Concentrated Juice Market Size (2024 – 2030)

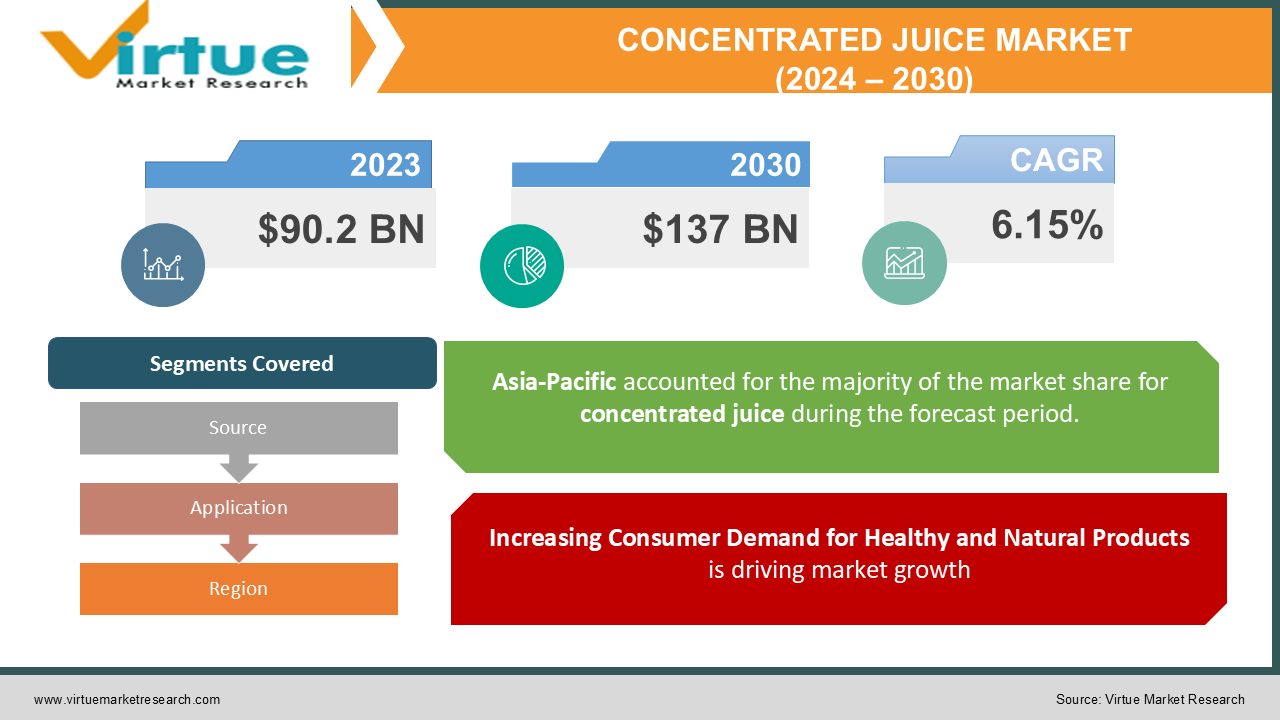

The Global Concentrated Juice Market was valued at USD 90.2 billion in 2023 and will grow at a CAGR of 6.15% from 2024 to 2030. The market is expected to reach USD 137 billion by 2030.

The Concentrated Juice Market deals with the production and sale of fruit and vegetable juices in concentrated forms, which offer longer shelf life and ease of transportation. These products are used extensively across multiple industries, including beverages, confectionery, and bakery. As consumer preferences shift towards healthier drinks and natural products, the demand for concentrated juice continues to increase. Furthermore, growing awareness regarding the benefits of fruit-based nutrition is fueling market expansion.

Key Market Insights

-

This market is still dominated by the beverage industry, due to the fact that its usage accounts for more than 65% of the demand generated in 2023. The trend of cold-pressed juices and smoothies is further fueling this demand.

-

Asia-Pacific is the region with the highest growth rate, estimated to grow at the rate of 7.8% CAGR within the forecast period. An increase in disposable incomes and a change in diets are giving momentum to this.

-

Orange juice concentrate is the major fruit type, capturing over 30% of the total share. Its demand comes through soft drinks, candies and gummies, and flavorings.

-

Health beverages, for instance, green juice and detox beverages, have provided the source of growth in vegetable concentrates as the use of vegetable concentrates grows, driven by consumers becoming increasingly concerned about "saving themselves from sugar-toned beverages".

-

A great deal of premium concentrates organic and non-GMO have entered the markets to meet the increasing demands for clean-label products.

-

Concentrated juices rely highly on e-commerce platforms as an important channel of distribution. Sales reported online grocery and retail increased by 25% for the year 2023.

Global Concentrated Juice Market Drivers

Increasing Consumer Demand for Healthy and Natural Products is driving market growth: As wellness and nutrition are placed increasingly in the spotlight, consumers worldwide are slowly shifting toward healthier beverages, thereby driving demand for concentrated juices. Fruit- and vegetable-based concentrates are perceived as carriers of essential vitamins, minerals, and antioxidants. The dominant trend of replacing sweetened soft drinks with healthy juices is perfectly complemented by what is available in the market. Also, constantly growing lifestyle diseases such as obesity and diabetes have created a higher demand for low-calorie soft drinks and sugar-free juice concentrates. These health trends advance the growth of the market, especially within the developed markets of North America and Europe.

Growing Popularity of Convenient and Shelf-Stable Products is driving market growth: Concentrated juices have extended shelf life and minimize constant replenishments, thereby making them ideal for ready-to-drink beverages, confectionery, and bakery products. Central to the product formulation in the beverage industry, concentrated juices offer easy means of transport and storage for manufacturers. Increasing demand from consumers for convenient meal solutions that come in the form of smoothies and ready-on-the-go drinks has heightened the demand for concentrated juice products even further. The reconstituted concentrates into fresh juices also brought huge interest from consumers and food service providers.

Expansion of E-Commerce and Digital Platforms is driving market growth: E-commerce platforms have henceforth revolutionized the world's concentrated juice market. Consumers have opted massively for online shopping due to convenience and better product varieties. Retailers are utilizing digital mediums as an entry point to upscale their reach and provide personalized product solutions to both themselves and consumers. The subscription model via online media is also becoming popular, primarily among health-conscious consumers looking to drink fresh and healthy drinks like juice concentrates. E-commerce channels have further enabled small and mid-sized companies to reach global audiences, which has contributed to much growth in the market.

Global Concentrated Juice Market Challenges and Restraints

High Sugar Content and Health Concerns are restricting market growth: Although concentrated juices are technically of natural origin, many contain a lot of sugar, attracting criticism from health advocates and regulatory bodies. Governments around the world have introduced sugar taxes and marketing restrictions on high-sugar products, which is a massive challenge to producers. Consumers also begin to appreciate the related health impact of excessive sugar intake. Some of the known risks from excessive sugar intake include diabetes and obesity, making companies reformulate their products using reduced sugar levels, which may make them less savory and then affect acceptance by consumers.

Seasonal Availability and Raw Material Price Volatility are restricting market growth: Production of fruit and vegetable concentrates is heavily reliant on season crops produced during the particular season; therefore, this activity is vulnerable to climatic changes and other agricultural challenges. Poor harvests due to droughts, floods, and the like could lead to interruptions in the supply chains, thereby creating price volatility. Furthermore, delivery as well as stockholding of perishable raw materials demand massive investment that adds to the cost of operations. All these make it a challenge for manufacturing companies, particularly small and medium-sized ones, to keep steady operations and profitability levels all through the year with consistent quality output.

Market Opportunities

Concern for health and wellness is further driving the market for concentrated juices with the high demand for natural, organic, and plant-based products. Consumers are desirous of clean-label products with absolutely no artificial additives, preservatives, or GMOs. This consumer disposition continues to influence manufacturers and others to innovate and launch new products that suit these tastes. The other push factors in this emerging market of functional beverages include increased demand for immunity-boosting drinks and the consumption of energy drinks with natural ingredients. The increasing vegan population base across the globe can provide further opportunities for vegetable-based concentrates, alongside plant-based juices for a diverse consumer base. Manufacturers will continue capitalizing on the personalized nutrition trend by creating customized blends for specific consumer needs. Emerging markets, especially in Asia-Pacific and South America, would be considered strategic locations with high growth potential. Disposable incomes also increase in such economies while consumer preferences change towards healthier products; hence, the quality of products needs to improve to gain acceptance. Advancements in processing technologies, especially cold-pressing and high-pressure processing (HPP), can offer the possibility of enhancing the final product quality without any compromise on regulatory compliance. Such innovations in taste and nutritional content also help the manufacturer offer a product that stands out in a crowded marketplace. In summary, the concentrates market is well geared for significant growth based on these emerging consumer preferences and technologies.

CONCENTRATED JUICE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.15% |

|

Segments Covered |

By Source, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Döhler Group, Archer Daniels Midland Company, SunOpta Inc., Ingredion Incorporated, SVZ Industrial Fruit & Vegetable Ingredients, AGRANA Beteiligungs-AG, Kanegrade Ltd, Kerry Group plc, CitroGlobe S.p.A., China Haisheng Juice Holdings Co., Ltd. |

Concentrated Juice Market Segmentation - By Source

-

Fruit Concentrates

-

Vegetable Concentrates

-

Mixed Concentrates

-

Organic Concentrates

Fruit concentrates are the largest segment, driven by high consumer demand for orange, apple, and berry-based products, which are widely used in beverages and confectioneries.

Concentrated Juice Market Segmentation - By Application

-

Beverages

-

Confectionery

-

Bakery Products

-

Dairy & Frozen Products

-

Others

The beverages segment holds the largest market share, driven by the widespread use of concentrates in juices, smoothies, and soft drinks across the food service and retail sectors.

Concentrated Juice Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific leads the market with rapid growth due to increasing consumer spending on healthy food and beverages, expanding middle-class populations, and changing dietary preferences. Countries like China, India, and Japan are at the forefront of this regional expansion.

COVID-19 Impact Analysis on the Concentrated Juice Market

The COVID-19 outbreak significantly disrupted the concentrated juice market's supply chains and exacerbated challenges faced in the production and distribution of raw materials. With people growing more aware of their health, there was a sharp increase in the demand for health-oriented products, such as immunity-boosting beverages. In a bid to increase immunity levels, most consumers started looking at natural products. Fruit and vegetable concentrates therefore reaped significantly from such an avenue, with subsequent growth in sales. Access to e-commerce channels also increased during this period. Most consumers at that time preferred contactless shopping and home delivery options. However, this change, made the access to concentrated juices easier and even more evolved in relation to changing shopper preference requirements. Even though, of course, there were initial difficulties when entering this market due to certain supply chain restrictions, it was during this pandemic period that one really highlighted the growing necessity for functional foods and beverages. This focus on health and wellness should give the concentrated juice market a long-term growth push, as the consumer seeks better-for-you products in this post-pandemic world.

Latest Trends/Developments

Concentrated juice is an area of interest in development today, with demand for organic and non-GMO items at new highs. As consumers become increasingly demanding within this space-clean label and sustainability- some of these manufacturers are beginning to focus on making these offerings mainstream. This is part of a greater trend toward healthier, more transparent food choices in general. There is also growing interest in innovative product launches, including plant-based juices and functional beverages fortified with vitamins and minerals getting mainstream. These catered to health-conscious consumers, who want additional nutritional benefits along with great taste. The cold-pressed and high-pressure processed juices are preferred because of their great flavor and nutritional profiles compared to others. Its superior flavors and nutritional profiles appeal to those who give importance to quality in the beverages they use. That is why the sustainability-oriented trends place companies heavily on researching the best eco-friendly packaging solutions aligned with consumers' preferences in using environmentally responsible products. Also, joint ventures between beverage manufacturers and health-oriented brands are growing at lightning speed. The partnerships allow the formulation of personalized wellness beverages, thus pushing product lines further and increasing consumer selection options. The latest trends only underscore a healthy tenor for the future-concentrated juice market.

Key Players

-

Döhler Group

-

Archer Daniels Midland Company

-

SunOpta Inc.

-

Ingredion Incorporated

-

SVZ Industrial Fruit & Vegetable Ingredients

-

AGRANA Beteiligungs-AG

-

Kanegrade Ltd

-

Kerry Group plc

-

CitroGlobe S.p.A.

-

China Haisheng Juice Holdings Co., Ltd.

Chapter 1. Concentrated Juice Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Concentrated Juice Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Concentrated Juice Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Concentrated Juice Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Concentrated Juice Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Concentrated Juice Market – By Source

6.1 Introduction/Key Findings

6.2 Fruit Concentrates

6.3 Vegetable Concentrates

6.4 Mixed Concentrates

6.5 Organic Concentrates

6.6 Y-O-Y Growth trend Analysis By Source

6.7 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Concentrated Juice Market – By Application

7.1 Introduction/Key Findings

7.2 Beverages

7.3 Confectionery

7.4 Bakery Products

7.5 Dairy & Frozen Products

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Concentrated Juice Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Source

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Source

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Source

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Source

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Source

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Concentrated Juice Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Döhler Group

9.2 Archer Daniels Midland Company

9.3 SunOpta Inc.

9.4 Ingredion Incorporated

9.5 SVZ Industrial Fruit & Vegetable Ingredients

9.6 AGRANA Beteiligungs-AG

9.7 Kanegrade Ltd

9.8 Kerry Group plc

9.9 CitroGlobe S.p.A.

9.10 China Haisheng Juice Holdings Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Concentrated Juice Market was valued at USD 90 billion in 2023 and is expected to reach USD 137 billion by 2030, growing at a CAGR of 6.15% during the forecast period.

The key drivers include increasing demand for healthy and natural products, the growing popularity of convenient and shelf-stable beverages, and the expansion of e-commerce platforms.

The market is segmented by source into (fruit, vegetable, mixed, and organic concentrates) and by application into (beverages, confectionery, bakery products, dairy & frozen products, and others.)

Asia-Pacific is the dominant region, driven by increasing consumer spending, changing dietary habits, and expanding middle-class populations in countries like China and India.

Key players include Döhler Group, Archer Daniels Midland Company, SunOpta Inc., Ingredion Incorporated, and Kerry Group plc.