Comprehensive Genomic Profiling Cancer Biomarkers Market Size (2024 – 2030)

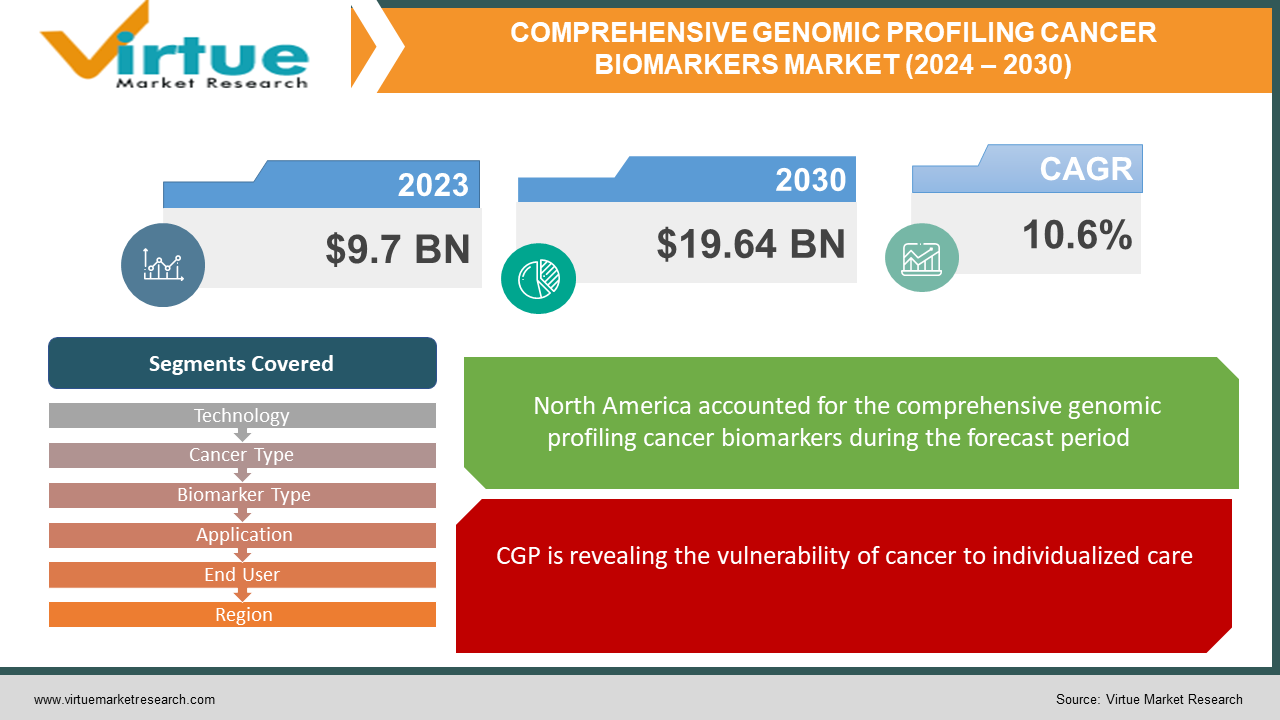

The global Comprehensive Genomic Profiling Cancer Biomarkers Market size was exhibited at USD 9.7 billion in 2023 and is projected to hit around USD 19.64 billion by 2030, growing at a CAGR of 10.6% during the forecast period from 2024 to 2030.

Through a wide range of gene analyses, CGP provides an extensive examination of the genetic composition of a tumor. This makes it possible to identify a wide range of biomarkers, including gene rearrangements (abnormal DNA pairings), copy number modifications (gene quantity changes), and mutations in cancer genes (a particular kind of genetic instability). Biomarkers shed light on the aggressiveness of malignancy, possible responses to treatment, and prognosis for the patient. CGP provides a more comprehensive picture for better diagnoses and more focused treatment strategies than traditional approaches do. Even those who are qualified for clinical trials of new cancer treatments can be identified by it. However, because not every mutation found has been shown to have clinical importance, interpreting CGP data can be difficult. Cost and insurance coverage may be restrictions.

Key Market Insights:

Due to several intriguing industry insights, the comprehensive genomic profiling (CGP) market for cancer biomarkers is expected to rise significantly. First off, there is a growing need for accurate diagnosis tools due to the rising incidence of cancer worldwide, and CGP is just what the doctor ordered. Second, the move towards personalized medicine is in perfect harmony with CGP's capacity to detect genetic changes in a tumor, enabling customized treatment regimens based on the individual characteristics of every patient. Furthermore, CGP is becoming more affordable, quicker, and available to a larger variety of patients thanks to developments in DNA sequencing technologies. Finally, the importance of CGP in directing treatment choices becomes even more clear when researchers find new biomarkers that are clinically meaningful. This combination of elements indicates a promising future for the CGP market.

Global Comprehensive Genomic Profiling Cancer Biomarkers Market Drivers:

CGP is revealing the vulnerability of cancer to individualized care.

Traditionally, broad-spectrum medicines that targeted rapidly dividing cells across the body were used in cancer treatment, which frequently took a "one-size-fits-all" approach. These medicines can have serious adverse effects because they affect healthy cells as well, even though they are beneficial for some people. This method is revolutionized by personalized medicine, which considers each person's genetic composition. This is the role of CGP. Through a thorough DNA analysis of a tumor, CGP can identify mutations that are responsible for the cancer's growth. This increased understanding serves as a kind of treatment plan customization. Equipped with this knowledge, medical professionals can create tailored treatments that take advantage of these mutations, thereby targeting cancer's weak point. With less detrimental effects on healthy cells, these focused medicines have the potential to be far more successful in battling cancer.

Personalised Strikes to One-Size-Fits-All How Biomarkers Help Focus the War on Cancer

CGP honed its weaponry in the war on cancer. This improvement is being driven by the discovery of more biomarkers that are clinically meaningful. These biomarkers disclose the unique vulnerabilities of a tumor, much like fingerprints do. With this improved understanding, more focused therapies and drugs intended to take advantage of certain weaknesses become possible. There are many advantages: when compared to conventional treatments, tailored therapies may be less likely to cause side effects and more successful in shrinking tumors. With this growing collection of biomarkers at its disposal, CGP can also create individualized treatment programs for every patient. These treatment strategies have the potential to improve response rates, lengthen remissions, and eventually improve patient outcomes by targeting the specific mutations that are causing the cancer.

Global Comprehensive Genomic Profiling Cancer Biomarkers Market Restraints and Challenges:

Complex technology and data analysis lead to high expenses, which burden healthcare systems and restrict patient access. Uncertainty in guidelines and the varying clinical value of certain biomarkers lead to difficulties with reimbursement. It takes experience to transform CGP data into actionable plans because the interpretation process is complicated. The limited availability of tumor samples may limit the usefulness of the test. Standardized testing techniques are hampered by the uncertain and changing regulatory environment across national borders. Concerns about data security, privacy, and ethical use of genetic data beyond cancer treatment are brought up by the abundance of genetic data. To fully realize the potential of CGP and transform it into a useful and accessible tool for individualized cancer therapy, these constraints must be addressed through cost-cutting technologies, more transparent reimbursement guidelines, continuous biomarker validation, and maneuvering through the changing regulatory environment.

Global Comprehensive Genomic Profiling Cancer Biomarkers Market Opportunities:

The global CGP cancer biomarkers market teems with opportunities. The rise of precision oncology perfectly complements CGP's ability to identify targets for effective, low-side-effect therapies. A burgeoning pharmaceutical pipeline of targeted drugs fuels demand for CGP testing to identify suitable patients. Advancements in DNA sequencing technology like NGS are making CGP faster, cheaper, and more accessible. Growing awareness among patients and healthcare professionals along with the exploration of novel applications in minimal residual disease detection and companion diagnostics further expands the market. Strategic partnerships between test providers, drug companies, and healthcare institutions can accelerate innovation, streamline processes, and improve patient access, ultimately unlocking the full potential of CGP and transforming personalized cancer care.

COMPREHENSIVE GENOMIC PROFILING CANCER BIOMARKERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.6% |

|

Segments Covered |

By Technology, Cancer Type, Biomarker Type, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bristol Myers Squibb, Caris Life Sciences, F. Hoffmann-La Roche Ltd., Foundation Medicine, Genomic Health, Guardant Health, Merck & Co., Inc., NanoString Technologies, Pfizer Inc., Roche Diagnostics |

Global Comprehensive Genomic Profiling Cancer Biomarkers Market Segmentation: By Technology

-

Next-Generation Sequencing (NGS)

-

Sanger Sequencing

-

Microarrays

In the global comprehensive genomic profiling cancer biomarkers market by technology, next-generation sequencing (NGS) is the dominant technology. Because of its greater capabilities, NGS has a definite edge over Sanger Sequencing and microarrays. It can analyze vast volumes of genomic data, which is precisely what CGP needs. Moreover, NGS testing is becoming more affordable, increasing accessibility to CGP testing. Additionally, NGS outperforms its rivals in terms of accuracy, successfully identifying mutations and other genomic variants. Another benefit of NGS is its versatility. Unlike prior technologies, it can analyze different kinds of genomic material, providing a more thorough examination. These developments bolster NGS's standing as the industry leader and fastest-growing technology for CGP cancer biomarkers.

Global Comprehensive Genomic Profiling Cancer Biomarkers Market Segmentation: By Cancer Type

-

Breast Cancer

-

Lung Cancer

-

Colorectal Cancer

-

Other Cancers (e.g., prostate, pancreatic)

Breast cancer is the most common type of cancer worldwide, especially in women. This is probably why it is the largest section. This means that more patients will need to have CGP testing. The fastest-growing market, nevertheless, is less defined. With its increasing incidence and the growing emphasis on targeted therapies that require CGP testing, lung cancer is a serious contender. Prostate and pancreatic cancers are included in the "Other Cancers" section, which may have the quickest growth rate. This is motivated by the continuous identification of novel biomarkers and the potential of CGP to enhance treatment results in these domains.

Global Comprehensive Genomic Profiling Cancer Biomarkers Market Segmentation: By Biomarker Type

-

Genomic Biomarkers (Mutations, Copy Number Alterations)

-

Protein Biomarkers

Although copy number changes and mutations are the most common types of genomic biomarkers in the CGP cancer biomarkers industry, things may be starting to change. These genetic markers have historically been the workhorses, dictating treatment choices because of their well-established function and CGP's capacity for thorough analysis. Protein biomarkers, on the other hand, are becoming a serious candidate for the fastest-growing market. This market is growing because of its capacity to provide more information on tumor biology, quicker analytical times for treatment planning, and growing acceptance of their importance. Protein biomarkers may become more important in the CGP market in the future, supplementing their well-established genetic counterparts.

Global Comprehensive Genomic Profiling Cancer Biomarkers Market Segmentation: By Application

-

Targeted Therapy Selection

-

Clinical Trial Selection

-

Prognosis and Risk Stratification

-

Minimal Residual Disease Detection

-

Companion Diagnostics

The market for CGP cancer biomarkers worldwide by application is diverse, with major contributions from each market area. Right now, targeted therapy selection probably has the upper hand because CGP is a personalized medicine powerhouse that is excellent at identifying mutations that certain medications can target. The two leading competitors in the fastest-growing title, however, are companion diagnostics and minimal residual disease (MRD) detection. The intriguing prospect of detecting cancer cells that remain after treatment by MRD detection presents itself, enabling prompt intervention and possibly improved results. The union of CGP with targeted medicines, known as companion diagnostics, is likewise thriving. By using CGP to find patients who have the proper mutations for medications, these tests maximize the efficacy of treatment.

Global Comprehensive Genomic Profiling Cancer Biomarkers Market Segmentation: By End User

-

Hospitals & Clinics

-

Research Institutions

-

Pharmaceutical & Biotechnology Companies

The end user base served by the global market for CGP cancer biomarkers is diverse. Currently, in the first place, Hospitals & Clinics use CGP testing for patient diagnosis and treatment regimens. Pharmaceutical and biotechnology companies, however, are competing to be the fastest-growing industry. This expansion is being driven by a few causes, including the rising use of companion diagnostics that utilize CGP technology, the emergence of targeted medicines based on biomarkers discovered through CGP, and the requirement for these firms to identify eligible patients for new cancer medication trials. This pattern highlights the growing importance of CGP in the pharmaceutical sector and the advancement of tailored cancer treatments.

Global Comprehensive Genomic Profiling Cancer Biomarkers Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Geographically, the global market for CGP cancer biomarkers is divided, with North America presently holding the largest share. This dominance is the result of several elements coming together, including a high cancer rate, a robust presence of big technology and pharmaceutical corporations, and a well-established healthcare system that is open to using personalized medicine techniques. But over the Pacific, the winds of change are blowing. The area with the fastest projected growth is the Asia-Pacific area. Adoption of CGP is thriving due to its economic development, rising healthcare spending, and rising cancer incidence. Furthermore, it is anticipated that the CGP market will advance due to a rising awareness of personalized medicine in this area. In the future, the Asia-Pacific area is expected to play a significant role in CGP cancer diagnostics.

COVID-19 Impact Analysis on the Global Comprehensive Genomic Profiling Cancer Biomarkers Market:

The impact of the COVID-19 pandemic on the global market for CGP cancer biomarkers has been uneven. Initial disruptions included kinks in the testing material supply chain, as well as delays in clinical trials that depend on CGP for patient selection and elective cancer procedures that would typically include CGP testing. But there were also advantages to the pandemic. The COVID-19 attention on personalized medicine may rekindle interest in CGP's use in targeted cancer treatment. The increase in telehealth consultations makes it possible to conduct distant conversations about CGP testing. In the long run, efficiency and accessibility may have been enhanced by the pandemic by hastening the development of remote testing platforms and automation in CGP analysis.

Recent Trends and Developments in the Global Comprehensive Genomic Profiling Cancer Biomarkers Market:

The global market for CGP cancer biomarkers is booming with new developments. The analysis of tumor DNA found in a patient's blood, known as liquid biopsies, is gaining popularity as a less invasive testing technique. By interpreting intricate genomic data, identifying important mutations, and even forecasting treatment outcomes, artificial intelligence is assisting. With the help of other omics technologies, CGP is collaborating to provide a more complete image of the tumor, opening the door to novel therapy targets. The union of CGP and pharmaceuticals is flourishing thanks to companion diagnostics, which are tests that pinpoint individuals who have the proper mutations for medications. Finally, CGP is being investigated for early cancer detection by identifying cancer cells that remain after treatment, enabling quicker intervention and maybe improved patient outcomes.

Key Players:

-

Bristol Myers Squibb

-

Caris Life Sciences

-

F. Hoffmann-La Roche Ltd.

-

Foundation Medicine

-

Genomic Health

-

Guardant Health

-

Merck & Co., Inc.

-

NanoString Technologies

-

Pfizer Inc.

-

Roche Diagnostics

Chapter 1. Comprehensive Genomic Profiling Cancer Biomarkers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Comprehensive Genomic Profiling Cancer Biomarkers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Comprehensive Genomic Profiling Cancer Biomarkers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Comprehensive Genomic Profiling Cancer Biomarkers Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Comprehensive Genomic Profiling Cancer Biomarkers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Comprehensive Genomic Profiling Cancer Biomarkers Market – By Technology

6.1 Introduction/Key Findings

6.2 Next-Generation Sequencing (NGS)

6.3 Sanger Sequencing

6.4 Microarrays

6.5 Y-O-Y Growth trend Analysis By Technology

6.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Comprehensive Genomic Profiling Cancer Biomarkers Market – By Cancer Type

7.1 Introduction/Key Findings

7.2 Breast Cancer

7.3 Lung Cancer

7.4 Colorectal Cancer

7.5 Other Cancers (e.g., prostate, pancreatic)

7.6 Y-O-Y Growth trend Analysis By Cancer Type

7.7 Absolute $ Opportunity Analysis By Cancer Type, 2024-2030

Chapter 8. Comprehensive Genomic Profiling Cancer Biomarkers Market – By Biomarker Type

8.1 Introduction/Key Findings

8.2 Genomic Biomarkers (Mutations, Copy Number Alterations)

8.3 Protein Biomarkers

8.4 Y-O-Y Growth trend Analysis By Biomarker Type

8.5 Absolute $ Opportunity Analysis By Biomarker Type, 2024-2030

Chapter 9. Comprehensive Genomic Profiling Cancer Biomarkers Market – By Application

9.1 Introduction/Key Findings

9.2 Targeted Therapy Selection

9.3 Clinical Trial Selection

9.4 Prognosis and Risk Stratification

9.5 Minimal Residual Disease Detection

9.6 Companion Diagnostics

9.7 Y-O-Y Growth trend Analysis By Application

9.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 10. Comprehensive Genomic Profiling Cancer Biomarkers Market – By End-User

10.1 Introduction/Key Findings

10.2 Hospitals & Clinics

10.3 Research Institutions

10.4 Pharmaceutical & Biotechnology Companies

10.5 Y-O-Y Growth trend Analysis By End-User

10.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 11. Comprehensive Genomic Profiling Cancer Biomarkers Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Technology

11.1.2.1 By Cancer Type

11.1.3 By Biomarker Type

11.1.4 By End-User

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Technology

11.2.3 By Cancer Type

11.2.4 By Biomarker Type

11.2.5 By Application

11.2.6 By End-User

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Technology

11.3.3 By Cancer Type

11.3.4 By Biomarker Type

11.3.5 By Application

11.3.6 By End-User

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Technology

11.4.3 By Cancer Type

11.4.4 By Biomarker Type

11.4.5 By Application

11.4.6 By End-User

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Technology

11.5.3 By Cancer Type

11.5.4 By Biomarker Type

11.5.5 By Application

11.5.6 By End-User

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Comprehensive Genomic Profiling Cancer Biomarkers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Bristol Myers Squibb

12.2 Caris Life Sciences

12.3 F. Hoffmann-La Roche Ltd.

12.4 Foundation Medicine

12.5 Genomic Health

12.6 Guardant Health

12.7 Merck & Co., Inc.

12.8 NanoString Technologies

12.9 Pfizer Inc.

12.10 Roche Diagnostics

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Comprehensive Genomic Profiling Cancer Biomarkers Market size is valued at USD 9.7 billion in 2023.

The worldwide Global Comprehensive Genomic Profiling Cancer Biomarkers Market growth is estimated to be 10.6% from 2024 to 2030.

The Global Comprehensive Genomic Profiling Cancer Biomarkers Market is segmented By Technology (Next-Generation Sequencing (NGS), Sanger Sequencing, Microarrays); By Cancer Type (Breast Cancer, Lung Cancer, Colorectal Cancer, Other Cancers (e.g., prostate, pancreatic)); By Biomarker Type (Genomic Biomarkers (Mutations, Copy Number Alterations), Protein Biomarkers); By Application (Targeted Therapy Selection, Clinical Trial Selection, Prognosis, and Risk Stratification, Minimal Residual Disease Detection, Companion Diagnostics ); By End User (Hospitals & Clinics, Research Institutions, Pharmaceutical & Biotechnology Companies) and By Region.

With opportunities for growth in liquid biopsies, AI integration, multi-omics profiling, companion diagnostics, and early cancer diagnosis, the market for CGP cancer biomarkers appears to have a bright future.

The market for CGP cancer biomarkers was affected by the COVID-19 pandemic in a variety of ways. Early setbacks were from changes in resources and postponements of clinical trials. On the other hand, the pandemic also brought attention to the significance of personalized treatment, which may eventually help CGP.