdowns. Many dairy farms struggled with logistical challenges, which delayed the collection and processing of milk. As condensed whey is derived from whey protein, disruptions at the early stages of dairy production significantly affected its supply. As the pandemic led to heightened health awareness, many consumers turned to protein-rich foods as part of efforts to boost their immune systems and maintain health during lockdowns. Whey protein, known for its high-quality protein content, became a sought-after ingredient in supplements, ready-to-drink beverages, and functional foods. This shift in consumer behaviour benefited the condensed whey market as demand surged for health supplements, protein shakes, and functional dairy products. Lockdowns and social distancing measures also led to significant changes in consumer eating habits. With people staying home more often, there was an increase in the consumption of packaged foods, including processed snacks, baked goods, and ready-to-eat meals, many of which contain condensed whey as an ingredient. As a result, the demand for whey-based products in the food and beverage industry experienced growth during the pandemic. The pandemic forced companies to quickly adapt their production facilities to meet the evolving demand for consumer goods.

Latest Trends and Developments:

One of the most prominent trends in the condensed whey market is the growing consumer demand for protein-rich foods, especially among health-conscious individuals. Condensed whey, a key source of high-quality protein, has become an essential ingredient in various nutritional supplements, protein shakes, and functional foods. This trend is driven by the increasing awareness of the benefits of protein in maintaining muscle mass, promoting satiety, and supporting overall health. With the rise of fitness culture and the growing popularity of sports nutrition, whey protein has found its place in a wide range of products designed for active individuals, including ready-to-drink protein beverages, snack bars, and baked goods. The increased focus on health and immunity during the COVID-19 pandemic has accelerated this trend, with more consumers turning to protein supplements to support their wellness goals. While dairy-based products have historically been the cornerstone of the condensed whey market, the increasing popularity of plant-based diets has spurred innovation within the sector. Consumers seeking alternatives to traditional dairy products due to lactose intolerance, dietary restrictions, or environmental concerns are driving demand for plant-based whey alternatives. These alternatives aim to replicate the nutritional benefits of whey protein but are derived from plant-based sources like peas, soy, and hemp. As consumers become more aware of the ingredients in their food, there is a growing demand for clean label products. Clean labeling refers to transparency in product ingredients, with minimal processing and no artificial additives or preservatives. In the condensed whey market, this trend has led to a rise in products that highlight their natural, wholesome ingredients and exclude any synthetic additives.

Key Players:

-

Arla Foods

-

Fonterra Co-operative Group

-

Glanbia PLC

-

Saputo Inc.

-

Lactalis Ingredients

-

Friesland Campina

-

Dairy Farmers of America

-

Agropur Cooperative

-

Hilmar Cheese Company

-

Carbery Group

Chapter 1. Condensed Whey Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Condensed Whey Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Condensed Whey Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Condensed Whey Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Condensed Whey Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Condensed Whey Market – By Type

6.1 Introduction/Key Findings

6.2 Liquid Condensed Whey

6.3 Powdered Condensed Whey

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Condensed Whey Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Specialty Stores

7.4 Online Retail

7.5 Direct Sales

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Condensed Whey Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Condensed Whey Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Arla Foods

9.2 Fonterra Co-operative Group

9.3 Glanbia PLC

9.4 Saputo Inc.

9.5 Lactalis Ingredients

9.6 Friesland Campina

9.7 Dairy Farmers of America

9.8 Agropur Cooperative

9.9 Hilmar Cheese Company

9.10 Carbery Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

One of the most significant drivers for the growth of the condensed whey market is the rising consumer demand for protein-rich foods. Whey protein, known for its high biological value and essential amino acid profile, is increasingly popular in the health and wellness sector.

Despite its high nutritional value, condensed whey, like other dairy products, contains lactose. This poses a challenge for consumers with lactose intolerance, a condition where the body cannot properly digest lactose, leading to digestive discomfort.

Arla Foods, Fonterra Co-operative Group, Glanbia PLC, Saputo Inc., Lactalis Ingredients, Friesland Campina.

Asia Pacific currently holds the largest market share, estimated around 35%.

Middle East has shown significant room for growth in specific segments.