Composites Beam Market Size (2024-2030)

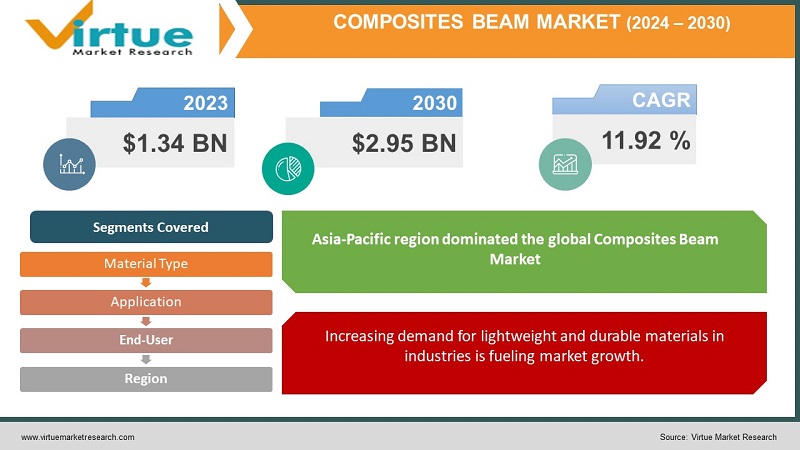

The Global Composites Beam Market was valued at USD 1.34 billion and is projected to reach a market size of USD 2.95 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.92%.

The market is witnessing a growing need, for durable materials in industries, including construction, transportation, and aerospace. To meet this demand composite beams are being widely utilized. These beams are made by combining materials like carbon fiber, glass fiber, and polymers. By blending these materials composite beams offer advantages over conventional options like steel and wood. They are lighter in weight yet stronger and more resistant to corrosion and fatigue. Composite beams find applications in a range of areas such, as bridges, buildings, automobiles, aircraft, spacecraft, turbines, generators windmills, well as medical devices.

Key Market Insights:

In 2019 the National Marine Manufacturers Association (NMMA) based in Chicago, Illinois, United States made an announcement stating that there was a 4% increase, in powerboat sales compared to the year.

The demand for materials such as carbon fiber, epoxy resin, and 3D printing has been on the rise due to the growing production of outboard-powered boats. Additionally, with more powerful outboards being used on boats nowadays, there is a need for lighter hulls and decks, without compromising performance.

The marine industry is experiencing a rise, in the use of printing leading to an increased demand for carbon composites. Additionally, there is a growing trend, toward using 3D printed molds.

In October 2020 Moi Composites introduced the MAMBO (Motor Additive Manufacturing BOat) a boat made from fiberglass thermoset material using 3D printing technology.

Composites Beam Market Drivers:

Increasing demand for lightweight and durable materials in industries is fueling market growth.

Composite beams are gaining popularity, across industries due to their characteristics of being lightweight and long-lasting. They are composed of materials, such as carbon fiber, glass fiber, and polymers each with its distinct properties. This combination of materials grants beams advantages over traditional options like steel and wood. One notable advantage is that composite beams are lighter in weight compared to materials. This makes them well-suited for applications where reducing weight is crucial in industries like transportation and aerospace. For instance, composite beams find application in aircraft and spacecraft to reduce weight and enhance fuel efficiency. Moreover, they also contribute to weight reduction and performance improvement in vehicles. Not only are beams lightweight but they also exhibit exceptional strength and durability. They can withstand loads while remaining resistant to corrosion and fatigue. These qualities make them highly suitable for applications where strength and durability play a role, such as the construction industry. For example, composite beams are extensively used in bridges, buildings, and other structures to provide support. The growing demand for durable materials, across various industries is propelling the expansion of the composite beams market. As businesses become more aware of the multitude of benefits offered by these components they continue to find an ever-increasing array of applications.

Growing awareness of the benefits of composite beams is contributing to the market expansion.

As businesses increasingly recognize the advantages of beams, including their lasting nature ability to resist corrosion, and minimal maintenance needs the demand, for such products is projected to rise. Composite beams consist of materials, such, as carbon fiber, glass fiber, and polymers each with properties. This combination grants beams advantages over conventional materials like steel and wood.

One key advantage of beams lies in their durability. They exhibit resistance to corrosion, fatigue, and other forms of deterioration. Consequently, they are well suited for applications where long-term performance is crucial, such as bridges and buildings. Another benefit of beams is their maintenance requirements. Unlike materials, they do not necessitate painting or other forms of upkeep. This characteristic can save businesses an amount of time and money throughout the lifespan of the structure.

The recognition of these advantages has propelled a growing demand for beams across industries including construction, transportation, and aerospace. For instance, composite beams find use in bridges, buildings, vehicles, and aircraft as spacecraft. As awareness about the benefits of beams continues to rise so does the demand, for these products. Composite beams represent a durable material that offers advantages over traditional alternatives across a wide range of applications.

Government initiatives to promote the use of composite materials are boosting market growth.

Authorities worldwide are encouraging the adoption of materials, across sectors to decrease overall weight and enhance fuel efficiency. This forms part of an initiative to decrease greenhouse gas emissions and combat climate change. Composite materials are created by combining two or more materials with properties, such, as carbon fiber, glass fiber, and polymers.

Governments are encouraging the adoption of materials through means including; Offering financial incentives to businesses that utilize composite materials, investing in research and development efforts for materials and manufacturing techniques, establishing industry standards for the usage of materials, and Educating businesses and consumers about the advantages of composite materials.

For instance, the US Department of Energy has launched a program known as the Lightweight Materials for Transportation (LMAT) Program. Its primary aim is to support the advancement and implementation of materials in transportation applications. The LMAT Program provides funding for both research projects and real-world demonstrations showcasing the utilization of materials. Similarly, the European Union has initiated endeavors to promote the use of materials. The EU Composite Materials Cluster is an alliance, between research institutions and industry partners dedicated to developing and commercializing materials and technologies. The government-led promotion of materials is projected to propel market growth in this sector in years. The use of materials is expanding across applications and gaining popularity as businesses increasingly recognize their advantages.

Composites Beam Market Restraints and Challenges:

High processing and manufacturing costs are limiting market growth.

Composites are increasingly being used in aerospace, transportation, and other industries such as building and electronics. Composites now account for more than half of the structural weight of big transport airplanes. However, the expensive material and manufacturing costs limit their application. To lower the cost of composite products, it is vital to employ technologies to precisely assess costs during the early design stages. Composites production is a capital-intensive process that necessitates significant expenditure. Because composites require a long curing time, the molding process is slow. Furthermore, basic materials like carbon fibers and thermoplastic resins are expensive. As a result, despite its numerous advantages over traditional materials such as steel and aluminum, the utilization of composites in the automotive sector remains minimal. The significant expenditure required for composite manufacture is limiting market expansion in the automotive industry.

Composites Beam Market Opportunities:

The increasing demand, for buildings, is opening up opportunities for the use of composite beams in the construction industry. Composite beams offer energy efficiency. Leave a smaller carbon footprint compared to traditional materials like steel and concrete. Sustainable buildings are designed to minimize their impact on the environment throughout their life cycle from construction to operation to demolition. Composite beams can play a role in reducing the impact of buildings in multiple ways.

Enhanced energy efficiency; The thermal conductivity of beams is lower than that of materials making them more energy efficient. By using beams we can reduce the heating. Cooling energy requirements of buildings.Reduced carbon footprint; Composite beams have a carbon footprint compared to materials because they require less energy during production. This is due to the use of materials with embodied energy, such, as carbon fiber and glass fiber.

The increasing need, for structures, is driving a thriving market for composite beams in the construction sector. Composite beams provide advantages for buildings, such as improved energy efficiency, reduced carbon emissions, long-lasting durability, lightweight design, and enhanced flexibility. With the rising adoption of building practices by businesses and governments the demand, for composite beams is projected to keep expanding.

The Bullitt Center, in Seattle Washington has been certified with LEED Gold. Incorporates beams in its floor and roof structure. These composite beams play a role, in minimizing the building's energy needs and making an environmental impact. The headquarters of New Belgium Brewing Company, in Fort Collins Colorado has achieved the level of certification, in the Living Building Challenge, Platinum. To enhance its performance and reduce the weight of the building composite beams are utilized in its roof structure. Similarly at the Googleplex located in Mountain View, California which aims to achieve zero energy consumption composite beams are employed in its floor structure. The use of these beams not only helps to decrease the energy requirements of the building but also contributes significantly towards achieving its goal of net zero energy consumption.

COMPOSITES BEAM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.92% |

|

Segments Covered |

By Material Type, End User, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Pultruded Composites Inc., Ashland Inc., Strongwell, PPG Industries Inc., 3M Company, Owens Corning Corporation, Hexcel Corporation, Toray Industries Inc, Teijin Limited, Mitsubishi Rayon Co., Ltd., Gurit Holding AG, SGL Carbon SE |

Composites Beam Market Segmentation:

Composites Beam Market Segmentation: By material type:

- Carbon fiber reinforced polymer (CFRP)

- Glass fiber reinforced polymer (GFRP)

- Aramid fiber reinforced polymer (AFRP)

- Hybrid composites

In 2022, based on the material type, the Carbon fiber reinforced polymer (CFRP)segment accounted for the largest revenue share by almost 60% and has led the market. CFRP beams, known for their strength and lightweight properties are highly sought after, in industries where both robustness and reduced weight are crucial. These applications are particularly prevalent in the aerospace and transportation sectors.

Among the types of beams available hybrid composites have been experiencing remarkable growth with a compound annual growth rate (CAGR) exceeding 15%. Hybrid composites combine fiber types, such as carbon fiber and glass fiber offering advantages over traditional composite materials. Notably, they exhibit toughness and impact resistance.

The utilization of composites has expanded across a range of fields including bridges, buildings, and vehicles. As awareness about the benefits they offer continues to increase there is a projected rise in demand, for these materials.

Composites Beam Market Segmentation: By application:

- Construction

- Transportation

- Aerospace

- Industrial

- Other (e.g., medical devices, sporting goods)

In 2022, based on the application, the Construction segment accounted for the largest revenue share by almost 50% and has led the market. Composite beams are finding increasing use, in construction projects, including the construction of bridges, buildings, and stadiums. The field of transportation has seen growth in the application of beams with a compound annual growth rate (CAGR) exceeding 15%. Composite beams are increasingly being employed in transportation sectors, like aircraft, vehicles, and trains.

The increasing need, for sturdy and long-lasting materials in the transportation industry, is anticipated to propel the expansion of the composite beams market in the future. The Boeing 787 Dreamliner incorporates beams in its wings and fuselage which aid in reducing the weight of the aircraft and enhancing fuel efficiency. Similarly, the Tesla Model S utilizes beams in its chassis and battery pack to decrease vehicle weight and improve performance. Additionally, the Siemens Velaro Novo high-speed train employs beams in its car bodies to lighten the train's load and enhance speed and efficiency. This rising demand for beams within transportation is expected to be a driver of growth in the composite beams market, over the coming years.

Composites Beam Market Segmentation: By end user:

- Commercial

- Residential

- Government

- Military

In 2022, based on the end user, the Commercial segment accounted for the largest revenue share by almost 60% and has led the market. Composite beams find applications, in sectors, including bridges, buildings, and stadiums.

Among end users, the industrial sector has witnessed the growth rate of composite beams with a Compound Annual Growth Rate (CAGR) exceeding 15%. Industrial applications of beams continue to expand and encompass areas, like wind turbines, oil and gas platforms, and manufacturing equipment.

Composites Beam Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2022, the Asia-Pacific region dominated the global Composites Beam Market with a revenue of 40%. The area is undergoing an upswing and urban development resulting in a rising need, for composite beams across various sectors, like construction, transportation, and manufacturing. The Middle East and Africa region is anticipated to grow at the fastest CAGR of about 15.87% during the forecast period. The demand, for beams in infrastructure projects, such, as bridges and buildings are increasing in the region.

COVID-19 Impact Analysis on the Global Composites Beam Market:

The global market, for beams has been adversely affected by COVID-19. Supply chain disruptions, labor shortages, and decreased demand in industries are among the challenges faced. One of the difficulties experienced by the beam market during the pandemic is disruptions in the supply chain. Manufacturers have faced obstacles in procuring the materials for production resulting in higher costs and delays. Additionally, labor shortages have been a concern within the industry. Many manufacturers had to downsize their workforce due to pandemic-related circumstances making it challenging to meet product demand.

Furthermore, several industries such as construction and transportation have witnessed a decline in demand for beams due to COVID-19. Construction projects have been heavily impacted by the pandemic leading to reduced requirements for beams. Similarly, with setbacks in transportation sectors like vehicles and aircraft, there has been a decrease in demand, for these beams. Despite these effects caused by COVID-19, it is anticipated that the global composites beam market will gradually recover over time. The need, for long-lasting materials in industries is predicted to keep increasing. Furthermore, advancements, in technology regarding the production of beams are anticipated to bring down expenses and enhance manufacturing effectiveness.

Latest Trends/ Developments:

In years there has been a growth and transformation, in the use of composite materials within the aerospace industry. Whether it's for business jets or commercial aircraft aircraft manufacturers are actively adopting materials to enhance structures. The aviation sector was one of the pioneers in utilizing fiber-reinforced thermoplastics. Currently, the prevalent thermoplastic compositions in the market contain carbon. Are known as Polyetheretherketone (PEEK) or Polyetherimide (PEI). These materials have gained popularity for aircraft applications due to their ability to be melted and molded repeatedly which offers advantages. Moreover, thermoplastics contribute to the construction, with improved damage tolerance by providing durability properties.

According to data released in 2019 by the National Marine Manufacturers Association (NMMA) based in Chicago, Illinois, there was a 4% increase, in the sales of powerboats from 2017 to 2018. The demand for these materials continues to be influenced by the growing popularity of outboard-powered boats and the increased use of carbon fiber, epoxy resin, and 3D printing. Moreover, there is a rising need for hulls and decks without compromising performance due to the size and greater number of outboard motors per boat. Another noticeable trend is the expanding utilization of 3D printing in the marine sector leading to an increased demand for carbon composites and a faster transition, towards using 3D printed molds.

Key Players:

- Pultruded Composites Inc.

- Ashland Inc.

- Strongwell

- PPG Industries Inc.

- 3M Company

- Owens Corning Corporation

- Hexcel Corporation

- Toray Industries Inc.

- Teijin Limited

- Mitsubishi Rayon Co., Ltd.

- Gurit Holding AG

- SGL Carbon SE

In October 2022 Toray Advanced Composites strengthened its partnership, with Specialty Materials. This partnership allows engineers to easily manage and control factors for solutions using high-quality products produced domestically in the US supply chain.

In April 2022 Owens Corning acquired WearDeck, a US-based company specializing in weather decks. This acquisition is a move towards driving growth at Owens Corning while focusing on material solutions in the building and construction industry.

During April 2022 Gurit Holding AG acquired a 60% stake, in Fiberline Composites A/S. Fiberline Composites A/S is a technology provider that specializes in the production of carbon and glass products through pultrusion manufacturing.

Chapter 1. Global Composites Beam Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Composites Beam Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Composites Beam Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Composites Beam Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Composites Beam Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Composites Beam Market– By Material type

6.1. Introduction/Key Findings

6.2. Carbon fiber reinforced polymer (CFRP)

6.3. Glass fiber reinforced polymer (GFRP)

6.4. Aramid fiber reinforced polymer (AFRP)

6.5. Hybrid composites

6.6. Y-O-Y Growth trend Analysis By Material type

6.7. Absolute $ Opportunity Analysis By Material type , 2024-2030

Chapter 7. Global Composites Beam Market– By Application

7.1. Introduction/Key Findings

7.2. Construction

7.3. Transportation

7.4. Aerospace

7.5. Industrial

7.6. Other (e.g., medical devices, sporting goods)

7.7. Y-O-Y Growth trend Analysis By Application

7.8. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Global Composites Beam Market– By End-User

8.1. Introduction/Key Findings

8.2. Commercial

8.3. Residential

8.4. Government

8.5. Military

8.6. Y-O-Y Growth trend Analysis End-User

8.7. Absolute $ Opportunity Analysis End-User , 2024+-2030

Chapter 9. Global Composites Beam Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Material type

9.1.3. By Application

9.1.4. By End-User

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Material type

9.2.3. By Application

9.2.4. By End-User

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Material type

9.3.3. By Application

9.3.4. By End-User

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By Material type

9.4.3. By Application

9.4.4. By End-User

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Material type

9.5.3. By Application

9.5.4. By End-User

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Composites Beam Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Pultruded Composites Inc.

10.2. Ashland Inc.

10.3. Strongwell

10.4. PPG Industries Inc.

10.5. 3M Company

10.6. Owens Corning Corporation

10.7. Hexcel Corporation

10.8. Toray Industries Inc.

10.9. Teijin Limited

10.10. Mitsubishi Rayon Co., Ltd.

10.11. Gurit Holding AG

10.12. SGL Carbon SE

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Composites Beam Market was valued at USD 1.34 billion and is projected to reach a market size of USD 2.95 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.92%.

Increasing demand for lightweight and durable materials in industries, growing awareness of the benefits of composite beams, and Government initiatives to promote the use of composite materials treatment are propelling the global composites beam industry.

Based on application, the Global Composites Beam Market is segmented by Construction, Transportation, Aerospace, Industrial, and Other (e.g., medical devices, sporting goods).

Asia-Pacific is the most dominant region for the Global Composites Beam Market.

Pultruded Composites Inc., Toray Industries Inc., Ashland Inc., Owens Corning Corporation, Strongwell, PPG Industries Inc., and Gurit Holding AG are the key players operating in the Global Composites Beam Market